Buy Now Pay Later (BNPL) model is old but, new to Pakistan. Because of wide-scale scams and data theft by illegal nano-lending apps and platforms, people don’t trust them.

To help people make the right choice; we have listed the top 3 Buy Now Pay Later Apps In Pakistan, registered with SECP Pakistan. These lending apps operate on EWA (Earned Wage Access), B2B, and B2C (BNPL) models.

Our list includes the following BNPL apps:

- Muawin Loan App (B2B Financing)

- ZOOD (Buy Now Pay Later App)

- & Abhi-Your Salary Now! (Earned Wage Access).

We have highlighted their key services/products and a step-by-step guide on how you can get access to the loans (financing) offered by these BNPL apps. Let’s get started with our guide!

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

Top 3 Buy Now Pay Later Apps In Pakistan | Buy Now Pay Later Pakistan Without Credit Card

Table Of Contents

- Top 3 Buy Now Pay Later Apps In Pakistan | Buy Now Pay Later Pakistan Without Credit Card

Recommended Readings: Fori Loan In Pakistan (20K-2Lakh) | Emergency Cash Loan In Pakistan

ZOOD Digital Lending App

The ZOOD Digital Lending App is known as the Buy Now Pay Later loan app. ZOOD is a company that helps lots of people and small businesses in Pakistan, Iraq, Uzbekistan, and Lebanon with their money.

They have offices in Switzerland and serve over 10 million users. ZOOD offers different services like lending money to ZoodPay, online shopping at ZoodMall, and delivery at ZoodShip. They focus on making finance easy and accessible for everyone.

ZOOD Loan App Products

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

ZOODPay

Our platform manages a vast market of over 300 million users and more than 5 million small and medium-sized enterprises (SMEs) across Uzbekistan, Lebanon, and Pakistan. We offer easy financing options through modern distribution channels.

ZoodPay Buy Now Pay Later (BNPL) Options:

- With ZoodPay, you can enjoy shopping online or in-store and pay in 4, 6, or 12 installments.

- ZoodPay BNPL provides a flexible and interest-free payment plan, splitting the total amount into four equal parts.

- When you choose this option, you’ll pay 25% upfront and the rest in three monthly installments, all without any additional charges.

- The maximum lending amount under ZoodPay BNPL is $500 or its equivalent in local currency.

ZoodPay Credit:

- ZoodPay Credit offers an interest-bearing payment solution repaid over 6 or 12 equal installments.

- You can get a loan amount of up to $1,500 or in local currency with ZoodPay Credit.

Business-to-Business (B2B) Solutions:

- ZoodPay provides SME inventory financing with a repayment period of 30 days.

Consumer Options:

- For consumers, ZoodPay offers a Buy Now Pay Later option with 4 installments.

- Consumers can also choose ZoodPay Consumer Credit, which allows repayment over 6 or 12 installments.

- ZoodPay Marketplace: Our marketplace feature on ZoodMall offers flexible payments for a wide range of products. With over 7 million products from 30,000 sellers, you can find everything you need with ease.

- ZoodPay Merchant: Merchants can offer flexible payment options to their customers online or in their stores through our API integration. Currently, over 1,000 online merchants utilize our services.

- In-store Payments: ZoodPay also facilitates flexible payments in brick-and-mortar stores, with over 3,000 participating locations.

Recommended Reading: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

ZOODMall Buy Now Pay Later

ZoodMall Buy Now Pay Later, part of the ZOOD family, is an online marketplace where you can buy now and pay later, without any added interest or hidden charges. Discover millions of products from both local and international sellers, covering a wide range of categories to meet all your needs.

Easy Payment Options:

- Enjoy the ease of buying in installments with ZoodPay, ZOOD’s payment solution.

- Choose from 4, 6, or 12 installments to spread your payments conveniently.

- With ZoodMall, you can shop in your local currency.

Shopping Experience:

- Shop for mobile phones, electronics, home appliances, beauty products, toys, and much more, all in one place.

- Experience a shopping journey with no hidden fees and transparent pricing.

Repayment Options:

- Opt for the ‘Pay After Delivery’ option for a full interest-free repayment within 14 days after receiving your order.

- ZoodPay’s application process is fully online, and approval is instant, ensuring a seamless experience for users.

Download the App Now:

- Don’t miss out on amazing deals and a stress-free shopping experience offered by ZOOD.

- Download the ZoodMall app today and start enjoying convenient shopping with flexible payment options.

Key Features of ZoodMall:

- Explore over 7 million products available on the platform.

- Enjoy the convenience of buying now and paying later with up to 12 installments.

- Benefit from 0% interest and no hidden fees on your purchases.

- Choose from a network of over 30,000 trusted merchants.

Recommended Reading: Top 3 Loan Apps In Pakistan (50K-100K Urgent Cash Loan)

ZOODShip Buy Now Pay Later

ZOODShip buy now pay later, powered by Fargo, is an innovative e-logistics company leading the way in last-mile delivery services across Uzbekistan. With a strong emphasis on efficiency, reliability, and customer satisfaction, Fargo ensures quick and secure deliveries right to your doorstep.

Trusted Partner for Businesses:

- ZoodShip, backed by Fargo, has become a reliable partner for businesses of all sizes, including large e-commerce platforms and local retailers.

- The company offers flexible solutions, personalized delivery choices, and cost-effective pricing strategies to meet each client’s specific needs.

E-Logistics Solutions:

- Whether it’s delivering packages to customers or managing supply chains seamlessly, ZoodShip, powered by Fargo, leads the e-logistics industry in Uzbekistan.

- Utilizing cutting-edge technology and a dedicated team, Fargo is reshaping last-mile delivery, making it faster, more dependable, and more convenient.

Our Achievements:

- Over 100,000 parcels are delivered each month, showcasing our commitment to efficient service.

- We achieve a remarkable 90% delivery rate within 24 hours, ensuring prompt deliveries for our customers.

- Our services cover 120 cities across Uzbekistan, providing widespread coverage.

- With a team of over 200 dedicated employees, we ensure top-notch service quality.

- We collaborate with over 1,000 partners, facilitating seamless logistics operations.

- Our fulfillment center spans over 2,500 square meters, equipped to handle large volumes of shipments.

- Customers benefit from over 30 convenient pick-up points and more than 250 lockers for easy retrieval of their packages.

Recommended Reading: Top 7 Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

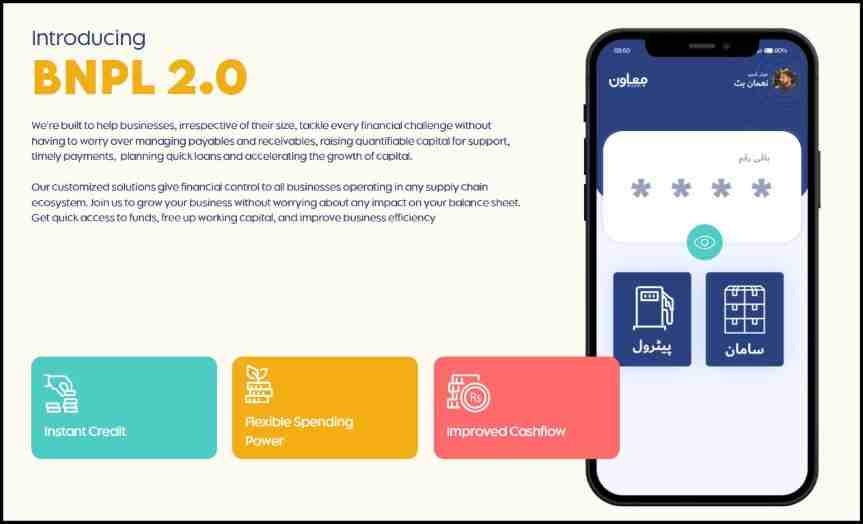

Muawin Loan App (B2B Buy Now Pay Later App)

Muawin Buy Now Pay Later is a special app where you can buy things now and pay for them later. It’s a big deal for everyone because it’s Pakistan’s first app like this. It helps businesses of all sizes handle their money better.

With this app, businesses can manage their payments easily, get money quickly, and make their business better without worrying too much about money problems. It’s like having a friend to help you with your finances.

Muawin Loan App Product

Muawin Munafa

Muawin Munafa is a program that allows you to buy items now and pay for them later. Small retailers are provided easy access to credit for their working capital needs. Working capital is offered in the form of inventory, allowing retailers to order and receive goods before making any payments.

Benefits for Retailers:

- Flexible Working Capital: Access to credit enables retailers to stock up on more products, leading to increased sales opportunities.

- Payments: Retailers can make payments conveniently through various methods such as e-wallets, cash, cheques, and bank transfers.

- Shariah Compliance: Retailers can access inventory through Islamic credit with fixed service fees, according to Shariah principles.

- Quick Processing: Working capital applications are processed within 5 hours, with inventory delivered within 48 hours after acceptance.

- Flexible Repayment: Retailers enjoy flexible repayment terms tailored to their needs, facilitating easier management of stock rotation.

- Credit Limit Incentives: Good payment behavior results in higher credit limits, leading to increased profitability for retailers.

Benefits for Partners:

- Increased Product Variety: Buy various products and boost SKU penetration for partners.

- Higher Sales Volume: Retailers stocking up on unique items leads to increased sales volume, benefiting partners.

- Customer Retention: Building strong relationships with partners encourages retailers to continue working with them, fostering long-term growth and customer retention.

Muawin Sahulat

Gig economy workers can access fuel on credit through our fuel partners. Increased Earnings By having access to fuel financing, gig workers can complete more rides or deliveries, leading to higher income.

Benefits for Retailers:

- Fuel Credit Cards: Retailers can access fuel credit cards to free up their working capital.

- Convenient E-Top Ups: Digital management of fuel limits and payments makes it easy for retailers.

- Shariah-Compliant: The program offers Shariah-friendly credit options.

- Credit Limit Rewards: Good repayment behavior leads to increased credit limits and rewards.

- Enhanced Mobility: With more fuel, gig workers can complete more rides or deliveries, increasing their mobility.

Benefits for Partners:

- Customer Loyalty: Partners’ agents are likely to grow further with the platform by offering unique services.

- Higher Ratings: End-users benefit from easier access to rides, leading to a positive outlook for the platform.

- Healthier Competition: With more working capital available, partners’ agents can compete for more rides.

Recommended Readings: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

Muawin Kashtkar

Farmers can access working capital in the form of inputs, which they can order and receive before making any payments.

Benefits for Farmers:

- Working Capital: Access to credit enables farmers to purchase more inputs, leading to increased sales opportunities.

- Convenient Payments: Farmers can make payments easily through various methods like e-wallets, cash, cheques, and bank transfers.

- Shariah-Compliant: The program offers Islamic credit options with fixed service fees.

- Quick Processing: Working capital applications are processed within 5 hours, with inputs delivered within 48 hours of acceptance.

- Flexible Repayment: Farmers enjoy easy repayment terms tailored to their needs, making input rotation easier.

- Credit Limit Incentives: Demonstrating good payment behavior leads to higher credit limits, resulting in greater profits.

Benefits for Dealers:

- Increased Product Variety: Encouraging farmers to purchase more diverse products boosts SKU penetration for dealers.

- Higher Sales Volume: Farmers selling more inputs due to secured financing translates to increased profits for both parties.

- Customer Retention: Building strong relationships with dealers encourages farmers to continue working with them, fostering long-term growth and customer loyalty.

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

Abhi-Your Salary Now Loan App

Qist Bazaar, a popular Buy Now Pay Later (BNPL) marketplace in Pakistan, has joined forces with ABHI to offer buy now pay later services using earned salaries. This aims to empower ABHI users to access buy now pay later facilities through the ABHI mobile app, and installment-based purchases.

Key Features of the Partnership:

- Employees of companies affiliated with ABHI can now purchase various electronics through the Qist Bazaar platform using affordable monthly installments via the ABHI app.

- The process is simple and involves logging into the ABHI app, selecting Qist Bazaar, and making the down payment through ABHI to buy items from the platform.

Abhi-Your Salary Now Loan Products

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | Abhi- Your Salary Now Loan App

ABHI Salary

ABHI allows employees to access their earned but unpaid salary at any time and from anywhere through the app or SMS. They can withdraw their salary, pay bills, and send money to family or friends whenever needed, reducing financial stress and increasing productivity for employers.

How It Works:

- Your company signs up with ABHI, and you download the ABHI mobile app.

- Your balance, representing your earned wages, is displayed on the app and increases daily, reaching its maximum on the last day of the month.

- To make a transaction, enter the required amount and select the withdrawal account. Then, send the money there.

- The transfer is completed in just 30 seconds, and a fixed fee of Rs.100 is charged for each transaction.

- Your company automatically deducts the transacted amount and the transaction fee from your salary before processing your payroll.

- The remaining salary is then credited into your account by your company as part of the regular payroll.

ABHI Factoring

Invoice Factoring is a financial service provided by ABHI buy now pay later that allows businesses to borrow against their future cash flows. This service helps businesses optimize their operations, reduce overall costs, and gain better control over their cash flow.

How It Works:

- The company submits relevant invoices to ABHI, indicating the amount they want to be discounted or factored in.

- ABHI’s risk and compliance departments assess the company’s financial stability by analyzing its bank statements and financial audit reports.

- Once approved, ABHI determines the amount to be provided, usually up to 80% of the total invoice amount.

- The approved amount is then transferred directly into the company’s corporate account via IBFT (Interbank Fund Transfer).

- A transaction report is sent to the company for record-keeping.

- ABHI communicates a repayment date to the company.

- Upon receiving payment from their client, the company repays ABHI the Loan amount along with a service fee, as agreed upon.

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

Abhi Financing

ABHI Buy Now Pay Later, in collaboration with BlueEx, offers Cash on Delivery Financing, a Shariah-compliant short-term loan solution designed to address the cash flow challenges faced by e-commerce platforms.

How It Works:

- Application: Fill out the form on the BlueEx website and submit your application.

- Financial Evaluation: Team ABHI conducts a financial assessment to determine your eligibility for a Shariah-compliant loan.

- Agreement: If approved, you agree and sign BlueEx as your exclusive Cash on Delivery partner.

- Loan Disbursement: ABHI disburses the cash into your account, enabling you to purchase necessary stock and increase sales.

- Delivery and Payment Collection: For each Cash on Delivery sale, BlueEx efficiently delivers orders and collects payments, which are then settled with ABHI on a weekly, bi-weekly, or monthly basis, capped at a pre-decided repayment amount.

- Reapplication: Once the loan is paid off, you have the option to reapply, repeating the process to access funding again.

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

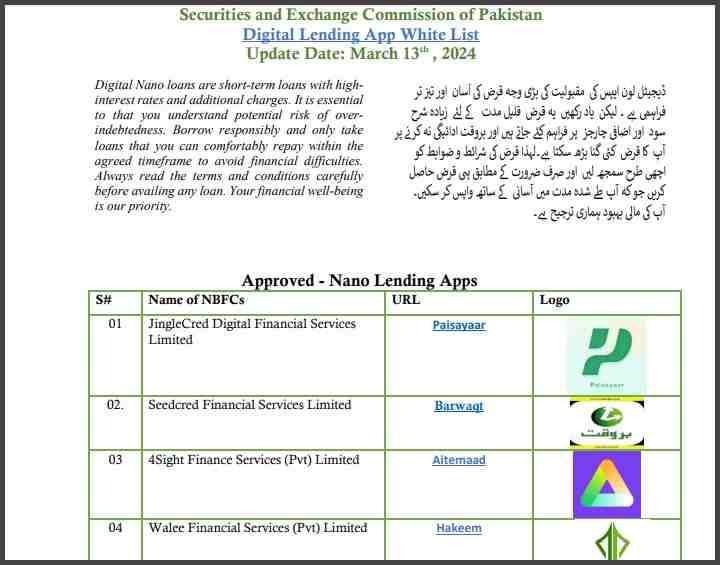

SECP Registered Loan Apps List | SECP Loan App

The following loan apps are registered with SECP and these nano lending apps are authorized for carrying loan services across Pakistan.

Here is an updated list of loan apps that provide 10,000 to 50,000 online loans in Pakistan:

- Barwaqt

- Paisayaar

- Aitemaad

- Hakeem

Recommended Reading: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

FAQs | Buy Now Pay Later Apps

What are Buy Now Pay Later Apps?

Buy Now Pay Later (BNPL) apps are a type of financial service that allows users to purchase goods and services immediately but defer payment to a later date. This model is relatively new to Pakistan but has been around for some time globally. Due to concerns about scams and data theft from unauthorized nano-lending apps, people in Pakistan have been hesitant to trust such platforms. But these top three Buy Now Pay Later Apps in Pakistan are registered with the SECP.

Which are these top Buy Now Pay Later Apps?

Our list includes the following Buy Now Pay Later apps:

Muawin Loan App (B2B Financing)

ZOOD (Buy Now Pay Later App)

& Abhi-Your Salary Now! (Earned Wage Access).

What are the top Buy Now Pay Later Apps in Pakistan that are registered with SECP?

Here is an updated list of loan apps that provide 10,000 to 50,000 online loans in Pakistan:

Barwaqt

Paisayaar

Aitemaad

Hakeem

Which product is offered by the ZOOD Buy Now Pay Later app?

ZOOD Buy Now Pay Later (BNPL) is a convenient payment solution offered by ZOOD, a leading digital lending platform.

ZoodPay BNPL: Flexible payment options allowing users to pay in 4, 6, or 12 installments without interest.

ZoodPay Credit: Interest-bearing payment solutions with repayment options over 6 or 12 equal installments.

Consumer Buy Now Pay Later: BNPL options for consumers with 4 installments or Consumer Credit with 6 or 12 installments.

ZoodMall BNPL: Shopping on ZoodMall with the option to buy now and pay later, with no interest or hidden fees.

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Do you have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment