Want to get 50K to 1 Lakh digital loan in Pakistan? Well, here is a list of the top 3 online loan apps in Pakistan that are registered and licensed by SECP to provide loan services across Pakistan.

Q1. Which online loan apps provide loans by using your mobile only?

Here is a list of the top 3 digital loan apps that provide online loans of up to Rs.1 Lakh:

- SmartQarza Loan App- Get a digital loan of Rs. 2,000 to Rs. 25,000.

- Paisayaar Loan App-Get a digital loan of Rs. 5,000 to Rs. 30,000.

- Abhi-Your Salary Now!-Get a digital loan of Rs. 10,000 to Rs. 50,000 (Repeated users can get up to Rs. 1 Lakh loan).

Now, the question is! How to get a 50K-1Lakh Digital Loan In Pakistan by using these nano apps?

Just, visit the Google Play Store from your mobile and download one of the above-mentioned loan apps. Sign up using your mobile number and CNIC Number. Select your desired loan and confirm your loan amount.

The loan amount will be transferred into your Easy Paisa, Jazz Cash, or bank account within 5 minutes of your loan form submission. You have to return the selected amount within 30-90 days.

Now, let’s discuss eligibility criteria, maximum loan limits, and the detailed process of getting at least a Rs. 50,000 digital loan in Pakistan within 5 minutes.

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | 30K Advance Salary Loan

Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

Table Of Contents

- Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

Top 3 SECP Registered Digital Loan Apps In Pakistan

Here are the Top 3 SECP Verified Digital Loan Apps:

These only three apps are verified by SECP. These three digital loan apps are verified and downloaded from the Play Store/Apple Store etc. You get loans from these digital loan apps because these apps are Real, not Fake.

Recommended Reading: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

SmartQarza Loan App

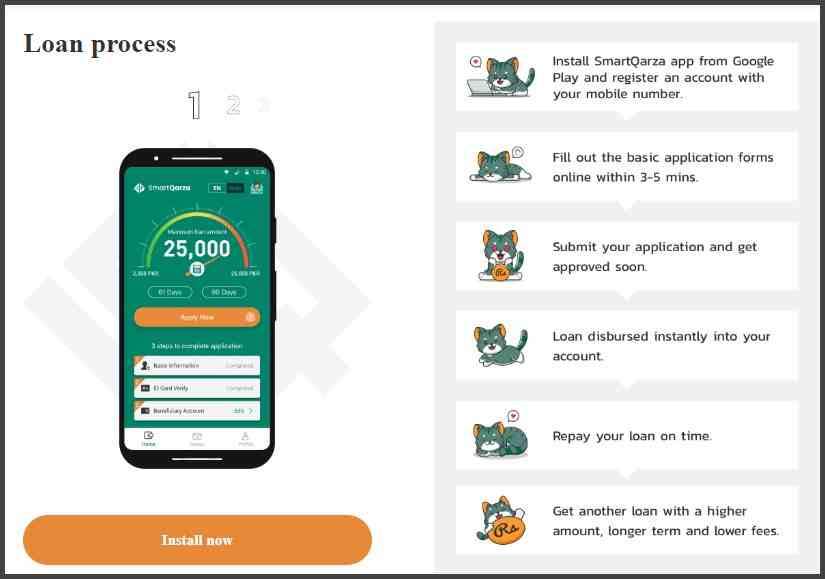

SmartQarza offers a simple way to apply for a personal loan in Pakistan. Anyone who meets the requirements can apply easily.

Just fill out some basic information online, select the loan that suits your needs, and once approved, the money will be transferred to your account instantly. Let’s discuss it!

Loan Amount

With the SmartQarza Loan App, you can borrow between 2,000 PKR to 20,000 PKR. Please note that these loans do have interest charges associated with them.

Recommended Reading: Top 7 Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

Loan Charges

If you get a loan Amount of 25,000 and the Highest APR of 220% and get a loan for 90 days so following charges are allowed on this Loan Amount.

Markup Charges

The markup charges with SmartQarza are a fixed amount, and they are set at 375 PKR for any of the loan amounts or the duration for which you get.

Whether you get a smaller or larger sum or for a short or extended period, the markup charge remains the same at 375 PKR.

Recommended Reading: Top 3 Loan Apps In Pakistan (50K-100K Urgent Cash Loan)

Services Fee

In the Loan Calculator, if you get a loan Amount of 25,000 PKR with a high Annual Percentage Rate (APR) of 220% for a 90-day term, you will be charged a service fee of 6,593.32 PKR. This service fee covers the cost of processing the loan and providing the associated services.

Process Fee

In the Loan Calculator, if you borrow 25,000 PKR with a 220% Annual Percentage Rate (APR) for 90 days, there’s an additional fee of 6593.32 PKR. This fee is called a processing fee and is charged to cover the cost of handling your loan application.

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

Late Fee

If you don’t pay on time, a late fee will be applied. This fee amounts to 2% of the applied on the total Loan.

Contact Details

Email: SmartQarza@outlook.com

Address: Office numbers 02 and 04, 2nd Floor Rajpoot Plaza GT Road Wah Cantt Tehsil Taxila District Rawalpindi, Punjab, Pakistan

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

Paisayaar Loan App

Paisayaar is an online Digital loan app under JINGLECRED DIGITAL FINANCE LIMITED. It’s a safe and flexible way to get a digital loan.

You can pick how you want to receive your loan and pay it back through various methods, and there are no hidden fees. You can get a loan amount between 1,000 to 25,000 PKR.

Loan Amount

Paisayaar is an online digital loan app under this app you can get loan amounts ranging from 1,000 to 25,000 PKR. You can get this amount in a very simple and easy way in a few minutes.

Recommended Reading: Top 7 Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

Loan Charges

Markup Rate

The interest you’ll be charged daily falls between 0% and 0.6%. If you get a Pkr. 25000 loan for 90 days the interest rate on the total amount is Pkr. 13,500. This amount also gives the total amount.

Recommended Reading: Top 3 Loan Apps In Pakistan (50K-100K Urgent Cash Loan)

Loan Days

This loan amount is given for 90 days. This loan is not interest-free if you do not pay this amount on time otherwise extra charges also apply.

Late Fee

If you do not pay this loan amount then other late fee charges also apply. If you’re late with your repayment, there’s a penalty interest of 2% to 2.5% per day.

Like, if you get a 25000 loan for 90 days and do not pay on time, and pay 20 days late.

If you pay on time total loan amount is 385,00 PKR. Then after 20 days late, you pay Pkr. 50,000. This means the late fee amount for 20 days is Pkr. 11500.

Contact Details

Address: Fortune Residency, Ground Floor, Street no. 26, National Police Foundation, E11/4, Islamabad.

Email: support@paisayaar.pk

Phone: 051-111-883-883 (Service Hotline)051-884-127-0 (Service Hotline) 03088888260 Grievance redressal officer

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | 30K Advance Salary Loan

Abhi-Your Salary Now!

Abhi Your Salary Now is a digital loan app. Employees can get the money they earned but haven’t received yet using an app or by texting.

About 80% of people in Pakistan get their salary and quickly spend it all. With ABHI, you can get your money whenever you need it, using the ABHI App, SMS, or WhatsApp.

Loan Amount

With the Abhi Your Salary Now app, you can quickly and easily get a digital loan in Pakistan, amounts ranging from 1,000 to 30,000 rupees, in just 3 minutes.

The process is very simple and easy you can get an urgent loan in straightforward ways. This loan amount is not interest-free you have to pay additional money for it.

Recommended Reading: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

Loan Charges

Interest/Markup Charges

Abhi Your Salary Now, you can get a loan from Pkr.1,000 to Pkr.30,000, and you get up to 90 days to return it. The interest you pay each day can be as low as 0% and up to 0.6%.

Late Fee

If you do not pay your payment on time, there’s a penalty of 2% to 2.5% per day, but these rates and the number of days may vary a bit.

Contact Details

Address: 505A, 5th Floor Fortune Towers, Shahrah-e-Faisal, Karachi Office # 5, Floor 6, Askari Corporate Tower, Lahore

Email: connect@abhi.com.pk

Phone: +92 304 111 5276

Pros And Cons Of Digital Loan Apps

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

Pros Of Digital Loan Apps

- Quick Access to Urgent Digital Loans Apps: These apps provide immediate loans ranging from 10,000 to 30,000.

- Simple Application Process: You can apply for a loan and get approval in just 3 minutes.

- Ease of Repayment: The repayment process is simple, making it easy for you to pay back the loan.

- SECP Verification: These apps are verified by the Securities and Exchange Commission of Pakistan (SECP), ensuring their legitimacy and reliability.

Cons Of Digital Loan Apps

- Not Compliant with Islamic Practices: Some loan apps may not follow Islamic principles in their lending processes.

- High Fees: These apps often impose high charges.

- High-Interest Rates: They may have high-interest rates, sometimes as much as 3%.

- Costly Application Process: There could be significant charges for the loan application process, sometimes as high as 5000 rupees.

Recommended Reading: Fori Loan In Pakistan (20K-2Lakh) | Emergency Cash Loan In Pakistan

FAQs | Digital Loan Apps

What are loan apps?

Digital Loan apps are mobile applications that allow users to get loan money directly from their smartphones. These apps ease the loan process, enabling users to apply for loans, receive approvals, and often get funds deposited directly into their linked bank accounts using their mobile devices.

Write the name of the Top 3 SECP Verified Loan Apps.

Here is the name of the Top 3 SECP Verified Digital Loan Apps:

1. SmartQarza Loan App

2. Paisayaar Loan App

3. Abhi Your Salary Now Loan App

How much can I get a loan through the SmartQarza Loan App?

SmartQarza offers loan amounts ranging from 2,000 PKR to 20,000 PKR.

What are the charges associated with a loan from SmartQarza?

For instance, for a 25,000 PKR loan over 90 days, charges include a fixed:

Markup Charges: 375 PKR

Service Fee: 6,593.32 PKR

Process Fee: 6,593.32 PKR

What happens if I’m late in repaying my loan from SmartQarza?

Late payments incur a late fee, amounting to 2% of the total loan amount.

What loan amounts are available through the Paisayaar Loan App?

Paisayaar provides loan amounts from 1,000 PKR to 25,000 PKR.

What are the interest rates and penalties for late payments with Paisayaar?

Interest rates vary between 0% to 0.6% per day. Late payments are penalized at a rate of 2% to 2.5% per day.

What loan amounts can I access through Abhi Your Salary Now?

Abhi Your Salary Now offers loan amounts ranging from 1,000 PKR to 30,000 PKR.

What are the interest rates and repayment periods available with Abhi Your Salary Now?

The interest rates range from 0% to 0.6% per day, and the repayment period can extend up to 90 days.

What verification ensures the reliability of these loan apps?

The listed loan apps, including SmartQarza, Paisayaar, and Abhi Your Salary Now, are verified by the Securities and Exchange Commission of Pakistan (SECP).

What are the contact details for SmartQarza, Paisayaar, and Abhi Your Salary Now?

Contact details for SmartQarza include an email at smartqarza@outlook.com and an office address in Punjab, Pakistan. For Paisayaar, it’s support@paisayaar.pk and an address in Islamabad. Abhi Your Salary Now’s contact details include connect@abhi.com.pk and offices in Karachi and Lahore.

What are the disadvantages of using these Digital loan apps?

Some drawbacks include non-compliance with Islamic practices, high fees, high-interest rates (up to 3%), and potentially costly application processes, sometimes involving charges as high as 5000 rupees.

How do I apply for a 50K-1 Lakh Digital Loan using these nano apps?

Apply for a 50K-1 Lakh Digital Loan using these nano apps:

Visit the Google Play Store from your mobile.

Download and install one of the mentioned loan apps.

Sign up with your mobile number and CNIC.

Select the Loan amount and confirm the loan.

The loan amount will be transferred to your Easy Paisa, Jazz Cash, or bank account within 5 minutes.

Repay the selected amount within 30-90 days.

What are the pros of using digital loan apps for quick access to urgent funds?

Pros of using digital loan apps for quick access to urgent funds:

Quick Access: Instant loans ranging from 10,000 to 30,000 PKR.

Simple Application Process: Approval in just 3 minutes.

Ease of Repayment: Convenient repayment process.

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment