Disclaimer! Due to the involvement of Urgent Loan Apps In Pakistan in illegal activities, like spamming their users, blackmailing, and data theft

We have made changes in our content by highlighting the top alternatives of Urgent Loan Apps In Pakistan that provide interest-free loans all over Pakistan.

we have highlighted the top welfare organizations in Pakistan that provide interest-free loans of PKR 50,000 to 2 Lakh loan to start a new business or to meet urgent needs.

Our list includes the following welfare organizations that provide interest-free loans of Rs.50,000-200,000 and are the best alternatives for Urgent Loan Apps In Pakistan:

- The Hunar Foundation

- Saylani Welfare Trust

- Akhuwat Foundation

- Alkhidmat Urgent

- Kashaf Foundation

- Chhipa Welfare Association.

These welfare organizations operate through their offices, websites, or their loan apps. So, to get urgent loan apps in Pakistan from these organizations you can get loans the way that suits you.

In the beginning, we have enlisted the top 7 conventional loan apps in Pakistan that provide urgent cash loans with fixed interest rates. Our list includes:

- Barwaqt – Digital Lending App

- Paisayaar-Urgent Cash Loan App

- Aitemaad-Quick Loan App

- Abhi – Your Salary Now!

- Zood (ZoodPay & ZoodMall) Buy Now, Pay Later

- Muawin – (B2B Financing)

- Easypaisa Loan App.

Having stated above let’s start our guide to top welfare organizations that are the best alternatives to Urgent Loan Apps In Pakistan. Let’s start our guide!

Recommended Reading: Top 3 Loan Apps In Pakistan (50K-100K Urgent Cash Loan)

Top 7 Urgent Loan Apps In Pakistan | Urgent Cash Loan Apps In Pakistan

Table Of Contents

- Top 7 Urgent Loan Apps In Pakistan | Urgent Cash Loan Apps In Pakistan

- List Of Top 7 Urgent Cash Loan Apps In Pakistan (Operate On Interest-Basis)

- Barwaqt – Digital Lending App

- Paisayaar-Urgent Cash Loan App

- Aitemaad-Quick Loan App

- Abhi – Your Salary Now!

- Zood (ZoodPay & ZoodMall) Buy Now, Pay Later

- Muawin – (B2B Financing)

- Easypaisa Loan App

- List Of Welfare Organizations In Pakistan (Providing Interest-Free Loans)

List Of Top 7 Urgent Cash Loan Apps In Pakistan (Operate On Interest-Basis)

Firstly, we will list down the top 7 conventional digital loan apps that work on an interest basis but provide urgent loans within a few minutes and operate 24/7.

These loan apps are registered/authorized by SECP Pakistan to carry out digital lending services across Pakistan.

Let’s get started with this part of our guide!

Barwaqt – Digital Lending App

Barwaqt is one of the top Loan Apps In Pakistan authorized by the Securities and Exchange Commission of Pakistan (SECP), ensuring its credibility and legality. Through Barwaqt, users can access hassle-free online financing without collateral, thus offering a secure platform for monetary transactions.

Barwaqt Loan Details

Barwaqt is an app in Pakistan where you can ask for a personal loan online, and you can get up to Rs. 25,000. You can apply whenever you need it, and anywhere in Pakistan.

Here are the details:

- Loan Amount: You can get a loan from PKR 1,500 to PKR 25,000.

- Loan Term: Choose to pay back in 61 to 90 days.

- Annual Interest Rate (APR): The yearly interest rate is 24%, and that’s the highest rate too.

- Other Fees: No extra charges.

For example, let’s say you borrow PKR 6,000 for 3 months:

- Monthly Markup Rate Calculation: Divide the 24% annual interest rate by 12 months to get a 2% monthly rate.

- Total Markup Calculation: Multiply the loan amount (PKR 6,000) by the monthly interest rate (2%), and then by the number of months (3): Total Markup = PKR 360.

- Total Repayment Amount: Add the markup to the loan amount to get the total repayment: Total Repayment Amount = PKR 6,000 + PKR 360 = PKR 6,360.

- Monthly Payment Amount: Divide the total repayment by the number of months: Monthly Payment Amount = PKR 6,360 / 3 = PKR 2,120.

So, for a PKR 6,000 loan over 3 months, the total repayment is PKR 6,360, with monthly payments of PKR 2,120.

Barwaqt Loan App Helpline Number

- Barwaqt Helpline Number: 021-36494000

- Email: cs@barwaqtfintec.com

- Address: LDA Community Centre, Near Barkat Market Passport Office, Lahore

Repayment Options: Barwaqt provides borrowers with flexible repayment options, allowing them to choose the best method for their convenience.

- Repayment Via 1 Bill: Borrowers can easily repay their loans through a single bill payment, simplifying the repayment process and ensuring timely payments.

- Repayment Via Mobile Wallet: Barwaqt facilitates loan repayment through mobile wallets, and settles their dues using digital payment methods.

- Repayment Via Easypaisa: Borrowers can repay their loans via Easypaisa, a popular digital payment platform in Pakistan, ensuring ease of transactions.

- Repayment Via JazzCash: Barwaqt also accepts loan repayments through JazzCash, providing a convenient avenue to settle outstanding balances.

Recommended Reading: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

Paisayaar-Urgent Cash Loan App

Are you in need of quick cash assistance? Look no further! Paisayaar offers access to urgent loans right from your mobile phone.

Here are the key loan details:

Maximum Loan Limit: Gain access to loans of up to Rs 25,000 instantly, through your mobile device.

Term of Loan: Repayment options spanning between 60 to 90 days.

How To Get A Cash Loan From Paisayaar Loan App?

- Download the Paisayaar Loan application from the Google Play Store.

- Provide Your Details:

- Complete the straightforward application process by furnishing your information.

- Customize Your Loan:

- Tailor your loan request by specifying the desired amount through the user-friendly interface.

- Await Approval:

- Relax as our efficient system processes your application promptly.

- Receive Your Loan:

- Once approved, you can access your loan right away.

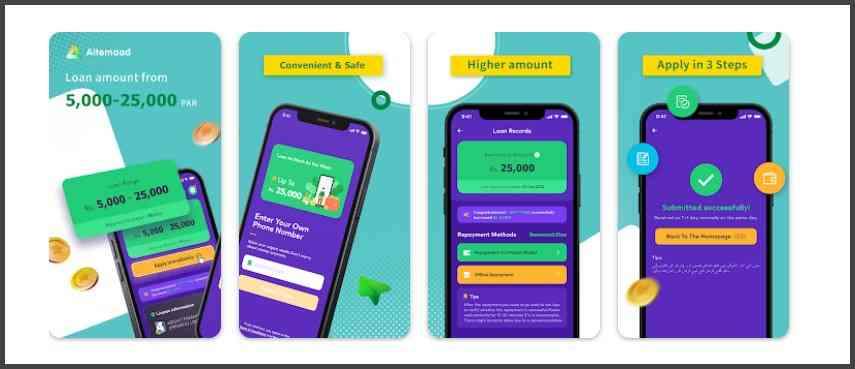

Aitemaad-Quick Loan App

The Aitemaad loan app provides urgent loans ranging from Rs 25,000 to Rs 50,000 online by using your mobile 24/7.

How To Get Urgent Cash Loan Via Aitemaad Loan App?

- Registration Process:

- Begin by registering yourself on the Aitemaad platform.

- Download the Aitemaad app and complete the registration process effortlessly.

- Submission of Information:

- Provide all necessary details as requested during the registration process.

- Select the desired loan amount based on your requirements and eligibility.

- Loan Approval and Disbursement:

- Following the submission of your information, our system swiftly assesses your application.

- Once the assessment is complete, the approved loan amount is seamlessly transferred directly to your bank account, ensuring quick access to funds.

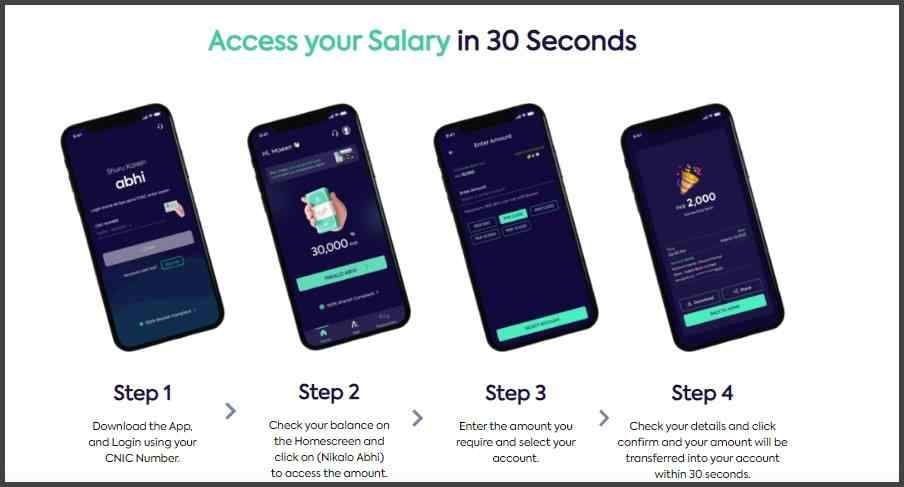

Abhi – Your Salary Now!

Services Offered:

- Advance Salary: Access a portion of your salary before the payday.

- Invoice Factoring: Utilize invoices to secure immediate funds for your business needs.

- Payroll Processing: Streamline your company’s payroll management with our efficient processing solutions.

- Payroll Financing: Secure financing options based on your payroll to meet your business requirements.

How To Get Advance Salary Via Abhi – Your Salary Now! App?

Effortless Steps to Obtain Advance Salary through Abhi – Your Salary Now! App:

- Company Onboarding:

- Your employer joins the ABHI platform, enabling you to access its services.

- Download the ABHI mobile app to embark on your financial journey.

- Real-time Balance Tracking:

- Monitor your available balance on the app, witnessing daily increments until the maximum amount is reached by month-end.

- Transaction Process:

- Should you require funds, simply input the desired amount and select the withdrawal account, whether existing or newly added.

- Initiate the transfer, and within 30 seconds, the selected amount will be credited to your chosen account.

- Transaction Fee:

- A nominal fixed fee of Rs.100 is levied on each transaction, ensuring transparency and ease of use.

- Automated Salary Deduction:

- Your company deducts the transacted amount and the transaction fee from your upcoming salary before processing the payroll.

- Remaining Salary Disbursement:

- Upon payroll processing, your remaining salary is credited to your account by your employer, ensuring seamless financial management.

Zood (ZoodPay & ZoodMall) Buy Now, Pay Later

Zood serves:

- 300 million individuals.

- 5 million SMEs across Lebanon, Uzbekistan, and Pakistan.

ZoodPay: Lending Services

Flexible Buy Now, Pay Later (BNPL) Option:

- ZoodPay BNPL offers a convenient, interest-free payment solution, allowing customers to split their payments into four equal installments.

- When opting for ZoodPay BNPL at checkout on ZoodMall or partner websites, customers settle 25% of the total amount immediately, with the remaining 75% divided equally over the following three months.

- Enjoy the convenience of interest-free payments without any additional fees.

- The maximum lending amount for ZoodPay BNPL is $500 or its equivalent in local currency.

ZoodPay Credit: Interest-Bearing Payment Solution:

- ZoodPay Credit provides customers with a flexible repayment option spread over 6 or 12 equal installments.

- Customers can access a maximum lending amount of $1,500 or its equivalent in local currency when utilizing ZoodPay Credit.

- Enjoy the convenience of spreading payments over a longer period while managing your finances effectively.

Muawin – (B2B Financing)

Pakistan’s Pioneer B2B Buy Now Pay Later Platform:

Muawin Products & Services

Munafa: Empowering Small Retailers

- Munafa is specifically crafted to cater to the needs of small retailers, providing them with convenient access to credit to fulfill their working capital requirements.

- Enjoy seamless financing solutions tailored to the unique needs of small businesses, ensuring smoother operations and growth opportunities.

Sahulat: Supporting Gig Economy Workers

- Sahulat is meticulously designed to assist gig economy workers, offering them smart and accessible fuel financing solutions to meet their mobility needs.

- Benefit from hassle-free access to fuel financing, ensuring uninterrupted work and enhanced productivity for gig workers across various industries.

Kashtkar: Empowering the Agri-Community

- Kashtkar is dedicated to serving the agricultural community, providing all stakeholders in the supply chain with access to credit from the procurement to the sale of farming inputs.

- Experience tailored financing solutions designed to optimize agricultural operations and enhance productivity throughout the farming cycle.

Easypaisa Loan App

- Maximum Loan Limit: Access up to PKR 10,000 through EasyCash Loan, providing immediate relief for your financial needs.

- Flexible Tenor Options: The tenor of this loan is 60 days for transactions made through the app and 30 days for other channels.

How To Repay Easypaisa Loan?

- Manual Repayments:

- Simply navigate to the “Repay” option on the main loan screen to initiate manual repayments effortlessly.

- Auto-Debit Facility:

- Opt for the hassle-free auto-debit facility by depositing funds into your mobile account.

- Easypaisa will automatically collect the repayment amount through an auto-debit feature on and after the due date, ensuring seamless repayment without any additional effort on your part.

Recommended Reading: Fori Loan In Pakistan (20K-2Lakh) | Emergency Cash Loan In Pakistan

List Of Welfare Organizations In Pakistan (Providing Interest-Free Loans)

Urgent Loan Apps in Pakistan refer to mobile applications that facilitate the provision of quick and immediate cash loans to individuals in need.

These apps typically offer loans ranging from a minimum of 5,000 PKR to a maximum of 50,000 PKR or more, all without charging any interest.

Examples of such websites and apps include the Kashf Foundation and Alkhidmat Foundation. Here is the name of the Top 7 Urgent Loan Apps In Pakistan that give interest-free loans.

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

The Hunar Foundation Loan Apps

The Hunar Foundation is an urgent loan app in Pakistan that aims to empower economically disadvantaged individuals by providing them with technical education and vocational skills.

Their primary focus is on sectors such as automotive, construction, hospitality, and information technology.

By equipping individuals with valuable skills, the organization seeks to enhance their employability and enable them to lead better lives.

While the Hunar Foundation does not directly provide interest-free loans, they may offer financial assistance or scholarships to deserving students who enroll in their vocational training programs.

These scholarships can help cover the cost of education and training, thereby reducing the financial burden on students.

Recommended Reading: 25,000 Online Urgent Loan In Pakistan (SECP Verified)

- Student Loans: The Hunar Foundation offers student loans to support individuals pursuing technical and vocational education. These loans are designed to cover the cost of tuition fees, training materials, and other related expenses.

- Business Loans: The Hunar Foundation provides business loans to aspiring entrepreneurs who have completed their vocational training programs. These loans aim to assist individuals in starting their small businesses or expanding existing ones.

- Emergency Loans: In certain cases, the Hunar Foundation may provide emergency loans to individuals facing unexpected financial crises.

The Hunar Foundation Helpline

- Corporate Office Landline: (+92-21) 35090208

- Email: info@hunarfoundation.org

- Address: Corporate Office: 83/4, DEH DIH, Ibrahim Hyderi Road, Near Millennium Institute of Technology & Entrepreneurship (MiTE), Taluka Korangi District, Karachi, Sindh, Pakistan.

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | 30K Advance Salary Loan

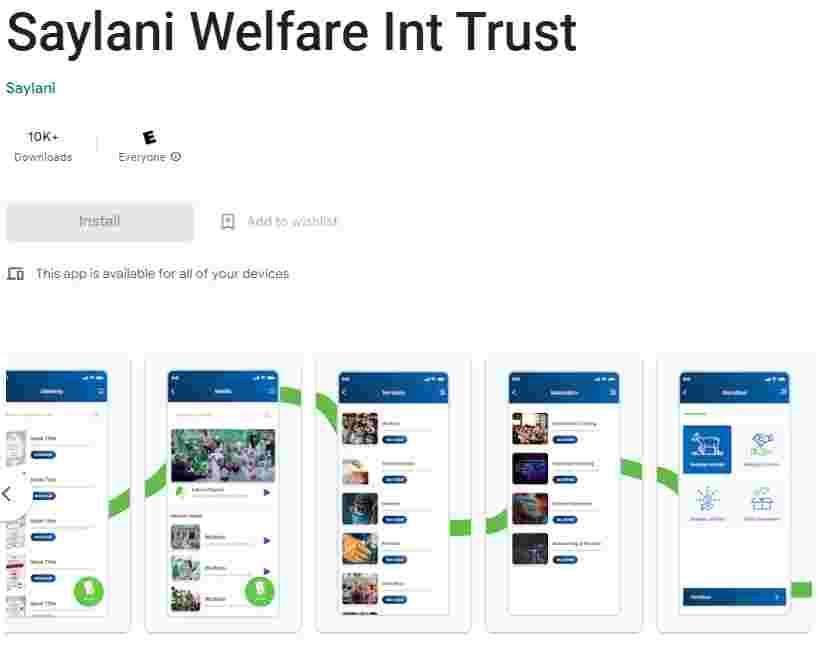

Saylani Welfare Trust Loan

Saylani Welfare Trust is an urgent loan app in Pakistan, it is also a renowned non-profit organization in Pakistan that is dedicated to providing various humanitarian services to underprivileged segments of society.

By providing interest-free urgent loan apps in Pakistan, Saylani Welfare Trust aims to promote financial inclusion and enable individuals to improve their lives and pursue their goals without the burden of interest charges.

- Education Loans: Saylani Welfare Trust offers interest-free urgent loan apps in Pakistan for education loans ranging from Rs. 10,000 to Rs. 200,000. These loans are designed to support individuals in pursuing their educational goals, covering expenses such as tuition fees, books, and other educational necessities.

- Emergency Loans: The loan apps by Saylani Welfare Trust also provide interest-free emergency loans ranging from Rs. 10,000 to Rs. 200,000. These loans are intended to assist individuals facing unexpected financial crises, such as medical emergencies or unforeseen personal expenses.

- Small Business Loans: Saylani Welfare Trust recognizes the importance of entrepreneurship and offers interest-free small business loans ranging from Rs. 10,000 to Rs. 200,000.

- Health Care Loans: Saylani Welfare Trust also extends interest-free loans for healthcare purposes. Although the specific loan amount range is not mentioned, these loans are tailored to support individuals in meeting their medical expenses, including hospital bills, surgeries, medications, and other healthcare-related costs.

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

Akhuwat Foundation Loan

Akhuwat Foundation is a renowned non-profit organization that focuses on poverty alleviation and community development through various initiatives, including interest-free microfinance.

Here are some of the types of loans provided by the Akhuwat organization include:

- Liberation Loan: The Liberation Loan offered by the Akhuwat Foundation Loan App provides individuals with a range of 10,000 to 100,000 Pakistani Rupees. This loan aims to support individuals in their journey toward financial independence, enabling them to invest in income-generating activities, start a small business, or meet personal financial needs.

- Marriage Loan: The Akhuwat Foundation Loan App offers a Marriage Loan range of 10,000 to 50,000 Pakistani Rupees. This loan is designed to assist individuals in covering the expenses associated with weddings, including wedding ceremonies, dowry, bridal expenses, and other related costs.

- Health Loan: With a range of 10,000 to 50,000 Pakistani Rupees, the Health Loan provided by the Akhuwat Foundation Urgent Loan Apps In Pakistan addresses the financial challenges of medical treatments and healthcare expenses. This loan helps individuals access necessary healthcare services and cover medical bills, surgeries, medications, and other healthcare-related costs.

- Emergency Loan: The Emergency Loan range of 10,000 to 50,000 Pakistani Rupees provided by the Akhuwat Foundation Loan App aims to support individuals during unexpected financial crises.

- Housing Loan: The Akhuwat Foundation Urgent Loan Apps In Pakistan offers a Housing Loan range of 30,000 to 100,000 Pakistani Rupees. This loan is intended to assist individuals in meeting their housing needs, including home repairs, renovations, or even purchasing land for constructing a house.

- Educational Loan: The Educational Loan provided by the Akhuwat Foundation Urgent Loan Apps In Pakistan ranges from 10,000 to 50,000 Pakistani Rupees. This loan is tailored to support individuals pursuing educational opportunities by covering tuition fees, books, supplies, or other educational expenses.

Alkhidmat Urgent Loan

The Alkhidmat Foundation provides an urgent loan app in Pakistan convenient and accessible platform for individuals to obtain interest-free urgent loan apps in Pakistan for various purposes, such as education, healthcare, business development, emergencies, and more.

Here are the loan-giving types provided by the Alkhidmat Foundation:

- Small Business Loan (Interest-Free): Alkhidmat Foundation provides interest-free Small Business Loans up to PKR 100,000. These loans aim to empower individuals by providing financial support to start or expand their small businesses, fostering entrepreneurship and economic growth.

- Loan for Orphan’s Mother: Alkhidmat Foundation offers a specific loan category designed to support mothers who are taking care of orphaned children. This loan, amounting to PKR 100,000, aims to assist these mothers in meeting their financial needs and providing a stable environment for the upbringing of orphaned children.

- Liberation Loan: Alkhidmat Foundation also provides Liberation Loans, which amount to PKR 50,000.

Recommended Reading: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

Akhuwat Foundation Helpline

- Phone: 042-111-448-464

- Email: info@akhuwat.org.pk

- Address: 19 Civic Center, Minhaj Ul Quran University Rd، Sector A-II Twp Commercial Area Lahore, Punjab

Kashf Foundation Urgent Loan

Kashf Foundation urgent loan apps in Pakistan have emerged as a reliable source of financial assistance for individuals in need.

Through Kashf Foundation urgent loan apps in Pakistan, individuals can apply for loans for various purposes, including small business development, education, healthcare, emergencies, and more.

The loan amounts and specific categories may vary based on the applicant’s needs and eligibility.

The Qarz-e-Hasna loan program encompasses several loan types, each with specific loan ranges:

- Individual Loan: This loan type offers loan amounts ranging from PKR 10,000 to PKR 100,000. It is designed to assist individuals in meeting their personal financial needs, such as emergencies, medical expenses, debt consolidation, or other urgent requirements.

- Group Loan: The Group Loan option provides higher loan amounts, ranging from PKR 50,000 to PKR 500,000. This loan is specifically designed to support collective initiatives and group-based projects, fostering community collaboration and socio-economic development.

- Agriculture Loan: The Agriculture Loan program focuses on supporting individuals involved in agricultural activities. The loan amounts provided range from PKR 10,000 to PKR 100,000, aiming to enable farmers and agriculturists to invest in agricultural practices and enhance productivity.

- Microenterprise Loan: Microenterprise Urgent Loan Apps In Pakistan are available for individuals looking to start or expand their small businesses. The loan amounts provided range from PKR 10,000 to PKR 500,000, facilitating entrepreneurship and fostering economic growth at the grassroots level.

- Livestock Loan: The Livestock Loan program caters to individuals involved in livestock farming. It offers loan amounts ranging from PKR 10,000 to PKR 100,000, allowing farmers to invest in livestock and related activities for sustainable income generation.

- Education Loan: The Education Loan option supports individuals pursuing educational endeavors. Loan amounts range from PKR 10,000 to PKR 100,000, assisting students in covering education-related expenses, including tuition fees, books, and other educational necessities.

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

Kashf Foundation Helpline

- Fax: +92-42-35248916

- Phone: +92-42-111-981-981

- Email: info@kashf.org

- Address: 1 C Shahrah Nazaria-e-Pakistan, Lahore, Pakistan

Chhipa Welfare Association Loan

Chhipa Welfare Association: The interest-free urgent loan apps in Pakistan programs provided by the Chhipa Welfare Association are designed to cater to various needs and purposes.

The loan amounts offered within each category are as follows:

- Qarz-e-Hasna: The loan amount can range from Rs. 10,000 to Rs. 50,000. This general loan category aims to support individuals in meeting their immediate financial needs, providing them with access to funds without the burden of interest charges.

- Educational Loan: The loan amount for educational purposes ranges from Rs. 10,000 to Rs. 50,000. This loan category assists individuals in financing their educational expenses, including tuition fees, books, and other educational requirements.

- Health Care Loan: The loan amount for health care purposes also ranges from Rs. 10,000 to Rs. 50,000. This loan category supports individuals in covering their medical expenses, such as hospital bills, medications, surgeries, and other healthcare-related costs.

- Business Loan: The business loan category provides loan amounts ranging from Rs. 10,000 to Rs. 50,000. This loan is specifically designed to support individuals in starting or expanding their small businesses, promoting entrepreneurship and economic growth.

Recommended Reading: Fori Loan In Pakistan (20K-2Lakh) | Emergency Cash Loan In Pakistan

Chhipa Welfare Helpline

- Phone: +92-21-111-111-134

- Email: info@chhipa.org

- Address: CHHIPA HEAD OFFICE, Plot No. ZC-5, Sector 8/A, FTC Bridge, Shahrah-e-Faisal, Karachi-74400, Sindh, Pakistan.

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

FAQs | Urgent Loan Apps In Pakistan

What are Urgent Loan Apps In Pakistan?

Urgent Loan Apps in Pakistan refer to mobile applications facilitating quick cash loans, typically ranging from 5,000 PKR to 50,000 PKR, without charging any interest. Examples include the Kashf Foundation and Alkhidmat Foundation.

What loan apps provide interest-free loans in Pakistan?

Top Urgent Loan Apps in Pakistan that provide interest-free loans of PKR 50,000 to 2 Lakh loan to start a new business or to meet urgent needs.

The Hunar Foundation

Saylani Welfare Trust

Akhuwat Foundation

Alkhidmat Urgent

Kashaf Foundation

Chhipa Welfare Association.

Why consider alternatives to What are Urgent Loan Apps In Pakistan?

Due to concerns about illegal activities, spamming, blackmailing, and data theft associated with Urgent Loan Apps, we recommend exploring alternatives for interest-free loans in Pakistan.

What does The Hunar Foundation offer in terms of loans?

The Hunar Foundation primarily offers Student Loans, Business Loans, and Emergency Loans to individuals pursuing technical and vocational education or aspiring entrepreneurs.

What types of interest-free loans does Saylani Welfare Trust provide?

Saylani Welfare Trust offers Education Loans, Emergency Loans, Small Business Loans, and Health Care Loans, ranging from Rs. 10,000 to Rs. 200,000.

What loan categories are available from the Akhuwat Foundation?

Akhuwat Foundation provides Urgent Loan Apps in Pakistan like Liberation Loans, Marriage Loans, Health Loans, Emergency Loans, Housing Loans, and Educational Loans, with varying amounts to support diverse needs.

What types of interest-free loans can be obtained from the Alkhidmat Foundation?

Alkhidmat Foundation offers Small Business Loans, Loans for Orphan Mothers, and Liberation Loans, with loans ranging from PKR 50,000 to 100,000.

What are the loan programs offered by the Kashf Foundation?

Kashf Foundation provides Urgent Loan Apps in Pakistan like Individual Loans, Group Loans, Agriculture Loans, Microenterprise Loans, Livestock Loans, and Education Loans, catering to various financial needs.

What loan options are available through the Chhipa Welfare Association?

Chhipa Welfare Association offers Qarz-e-Hasna, Educational Loans, Health Care Loans, and Business Loans, ranging from Rs. 10,000 to Rs. 50,000.

What are the benefits of using Urgent Loan Apps?

Benefits include quick access to funds, interest-free loans, a simple application process, easy repayment options, convenient accessibility, varied loan amounts, minimal documentation, and no extensive credit checks.

How can I apply for loans from the mentioned welfare organizations?

To apply for loans, visit the respective offices of The Hunar Foundation, Saylani Welfare Trust, Akhuwat Foundation, Alkhidmat Urgent, Kashaf Foundation, or Chhipa Welfare Association. Some organizations also provide online applications through their websites or dedicated loan apps.

Does Saylani Welfare Trust impose any interest on their educational loans?

No, Saylani Welfare Trust provides interest-free educational loans, supporting individuals in pursuing their educational goals without the burden of interest charges.

What is the maximum loan amount offered by Kashf Foundation’s Group Loan program?

The Group Loan program by the Kashf Foundation provides higher loan amounts, ranging from PKR 50,000 to PKR 500,000, supporting collective initiatives and group-based projects.

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

If you find the information in this article valuable, we would greatly appreciate it if you could take a moment to comment and share it with others. Your support helps us reach more people with important information.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment