Are you looking for the best bank for solar financing in Pakistan?

Look no further, we have compiled a list of the top 7 banks in Pakistan that provide solar panels in installments across Pakistan.

These banks provide loans for solar installations ranging from Rs. 100,000 to Rs.2,500,000 on lower interest rates compared to other private companies that provide solar loans.

Our list includes the following top banks of Pakistan:

- Meezan Bank

- Bank Alfalah

- HBL

- UBL

- JS Bank

- Bank Of Punjab

- Bank Of Khyber

We will discuss their eligibility criteria, document requirements, solar financing limits, and a step-by-step guide on how you can apply for solar loans from the banks.

Let’s get started with our guide!

Recommended Reading: Prime Minister Solar Panel Scheme 2024 | Solar Tubewell Scheme

Solar Panel On Installments In Pakistan | Solar Financing Pakistan

Table Of Contents

- Solar Panel On Installments In Pakistan | Solar Financing Pakistan

Recommended Reading: Solar Tubewell Subsidy In Pakistan | Solar Tubewell+Biogas Plants

Meezan Bank Solar Financing

Meezan Bank helps you get solar panels for your home. With Meezan Solar, you can pay the whole system in installments without extra interest. This means you can save up to half your monthly electricity bill.

This helps the environment too. You can get a solar system from 1 kilowatt to 1000 kilowatts. The financing starts from Rs. 100,000 and goes up to Rs. 2,500,000.

Recommended Reading: Electric Bike Scheme For Students 2024 | Punjab e-bike Scheme Registration

Meezan Bank Solar Financing Details

- Islamic Financing Approach: Meezan Bank offers solar financing based on the Islamic principles of Musawamah.

- Flexible Installments: You can pay back the loan in monthly installments that suit your budget.

- Special Discounts: Premium customers may receive special discounts on their financing.

- Loan Duration: You can choose a repayment period ranging from 1 year (minimum) to 5 years (maximum).

- System Capacity: Meezan Bank finances solar systems ranging from 1 kilowatt to 1000 kilowatts.

- Loan Amount: The financing amount starts from PKR 100,000 and goes up to PKR 2,500,000.

- Security Requirements: The bank may require a Hire Purchase Agreement (HPA) on the solar panels and three post-dated cheques.

- Ownership Requirement: You must own the property where the solar panels will be installed.

- Requirement for Co-applicants: Co-applicants do not need to meet income requirements.

- Down Payment for On-Grid Systems: Depending on your credit history, you may need to pay a down payment ranging from 15% to 50%.

- Down Payment for Off-Grid Systems: The down payment for off-grid systems is between 30% to 50%.

- Special Offer for Premium Banking Customers: Premium Banking customers can get financing up to PKR 3,000,000.

Recommended Reading: Turkey Visit Visa Price In Pakistan 2024 {e-Visa Fee+Documents}

Meezan Bank Solar Financing Requirements

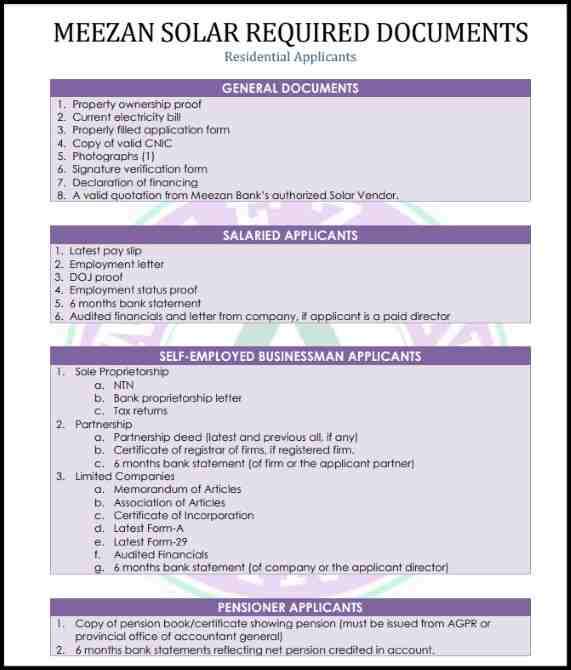

Documents Required For Meezan Bank Solar Scheme

For Residential Applicants:

General Documents:

- Proof of property ownership.

- Current electricity bill.

- Completed application form.

- Copy of valid CNIC.

- One photograph.

- Signature verification form.

- Declaration of financing.

- Valid quotation from Meezan Bank’s authorized Solar Vendor.

For Salaried Applicants:

- Latest pay slip.

- Employment letter.

- Proof of Date of Joining (DOJ).

- Proof of employment status.

- Six months’ bank statement.

- Audited financials and letters from the company.

For Self-Employed Businessman Applicants:

- For Sole Proprietorship:

- NTN.

- Bank proprietorship letter.

- Tax returns.

- For Partnership:

- Partnership deed (latest and previous, if any).

- Certificate of registrar of firms (if registered).

- Six months bank statement (of the firm or the applicant partner).

- For Limited Companies:

- Memorandum of Articles.

- Articles of Association.

- Certificate of Incorporation.

- Latest Form-A.

- Latest Form-29.

- Audited financials.

- Six months bank statement (of the company or the applicant director).

For Pensioner Applicants:

- Copy of pension book/certificate showing pension (issued from AGPR or provincial office of accountant general).

- Six month’s bank statements reflecting net pension credited to the account.

Eligibility Criteria for Meezan Bank Solar Financing

- Nationality and Age Requirements: Applicants must be Pakistani citizens, adults, and permanent residents holding a CNIC. The minimum age is 20 years, and the maximum age is 60 years or up to the age of retirement at the time of maturity. Co-applicants must be under 75 years of age.

- Income Criteria: The minimum monthly gross salary should be PKR 100,000.

- Job Tenure: Applicants must have a continuous employment history of at least 2 years with their current employer.

- Tax Compliance: Applicants must be active taxpayers with an NTN number.

- References: Two references are required from the applicant.

- Mandatory Account: Having an account with Meezan Bank is mandatory.

- Debt Burden Ratio (DBR): The maximum DBR allowed is 40% for applicants new to the industry or with a credit history of less than 12 months, and 45% for customers with an established credit history of 12 months or more.

Recommended Reading: DAP Subsidy Registration Online 2024 | DAP Subsidy Check Online

Meezan Bank Solar Financing Interest Rate

- Processing Charges: PKR 5,000 plus Federal Excise Duty (FED).

- Documentation Charges: Determined based on actual costs.

- Late Payment Charges: There are no late payment charges.

- Meezan Energy Partner Survey Charges: Actual charges may apply if a survey is conducted by the Meezan Energy Partner.

- Termination: You have the option to terminate the financing anytime by paying the remaining installments.

- STR Fee: An additional PKR 1,000 STR Fee applies.

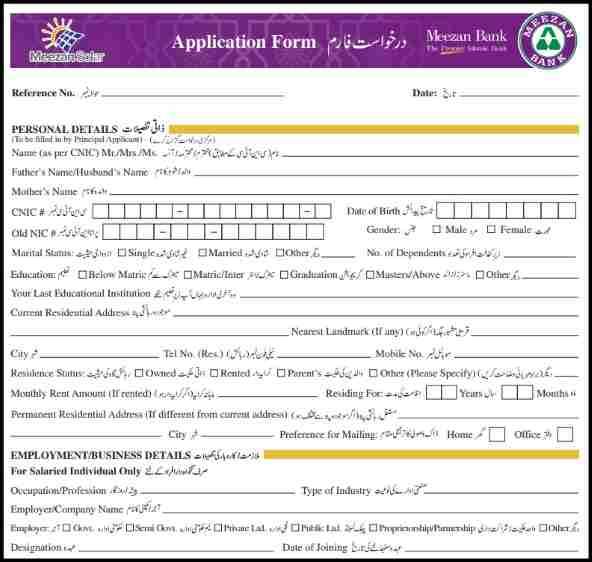

Meezan Bank Solar Scheme Application Form

You can download this application form through this link https://www.meezanbank.com/wp-content/themes/mbl/downloads/solar-application-form.pdf.

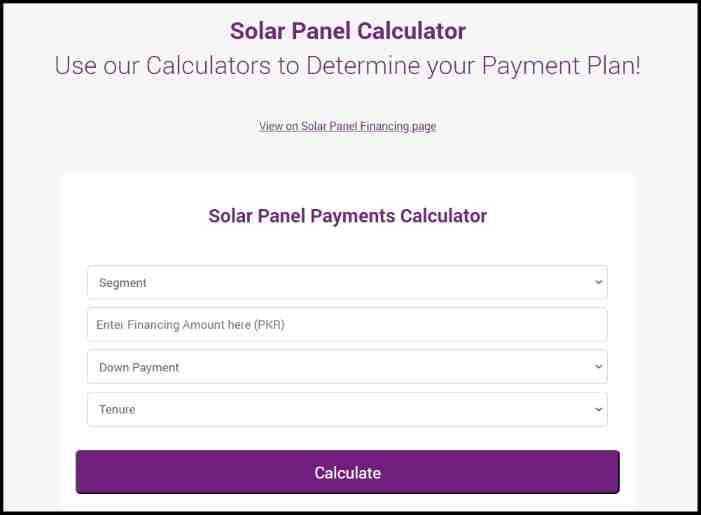

Meezan Bank Solar Financing Calculator

You can download this Calculator to Calculate your solar budget through this link https://www.meezanbank.com/solar-panel-calculator/.

Recommended Reading: Top 15 Real Estate Companies In Pakistan 2024 (Buy+Sell+Rent)

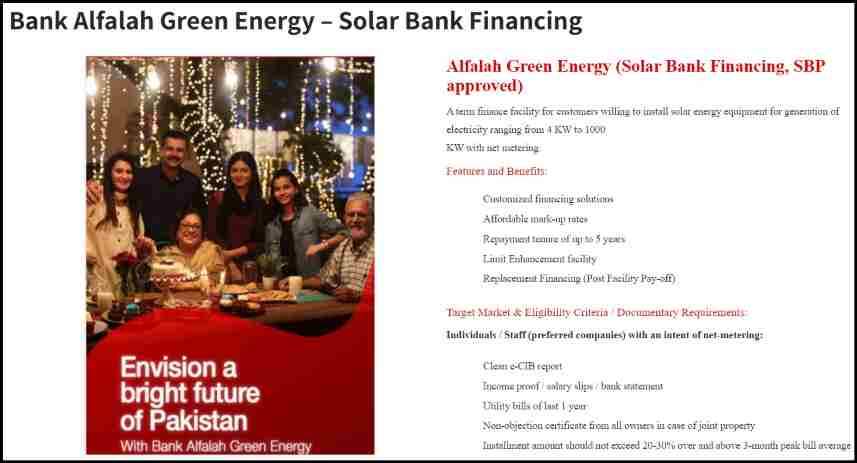

Bank Alfalah Solar Financing

Bank Alfalah is offering solar financing in Pakistan under the project name “Alfalah Green Energy.” This initiative allows customers to install solar energy to generate electricity without paying any extra interest. The financing is provided in easy installments. The facility covers a range of systems from 4 kilowatts to 1000 kilowatts and includes net metering.

Bank Alfalah Solar Financing Requirement

Eligibility Criteria and Documentary Requirements for Solar Financing:

- A clean e-CIB report is required.

- Proof of income such as salary slips or bank statements.

- Utility bills from the last year.

- Non-objection certificate from all property owners in case of joint ownership.

- The installment amount should not exceed 20-30% above the average of the peak bill over the last three months.

- Load applicability is determined by the respective DISCO (Distribution Company) and Vendor survey report.

For Commercial, SMEs & Agri-Business:

- A clean e-CIB report is required.

- Evidence of being in business for at least three years.

- Utility bills from the last year.

- Non-objection certificate from all property owners in case of joint ownership.

- The installment amount should not exceed 20-30% above the average of the peak bill over the last three months.

- Load applicability is determined by the respective DISCO and Vendor survey reports.

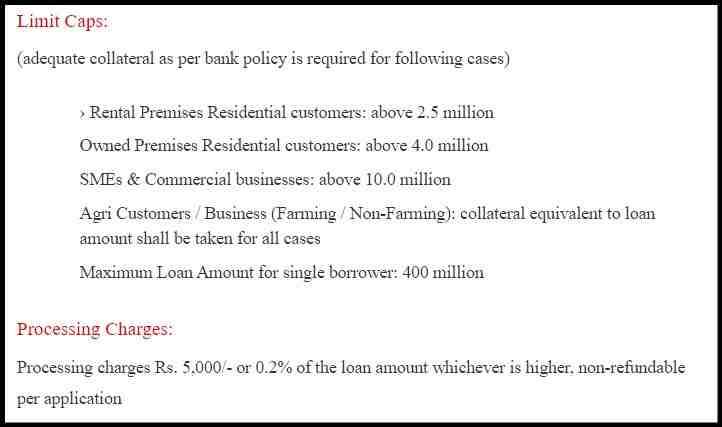

Bank Alfalah Solar Financing Amount

Bank Alfalah Solar Financing Amount:

- Residential customers renting premises can avail of loans above 2.5 million.

- Residential customers owning premises can access loans above 4.0 million.

- SMEs & commercial businesses can obtain loans above 10.0 million.

- Agricultural customers/businesses (farming/non-farming) need collateral equivalent to the loan amount for all cases.

- The maximum loan amount for a single loan is 400 million.

Solar Financing Processing Charges:

- Processing charges are either Rs. 5,000/- or 0.2% of the loan amount, whichever is higher, and are non-refundable per application.

Insurance:

- Insurance for the first year will be charged upfront with the down payment and will be included in installments for the remaining years.

Recommended Reading: Prime Minister Solar Panel Scheme 2024 | Solar Tubewell Scheme

Bank Alfalah Solar Financing Interest Rate+Mark Up

Mark-up Rate:

- The interest rate is fixed at 6% per year.

Frequency of Payments:

- Principal payments can be made monthly, quarterly, or bi-annually.

- Interest payments can be made monthly or quarterly.

Financing Tenure:

- You can repay the loan over up to 5 years, with a grace period of 3 months.

Down Payment:

- For self-owned premises and agricultural facilities, the down payment is 20%.

- For rental and lease, the down payment is 25%.

- Staff members with an intent of net metering have a down payment requirement of 10%.

Security:

- Hypothecation of equipment.

- Personal guarantees may be required.

- Down Payment: may need to be provided.

- Insurance coverage is mandatory.

- In some cases, a mortgage of property or cash/cash securities may be required, depending on the situation.

UBL Solar Financing

UBL Solar Financing Calculator

Recommended Reading: Governor Sindh Initiative For Artificial Intelligence | Governor Sindh IT Program

JS Bank Solar Financing

JS Smart Roshni Solar Solution Financing by JS Bank is a smart way for citizens of Pakistani and also business owners in Pakistan to affordably power their businesses while reducing dependence on the grid.

This financing covers solar, wind, and biogas options. With over 400 solar projects funded for homes and farms, JS Bank shows its dedication to clean energy. More than 33% of our branches are solar-powered, highlighting our commitment to clean energy adoption nationwide.

JS Bank Solar Financing Details

JS Bank Solar Financing Features are:

- Processing Fee & Charges: The processing fee and charges follow the Bank’s updated Schedule of Charges (SOC).

- Financing for Small & Medium Enterprises (SMEs): SME finance is based on the cash flows of the business.

- Financing Range: Loans are available between PKR 500,000/- and PKR 10,000,000/-.

- Equity Requirement: A minimum of 20% equity of the total solution quotation value is required.

- Collateral: Any collateral is accepted along with the hypothecation of the energy solution. Personal guarantees and post-dated cheques are also required.

- Tenor: The financing tenor ranges between 3 to 5 years.

- Repayment Structure: Repayment is made through equal monthly installments.

- Energy Solution Insurance: Insurance for the energy solution is mandatory, particularly for solar solutions.

JS Bank Solar Financing Eligibility Criteria

- Applicant must be a Pakistani national.

- The business must have been operational for at least one (1) year, with sufficient knowledge of the business operations.

- Proof of ownership of premises for solar installation is required. If the property is not owned (leased/rented), a No Objection Certificate (NOC) from the owner is necessary.

- A satisfactory credit history of the existing bank is required.

- The applicant must demonstrate financial ability to afford and repay the finance.

- *Disclaimer: Limits allowable to Small Enterprises and Middle Enterprises under SBP’s Prudential Regulations for SMEs.

Bank Of Punjab Solar Financing

The Bank of Punjab is offering a financing scheme for Renewable Energy to address the energy challenges in Pakistan. Through the BoP Renewable Energy Finance Facility, energy projects for households, commercial, and industrial purposes can get financing.

The process is easy and fast, with up to 25 million for small enterprises and up to 200 million for medium enterprises and above. The financing tenure is up to 10 years with a markup rate of 6% per annum. The facility type includes both term and demand finance.

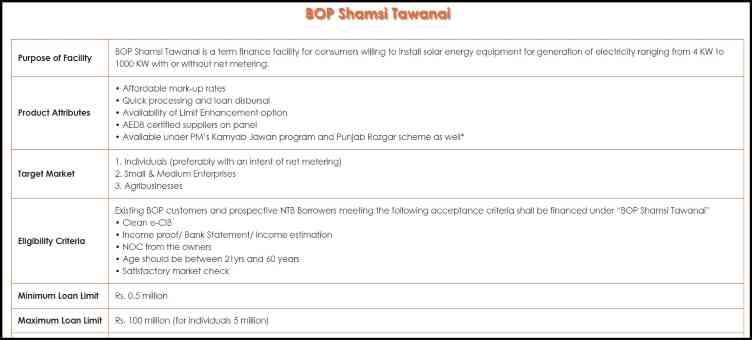

BOP Shamsi Tawanai provides a term finance facility for consumers interested in installing solar energy ranging from 4 KW to 1000 KW, with or without net metering.

Bank Of Punjab Solar Financing Details

BOP Shamsi Tawanai provides term finance for consumers aiming to install solar energy systems to generate electricity, ranging from 4 KW to 1000 KW, with or without net metering.

- Product Attributes:

- Affordable mark-up rates

- Quick processing and loan disbursal

- Eligible under PM’s Kamyab Jawan program and Punjab Rozgar scheme.

- Target Market:

- Individuals

- Small & Medium Enterprises

- Agribusinesses

- Eligibility Criteria:

- Clean e-CIB

- Proof of income/Bank statement/Income estimation

- NOC from owners

- Age between 21 and 60 years

- Satisfactory market check

- Loan Limits:

- Minimum: Rs. 0.5 million

- Maximum: Rs. 100 million (individuals up to 5 million)

- Down Payment:

- For Individuals/SMEs:

- 20% down payment for owned premises/family-owned with NOC

- 25% down payment for rental/lease premises with proof of ownership and NOC

- 25% down payment in other cases

- For Agri Customers/Business:

- Minimum 20% down payment for owned/family-owned premises/land

- 25% down payment in other cases

- For Individuals/SMEs:

- Tenure:

- Maximum: 8 years with a 3-month grace period

- Repayment Frequency:

- Monthly/Quarterly/Bi-annually

- Security:

- Hypothecation of Equipment AND

- Mortgage of Property (30% margin on mortgage value)

- OR Cash/Near Cash Collateral (10% on encashment value)

- OR Lien on Vehicles (30% margin on mortgage value)

- OR Security amount equal to 50% of the loan amount with online power generation monitoring

- OR Charge on Agri land through Zarai Pass Book (40% margin on last three years Oast Bai/Schedule rate value as assessed by revenue or evaluator) (for agri customers/businesses only)

- Hypothecation of Equipment AND

- Insurance:

- First-year insurance with down payment, remaining amount built into installments

- Pricing/Mark-up:

- As per prevailing market rates

- Processing Fee:

- As per the Schedule of Charges

Recommended Reading: Solar Tubewell Subsidy In Pakistan | Solar Tubewell+Biogas Plants

Bank Of Khyber Solar Financing

Bank Of Khyber Solar Financing Eligibility Criteria

Bank of Khyber Solar financing eligibility criteria are:

- Minimum monthly Net Income of PKR 25,000/-

- Age of Client from 22 years to 58 years (65 Years for Businessman)

- Engaged in business or service for more than 2 years

- Holding valid CNIC

- Clean ECIB report

- Solar system & its price to be negotiated by borrower directly with BOK’s approved vendor.

- Applicants scoring Credit Risk Rating from 1 to 5 only will be eligible for this facility

Bank Of Khyber Solar Financing Amount

Finance Limit:

- Category A: PKR 50,000/- to PKR 200,000/-

- Category B: PKR 200,001/- to PKR 500,000/-

- Category C: PKR 500,001/- to PKR 2,000,000/-

Debt to Equity Ratio:

- 25% to be paid by the customer & remaining 75% to be paid by the Bank to the authorized dealer

Bank Of Khyber Solar Financing Interest+Tenure+Others

- Finance Period: 6 months to 60 months

- Profit Rate: Profit rate @ 09% to 15% p.a. Applicable profit rate shall be as per HO-IBG’s monthly circular applicable at the time of transaction

- Security:

- Category A: One PG of Grade 17 or above Govt employee OR One PG of BOK a/c holder maintaining average balance more than facility amount.

- Category B: Two PGs of Grade 17 or above Govt employees OR Two PGs of BOK a/c holders maintaining an average balance more than the facility amount.

- Category C: Mortgage of residential House (as per Bank policy) OR Any other tangible security approved by the Group Head.

- Insurance: Client’s accidental death Takaful up to the finance amount.

- Repayment: Through monthly installments and Default Obligation As per BOK IBG’s Schedule of Charges.

- Sanction Authority: Head Islamic Asset Division for up to PKR 200,000/- Group Head IBG with Head Islamic Asset Division for facility exceeding PKR 200,000/-

FAQs | Solar Financing

What is Solar Financing In Pakistan?

In Pakistan, because of the high cost of electricity and high load-shedding, many banks are offering solar financing with easy payment plans and no added interest. You can select repayment terms from 1 to 5 years and finance solar systems ranging from 1 kilowatt to 1000 kilowatts. The financing amount usually starts at PKR 100,000 and can go up to PKR 2,500,000, but the specific terms and limits may vary depending on the bank.

Which banks offer Solar Financing In Pakistan?

Our list includes the following top banks of Pakistan:

Meezan Bank

Bank Alfalah

HBL

UBL

JS Bank

Bank Of Punjab

Bank Of Khyber

What is the Meezan Bank Solar Financing amount and tenure?

Meezan Bank offers solar financing with easy installments and no extra interest, helping you save on your electricity bill while benefiting the environment. You can choose repayment terms from 1 to 5 years and finance systems from 1 kW to 1000 kW. Premium customers may enjoy special discounts, and financing ranges from PKR 100,000 to PKR 2,500,000. Property ownership is required, and co-applicants don’t need to meet income requirements. Depending on your credit history, down payments for on-grid systems range from 15% to 50%, and for off-grid systems, it’s between 30% to 50%. Premium Banking customers can get financing up to PKR 3,000,000.

How much Solar Financing Amount was given by Bank Alfalah?

Bank Alfalah Solar Financing Amount for Residential renters can get loans above 2.5 million, owners above 4.0 million, and SMEs & commercial businesses above 10.0 million. Agri customers need collateral equal to the loan amount. Maximum loan: 400 million. Processing fees are Rs. 5,000/- or 0.2% of the loan. Fixed interest is 6% annually. Down payments range from 10% to 25% based on property type.

What are JS Bank Solar Financing Limits?

JS Bank’s Smart Roshni Solar Solution Financing offers affordable energy solutions for Pakistani citizens and businesses, covering solar, wind, and biogas. With over 400 projects funded and 33% of our branches solar-powered, our features include Processing Fees & Charges as per Schedule of Charges (SOC), SME financing based on cash flows, loans from PKR 500,000/- to PKR 10,000,000/-, 20% minimum equity, collateral acceptance with hypothecation, 3 to 5-year tenor, equal monthly installments for repayment, and mandatory energy solution insurance.

What is BOP Shamsi Tawanai Financing?

BOP Shamsi Tawanai provides term finance for solar energy systems ranging from 4 KW to 1000 KW. It offers affordable rates, quick processing, and eligibility under government schemes. The target market includes individuals, SMEs, and agribusinesses. Eligibility requires a clean record, proof of income, and NOC. Loans range from Rs. 0.5 million to Rs. 100 million. Down payment varies, and tenure is up to 8 years with flexible repayment options. Security options include equipment hypothecation and property mortgage.

What is BOK Raast Roshan Ghar?

The “Raast Roshan Ghar” Murabaha Facility from the Bank of Punjab assists diverse individuals, including government employees, self-employed professionals, and private sector workers. To qualify, a minimum monthly income of PKR 25,000 is required, along with a clean e-CIB report. Financing limits range from PKR 50,000 to PKR 2,000,000, with a 25% customer payment and 75% bank coverage. The finance period is 6 to 60 months, with a profit rate of 9% to 15% p.a.

Recommended Reading: Solar Tubewell Subsidy In Pakistan | Solar Tubewell+Biogas Plants

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Do you have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment