The financial situation of Pakistan has been f*ed off by our policymakers especially, by politicians. So, we have compiled this list of the best loan apps to help people meet their urgent cash needs.

Many loan shark apps are looting people of their hard-earned money and, because of the misinformation spread all over the internet.

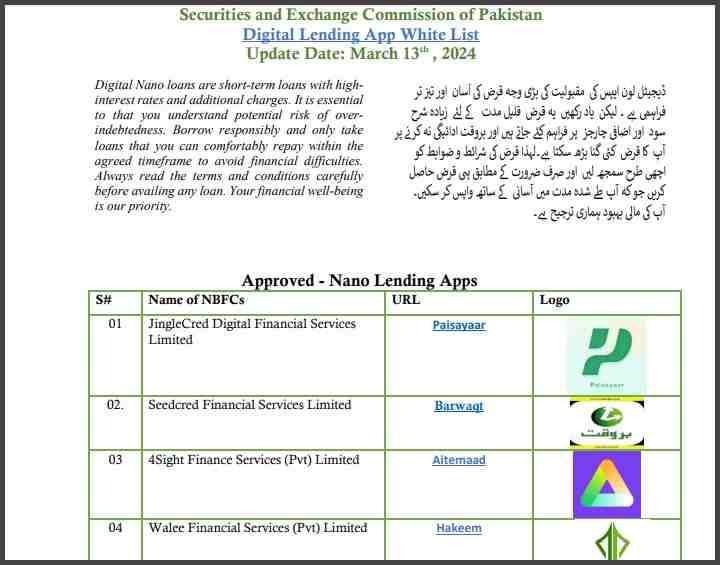

But, we are here to help you out, we have listed SECP-registered loan apps that act under the direct supervision of the government of Pakistan’s regulatory institutions.

Our list includes the best loan apps from the following categories:

- Easy/urgent loan apps e.g. Barwaqt & Aitemaad.

- Banking Apps that provide urgent loans in Pakistan e.g. Konnect by HBL

- Digital Wallet apps for microloans e.g. Easypaisa & Upaisa etc.

This article will explore maximum loan amounts and how to get urgent loans via these apps. Let’s start our guide!

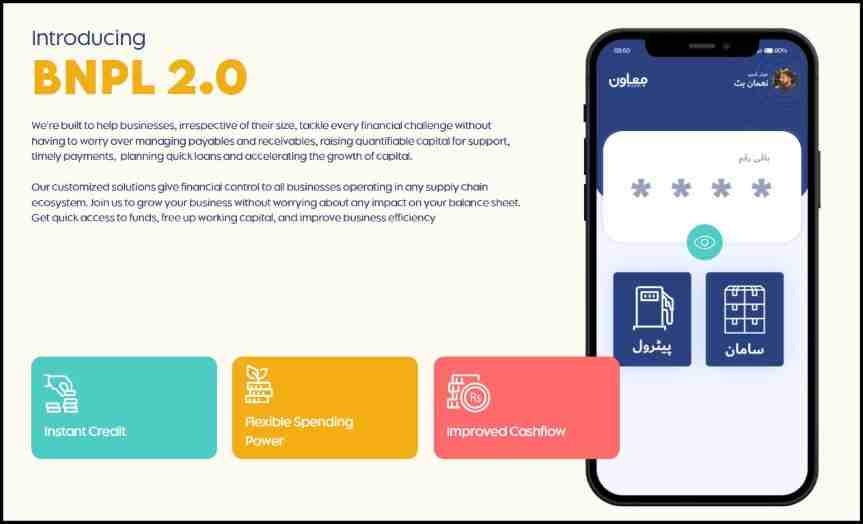

Recommended Reading: Buy Now Pay Later Apps In Pakistan (Top 3) | Buy Now Pay Later Pakistan

List Of Best Loan Apps In Pakistan | SECP Registered Loan Apps List

Table Of Contents

- List Of Best Loan Apps In Pakistan | SECP Registered Loan Apps List

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

Easy Loan Apps | Loan Apps Online (Top 5 Best)

- Barwaqt – Loan App

- Aitemaad-Quick Loan App

- BoBaCash – Personal Loan App

- Zood (ZoodPay & ZoodMall)-Buy Now, Pay Later App

- Paisayaar-Easy Cash Loan App

- Abhi Your Salary Now

- SmartQarza Loan App

- Muawin Loan App

Recommended Readings: Fori Loan In Pakistan (20K-2Lakh) | Emergency Cash Loan In Pakistan

Barwaqt – Best Loan Apps

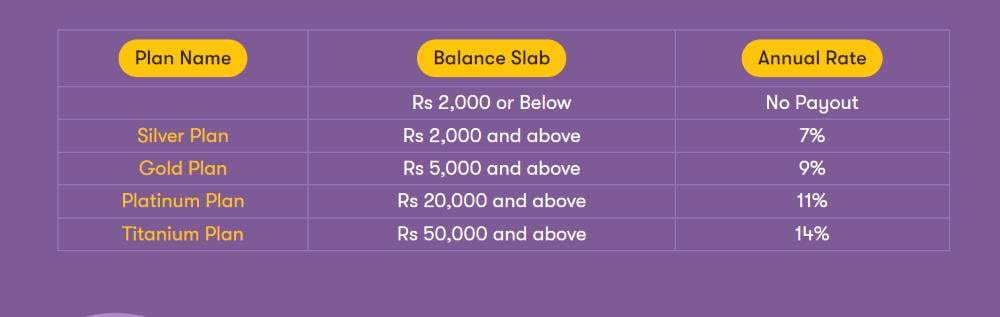

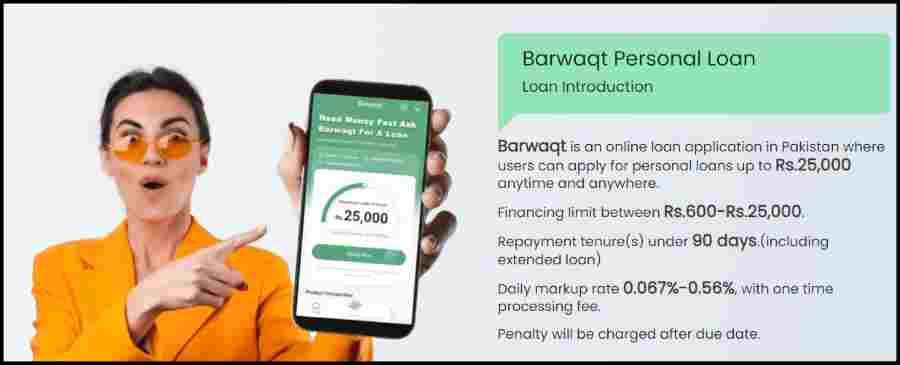

Barwaqt is an online Best loan app that helps people in Pakistan get short-term digital credit, even if they don’t have a bank account. It’s made to be easy, fast, and trustworthy for everyone. With Barwaqt, you can get a loan amount up to Rs.25,000 whenever needed, no matter where you are.

Barwaqt is a genuine and SECP-verified loan app in Pakistan, always use the Token ID for repayment (personal bank account / Easypaisa / Jazz Cash account, etc.), and never transfer the amount to personal accounts or mobile wallets.

Loan Key Feature:

- Loan Amount: Barwaqt is the best loan app giving personal loans ranging from Rs.600 to Rs.25,000.

- Easy Application Process: You can apply for a loan anytime and anywhere through the Barwaqt app.

- Repayment: Repayment tenures, including extended loan options, are kept under 90 days.

- Interest Rates: Daily markup rates range from 0.067% to 0.56%, with a one-time processing fee. The actual rate depends on your credit status.

- Penalty Policy: There’s a penalty for late repayment, so making payments on time is essential to avoid extra charges.

- Building Credit: Barwaqt helps users build a credit identity, even if they haven’t used traditional banks.

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Best Loan Apps In Pakistan

Aitemaad-Quick Loan App

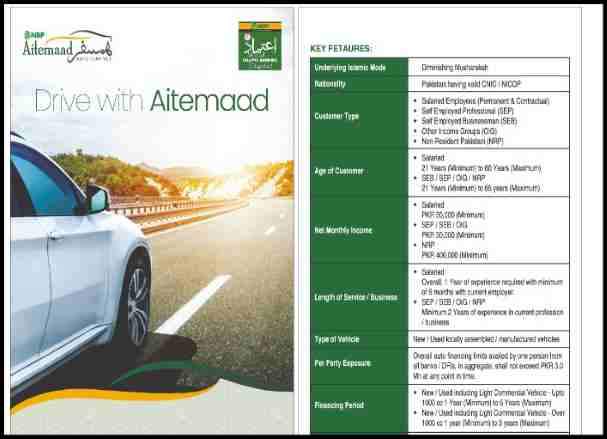

Aitemaad is the Best Loan Apps in Pakistan is a verified loan app in Pakistan, approved by SECP. It offers easy access to loans, requiring only that you’re 18 or older and have a valid CNIC. Getting a loan is very easy with Aitemaad.

The Aitemaad is the best Loan app registered with your Pakistani mobile number. You can Download the Aitemaad Loan App from the Google Play Store.

Aitemaad Best Loan Apps Details:

- Loan Details:

- Loan Term: 60-90 days

- Loan Amount: Rs. 1,000 to Rs. 25,000

- Maximum Annual Fee Rate: 2%-12% per year

- Example Calculation:

- For a Rs. 12,000 loan over 3 months:

- Monthly Markup Rate: 1%

- Total Markup: Rs. 360

- Total Repayment Amount: Rs. 12,360

- Monthly Payment Amount: Rs. 4,120

- For a Rs. 12,000 loan over 3 months:

- Eligibility Insights:

- Pakistani nationals aged 18 and above.

- Valid CNIC holders.

- Individuals with steady employment revenue.

- Repayment: Make repayments digitally through platforms like Easypaisa, Jazzcash, bank apps, and more.

Recommended Reading: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

BoBaCash – Personal Loan App

BoBaCash is an online credit loan software designed to help people with their loan requirements while ensuring the highest level of protection for their information. It’s a Loan App that makes getting loan money easy and secure.

- Rates and Fees:

- Loan Amount: Pkr 1000 – 10940

- Loan Term: 91 days to 360 days

- Interest Rate: 12%-28%

- Example: For a loan of Pkr 10940 with a term of 360 days and an interest rate of 25%, the total amount to be paid would be Pkr 13183.

- Why Choose BoBaCash:

- There are no hidden fees.

- Flexible payment terms.

- Safe, reliable, and flexible lending.

- Quick credit decisions.

- Customer support is available 24/7.

- Application Requirements:

- Valid ID.

- Acceptance of Vodafone, Airtel, or Tigo mobile money wallets.

- Residency and being over 18 years old.

- A mobile money account is registered in your name.

Recommended Reading: Top 3 Best Loan Apps In Pakistan (50K-100K Urgent Cash Loan)

Zood (ZoodPay & ZoodMall)-Buy Now, Pay Later App

ZOOD Best Loan Apps is a leading financial technology company providing innovative lending and e-commerce solutions across Pakistan, Iraq, Uzbekistan, and Lebanon.

From flexible lending options through ZoodPay to seamless online shopping experiences with ZoodMall and efficient last-mile delivery services via ZoodShip, ZOOD’s best loan apps are dedicated to simplifying financial transactions and enhancing the overall customer experience.

With offices in Switzerland and serving millions of users, ZOOD’s best loan apps stand as a trusted partner in the digital finance and e-commerce platform.

ZoodPay best loan apps:

- Offers Buy Now Pay Later options.

- Allows shopping in 4, 6, or 12 installments.

- Interest-free payment plan with 25% upfront and rest in 3 installments.

- The maximum lending amount is $500.

ZoodMall’s best loan apps:

- Online marketplace for buying now and paying later.

- Millions of products from local and international sellers.

- Offers payment in 4, 6, or 12 installments.

- The ‘Pay After Delivery’ option is available for full interest-free repayment within 14 days.

ZoodShip Buy Now Pay Later:

- E-logistics company providing last-mile delivery services.

- Reliable partner for businesses, large and small.

- Offers personalized delivery choices and cost-effective pricing.

- Achieved a 90% delivery rate within 24 hours, covering 120 cities.

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan Apps

Paisayaar-Easy Cash Best Loan App

Paisayaar-Easy Cash Best Loan Apps is one of the finest and most trustworthy loan apps in Pakistan. It offers personal loans ranging from PKR 5,000 to PKR 25,000, through mobile application round-the-clock, anywhere in the country. Backed by licensing from NBFC and approval from SECP.

- Loan Details:

- Loan amounts range from PKR 1,000 to PKR 25,000.

- The repayment period extends up to 90 days.

- Daily interest rates range from 0% to 0.6%, with a penalty interest of 2% to 2.5% per day for late repayments.

- Example Calculation:

- For a PKR 12,000 loan over 3 months:

- Monthly markup rate: 1%

- Total markup: PKR 360

- Total repayment amount: PKR 12,360

- Monthly payment amount: PKR 4,120

- For a PKR 12,000 loan over 3 months:

- Repay loans: Repay loans via Easypaisa using three different methods: Easypaisa App, and Easypaisa USSD.

Recommended Reading: Top 7 Urgent Best Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

Mobile Banking Apps (That Provide Online Loans)

- Konnect by HBL

- UBL Digital

- Alfa by Bank Alfalah

- MCB’s best loan apps

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

Konnect by HBL

HBL ReadyCash is a unique and easy solution for all your financial needs. You can get a loan amount of up to PKR 3 million, and you only pay interest on the amount you use. Plus, you can withdraw money using your HBL Debit Card or checkbook whenever you need it.

With HBL Phone Banking available round the clock, you can manage your finances anytime, day or night. The facility gets automatically renewed every year, depending on your needs. You get free life insurance along with the option to increase your loan limit every 12 months.

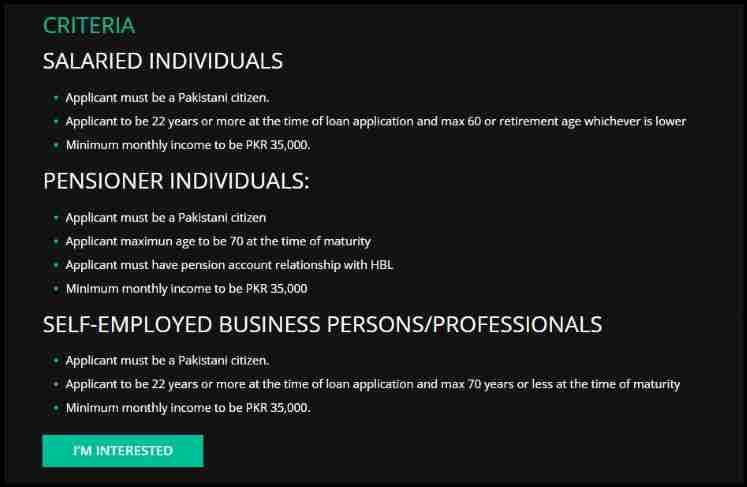

Eligibility

For Self-Employed Business/Sole-Proprietors/Partners:

- Business should be active for at least 2 years, with a 1-year relationship with HBL.

- Age between 25-62 years.

For Salaried Individuals:

- Minimum income of PKR 50,000 with salary credited to HBL.

- Age between 21-57 years.

Recommended Reading: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

Schedule of Charges

- One-time Processing Fee: Rs. 5,500 or 1.25% of the credit limit (whichever is higher).

- Annual Charges: Rs. 5,000 (charged from the end of the first year).

- Interest Rate: 33% per annum.

- Late Payment Charges: PKR 1,250 per late payment.

- Limit Enhancement Fee: PKR 2,500.

UBL Digital Loan

UBL CashPlus is a special loan product made to meet your financial needs with ease. It’s perfect for employees who get their salaries deposited in UBL or any other bank in Pakistan. With UBL CashPlus, you can get a loan amount of up to Rs. 3 million and choose a repayment period from 1 to 4 years.

Eligibility Criteria

To qualify for UBL CashPlus, you need to meet these simple requirements:

- Have a minimum monthly income of Rs. 40,000.

- Be between 21 and 60 years old.

- Be a salaried individual receiving your salary in UBL or any other bank in Pakistan.

Recommended Readings: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

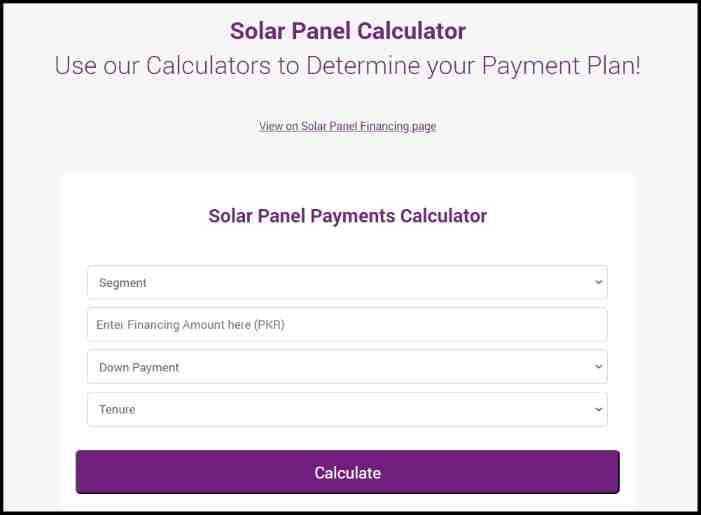

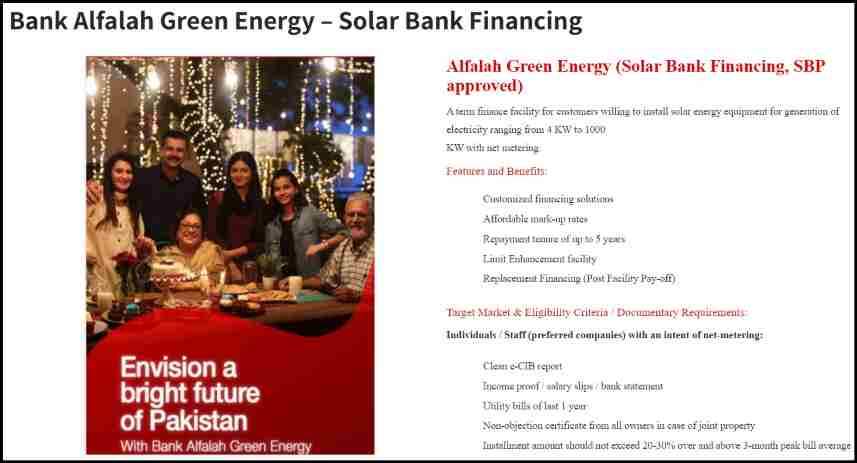

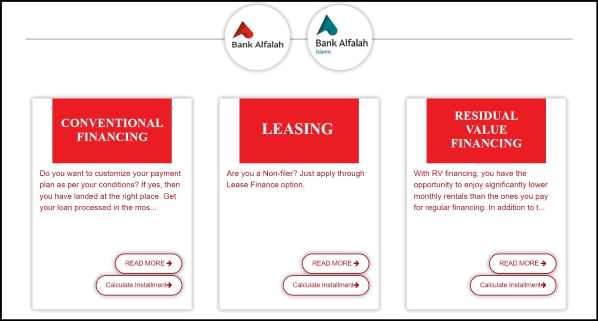

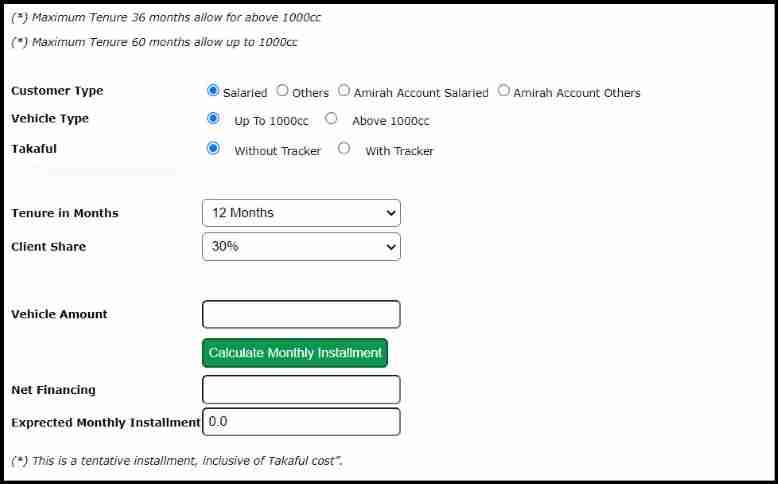

Alfa by Bank Alfalah

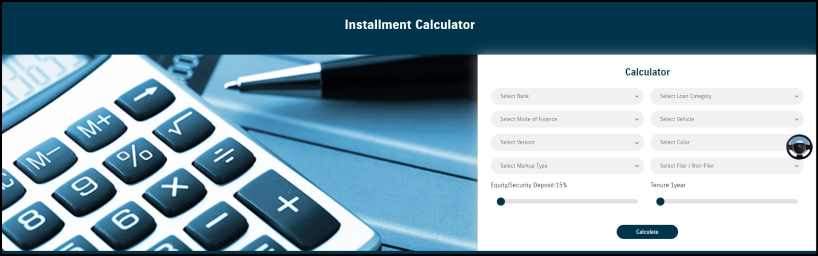

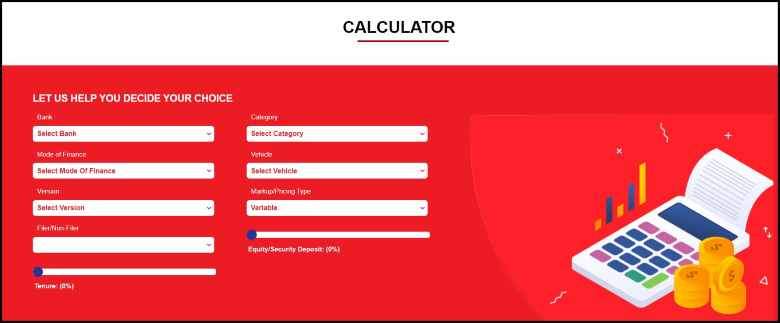

By Alfalah Instant Loan, Sometimes in life, we might need money urgently. Bank Alfalah is offering an Instant loan service through their ALFA app, giving existing account holders access to loans of up to PKR 1 million. No paperwork or visits to the bank are required. With Alfa’s easy and quick process, you can get a loan with just a few taps on your phone.

Loan Details

- Loan amount as little as Rs. 50,000 or up to Rs. 750,000.

- Choose a loan term from 1 to 4 years.

- You have the freedom to pick the amount and term that suits you best.

- Use the real-time installment calculator in the app to see your payments.

- No need to visit a bank branch or deal with any paperwork.

- Enjoy 24/7 instant loan disbursement.

Pakistan Digital Wallet Apps (To Get Urgent Loans)

- JazzCash – Your Mobile Account

- Easypaisa – Payments Made Easy

- UPaisa

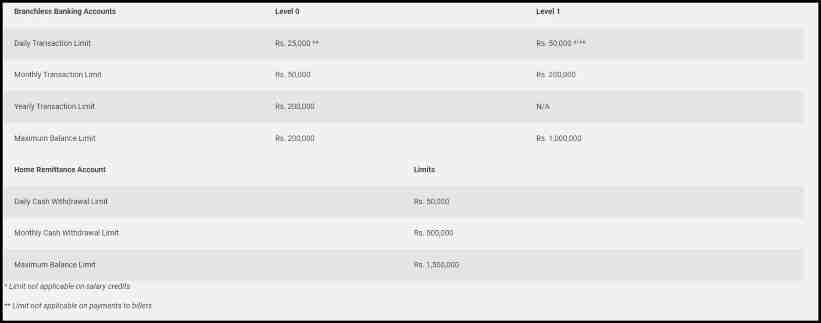

JazzCash – Your Mobile Account

JazzCash’s loan app, known as MobiCash, is a Pakistani mobile wallet and banking service provider. With JazzCash, you can manage your money easily using your mobile phone. With the introduction of ReadyCash, an instant loan service, customers can now get small loan amounts via the JazzCash best loan apps or USSD.

The loan is instantly credited to the Mobile Account, enabling immediate usage for short-term needs, and eliminating lengthy processes. The loan amount you have to repay within four weeks, with an early repayment option available.

Each customer can hold one loan at a time, up to Rs. 25,000. Currently, in a pilot phase, ReadyCash is accessible to a limited number of eligible customers, who are notified via SMS.

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Best Loan Apps In Pakistan

Easypaisa – Payments Made Easy

Easypaisa is a top loan app in Pakistan where you can not only get loan money but also send and receive funds from anyone, anywhere. It’s Pakistan’s first mobile banking platform. Need cash urgently? Apply for an easy cash loan without any paperwork and receive up to Rs. 15,000 in your account easily.

The loan amount ranges from PKR 200 to PKR 15,000, with an annual percentage rate between 24% to 40%. Please note that personal loans are available only to Pakistani citizens residing within Pakistan. Repaying your loan is now easier than ever Simply use the Easypaisa best loan apps to repay your dues.

FAQs | Best Loan Apps

What are Loan Apps In Pakistan?

In Pakistan, the best loan apps are apps that give loan money easily. You can get a loan amount ranging from Rs. 30,000 for 2 or 3 months with some interest. Getting these loans is simple. These apps are registered with SECP and are watched over by the government to make sure they follow the rules.

What kinds of these loan apps?

Our list includes the best loan apps from the following categories:

Easy and Urgent Loans: Apps like Barwaqt and Aitemaad make getting a loan quick and simple.

Banking Apps with Urgent Loans: Check out Konnect by HBL for fast loans directly from your bank.

Digital Wallet Apps for Microloans: Try Easypaisa or Upaisa for small loans through digital wallets.

Which are the Top 7 best Loan Apps in Pakistan?

What is the Aitemaad Best loan app in Pakistan?

Aitemaad is the best loan app in Pakistan, verified and approved by SECP. You need to be 18 or older with a valid CNIC. You can register with your Pakistani mobile number and download the Aitemaad Loan App from the Google Play Store. You can get a loan amount from Rs. 1,000 to Rs. 25,000 for 60-90 days, with an annual fee rate ranging from 2% to 12%. For instance, if you get Rs. 12,000 for 3 months, you’ll pay a total of Rs. 12,360, with a monthly payment of Rs. 4,120. Repayment is easy too just use digital platforms like Easypaisa, Jazzcash, or bank apps.

Why Jazzcash is Pakistan’s Best Loan App?

Yes, Jazzcash is Pakistan’s Best Loan Apps, which is known as MobiCash, is a mobile wallet and banking service in Pakistan. With ReadyCash, customers can quickly access small loans via the JazzCash app or USSD, credited instantly to their Mobile Account for immediate use. Repayment is within four weeks, with early repayment options. Each customer can have one loan at a time, up to Rs. 25,000. ReadyCash is currently in a pilot phase, available to eligible customers notified via SMS.

What is the Easypaisa loan app?

Easypaisa is the best loan app in Pakistan, offering not just loans but also funds transfer services. As Pakistan’s first mobile banking platform, it provides easy access to financial services. Apply for an easy cash loan without paperwork and receive up to Rs. 15,000 in your account quickly. Loan amounts range from PKR 200 to PKR 15,000, with an APR between 24% to 40%. Repayments are easy with the Easypaisa app.

What is the Alfa App by Alfala Bank?

Bank Alfalah offers Alfalah Instant Loan via their ALFA app, providing existing account holders with access to loans of up to PKR 1 million without any paperwork or branch visits. With loan amounts ranging from Rs. 50,000 to Rs. 750,000 and flexible repayment terms of 1 to 4 years, the loan can tailor their loans to suit their needs. The ALFA app also features a real-time installment calculator for easy payment planning, and loans are disbursed instantly, 24/7, making it a convenient option for those in need of urgent funds.

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | Abhi- Your Salary Now Loan App

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Do you have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!