Are you planning to get a brand new or a second-hand car on installment from the showroom and don’t know where to start?

In this article, we will explore the top showrooms and banks that provide new and used cars on installment in Pakistan with a minimum down payment.

Our list includes showrooms of top car manufacturers/dealers like:

- Pak Suzuki

- Toyota

- & Pakwheels.

Later, we have also listed the top 5 best banks in Pakistan that provide car loans on easy terms with their eligibility requirements and interest rates.

Our list of best banks that provide car loans are:

- Meezan Bank

- HBL

- Dubai Islamic Bank

- Bank Alfalah

- NBP

Let’s get started with our guide. Here we go!

Recommended Reading: How To Get A Used Car On Installments In Pakistan | Second Hand Cars On Installments

Car On Installment From Showroom | Second-Hand Cars Installments

Table Of Contents

- Car On Installment From Showroom | Second-Hand Cars Installments

- Car On Installment From Toyota Showroom

- Car On Installment From Pakwheels Car Financing

Recommended Reading: How To Get A Car On Installment Without Bank In Pakistan {Second-Hand Cars}

Car On Installment From Pak Suzuki Showroom

Pak Suzuki has made it super easy for people in Pakistan to get the car on installment. They’ve set up a special program where you can buy Suzuki cars very easily. They even have a system to make sure the used cars they sell are in great condition.

Pak Suzuki checks them thoroughly on 130 points to give customers peace of mind. And if you want to upgrade your old car to a new Suzuki, they have an exchange program. You can even trade in your old car for a certified used Suzuki. It’s all about making car buying simple and easy for everyone.

Services Offered By Pak Suzuki Showroom

Certified Used Car Services:

- Drive with confidence in a Suzuki-certified used car, checked by Pak Suzuki experts at 130 points for a smooth buying experience.

- Enjoy peace of mind with genuine documents and up to a 1-year warranty.

- Get 3 free services and the best price, with quick payment and priority delivery when you exchange your old vehicle.

Exchange Program:

- Upgrade your car easily with Suzuki’s exchange program, offering the best price for your used car and priority delivery.

- Visit any Suzuki 3s dealership to benefit from fair deals and transparent transactions.

Used Car Finance:

- Get a Suzuki Used car on installment Finance at Pak Suzuki dealerships, with competitive rates and no charges.

- Experience easy financing with clear terms and low down payment options.

Recommended Reading: Top 15 Car Leasing Companies In Pakistan {Tested+Reviewed}

Car On Installment From Pak Suzuki Showroom Details

Suzuki RV Financing Solution of the car on installment:

- With Pak Suzuki’s car on installment One Window Solution, you can now change your car every 2-3 years and upgrade your lifestyle.

- Through Suzuki RV Financing, enjoy lower monthly installments, approximately 30-35% less compared to traditional financing.

- You can pay up to 50% of the car financing amount at the end of the tenure, known as the Residual Value (RV) amount, making the loan amount less than half and reducing installments by 30-35%.

- After 2-3 years, upgrade to a new car by returning the current one with Pak Suzuki’s assistance in getting the guaranteed right market value.

- Benefit from the BUY BACK GUARANTEE for up to 3 years, where the dealership pays the RV amount to the bank, and you can utilize the remaining amount as a down payment for your new car.

Benefits of Suzuki RV Financing car on installment:

- Enjoy good resale value for your used car through Pak Suzuki dealerships.

- Avail discounted markup rates (up to K + 3%) and insurance rates (1.5 – 1.99%).

- Get preferred delivery for your new car.

- No early settlement charges if you decide to settle the loan and get a new car, allowing you to enjoy low monthly installments for your new car again.

Car on installment Terms and Conditions:

- This offer is available for specific Suzuki models including Alto VXR, WagonR (VXR, VXL & AGS), Cultus (VXL & AGS), and Swift (GL MT & GLX CVT).

- The maximum RV is up to 50% of the loan amount.

- Partner banks include Bank Alfalah Limited, Meezan Bank Limited, and MCB Bank Limited.

Recommended Reading: Top Car Leasing Companies In Pakistan {Tested+Reviewed}

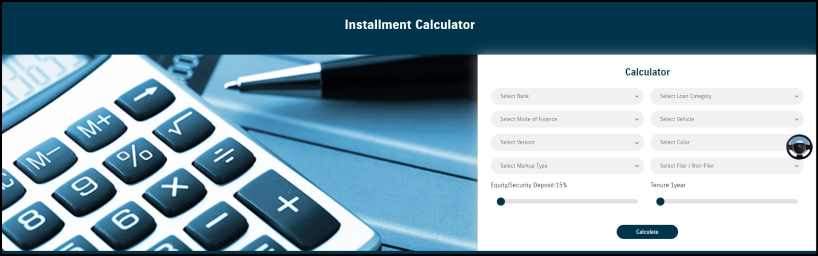

Suzuki Showroom Installment Calculator

Recommended Reading: How To Get A Car On Installment Without Bank In Pakistan {Second-Hand Cars}

Car On Installment From Toyota Showroom

Toyota provides an easy way to buy cars through installments right from their showroom. With Toyota Smart Finance, you can easily finance your favorite Toyota car. Just apply online, and then your Toyota will be ready for you at the dealership when it arrives.

Why Choose Toyota Smart Finance?

These are the Reasons to Choose Toyota car on installment Smart Finance:

- Customize your monthly installments or rentals according to your preferences by using the installment calculator.

- Compare various installment or rental options to find the one that suits you best.

- Easily submit your financing application from the comfort of your home or office.

- Benefit from the best markup and insurance rates available through Toyota Smart Finance.

- Keep track of your application status for added convenience and peace of mind.

- Experience transparent processing throughout the financing process.

- Enjoy quick delivery of your Toyota car once your financing is approved.

How To Get Car On Installment From Toyota Showroom?

Get a Car on Installment from the Toyota Showroom:

- Choose Your Toyota: Select your desired Toyota model from our wide range of options, bringing you closer to your dream car on installment.

- Select Your Financing Mode: Whether you prefer conventional financing, Islamic financing, or RV financing, we have options for your needs.

- Plan Your Budget: Simply choose the options that suit your budget, and we’ll take care of the rest by calculating everything for you.

- Complete Your Application: Upload all necessary information and documents to finalize your financing application.

- Track Your Application: Sit back and relax as you track the progress of your application using your CNIC and case ID. Your Toyota will be on its way to you soon!

Toyota Financing Option

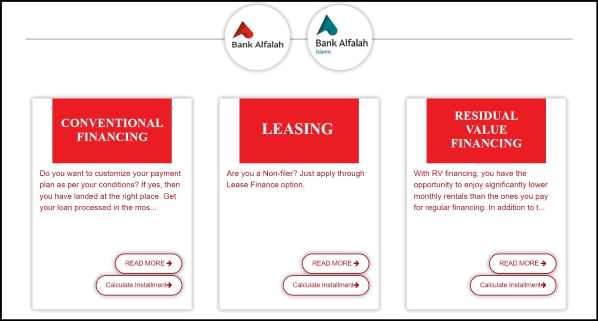

Bank Alfalah Financing

Conventional Financing:

- Customize your payment plan to fit your needs with our loan processing.

- Benefit from low markup rates, simplified documentation, and special insurance rates.

- Choose from multiple tenure options ranging from 1 to 7 years for added flexibility.

Leasing:

- Non-filers can easily apply through Lease Finance and enjoy a range of benefits.

- The vehicle is invoiced and registered in the name of the financing institution, with withholding tax paid by the bank.

- Enjoy affordable markup rates, minimal documentation, and quick processing, along with special insurance rates.

- Zero charges on car replacement, balloon payment option, and financing available for both new and imported vehicles for personal use.

Residual Value Financing car on installment:

- Enjoy lower monthly rentals compared to regular financing with Residual Value (RV) financing.

- Benefit from low markup rates, simplified documentation, and special comprehensive insurance rates.

- Choose from multiple tenure options ranging from 1 to 5 years, with a maximum RV of up to 50%.

- After the financing period, you have the option to make a lump sum balloon payment to purchase the car.

Bank Alfalah Islamic Financing

Car Ijarah:

If you’re looking for interest-free car financing, Islamic financing is the right choice for you. It’s easy and, most importantly, compliant with Shari’ah principles.

- Enjoy the following car on installment benefits:

- No lengthy documentation is required.

- Choose from multiple tenure options ranging from 1 to 7 years.

- No charges for insurance or registration.

- No rentals are charged before the delivery of the vehicle.

- Competitive pricing with no charges costs.

- Quick processing time.

Residual Value Financing:

With RV Financing, Toyota Finance allows customers to make a lump sum payment (up to 50% of the total financed amount) at the end of the financing period for increased affordability and repayment convenience.

Recommended Reading: How To Get A Used Car On Installments In Pakistan | Second Hand Cars On Installments

Available in selected cities including Islamabad, Rawalpindi, Jhelum, Peshawar, Lahore, Karachi, and more.

- car on installment Terms and conditions:

- Used and semi-commercial vehicles are not eligible.

- Choose the RV option that suits you best.

- Maximum financing period up to 5 years.

- Maximum RV up to 50%.

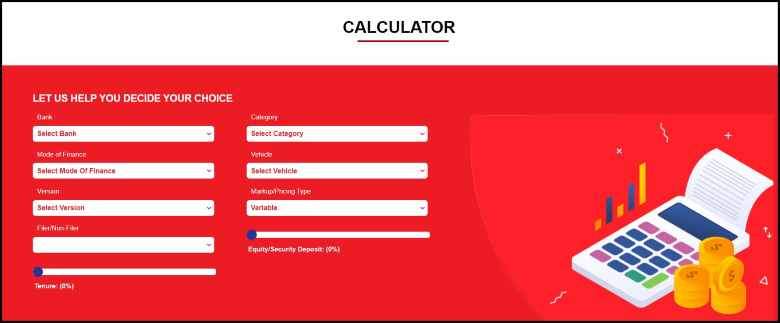

Toyota Car Financing Calculator

Recommended Reading: Top 15 Car Leasing Companies In Pakistan {Tested+Reviewed}

Car On Installment From Pakwheels Car Financing

Car on installment from Pak Wheels is a reliable option for getting cars on installment or upgrading your current one. With Pak Wheels, you can easily find your dream car within your budget. We’ve done thorough research on car financing procedures with various banks to make the process simple for you.

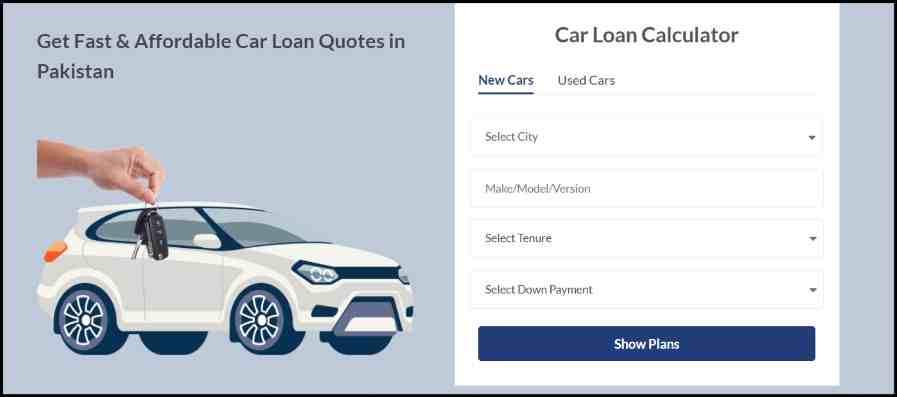

Our user-friendly car financing calculator helps you plan your payments for new or used vehicles quickly and confidently.

Pakwheels Car Financing Calculator

Why Choose PakWheels For Car Finance In Pakistan?

- Expert Assistance: Skilled representatives ensure an easy process, making your experience smooth.

- Best Rates: We share the lowest competitive rates from our partner banks, ensuring you get the best deal.

- Coverage Plans: customized coverage plans from partner banks cater to your specific requirements, ensuring protection.

- Rate Comparison: Compare rates effortlessly and secure the best deal from Pakistan’s top financing banks.

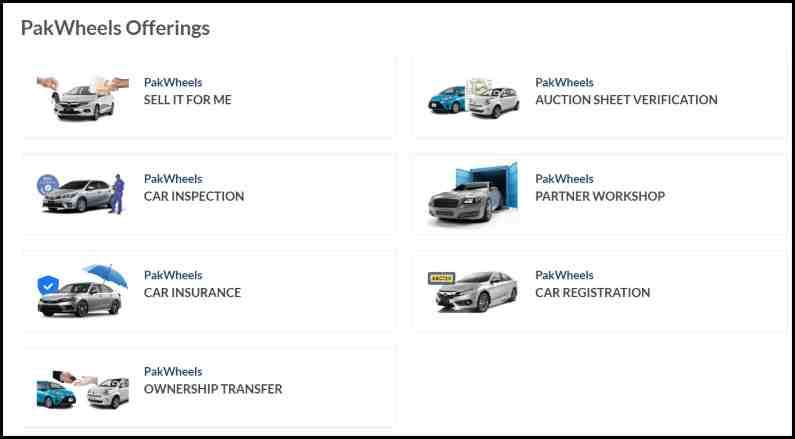

Services Offered PakWheels

- Sell It for Me: Let us handle the selling process for you.

- Auction Sheet Verification: We verify auction sheets for your peace of mind.

- Car Inspection: Our experts inspect cars to ensure quality and reliability.

- Partner Workshop: Access our trusted partner workshops for car maintenance and repairs.

- Car Insurance: Get comprehensive car insurance coverage through PakWheels.

- Car Registration: We assist with the easy registration of your vehicle.

- Ownership Transfer: Transfer car ownership smoothly with our assistance.

Pakwheels Car Financing Details

Minimum Down Payment Requirement:

- To get the car on installment, a minimum down payment of 35% is required.

- Utilize our easy-to-use car loan calculator to explore installment options in Pakistan.

car on installment Eligibility Criteria:

- Applicants must be at least 22 years old and not exceed 65 years at the time of loan maturity.

- Salaried individuals should have a maximum monthly income of RS 80,000, while self-employed individuals should earn at least RS 1,00,000 per month.

- For pensioners or those with remittance income, the minimum age should be 65 or less, with a monthly income of RS 1,00,000.

Maximum Financing Tenure:

- Banks typically offer car financing with a maximum tenure of 3-9 years.

Recommended Reading: How To Get A Used Car On Installments In Pakistan | Second Hand Cars On Installments

List Of Top 5 Best Car Financing Banks in Pakistan

These are the Best 5 banks to get the car on installment in Pakistan:

- Meezan Bank Car Loan

- HBL Car Loan

- Dubai Islamic Bank Car Loan

- Bank Alfalah Car Loan

- NBP Car Loan

Meezan Bank Car Loan

Car Ijarah is Meezan Bank’s unique car financing solution, offering Pakistan’s first interest-free car on installment plan. It operates on the Islamic principle of Ijarah, or Car leasing. This product is perfect for individuals seeking interest-free locally manufactured or assembled vehicles.

With Car Ijarah, the bank purchases the car on installment to the customer for a duration of 1 to 5 years, as agreed upon in the contract. At the end of the lease period, the vehicle can be sold at a nominal amount or gifted to the customer.

Meezan Bank Car Financing Features

Car on installment Key Features:

- Lowest Upfront Payment: Benefit from the lowest initial payment required.

- Rental Payment Starts After Vehicle Delivery: You start paying rentals only after receiving the vehicle.

- Quick Processing Time: Experience fast processing for your convenience.

- Minimum Security Deposit: Enjoy a security deposit as low as 30%*.

- WHT Coverage: Meezan Bank covers the Withholding Tax (WHT) on the vehicle purchase.

Who is Eligible for Car Ijarah? + Documents Required

Recommended Reading: How To Get A Car On Installment Without Bank In Pakistan {Second-Hand Cars}

Eligibility for Salaried Professionals:

- Permanent Employees: Must have worked in their current job for at least 3 months with a continuous employment history of 2 years.

- Contractual Employees: Should have 6 months of employment in their current job with a continuous employment history of 3 years.

- Net Take Home Income: Must be double the monthly rental (inclusive of takaful).

- Spouse’s Income: Up to 50% of the spouse’s verifiable income can be added.

- Debt-to-Income Ratio: Monthly payments, including the proposed Ijarah rental, shouldn’t exceed 40% of net/take-home income.

- Data Check: Both data check and e-CIB must be clear with no current default or overdue at the time of case approval.

Eligibility for Self-Employed Professionals / Businessmen:

- Minimum Experience: Minimum 2 years of continuous involvement in the current business/industry.

- Position: Must be a proprietor, partner, or director (sharing/holding percentage applies).

- Net Take Home Income: Must be double the monthly rental (inclusive of takaful).

- Spouse’s Income: Up to 50% of the spouse’s verifiable income can be added.

- Debt-to-Income Ratio: Monthly payments, including the proposed Ijarah rental, shouldn’t exceed 40% of net/take-home income. Up to 50% net/take-home income is allowed for locally manufactured or assembled vehicles up to 1000 CC engine capacity.

- Data Check: Both data check and e-CIB must be clear with no current default or overdue at the time of case approval.

Required Documents

Required Documents for Car On Installment:

- Application form filled and signed by the applicant.

- Copy of recent pay slip/certificate for Salaried individuals.

- Business Proof for Businessmen:

- Bank certificate confirming proprietorship.

- NTN (National Tax Number).

- Business Association letter or tax return, etc.

- Copy of last six months’ bank statements.

- One recent photograph.

- Specimen Signature card, preferably in the bank’s prescribed format.

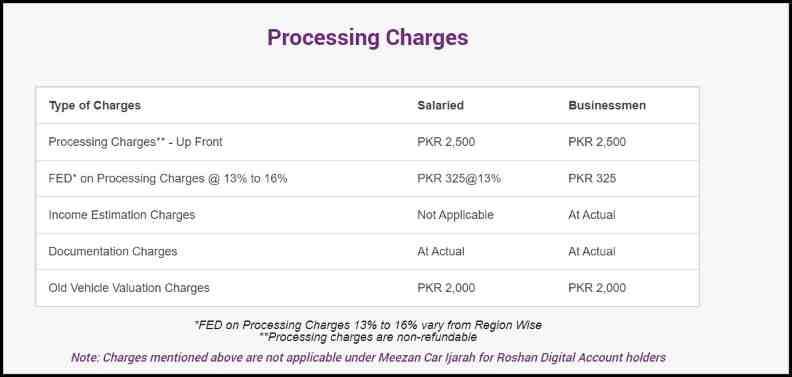

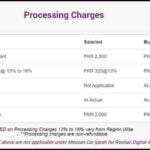

Meezan Bank Car Loan Processing Charges

- Car On Installment Plan For Salaried Person:

- Up-Front Processing Charges: PKR 2,500

- FED* on Processing Charges @ 13%: PKR 325

- Income Estimation Charges: Not Applicable

- Documentation Charges: Charged at Actual

- Old Vehicle Valuation Charges: PKR 2,000

- Car On Installment Plan For Businessmen:

- Up-Front Processing Charges: PKR 2,500

- FED* on Processing Charges @ 13%: PKR 325

- Income Estimation Charges: Charged at Actual

- Documentation Charges: Charged at Actual

- Old Vehicle Valuation Charges: PKR 2,000

FED on Processing Charges of 13% to 16% may vary depending on the region. Processing charges are. Nonrefundable Note: Charges mentioned above do not apply to Meezan Car Ijarah for Roshan Digital Account holders.

Meezan Bank Car Loan Interest Rate

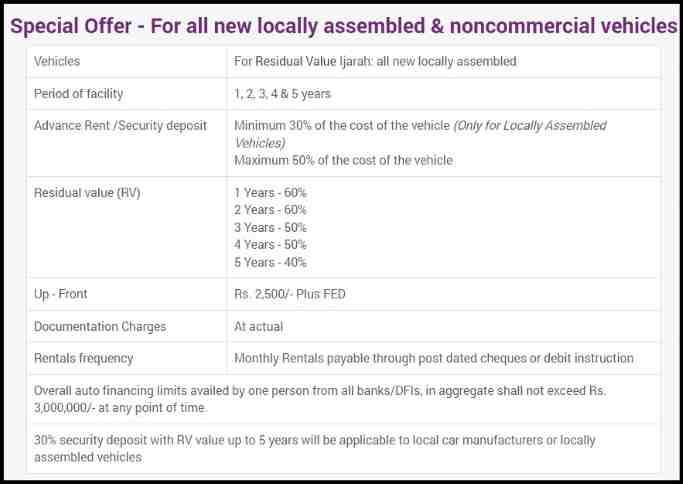

Meezan Bank Car On Installment Loan Details:

- Vehicles Eligible: Residual Value Ijarah is available for all new locally assembled vehicles.

- Period of Facility: Options for 1, 2, 3, 4, & 5 years.

- Advance Rent/Security Deposit:

- Minimum: 30% of the vehicle cost (applicable only for Locally Assembled Vehicles).

- Maximum: 50% of the vehicle cost.

- Residual Value (RV):

- 1 Year: 60%

- 2 Years: 60%

- 3 Years: 50%

- 4 Years: 50%

- 5 Years: 40%

- Up-Front Payment: Rs. 2,500/- Plus FED.

- Documentation Charges: Charged at actual cost.

- Rentals Frequency: Monthly rentals payable through post-dated cheques or debit instructions.

- Overall Auto Financing Limit: Aggregate financing limit across all banks/DFIs not to exceed Rs. 3,000,000/- at any point in time.

- Security Deposit: 30% security deposit with RV value up to 5 years applicable to local car manufacturers or locally assembled vehicles.

Meezan Bank Car Loan Calculator

Compare various cars and payment plans very easily using our calculators.

HBL Easy Car Loan

HBL provides the HBL Easy Car On Installment Loan, making it easy for you to buy your dream car on Installment plans. With this very easy financing facility, HBL offers financing up to 70% of your desired car’s value.

You can choose any vehicle you want and enjoy a fixed mark-up rate, tailored to your personal needs. Don’t just dream, make it a reality with HBL car on Installment.

HBL Car Loan Requirements

Documents Required for Salaried Person:

- Verified copy of CNIC.

- Two recent passport-size photographs.

- Latest original salary slip.

- Personal bank statement for the last three months.

Documents Required for Self-Employed Business Persons/Professionals:

- Verified copy of CNIC.

- Two recent passport-size photographs.

- Bank statement for the last 6 months.

- Bank letter confirming account details.

- Proof of occupation/business.

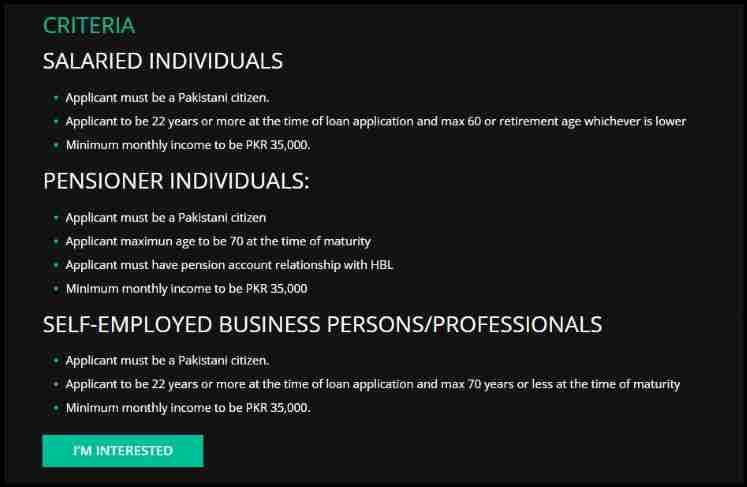

HBL Easy Car Loan Eligibility Criteria

Criteria for Salaried Person:

- Applicant must hold Pakistani citizenship.

- Applicant must be at least 22 years old at the time of loan application, with a maximum age of 60 or retirement age, whichever is lower.

- The minimum monthly income requirement is PKR 35,000.

Criteria for Pensioner Person:

- Applicant must be a Pakistani citizen.

- The maximum age limit at the time of maturity is 70 years.

- Applicant must have an existing pension account relationship with HBL.

- The minimum monthly income requirement is PKR 35,000.

Criteria for Self-Employed Business Persons/Professionals:

- Applicant must hold Pakistani citizenship.

- Applicant must be at least 22 years old at the time of loan application, with a maximum age of 70 years or less at the time of maturity.

- The minimum monthly income requirement is PKR 35,000.

Recommended Reading: How To Get A Car On Installment Without Bank In Pakistan {Second-Hand Cars}

HBL Easy Car Loan Features

- The car on Installment loan amount ranges from PKR 200,000 to PKR 3,000,000.

- Repayment period of up to 5 years.

- Choose any locally manufactured vehicle, new or used.

- Finance up to 70% of your preferred car’s value.

- Enjoy secured insurance with a tracker facility for peace of mind.

- Multiple payment options are available.

- Wide network of over 150 eligible dealers offering various brands and cars.

- Easily accessible application process with HBL’s 1600+ branches.

- Round-the-clock support through HBL Phone Banking.

HBL Easy Car Loan Calculator

By using the HBL Easy Car Loan Calculator select a car according to your budget.

HBL Islamic Car Finance

HBL Islamic Car on Installment offers a Musharakah-based solution to help you achieve your dream of owning a car on Installment. This facility operates on the concept of Musharakah, where both the bank and the customer become joint owners of the vehicle based on an agreed investment ratio.

The customer gradually purchases units of the bank’s share over time until they become the sole owner of the vehicle. Throughout this process, the customer pays agreed rentals for using the bank’s share until complete ownership is achieved.

HBL Islamic Car Features

- Finance is available for both new and used vehicles intended for personal use.

- Flexible payment tenure options:

- 1 to 5 years for vehicles up to 1000cc.

- 1 to 3 years for cars above 1000cc.

- Takaful coverage is provided through business partners on the HBL panel.

- Rental payments begin only after the delivery of the vehicle to the customer.

- Quick processing with minimal documentation requirements.

- Option for partial payments to ease the burden.

- Option for early termination of the facility if needed.

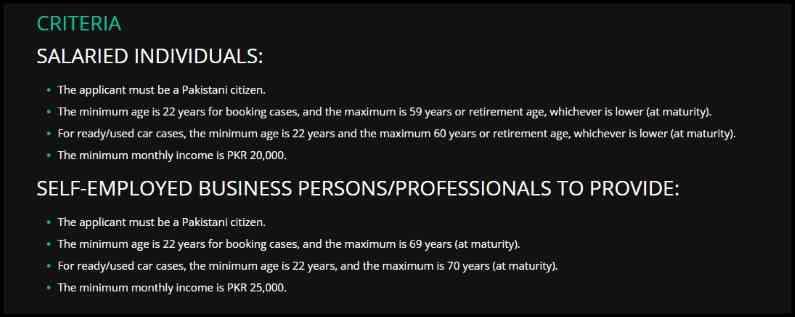

HBL Islamic Car Eligibility Criteria

Criteria for Salaried Person:

- Must hold Pakistani citizenship.

- The minimum age requirement is 22 years at the time of booking, with a maximum of 59 years or retirement age, whichever is lower, at maturity.

- For cases involving ready/used cars, the minimum age is 22, and the maximum is 60 years or retirement age, whichever is lower, at maturity.

- The minimum monthly income should be PKR 20,000.

Criteria for Self-Employed Business Persons/Professionals:

- Must be a Pakistani citizen.

- The minimum age requirement is 22 years at the time of booking, with a maximum of 69 years at maturity.

- For cases involving ready/used cars, the minimum age is 22 years, and the maximum is 70 years at maturity.

- The minimum monthly income should be PKR 25,000.

Dubai Islamic Bank Car Loan

Dubai Islamic Bank’s car on Installment service lets you enjoy driving your car with a very easy process. Our auto finance solution is designed to provide you with a fully Sharia-compliant way to get your dream car quickly. With our Musharaka cum Ijara model, you can get car on Installment.

Dubai Islamic Bank Car Loan Requirements

These are the following requirements for car on Installment:

Eligibility Criteria

- A salaried person must be at least 21 years old at the time of application and not exceed 60 years at the time of finance maturity.

- Self-employed professionals and businessmen must also be at least 21 years old at the time of application, with a maximum age limit of 65 years at the time of finance maturity.

- To be eligible for Dubai Islamic Auto Finance, applicants must have a minimum monthly net income of Rs. 25,000.

- Additionally, salaried individuals should have a work tenure of at least 3 months, while self-employed professionals and businessmen should have a work tenure of 6 months and 12 months, respectively.

Documents Required

- Copy of the primary applicant’s CNIC.

- Copy of the co-applicant’s CNIC.

- Two passport-size photographs.

- Latest salary slip.

- Six months bank statement.

- Bank certificate.

Dubai Islamic Bank Car Loan Interest Rate

Key Features:

- Low Takaful Rates: Enjoy Takaful rates compared to other banks, ensuring cost-effectiveness.

- Payment in Advance Booking Cases: Customers in Advance Booking cases don’t need to make monthly rental payments until they receive the car.

- Competitive Monthly Rentals: Benefit from competitive and affordable monthly rental rates, meeting industry standards.

- Flexible Financing Amount: DIBPL offers financing ranging from 70% to 85% of the car’s value, with a minimum financing amount of Rs. 100,000 and a maximum of Rs. 3,000,000.

- Shari’a Compliance: Our products are to Islamic principles and are Shari’a-compliant, ensuring interest-free transactions.

- Flexibility: Choose from financing options for both new and used cars, with payment plans ranging from 1 to 5 years. Enjoy the flexibility of ready delivery or booking. You can also club income and finance vehicles up to 9 years old.

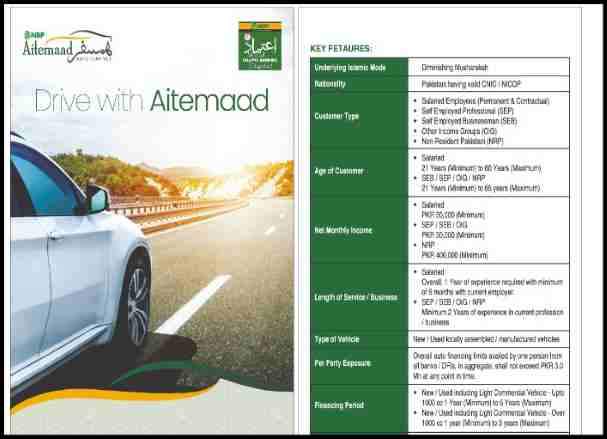

NBP Car Loan

NBP Car Loan lets you own your dream car. Enjoy low financing rates linked to SBP 01 Year KIBOR plus a spread, with special discounts for women customers. Installment payments are made through your NBP Aitemaad Islamic Banking account.

Repayment is structured in equal monthly installments including rental payments, Musharakah units, and Takaful payments. Partial payments are allowed after one year with a 5% charge on the buyout unit price, not exceeding 50% of the outstanding balance.

Early payments incur a 5% charge on the outstanding balance. All charges are updated in the NBP Aitemaad Schedule of Charges (SOC).

NBP Car Loan Requirements

These are the following NBP Car Loan Requirements:

Eligibility Criteria:

- Nationality: Must be a Pakistani citizen with a valid CNIC or NICOP.

- Gender: Open to males, females, and others (X).

- Customer Types: Available for various customer types including:

- Salaried Employees (Permanent & Contractual)

- Self-Employed Professionals (SEP)

- Self-Employed Businessmen (SEB)

- Other Income Groups (OIG) like pensioners, remittance earners, etc.

- Non-resident Pakistanis (NRP) with the mandatory requirement of a resident Pakistani co-customer.

- Age of Customer:

- Salaried: Minimum 21 years to maximum 60 years at the time of maturity.

- SEP/SEB/OIG/NRP: Minimum 21 years to maximum 65 years at the time of maturity.

- Net Monthly Income:

- Salaried/SEP/SEB/OIG: Minimum PKR 50,000.

- NRP: Minimum PKR 400,000.

- Length of Service/Business:

- Salaried: Minimum 1 year experience with at least 6 months at current employer (6 months for NBP employees).

- SEP/SEB/OIG/NRP: Minimum 2 years experience in current profession/business.

Required Documents:

- Copy of valid CNIC/NICOP.

- Two recent passport-size colored photographs.

- Attested salary slips/income proof for the last three months.

- Original/stamped & signed bank statement for the last six months (showing salary/income).

- Copy of the latest paid utility bill.

- Additional documents for NBP Employees:

- Liability Statement

- Verification of Educational Documents

- Non-Involvement Certificate

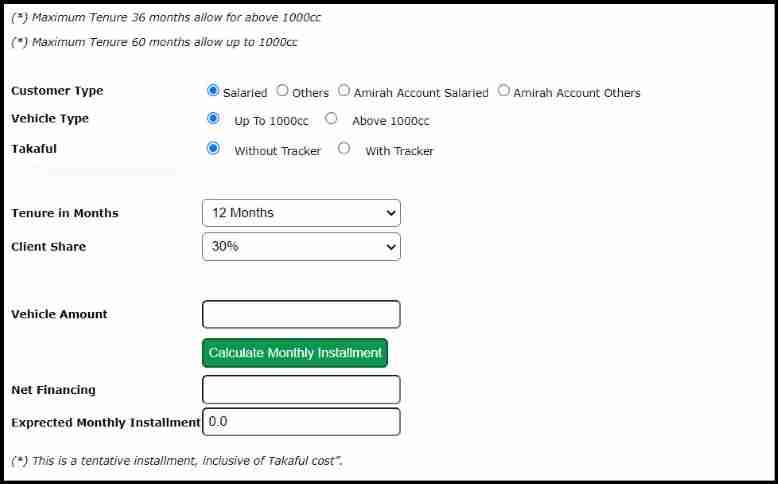

NBP Car Loan Calculator

FAQs | Car On Installment

Top 3 best showrooms for getting the car on installment?

Our list includes showrooms for getting cars on installment like:

Pak Suzuki

Toyota

& Pakwheels.

Which banks are best for getting the car on installment?

Our list of best banks that provide car loans are:

Meezan Bank

HBL

Dubai Islamic Bank

Bank Alfalah

NBP

How to Get Car On Installment From Pak Suzuki Showroom?

Pak Suzuki offers an easy-buy car on Installment in Pakistan. They provide certified used cars checked on 130 points for quality assurance. With an exchange program, you can trade in your old car for a new or certified used Suzuki. Financing options are available with low rates and no charges. Suzuki RV Financing allows you to change your car every 2-3 years with lower monthly installments and a buy-back guarantee. Terms and conditions apply, and the offer is available for specific Suzuki models through partner banks like Bank Alfalah, Meezan Bank, and MCB Bank.

What are Meezan Bank Car Loan Processing Charges?

Meezan Bank Car Loan Processing Charges:

Up-Front Processing Charges: PKR 2,500

FED on Processing Charges @ 13%: PKR 325

Income Estimation Charges: Not Applicable

Documentation Charges: Charged at Actual

Old Vehicle Valuation Charges: PKR 2,000

Please note:

FED on Processing Charges of 13% to 16% may vary depending on the region.

Processing charges are nonrefundable.

The charges mentioned above do not apply to Meezan Car Ijarah for Roshan Digital Account holders.

What are the eligibility criteria for an NBP Car Loan?

Must hold Pakistani citizenship.

Minimum age requirement is 21 years at the time of application, with a maximum of 60 years at maturity for salaried individuals.

Minimum age requirement is 21 years at the time of application, with a maximum of 65 years at maturity for self-employed individuals.

Minimum monthly income should be PKR 50,000.

Recommended Reading: How To Get A Used Car On Installments In Pakistan | Second Hand Cars On Installments

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Do you have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment