Loan For Business In Pakistan, many organizations give an interest-free Loan For Business. These loans are provided with big amounts, typically ranging from PKR 25,000 to PKR 5 lakh, without any interest charges.

The availability of interest-free loans for business in Pakistan has played a vital role in economic growth. It is a big opportunity for Pakistani people to take this interest-free Loan For Business In Pakistan for their growing business.

These are the Organizations that give interest-free loans to businesses in Pakistan.

Recommended Reading: How To Get Interest-Free Agriculture Loan In Pakistan {5-75Lakh}

Loan For Business In Pakistan | Personal Loan For Business In Pakistan

Table of Contents

- Loan For Business In Pakistan | Personal Loan For Business In Pakistan

Recommended Reading: Interest-Free Marriage Loan In Pakistan (35K-2Lakh) | Marriage Grant

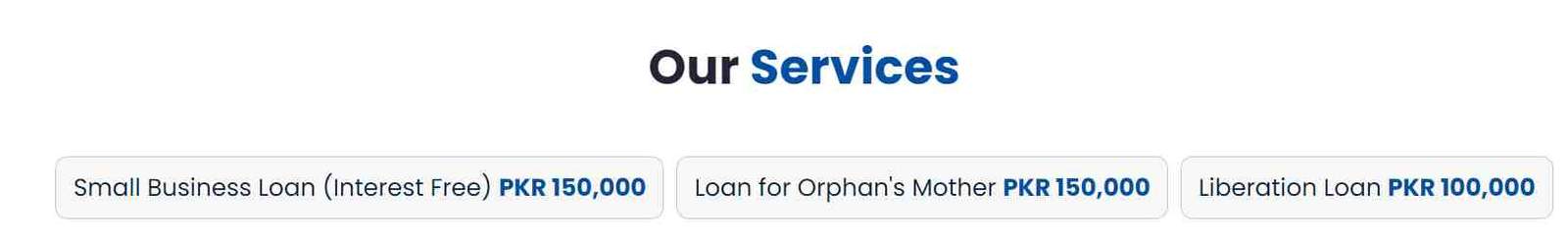

Alkhidmat Foundation

Alkhidmat Foundation Loan For Business In Pakistan type Mawakhat program is based on the Islamic principle of Qarze-e-Hasna, which encourages the Muslims Community to help those in need by giving interest-free loans to businesses in Pakistan.

This Mawakhat Loan For Business In Pakistan is helping poor families and individuals alleviate poverty and promotes interest-free loans as a viable model for poverty alleviation.

Alkhidmat Foundation gives loans for businesses in Pakistan amounting is PKR 150,000. It also provides social guidance, capacity building, and entrepreneurial training to its beneficiaries.

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

Loan Amount

Alkhidmat Foundation gives loans to businesses in Pakistan without interest. This loan Amount is PKR 150,000. This loan amount is interest-free.

How To Apply For Alkhidmat Foundation Business Loan

To apply for an Alkhidmat Foundation loan for business in Pakistan, follow these steps:

- Visit the Alkhidmat Website: Start by visiting the Alkhidmat Foundation’s official website at https://alkhidmat.org/.

- Visit a Nearby Office: Alternatively, you can visit a nearby Alkhidmat Foundation office to inquire about the loan application process and collect the necessary forms and information.

- Select Loan Type: Specify the type of loan you require, in this case, the “BUSINESS loan” or “Mawakhat loan,” depending on your needs.

- Obtain the Application Form: Acquire the Loan For Business In Pakistan application form, which will contain the details and requirements for the application process.

- Fill and Attach Documents: Complete the application form as per the provided instructions.

- Submit Your Application: Submit your filled-out application form and the necessary supporting documents to the Alkhidmat Foundation, either through their website or at one of their physical offices.

- Wait for Approval: After submitting your application, you will need to patiently await the processing and approval of your loan application.

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

Ihsaas Trust Loan For Business In Pakistan

Ihsaas Trust is a well-known charitable organization based in Pakistan, founded in 2012. Ihsaas Trust also offers Loan For Business In Pakistan.

Ihsaas Trust offers small-scale loans for businesses in Pakistan amounts ranging from PKR 5 lakh for those looking to establish a business and PKR 25,000 for personal needs.

The Trust employed microfinance as a strategy to alleviate financial limitations hindering budding entrepreneurs from commencing their businesses.

Ihsaas Trust Loan For Business Loan Amount

Ihsaas Trust offers small-scale loans for businesses in Pakistan amounts ranging from PKR 5 lakh for those looking to establish a business and PKR 25,000 for personal needs.

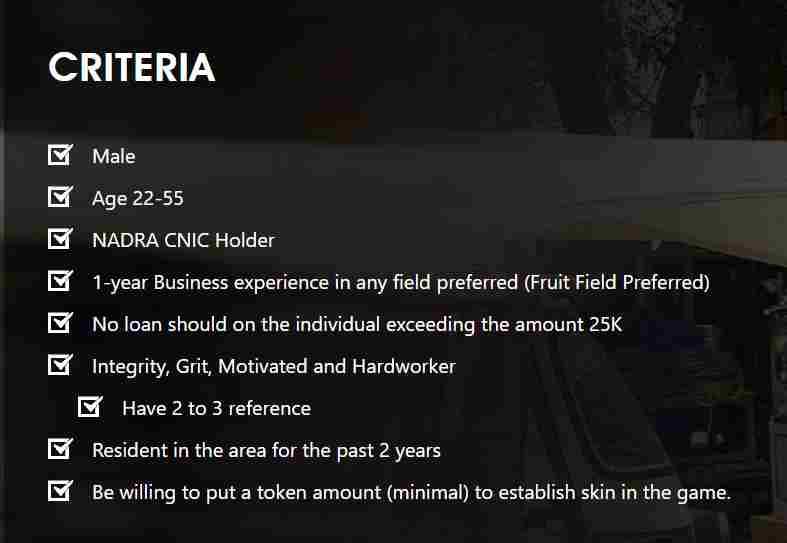

Ihsaas Trust Loan For Business Eligibility Criteria

The eligibility criteria for the Ihsaas Trust Loan For Business In Pakistan are as follows:

- Gender: Applicants must be male.

- Age: The age range for eligibility is between 22 and 55 years.

- NADRA CNIC Holder: Individuals should possess a valid NADRA Computerized National Identity Card (CNIC).

- Business Experience: A preferred criterion is having at least one year of business experience, with a preference for experience in the field, particularly the fruit sector.

- Existing Loans: Applicants should not have any existing loans exceeding the amount of 25,000 PKR.

- Personal Qualities: Applicants are expected to demonstrate qualities such as integrity, determination, motivation, and a strong work ethic.

- References: Applicants are required to provide 2 to 3 references as part of the application process.

- Residency: Applicants must have been residents in the specified area for the past 2 years.

- Investment: Applicants should be willing to contribute a minimal token amount as an expression of commitment and dedication to their business venture.

Recommended Reading: 10 Lakh Loan Without Interest In Pakistan Online Apply {Interest-free}

Ihsaas Trust Loan For Business Application Form

The Ihsaas Trust Loan For Business In Pakistan Application Form includes the following fields:

- Full Name: Please provide your full name.

- Mobile Number: Enter your mobile phone number for contact purposes.

- CNIC No.: Include your Computerized National Identity Card (CNIC) number in the format 11111-1111111-1.

- Terms and Conditions: By checking this box, you confirm that you have read and understood the eligibility criteria as mentioned on the page and assert your eligibility to apply under the Ihsaas enterprise facilitation stream.

- Submit: Click the “Submit” button to send your application.

Ihsaas Trust Loan Schemes

There are two types of Ihsaas Trust Scheme loans for business in Pakistan.

- Philanthropic Disbursement

- Enterprise Facilitation

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

Philanthropic Disbursement

In our approach at Ihsaas, we emphasize providing timely assistance to individuals and families through Zakat or Sadaqa.

This support is aimed at helping them address their immediate needs and eventually become self-sufficient. Presently, our areas of intervention encompass.

Financial Support

We offer financial support for healthcare requirements, spanning from primary to tertiary care. A substantial portion of our mission is focused on enhancing healthcare accessibility for the less privileged residents of Karachi.

While a considerable part of our work involves quantifiable factors such as the number of patients served, and partnerships established.

Ration Support

In the context of providing rations, the Trust has chosen to implement a direct cash transfer approach, significantly decreasing the disbursement timeline with the utilization of mobile payment solutions, such as Meezan Bank’s Cash over Counter service and Telenor’s EasyPaisa model.

Determining the disbursement amount for rations is intricately linked to the household’s population, thus enhancing equitable distribution and minimizing wastage.

Recommended Reading: How To Get A 5 Lakh Loan Without Interest In Pakistan {5-10 Lakh Loan}

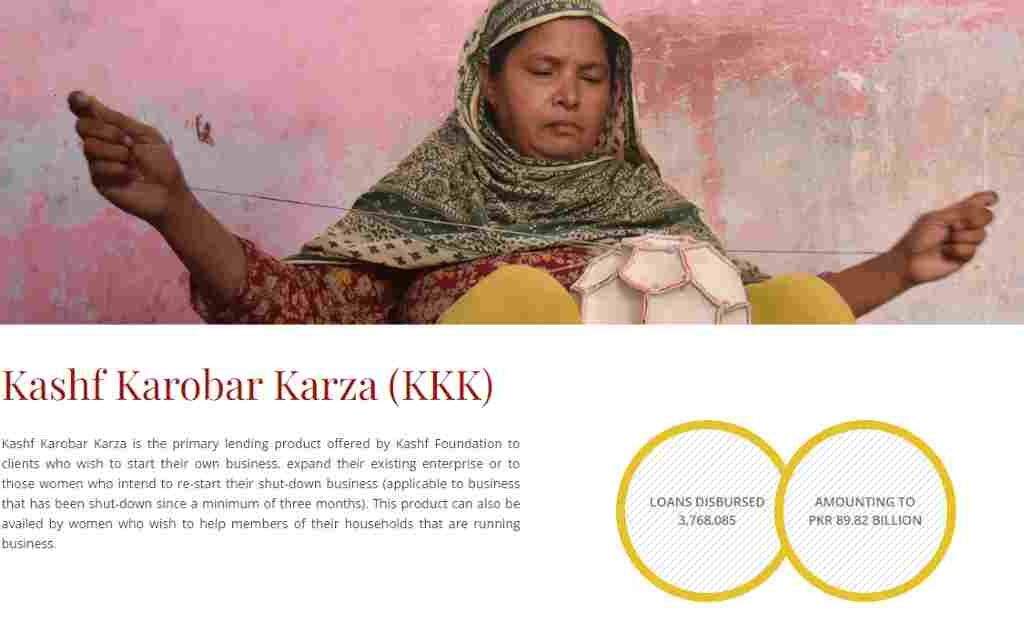

Kashf Foundation Loan For Business In Pakistan

In Pakistan, the Kashf Foundation offers a loan for business in Pakistan products called “Kashf Karobar Karza.”

loan for business in Pakistan is tailored to aid those aspiring to initiate new businesses, expand existing ones, or assist women in revitalizing businesses that have been inactive for a minimum of three months.

It’s also an option for women who aim to support their family members in managing their businesses.

Recommended Reading: 10 Lakh Loan For Business In Pakistan | Insaf Rozgar Scheme

Kashf Foundation Loan Amount

Kashf Foundation loans for business in Pakistan range from up to PKR 40,000 during the first loan cycle, with the upper limit extending to PKR 100,000.

Features

Here are the loan for business in Pakistan features and specifications of KKK:

- Term: loan for business in Pakistan term is 1 year, equivalent to 12 months.

- Installments: Repayments are structured into 12 equal monthly installments.

- Amount: Borrowers can access loans ranging from up to PKR 40,000 during the first loan cycle, with the upper limit extending to PKR 100,000.

- Documentation: A documentation fee of PKR 250 is applicable, and it is paid in monthly installments.

- Insurance: Borrowers have two insurance plan options. Plan A offers insurance with maternity coverage at a premium of PKR 1,850, paid in monthly installments. Plan B provides insurance without maternity coverage at a premium of PKR 1,200, also paid in monthly installments.

Recommended Reading: How To Get An Interest-free Loan Online {20K-1 Lakh}

Kashf Foundation Easy Loan

Kashf Easy Loan is a recent addition to our loan options, designed for people who need small loans quickly.

It’s a simple and accessible loan for businesses in Pakistan, providing PKR 15,000 to help those who need money urgently. We’re focusing on reaching out to people who might not have easy access to financial services, especially women with lower incomes.

Kashf Foundation Easy Loan Amount

Kashf Easy loan for business in Pakistan amount of PKR 15,000.

Features and Specifications

Here are the loan for business in Pakistan features and specifications of Kashf Easy Loan (KEL):

- Term: The loan term for KEL is one year, which equals 12 months.

- Installments: Repayments are divided into 12 equal monthly installments, making it easy to manage.

- Amount: KEL provides a loan amount of PKR 15,000, which is designed to meet small and urgent financial needs.

- Insurance: This loan product includes life insurance, offering added financial security to borrowers.

Recommended Reading: Mobile On Installment Without Interest (Range 10K-1Lakh) [Smartphone For All Scheme]

Loan For Business In Pakistan | FAQs

How much loan amount For Business offers Ihsaas Trust?

Ihsaas Trust offers a loan for business in Pakistan amounts ranging from 25k to 5Lakh.

Which Organization Gives Loans for Business In Pakistan?

Organization Giving loan for business in Pakistan:

1. Alkhidmat Foundation

2. Ihsaas Trust

3. Kashf Foundation

What is a business loan?

In Pakistan, many organizations give an interest-free Loan For Business. These loans are provided with big amounts, typically ranging from PKR 25,000 to PKR 5 lakh, without any interest charges.

The availability of interest-free loans for business in Pakistan has played a vital role in economic growth. It is a big opportunity for Pakistani people to take this interest-free loan for their growing business.

What is the typical loan amount offered in an interest-free Loan For Business In Pakistan?

The loan amount can vary, but it often ranges from PKR 25,000 to PKR 5 lakh, depending on the lending organization and the borrower’s needs.

Are there specific eligibility criteria for interest-free loans for businesses in Pakistan?

Yes, eligibility criteria vary by organization but may include age, gender, business experience, references, residency, and a commitment to repay the loan without interest.

What is Kashf Karobar Karza and how does it work?

Kashf Karobar Karza is a lending product by the Kashf Foundation designed for individuals looking to start or expand businesses. The loan term is 1 year, with 12 equal monthly installments. The loan amount ranges from up to PKR 40,000 (first loan cycle) to a maximum of PKR 100,000. Insurance options are available, with premiums paid in monthly installments.

What are the eligibility criteria for Kashf Karobar Karza loans?

Eligibility criteria typically include factors like gender, age, CNIC holder status, business experience, outstanding loans, personal qualities, references, residency duration, and a willingness to invest a token amount in the business. Specific details may vary.

What types of services does the Alkhidmat Foundation offer?

Alkhidmat Foundation offers services related to healthcare, education, disaster relief, orphan support, and various development projects.

How much is the Loan amount offered by Alkhidmat Foundation?

Alkhidmat Foundation gives loans to businesses in Pakistan without interest. This loan Amount is PKR 150,000. This loan amount is interest-free.

How much is the Loan amount offered by Ihsaas Trust?

Ihsaas Trust offers small-scale Business loans in Pakistan amounts ranging from PKR 5 lakh for those looking to establish a business and PKR 25,000 for personal needs.

What types of financial products does the Kashf Foundation offer?

Kashf Foundation offers microloans, business loans, and other financial services to support entrepreneurship and economic development.

How much is the Loan amount offered by the Kashf Foundation?

Kashf Foundation Kashf Karobar Karza KKK Scheme:

Kashf Foundation provides loans ranging from up to PKR 40,000 during the first loan cycle, with the upper limit extending to PKR 100,000.

Kashf Foundation Easy Loan Amount:

It’s a simple and accessible loan, providing PKR 15,000 to help those who need money urgently.

What are the eligibility criteria for Ihsaas Trust Business Loans?

The eligibility criteria for Ihsaas Trust loan for business in Pakistan include:

1. Gender: Male applicants

2. Age: Between 22 and 55 years

3. NADRA CNIC Holder

4. Business Experience: Preferably one year of business experience, with a preference for experience in the relevant field

5. Existing Loans: No existing loans exceeding PKR 25,000

6. Personal Qualities: Integrity, determination, motivation, and a strong work ethic

7. References: 2 to 3 references required

8. Residency: Residing in the specified area for the past 2 years

What are the features of Kashf Karobar Karza?

The features of Kashf Karobar Karza loan for business in Pakistan include:

1. Term: 1 year (12 months)

2. Installments: Repayments structured into 12 equal monthly installments

3. Amount: Ranging from up to PKR 40,000 to PKR 100,000

4. Documentation Fee: PKR 250 paid in monthly installments

5. Insurance: Two plan options with premiums paid in monthly installments.

What additional support does the Alkhidmat Foundation provide along with the interest-free business loan?

Apart from the interest-free loan of PKR 150,000, the Alkhidmat Foundation offers social guidance, capacity building, and entrepreneurial training to the beneficiaries, fostering holistic growth and development.

How can Ihsaas Trust’s Philanthropic Disbursement help individuals and families?

Ihsaas Trust’s Philanthropic Disbursement provides timely assistance through Zakat or Sadaqa, addressing immediate needs and supporting individuals and families to become self-sufficient.

How does the Kashf Foundation contribute to financial inclusion and women’s empowerment?

Kashf Foundation focuses on financial inclusion and women empowerment by offering accessible loan options like Kashf Karobar Karza and Kashf Easy Loan. These initiatives target individuals, especially women with lower incomes,

Recommended Reading: Khud Mukhtar Program (72K-1.5 Lakh Interest-Free Loan For Business)

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment