Loan In Pakistan, several prominent welfare organizations cater to the needs of the poor and needy by offering interest-free loans.

Following is a list of Welfare Organizations that give 50,000 Loan In Pakistan without interest, the list goes:

- Akhuwat Foundation

- Alkhidmat Foundation

- Kashf Foundation

- Pakistan Poverty Alleviation Fund (PPAF)

- Ihsaas Trust, Balochistan Rural Support Program (BRSP)

- Agahe Pakistan

With loan amounts ranging from PKR 50,000 to 5 Lakh at maximum, these organizations aim to alleviate poverty and empower individuals to improve their lives.

In this article, we discuss How To Get a 50,000 Loan In Pakistan, the application process, eligibility criteria, and how to apply for a loan.

Recommended Reading: How To Get A 5 Lakh Loan Without Interest In Pakistan {5-10 Lakh Loan}

How To Get A 50,000 Loan In Pakistan Without Interest

Table of Contents

- How To Get A 50,000 Loan In Pakistan Without Interest

- Interest-Free 50,000 Loan In Pakistan

Recommended Reading: 10 Lakh Loan Without Interest In Pakistan Online Apply {Interest-free}

Interest-Free 50,000 Loan In Pakistan

If you are seeking an interest-free Loan In Pakistan, there are several avenues you can explore.

Welfare organizations like the Akhuwat Foundation, Ihsaas Trust, and Pakistan Poverty Alleviation Fund (PPAF) offer interest-free loans in Pakistan to individuals in need, aiming to alleviate poverty and promote financial inclusion.

Additionally, microfinance institutions such as Khushhali Microfinance Bank and NRSP Microfinance Bank provide interest-free loans in Pakistan to support small business owners and entrepreneurs.

Contacting these organizations directly and understanding their eligibility criteria can help you access the interest-free loan you require.

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

Alkhidmat Foundation Loan In Pakistan

Alkhidmat Foundation is a reputable welfare organization in Pakistan that offers interest-free loans in Pakistan to support underprivileged individuals and families.

Their loan programs aim to empower people by providing financial assistance for various purposes, including starting or expanding small businesses.

With a focus on poverty alleviation and socio-economic development, the Alkhidmat Foundation strives to uplift the less fortunate in society.

Suppose you need a 50,000 PKR loan in Pakistan for your business or other legitimate needs. In that case, you can reach out to Alkhidmat Foundation to inquire about their loan facilities and eligibility criteria.

Alkhidmat Foundation provides various interest-free loans in Pakistan to cater to different needs. Some of their offerings include:

- Small Business Loan (Interest-Free): Alkhidmat Foundation offers a Small Business Loan program with a loan amount of PKR 100,000. This loan is designed to support individuals who wish to start or expand their small businesses. The loan term is typically two months, providing entrepreneurs with the necessary capital to kick-start their entrepreneurial ventures.

- Loan for Orphan’s Mother (Interest-Free): Alkhidmat Foundation also provides loans of PKR 100,000 specifically targeted toward the mothers of orphans. This loan program aims to empower these women by providing financial assistance, enabling them to meet their immediate needs and support their families.

- Liberation Loan (Interest-Free): Alkhidmat Foundation offers a Liberation Loan program with a loan amount of PKR 50,000. This loan is intended to provide financial relief to individuals who may be facing difficult circumstances or financial constraints. The loan term for this program is typically two months, giving borrowers the necessary support to overcome their challenges.

How to Apply For the Alkhidmat Foundation Loan

To apply for a loan in Pakistan with the Alkhidmat Foundation, you can follow these general steps:

- Visit the Alkhidmat Foundation website: Start by visiting the official website https://alkhidmat.org/.

- loan programs: Navigate to the loan section or search for the specific loan program you are interested in, such as the Small Business Loan or the Loan for the Orphan’s Mother.

- Gather necessary documents: Prepare the required documents such as your identification proof (CNIC), income proof, business details (if applicable), and any other supporting documents mentioned in the loan program requirements.

- Contact Alkhidmat Foundation: Reach out to Alkhidmat Foundation through their designated contact channels. This can be through their official phone number, email address, or by visiting their local office.

- Submit application and documents: Follow the instructions provided by Alkhidmat Foundation to submit your loan application.

- Attend interviews or assessments: Cooperate with them during this process and provide any additional information or clarification as requested.

- Await loan approval: They will inform you whether your loan has been approved or not.

Recommended Reading: Interest-Free Marriage Loan In Pakistan (35K-2Lakh) | Marriage Grant

Agahe Pakistan Interest-Free Loan In Pakistan

Agahe Pakistan is a notable organization in Pakistan that is dedicated to providing interest-free loans in Pakistan to individuals in need.

With a focus on financial inclusion and empowerment, Agahe Pakistan aims to support individuals and communities by offering accessible and interest-free loan options.

These loans in Pakistan serve as a vital resource for entrepreneurs, small business owners, and individuals looking to overcome financial challenges and improve their socio-economic conditions.

By providing interest-free loans in Pakistan, Agahe Pakistan plays a crucial role in promoting economic growth, poverty alleviation, and sustainable development in Pakistan.

Through its commitment to financial inclusivity, Agahe Pakistan strives to empower individuals and uplift communities across the country.

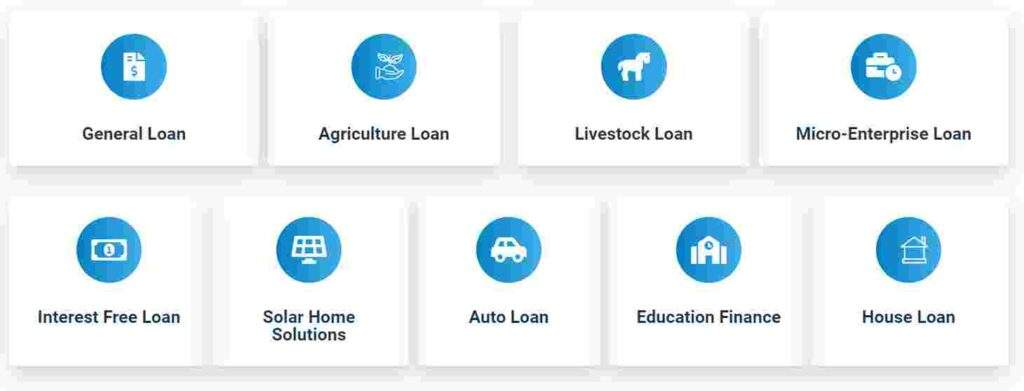

Agahe Pakistan is a notable organization in Pakistan that offers a range of interest-free Loan In Pakistan programs to cater to various needs. These loan programs include:

- General Loan: Agahe Pakistan provides general interest-free loans in Pakistan ranging from 20,000 PKR to 65,000 PKR. These loans are designed to assist individuals with their immediate financial requirements, such as covering expenses or meeting personal obligations.

- Agriculture Loan: Agahe Pakistan offers interest-free loans in Pakistan specifically tailored for agricultural purposes. The agriculture loan program provides funding in the range of 15,000 PKR to 75,000 PKR, supporting farmers and agricultural entrepreneurs in their farming activities.

- Livestock Loan: Agahe Pakistan extends interest-free loans ranging from 20,000 PKR to 150,000 PKR to individuals engaged in livestock-related businesses. These loans aim to support the growth and development of livestock-based enterprises.

- Micro-Enterprise Loan: Agahe Pakistan’s micro-enterprise loan program offers interest-free loans in the range of 75,000 PKR to 200,000 PKR. These loans are specifically tailored for small business owners and entrepreneurs, providing them with the necessary capital to start or expand their micro-enterprises.

- Solar Home Solutions: Agahe Pakistan recognizes the importance of renewable energy and offers interest-free loans for solar home solutions. The loan amounts range from 5,000 PKR to 260,000 PKR, enabling individuals to invest in solar-powered systems for their homes.

- Auto Loan: Agahe Pakistan also provides interest-free loans in Pakistan for individuals looking to purchase vehicles. The auto loan program offers funding in the range of 40,000 PKR to 200,000 PKR, assisting individuals in acquiring means of transportation.

Recommended Reading: How To Get Interest-Free Agriculture Loan In Pakistan {5-75Lakh}

Agahe Pakistan Interest-Free Loan

To apply for a loan in Pakistan with Agahe Pakistan, you can follow these general steps:

- Visit Agahe Pakistan’s official website: Start by visiting the official website of https://agahepakistan.org/.

- Explore loan programs: Navigate to the loan section or look for the specific loan program you are interested in, such as the General Loan, Agriculture Loan, Livestock Loan, Micro-Enterprise Loan, Solar Home Solutions, or Auto Loan.

- Gather necessary documents: These may include identification proof (CNIC), income proof, business details (if applicable), collateral (if required), and any other supporting documents specified by Agahe Pakistan.

- Contact Agahe Pakistan: Reach out to Agahe Pakistan through their designated contact channels, such as their phone number or email address. Inquire about the loan application process and express your interest in applying.

- Submit application and documents: Follow the instructions provided by Agahe Pakistan to submit your loan application. This may involve filling out an application form and attaching the required documents.

- Attend interviews or assessments: Depending on the loan program, Agahe Pakistan may conduct interviews or assessments to evaluate your eligibility and assess the viability of your loan request.

- Await loan approval: They will inform you whether your loan has been approved or not.

Ihsaas Trust Interest-Free Loan in Pakistan

Ihsaas Trust is a renowned organization that offers interest-free loans in Pakistan.

With a strong focus on philanthropy and enterprise facilitation, Ihsaas Trust aims to empower individuals by providing them with financial assistance and support.

Their interest-free loan programs are designed to uplift the underprivileged and economically disadvantaged, allowing them to improve their livelihoods and create sustainable business opportunities.

Ihsaas Trust’s commitment to philanthropic disbursements and enterprise facilitation has made a significant impact on the lives of countless individuals and communities across Pakistan.

Recommended Reading: Loan For Business In Pakistan Without Interest (25K-5Lakh)

Philanthropic Disbursements

- Education Support: Ihsaas Trust provides financial assistance for educational purposes, including school fees, tuition, and educational supplies. They aim to ensure that children have access to quality education, irrespective of their financial backgrounds.

- Healthcare Support: Ihsaas Trust offers financial aid to individuals and families in need of medical treatment, surgeries, and medications. They prioritize the provision of healthcare services to those who cannot afford proper medical care.

- Orphan Support: Ihsaas Trust extends support to orphaned children by providing financial aid for their living expenses, education, and overall well-being. They aim to create a nurturing environment for these children and help them build a better future.

Enterprise Facilitation

- Small Business Loans: Ihsaas Trust offers interest-free loans in Pakistan to aspiring entrepreneurs and small business owners. These loans help individuals start or expand their businesses, providing them with the necessary capital to pursue their entrepreneurial dreams.

- Skill Development Programs: Ihsaas Trust conducts skill development programs and vocational training to enhance the employability of individuals. These programs equip participants with valuable skills and knowledge, enabling them to secure better job opportunities or establish their enterprises.

- Entrepreneurship Support: Ihsaas Trust provides mentoring, guidance, and business support to individuals who wish to establish their businesses. They offer entrepreneurship training and resources to help individuals navigate the challenges of starting and managing a successful enterprise.

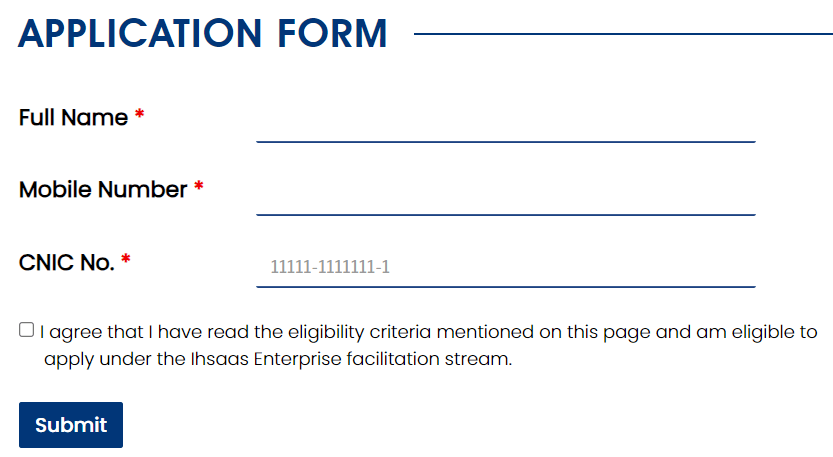

How To Apply For Ihsaas Trust Interest-Free Loan

To apply for an interest-free Loan In Pakistan with Ihsaas Trust, you can follow these general steps:

- Visit the Ihsaas Trust website: Start by visiting the official website of https://ihsaas.pk/. Look for the loan section or any specific information related to interest-free loans in Pakistan.

- Understand the loan programs: Explore the different loan programs offered by Ihsaas Trust. Read the details, eligibility criteria, and requirements of each program to determine which one suits your needs.

- Gather necessary documents: These may include identification proof (CNIC), proof of income, business details (if applicable), and any other supporting documents mentioned by Ihsaas Trust.

- Contact Ihsaas Trust: Reach out to Ihsaas Trust through their contact channels, such as their phone number or email address.

- Submit application and documents: This typically involves filling out an application form and attaching the required documents. Make sure to provide accurate and complete information.

- Attend interviews or assessments: Depending on the loan program, Ihsaas Trust may conduct interviews or assessments to evaluate your eligibility and assess the viability of your loan request.

- Await loan approval: They will inform you whether your loan has been approved or not.

Recommended Reading: 10 Lakh Loan For Business In Pakistan | Insaf Rozgar Scheme

FAQs | Loan In Pakistan | Interest-free Loan In Pakistan

What is an interest-free Loan In Pakistan?

An interest-free Loan In Pakistan is a type of loan where borrowers are not required to pay any interest on the borrowed amount. Organizations like Akhuwat Foundation, Pakistan Poverty Alleviation Fund (PPAF), Ihsaas Trust, Balochistan Rural Support Program (BRSP), Agahe Pakistan, and Alkhidmat Foundation offer interest-free loans to provide financial support to individuals and promote socio-economic development.

Who is eligible to apply for an interest-free Loan In Pakistan?

Each organization may have its own set of requirements regarding income, credit history, collateral, and purpose of the Loan In Pakistan.

What documents are typically required to apply for an interest-free loan?

Commonly required documents for an interest-free loan application may include identification proof (such as CNIC), proof of income, business details (if applicable), bank statements, residence proof, and any other documents specified by the organization.

What can an interest-free loan be used for?

Interest-free loans in Pakistan can be used for various purposes depending on the loan program and organization.

Common uses include starting or expanding a small business, investing in agriculture or livestock, financing education expenses, covering medical costs, purchasing necessary equipment or machinery, and supporting income-generating activities.

Do interest-free loans require collateral?

The requirement for collateral may vary depending on the organization and the loan program. Some interest-free loan programs may require collateral, such as property or assets, to secure the loan.

What is the repayment period for interest-free loans?

The repayment period for interest-free loans varies depending on the loan program and the amount borrowed. It can range from a few months to several years.

Can I apply for an interest-free loan if I have a bad credit history?

Each organization has its eligibility criteria regarding credit history. While some organizations may consider applicants with a less-than-perfect credit history, others may have stricter requirements.

Can I apply for an interest-free loan if I am unemployed?

The eligibility criteria for interest-free Loans In Pakistan may vary, and some loan programs may require a source of income or employment.

Recommended Reading: How To Get An Interest-free Loan In Pakistan Online {20K-1 Lakh}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment