We have enlisted top interest-free Loan apps in Pakistan, their eligibility criteria, and a step-by-step guide on getting an interest-free loan of PKR 50,000 to PKR 100K (Maximum 1-2 Lakh).

We have not discussed conventional loan apps in Pakistan, conversely, we have highlighted top welfare organizations that give loans of PKR 50K-100K without interest from anywhere in Pakistan.

Our guide is based on the following organizations operating through their physical offices, websites, and loan apps. Our top 4 recommendations are as follows:

Name of Top Organization that Gives Interest-Free Loans in Pakistan.

- Alkhidmat Foundation

- Akuwat Foundation

- Kashf Foundation

- Saylani Welfare Trust Loan Apps

Here is also the List of Top SECP Verified Loan Apps in Pakistan:

- Barwaqt

- Paisayaar

- Abhi- Your Salary Now!

- Zoodpay

- Muawin

Recommended Reading: Top 7 Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

Top 3 Loan Apps To Get Urgent Loan In Pakistan (Registered Loan Apps In Pakistan)

Table Of Contents

PaisaYaar Loan App

Paisayar is the best Loan app in Pakistan. It’s like a safe bank on your phone. You can get loan money quickly and easily. They follow all the rules and have a special license from the government. You can get a loan of up to Rs 25,000 for personal needs using just your mobile phone.

Paisayarr is very safe to use. They don’t charge any hidden fees, and your information is kept safe. They check how much you can get a loan by looking at your information and how you handle money. You can get the money in different ways and pay it back through many channels.

PaisaYaar Loan Details

- Loan Details:

- Loan Duration: You can get loan money for 60 to 90 days.

- Amount: You can get a loan from Rs. 1,000 to Rs. 25,000.

- Interest Rate: The interest rate you’ll be charged each day ranges from 0% to 0.6% of the total loan amount you get from this App.

- Example Calculation: Let’s say you get a loan of Rs. 12,000 for 3 months.

- Monthly interest rate: 12%/12 = 1%

- Total interest: Rs. 12,000*1%*3 = Rs. 360

- Total repayment: Rs. 12,000 + Rs. 360 = Rs. 12,360

- Monthly payment: Rs. 12,360/3 = Rs. 4,120

Advantages Of Loan Apps in Pakistan

- No barriers or guarantees are needed, as long as you’re 18 or older.

- Quick processing without long waits.

- Verification is available online 24/7.

- Your information is kept safe with multiple privacy protections.

How To Apply For Paisayaar Loan Apps in Pakistan?

- Download the Paisayaar app from the Google Play Store.

- Sign up with your phone number.

- Fill in your details, take a clear photo, and submit.

- Wait for approval, and then you’ll get the money.

How to Pay Back: You can repay through Easypaisa.

Through the:

- Easypaisa App

- Easypaisa USSD

- Easypaisa shops.

Paisayaar Contact Details

- Phone: 0308-8888260

- Email: support@paisayaar.pk

- Address: Fortune Residency, Ground Floor, Street no. 26, National Police Foundation, E11/4, Islamabad.

Abhi-Your Salary Now Loan App

Abhi Your Salary Now! is a special Loan app in Pakistan that’s like having your salary with you all the time. Many people in Pakistan spend their salary quickly, but with Abhi, you can get money whenever you need it. Just use the Abhi App, SMS, or WhatsApp to access your money easily.

Abhi-Your Salary Now Loan Details

You can get a loan amount ranging from 1,000 to 30,000 rupees with the Abhi Your Salary Now app in Pakistan. The interest rates range from 0% to 0.6% per day, and you have up to 90 days to pay it back.

However, the rates and days might vary slightly. If you’re late with your payment, there’s a penalty of 2% to 2.5% per day, but this can also vary a bit.

Abhi Your Salary Now App Contact Number

Here are the Contact details of Abhi Your Salary Now Loan apps in Pakistan:

- Address: 505A, 5th Floor Fortune Towers, Shahrah-e-Faisal, Karachi Office # 5, Floor 6, Askari Corporate Tower, Lahore.

- Email: connect@abhi.com.pk.

- Phone: +92 304 111 5276.

SmartQarza Loan App

SmartQarza popular loan app in Pakistan that provides loans whenever you need them. It’s completely legal and safe because it is registered/licensed by SECP Pakistan.

All you have to do is download the SmartQarza App from the Google Play Store on your phone. Your loan amount will be transferred to your Easypaisa or Jazz Cash account within 5 minutes.

SmartQarza Loan Details

With the SmartQarza Loan App, you can get loan amounts from 2,000 PKR to 25,000 PKR. But remember, there’s interest on the loan. For example, if you borrow 25,000 PKR with a 50% Annual Percentage Rate (APR) for 90 days:

- Markup: You’ll pay 375.00 PKR as the interest on the loan.

- Service Fee: There’s a service fee of 1,353.60 PKR for processing your loan and providing services.

- Process Fee: Another fee of 1,353.60 PKR is charged for processing your loan application.

- Late Payment Fee: If you’re late with your payment, a late fee of 2% of the remaining loan amount will be added.

Eligibility Criteria

- Age: You must be between 18 and 60 years old.

- Valid CNIC: You should be a Pakistani citizen with a valid CNIC.

- Valid Phone Number: You need a working phone number registered to your CNIC or a SIM card under your name.

For further details read our full guide at SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

Islamic Loan Without Interest In Pakistan (By Top Welfare Organizations)

Here are the top welfare organizations in Pakistan that give interest-free loans in Pakistan.

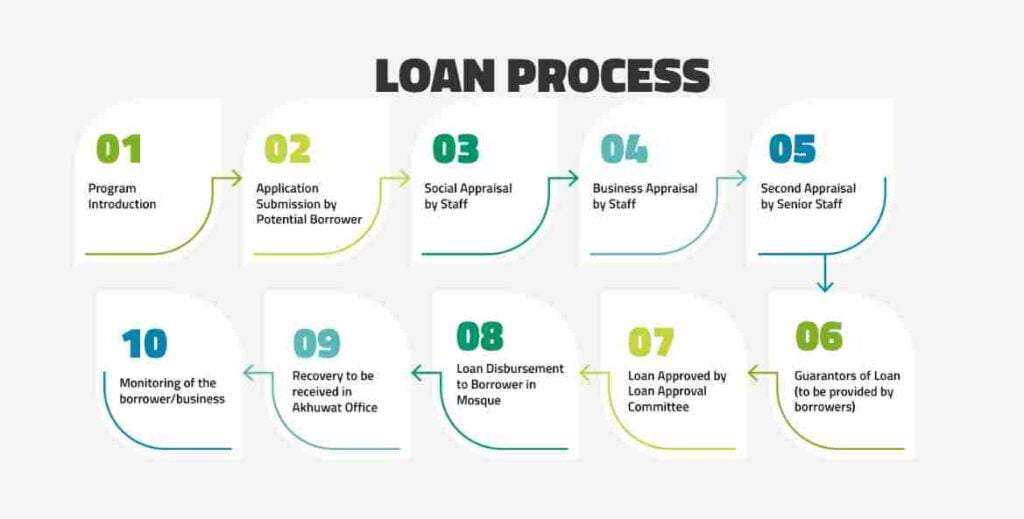

Akuwat Foundation Loan | Akhuwat Loan Apply Online

One of Pakistan’s leading interest-free loan apps is the Akuwat Foundation Loan App. Established as a non-profit organization, the Akuwat Foundation has made significant contributions to the socio-economic development of the country.

The foundation aims to uplift the underprivileged segments of society by providing interest-free loans to individuals in need. With a remarkable track record of serving over 4.6 million people across the country, the Akuwat Foundation has become the largest organization of its kind in Pakistan.

The Akuwat Foundation Loan App offers a convenient and accessible platform for individuals to apply for interest-free loans. The foundation operates on the principles of Islamic finance, ensuring that loans are provided on a not-for-profit basis, in line with ethical and religious considerations.

While specific requirements may vary, applicants are generally evaluated based on factors such as their income level, repayment capacity, and purpose of the loan. The Akuwat Foundation Loan App offers various interest-free loans to cater to different needs and requirements.

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

Here are the different types of loans available through the app with 0% interest rates:

- Family Enterprises Loan: This loan is designed to support individuals or families in starting or expanding small businesses. The loan range for family enterprises typically falls between 10,000 PKR to 50,000 PKR.

- Agricultural Loan: Aimed at farmers and individuals involved in agricultural activities. The loan amount for agricultural purposes through the Akuwat Foundation ranges from 10,000 PKR to 50,000 PKR.

- Liberation Loan: The Liberation Loan aims to assist individuals in breaking free from the cycle of poverty. The loan range for liberation purposes is typically between 10,000 PKR to 100,000 PKR.

- Housing Loan: This loan option aims to address the housing needs. The housing loan amount can range from 10,000 PKR to 100,000 PKR.

- Education Loan: The Akuwat Foundation also offers interest-free loans for educational purposes. The loan range for education purposes typically falls between 10,000 PKR to 50,000 PKR etc.

Akhuwat Loan Contact Number

- Website: The official website of the Akhuwat Foundation is https://www.akhuwat.org.pk.

- Helpline: The Akhuwat Foundation can be reached through their helpline at 042-111- (448-464).

- Email: Individuals can also reach out to the Akhuwat Foundation via email at info@akhuwat.org.pk.

- Address: Akhuwat Foundation, 19 Civic Centre, Township, Lahore, Pakistan

Alkhidmat Foundation Loan Apply Online

Founded in 1990, Alkhidmat Foundation Pakistan was the vision of a group of individuals driven by Islamic principles. Over the years, this vision has been fully realized, and today, the Alkhidmat Foundation operates extensively across all four provinces of Pakistan.

It officially obtained non-profit status in 1993 and has since been dedicated to offering relief and developmental services to the most disadvantaged and marginalized communities in Pakistan.

Operating as a non-profit, non-partisan, and independent humanitarian entity, Alkhidmat Foundation Pakistan addresses real-world challenges, responds to emergencies, and extends vital humanitarian aid.

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | 30K Advance Salary Loan

The Alkhidmat Foundation Loan App offers various types of loans within the range of PKR 50,000 to PKR 500,000. Here is a list of the loan types available through the app:

- Qarz-e-Hasna Loan: This loan provides interest-free ranging from PKR 50,000 to PKR 500,000. It aims to support individuals and families in need, enabling them to meet their immediate financial requirements without the burden of interest charges.

- Agriculture Loan: Alkhidmat Foundation offers loans specifically designed for agricultural purposes. This loan ranges from PKR 50,000 to PKR 500,000.

- Small Business Loan: The Small Business Loan option within the app provides support to aspiring entrepreneurs and small business owners. This loan ranges from PKR 50,000 to PKR 500,000.

- Liberation Loan: The Liberation Loan option aims to uplift marginalized communities and individuals by providing them with interest-free financial support. This loan ranges from PKR 50,000 to PKR 500,000.

- Education Loan: Alkhidmat Foundation recognizes the importance of education and offers interest-free loans for educational purposes. This loan ranges from PKR 50,000 to PKR 500,000

- Emergency Loan: This loan option is designed to provide immediate financial assistance during times of crisis and emergencies. This loan ranges from PKR 50,000 to PKR 500,000..

Alkhidmat Foundation Loan Contact Number

Kashf Foundation Loan

Kashf Foundation stands as a significant player in the quest to alleviate poverty in Pakistan by providing instant, interest-free loans. Their mission revolves around ensuring financial inclusion for all and fostering a society free from poverty and gender inequalities.

Kashf operates as a Non-Banking Microfinance Company, duly regulated by the Securities and Exchange Commission of Pakistan. Established in 1996, it holds the distinction of being Pakistan’s pioneering microfinance institution, initially following the Grameen model.

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

The Kashf Foundation Loan App offers a range of interest-free loan options. Here are the loan types provided by Kashf Foundation, along with their respective loan amounts:

- Qarz-e-Hasna: This loan is specifically designed to provide interest-free loans to low-income individuals who face difficulties accessing formal financial services. The loan amount can vary based on individual circumstances and needs.

- Individual Loan: Kashf Foundation offers loans ranging from PKR 10,000 to PKR 100,000. These loans are intended to support individuals in meeting their financial requirements.

- Group Loan: The Group Loan option extends financial support to groups of individuals, enabling them to collectively access larger loan amounts ranging from PKR 10,000 to PKR 500,000.

- Agriculture Loan: Kashf Foundation recognizes the importance of the agricultural sector. The Agriculture Loan ranges from PKR 10,000 to PKR 100,000, assisting farmers and agriculturists in meeting their farming-related expenses and improving productivity.

- Microenterprise Loan: This loan option supports microenterprises and small businesses. With loan amounts ranging from PKR 10,000 to PKR 500,000.

- Livestock Loan: The Livestock Loan option provides financial assistance to individuals involved in livestock farming. Ranging from PKR 10,000 to PKR 100,000.

- Education Loan: Recognizing the importance of education, the Kashf Foundation offers interest-free loans ranging from PKR 10,000 to PKR 100,000 to help individuals pursue educational opportunities.

Kashf Foundation Loan Contact Number

Saylani Welfare Trust Loan

Saylani Welfare International Trust is a prominent and distinguished organization in Pakistan, renowned for its exceptional mission of providing interest-free instant cash loans to combat poverty among the underprivileged.

Since its establishment in 1999, Saylani Welfare has consistently served as a beacon of hope, disbursing substantial funds primarily sourced from compassionate donors like yourself to uplift the lives of those less fortunate.

Over its remarkable 22-year journey, Saylani Welfare has ceaselessly and diligently worked to improve the circumstances of society’s most vulnerable and disadvantaged members.

Their unwavering dedication extends across various strata of society, including the middle class, lower middle class, and even the economically marginalized, with a steadfast commitment to addressing the needs of individuals at every stage of life.

- Education Loans: Saylani Welfare provides education loans ranging from Rs. 10,000 to Rs. 200,000.

- Emergency Loans: In times of unforeseen crises, Saylani Welfare extends emergency loans, ranging from Rs. 10,000 to Rs. 200,000.

- Small Business Loans: Small businesses play a vital role in economic growth and job creation. Saylani Welfare offers small business loans ranging from Rs. 10,000 to Rs. 200,000 to entrepreneurs and aspiring business owners.

- Health Loans: While the specific loan amount range for health loans is not mentioned, it’s clear that Saylani Welfare recognizes the importance of accessible healthcare.

Saylani Welfare Trust Helpline

- Address: A-25, Bahadurabad Chowrangi Karachi, Pakistan

- Phone: 92-311-1729526

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

List Of Online Loan Apps That Are Scamming People In Pakistan

Online Loan Scamming Apps

In Pakistan, some apps offer loans but end up scamming people. They contact people through calls or messages, offer they can get loans from these apps. These apps often give loans for a short period, like three months, but charge extremely high fees.

It’s important to be careful and not fall for these scams. So, in this problem, SECP takes action to ban these online Loan scamming apps. Here are the details of SECP-banned loan apps.

Recommended Reading: Fori Loan In Pakistan (20K-2Lakh) | Emergency Cash Loan In Pakistan

List of Online Loan Scamming Apps

Here are the Names of Online Loan Scamming Apps.

- PK Loan

- AiCash

- Asan Qarz

- B Cash

- Credit Cat

- Easy Loan

- Kredit

- Bonga

- Udhar Paisa

- Plati Loans

- Mrloan

- Fast Loan

- Easy Money

- CashBeam

- CashMate

- Zenn Park -Easy Instant Help

- Bee Cash

- Asaan Qarza- credit loans

Please be aware that the list above contains names of online loan apps that are associated with potential scamming activities.

List Of Loan Apps Blocked By Ministry Of Finance | Online Loan Apps Banned List

The Ministry of Finance in Pakistan has taken a decisive step to protect citizens from fraudulent practices by blocking several loan apps that were involved in scams across the country.

These loan apps, operating under the guise of legitimate lending platforms, exploited unsuspecting borrowers by promising quick loans without proper verification and imposing exorbitant interest rates and hidden charges.

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

Names of loan apps:

- Plati Loans

- Mrloan

- Swift Loans

- Fori Qarz Online Personal Loan

- CashPro-Immediate Approval

- Loanclub

- HamdardLoan

- QuickCash

- Superb Loans

- Galaxy Loan

- TiCash

- ZetaLoan- Easy Credit Wallet

- Harsha Tube – Quick Money

- Fair Loans

- Loan Credit Cash

- Aasan Lab – Easy Apply for Money

- Rose Cash – Loan Cash

- FinMore- Online Credit Loans

- BG Loan

- Get Welfare

- Tazza Centre – Get Money Soon

- UrCash

- Whale

- For Instant Loans

- Little Cash- Mobile Loans

- Debit Campsite

- LendHome

- Rico Box – Easy Apply Online

- Easy Mobile Loans

- 567 Speed Loan

- MyCash

- Zenn Park -Easy Instant Help

- Bee Cash

- Asaan Qarza- credit loans

- Yocash

- Apple Qist Qarz

- Easy Loans Credit Fast Pay

- Sallam Loan – Online Loan App

- CashCredit-Online Loan money bee

- Qarza Pocket -Personal Funds

Recommended Reading: Top Online Loan Apps In Pakistan | Best Loan Apps

Pros And Cons Of Loan Apps

Pros Of Loan Apps In Pakistan

- Instant Cash Access: Loan apps in Pakistan offer an easy way to access much-needed cash during emergencies or for planned expenses.

- Interest-Free Loans: Some loan apps in Pakistan provide interest-free loans, making it a cost-effective option for borrowers.

- Effortless Receipt: With loan apps, you can get loans directly into their bank accounts or digital wallets.

- Simple Repayment Methods: Loan apps often offer easy and user-friendly repayment options.

- Islamic Financing: Many loan apps in Pakistan offer Islamic financing options compliant with Shariah principles.

- Accessibility and Inclusivity: Loan apps have expanded financial inclusion in Pakistan by reaching underserved populations who may not have had access to traditional banking services

- Variety of Loan Products: Loan apps often offer a variety of loan products for different financial needs, whether it’s a personal loan, business loan, or education loan.

Cons of Loan Apps In Pakistan

- High-Interest Rates: One of the significant drawbacks of certain loan apps in Pakistan is the imposition of high interest rates. While many apps offer interest-free or low-interest loans.

- Security Issues: Some loan apps have raised concerns regarding data privacy and security.

- Limited Loan Amounts: Many loan apps in Pakistan have limitations on the maximum loan amounts they offer.

- Additional Fee Charges: In addition to interest rates, some loan apps may have hidden fees or charges that borrowers are not fully aware of.

- Not Always Aligned with Islamic Principles: For some individuals, borrowing from loan apps may not align with Islamic financial principles, particularly if the app charges interest.

Recommended Reading: Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

FAQs | Loan Apps In Pakistan

What is the maximum loan amount I can get from online Loan apps in Pakistan?

It varies from company to company. Usually, you can get PKR 5,000 to PKR 50,000 easily through Loan apps in Pakistan.

What are the Alkhidmat Foundation Loan apps in Pakistan?

The Alkhidmat Foundation Loan apps in Pakistan, specifically the Mawakhat Program, provide interest-free loans ranging from PKR 50,000 to PKR 500,000. This program is designed to promote the Islamic principle of Qarze-e-Hasna, encouraging Muslims to help those in need. The Loan apps in Pakistan aim to alleviate poverty by offering financial support along with social guidance, capacity building, and entrepreneurial training.

What are the key loan types offered by the Alkhidmat Foundation Loan App?

The Alkhidmat Foundation Loan App offers various interest-free loan types, including Qarz-e-Hasna Loan (PKR 50,000 to PKR 500,000), Agriculture Loan (PKR 50,000 to PKR 500,000), Small Business Loan (PKR 50,000 to PKR 500,000), Liberation Loan (PKR 50,000 to PKR 500,000), Education Loan (PKR 50,000 to PKR 500,000), and Emergency Loan (PKR 50,000 to PKR 500,000).

What are the Kashf Foundation Loan apps in Pakistan?

The Kashf Foundation Loan App introduces Kashf Easy Loa, a product designed to meet urgent financial needs. With an easily accessible loan amount of PKR 15,000, KEL targets an underserved segment, particularly low-income female clients, fostering microfinance readiness.

Do Loan apps in Pakistan offer flexible repayment options?

Loan apps in Pakistan may have limited flexibility when it comes to repayment options. Borrowers should carefully review the repayment terms, including tenure and frequency, to ensure they align with their financial situation and repayment ability.

How can I build credit through loan apps?

Yes, Some loan apps offer credit-building opportunities.

What are the advantages of Kashf Easy Loan?

Kashf Easy Loan offers quick access to funds, streamlined application processes, and promotes microfinance readiness among low-income individuals, especially women. It contributes to financial inclusion by providing a digital platform for underserved segments.

What factors should borrowers consider before using loan apps in Pakistan?

Borrowers should consider factors such as the security of the app, loan amounts offered, interest rates, repayment terms, potential hidden fees, and their financial capability before choosing a loan app.

What are the advantages of using loan apps over traditional banking channels?

Loan apps offer advantages such as convenience, easy application processes, quick disbursement of funds, accessibility 24/7, and the potential for credit-building opportunities. They eliminate the need for physical visits to banks and provide a streamlined digital experience.

Are loan apps in Pakistan interest-free?

Some Loan apps in Pakistan, such as those offered by Alkhidmat Foundation and Kashf Foundation, provide interest-free loan options. These organizations follow principles based on quartz-e-hasna where loans are provided without charging interest, promoting financial fairness and inclusion

What Are Online Scamming Loan Apps in Pakistan?

Online scamming Loan apps in Pakistan are fraudulent mobile applications that deceive and exploit individuals by offering quick loans with no proper verification, charging exorbitant interest rates, and imposing hidden fees.

Top 10 Loan QuickCashScamming Apps that are banned in Pakistan?

Following are the names of the Top 10 Loan Scamming Apps that were recently banned in Pakistan.

QuickCash Loan apps in Pakistan

Assan Qarza

Fori Qarz Loan apps in Pakistan

Easy Loan

Superb Loan

Fair Loan

Rose Cash Loan

Fori Instant Loan apps in Pakistan

Little Cash Loan

Qarza Pocket Loan

What are the details of the Paisayaar Loan apps in Pakistan?

You can get loan amounts ranging from Rs. 1,000 to Rs. 25,000 for 60 to 90 days with Paisayaar, with interest rates ranging from 2% to 12% annually. For instance, a loan amount of Rs. 12,000 for 3 months means paying Rs. 4,120 monthly, including interest. Repayment is easy via Easypaisa through the app, USSD, or at Easypaisa shops.

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment