Kashf Foundation Loan Scheme provides interest-free loans ranging from Rs. 15,000 to Rs. 300,000 to start small businesses, for children’s education, or to fulfill any urgent need.

The Kashf Foundation Loan program offers a range of interest-free loans including urgent microloans, business loans, and agriculture loans to help women entrepreneurs start their new businesses.

Kashf Foundation Loan Types Include:

- Kashf Easy Loan

- Kashf Karobar Karza

- Kashf School Sarmaya

- Kashf Mahweshi Karza

- Kashf Marhaba Loan

- Kashf Sahulat Karza

Now, let’s explore the type of loans provided by the Kashaf Foundation, their eligibility, requirements for successful applications, and a complete guide for getting a Kashaf Foundation Loan urgently. Here we go!

Recommended Reading: Free! Saylani Courses | Saylani Welfare Courses List

Kashf Foundation Loan Schemes | Kashf Foundation Loan Apply Online

Table Of Contents

- Kashf Foundation Loan Schemes | Kashf Foundation Loan Apply Online

- Kashf Foundation Loan Schemes Types

- Kashf Foundation Loan Application Process

What Is The Kashf Foundation?

Kashf Foundation stands as a beacon of hope and empowerment in Pakistan, dedicated to transforming the lives of low-income families and micro-entrepreneurs.

With unwavering commitment, the Kashf Foundation provides a lifeline through high-quality and sustainable microfinance services.

Their mission goes beyond economic empowerment; it’s about dignity and resilience.

By alleviating household poverty and fostering financial capabilities, the Kashf Foundation empowers individuals, especially women, to become the driving forces of social and economic transformation.

Recommended Reading: Aman Foundation Ambulance (Services+Helpline)

What are Kashf Foundation Loan Schemes?

Kashf Foundation’s commitment to uplifting low-income families and micro-entrepreneurs extends to a diverse range of interest-free loan schemes, this scheme known as the Kashf Foundation Loan Scheme.

These innovative financial solutions, such as the Kashf Easy Loan Scheme, Kashf Karobar Karza Scheme, Kashf School Sarmaya Scheme, Kashf Mahweshi Karza Scheme, Kashf Marhaba Loan Scheme, and Kashf Sahulat Karza Scheme, provide vital support to individuals striving for economic independence.

With loan amounts ranging from 15,000 to 100,000, the Kashf Foundation not only addresses financial needs but also empowers recipients to realize their dreams and ambitions.

Recommended Reading: List Of 11+ Welfare Organizations In Pakistan {Updated}

Kashf Foundation Loan Schemes Types

Kashf Easy Loan

The Kashf Easy Loan scheme is a financial lifeline offered by the Kashf Foundation to empower low-income individuals with the means to achieve their financial goals.

Kashf Foundation Loan scheme is designed with several key features and specifications:

1. Loan Term: The Kashf Easy Loan scheme operates on a one-year (12-month) term, providing borrowers with a manageable timeframe for repayment.

2. Equal Monthly Installments: Borrowers are required to make 12 equal monthly installments, making it easier for them to budget and plan their repayments effectively.

3. Loan Amount: The scheme offers a flexible loan amount, ranging from a minimum of PKR 40,000 in the first loan cycle to an upper limit of PKR 100,000.

4. Documentation: To participate in the scheme, borrowers are required to pay a documentation fee of PKR 250. This fee is spread out and paid in monthly installments, making it accessible for individuals with limited financial resources.

5. Insurance Options: This Kashf Foundation Loan scheme provides borrowers with insurance options to safeguard their financial well-being. There are two insurance plans available:

- Plan A: Priced at PKR 1,850, this plan includes maternity coverage, offering comprehensive protection for borrowers and their families. The premium for this plan is also paid in monthly installments.

- Plan B: Priced at PKR 1,200, this plan does not include maternity coverage. It provides essential insurance coverage to borrowers, and like Plan A, the premium is paid in monthly installments.

Recommended Reading: List of Animal Welfare Organizations In Pakistan {Helpline}

Kashf School Sarmaya Loan Scheme

The Kashf School Sarmaya Loan Scheme is a comprehensive credit program designed to address the unique needs of low-cost private schools while simultaneously enhancing the quality of education through teacher and school management training.

This scheme reflects the Kashf Foundation’s commitment to improving the education sector in Pakistan.

Key Features and Specifications:

1. Loan Term: The Kashf School Sarmaya Loan Scheme offers flexible loan terms ranging from 12 to 18 months, allowing schools to choose the duration that suits their financial planning.

2. Monthly Installments: Borrowers are required to make monthly installments over the loan term, ranging from 12 to 18 months, ensuring a convenient and manageable repayment schedule.

3. Loan Amount: Schools can access financial support with a minimum loan amount of PKR 60,000 for a 12-month loan tenure or PKR 75,000 for an 18-month loan tenure during the first loan cycle.

The maximum loan amount available for the first loan cycle is PKR 200,000, with the opportunity to access up to PKR 300,000 in the second loan cycle.

4. Documentation Charges: A one-time documentation fee of PKR 500 is applicable, making it accessible for schools seeking financial assistance.

5. Insurance Charges: Insurance charges are levied at 2% on PKR 20,000 and 1% on the remaining loan amount, ensuring coverage in case of unforeseen events.

6. Training Fees: Borrowers are required to pay a training fee of Rupees 1,000 along with the first installment. This fee covers the cost of capacity-building training for teachers and school management personnel.

7. School Profit: The Kashf School Sarmaya Loan Scheme provides an opportunity for schools to generate profits ranging from Rupees 8,000 to 70,000, contributing to the sustainability of these educational institutions.

8. Age Limit: Clients and their nominees must fall within the age range of 18 to 63 years and 5 months for an 18-month loan tenure or 18 to 63 years and 11 months for a 12-month loan tenure, ensuring inclusivity and accessibility to a wide range of applicants.

Recommended Reading: Top 5 International NGOs In Pakistan (Credible+Approved)

Kashf Easy Loan

The Kashf Easy Loan (KEL) is a timely and accessible financial solution introduced by the Kashf Foundation to cater to the immediate needs of clients seeking relatively small loan amounts for various purposes.

With its simplicity and ease of access, KEL is designed to make financial assistance readily available, offering a loan amount of PKR 15,000 to eligible borrowers.

Key Features and Specifications:

1. Loan Term: The Kashf Easy Loan comes with a one-year loan term, allowing borrowers a reasonable timeframe to repay the loan amount.

2. Monthly Installments: Borrowers are required to make 12 monthly installments, ensuring a manageable and structured approach to loan repayment.

3. Loan Amount: KEL provides a fixed loan amount of PKR 15,000, making it ideal for clients with modest financial requirements.

4. Insurance: This loan product also includes a life insurance component, providing additional security and peace of mind for borrowers and their families.

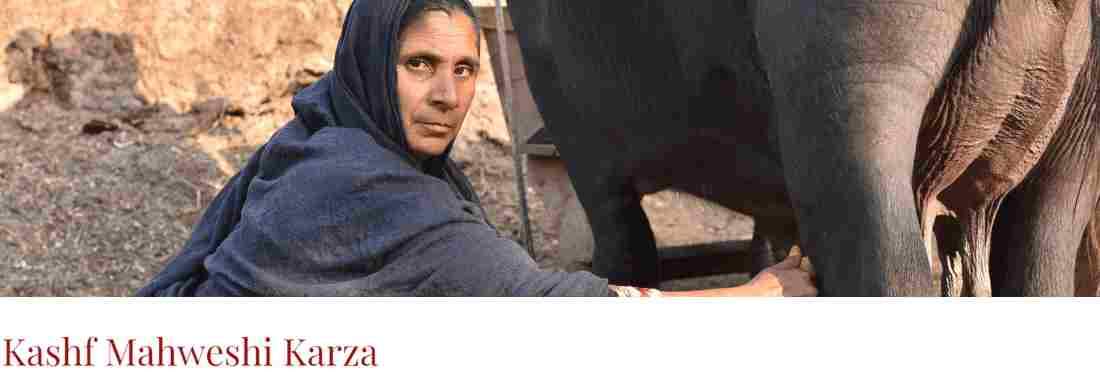

Kashf Mahweshi Karza

Introduced in 2017, the Kashf Mahweshi Karza is a pioneering initiative by the Kashf Foundation aimed at addressing the unique financial challenges faced by female livestock managers engaged in dairy and meat production.

This specialized loan product was conceived to provide much-needed credit support to empower women involved in the livestock sector, who often grapple with credit constraints.

Key Features and Specifications:

1. Purpose: The Kashf Mahweshi Karza is tailored to support two specific sectors within livestock management – dairy and meat production. Borrowers can choose between two options for each sector, with varying loan amounts and terms.

- Dairy: Borrowers can opt for either Option 1 (PKR 30,000 to 100,000) or Option 2 (PKR 100,001 to 150,000) to finance livestock animal purchases.

- Meat: Similar to dairy, borrowers have the choice between Option 1 (PKR 30,000 to 100,000) or Option 2 (PKR 100,001 to 150,000) to support livestock animal purchases.

2. Loan Terms: The Kashf Mahweshi Karza offers flexible loan terms to align with the specific needs of borrowers:

- Dairy: Option 1 has a 12-month term, while Option 2 extends to 18 months.

- Meat: The options for meat production vary from 6 months (Option 1), 12 months (Option 2), to 12 months with two bullet payments (Option 3).

3. Repayment: Borrowers are offered varying repayment structures based on their chosen option. For dairy, equal monthly installments of capital and interest payments are applicable.

4. Insurance: The Kashf Mahweshi Karza includes life insurance coverage for borrowers.

5. Training: This educational component aims to enhance the knowledge and skills of female livestock managers, empowering them to make informed decisions and manage their businesses effectively.

Recommended Reading: Top 10 Animal Welfare Organizations In Lahore (Helpline+Address)

Kashf Marhabah Product Scheme

Kashf Marhabah is a specialized financial product meticulously crafted to cater to the unique requirements of clients in the Khyber Pakhtunkhwa (KPK) province.

This product emerged in response to market research conducted by the Kashf Foundation, which identified a pronounced demand for microfinance in the region.

Key Features and Specifications:

1. Term: The Kashf Marhabah product operates with a fixed one-year term, providing borrowers with a clear timeframe for the lease arrangement.

2. Installments: Borrowers are required to make 12 monthly lease payments, ensuring a structured and manageable approach to repayment.

3. Loan Amount: Kashf Marhabah offers an initial loan amount of PKR 35,000 for the first loan cycle. Clients who establish a successful repayment history may access an upper limit of PKR 75,000 in subsequent loan cycles, allowing them to expand their financial resources as their needs evolve.

4. Documentation Charges: To initiate the process, borrowers are required to pay a documentation fee of PKR 400.

Kashf Sahulat Karza

Kashf Sahulat Karza is a valuable financial product offered exclusively to existing clients of the Kashf Foundation.

This loan is designed to provide a convenient cash inflow solution to address unforeseen emergency expenses or urgent needs that may arise during the client’s ongoing loan tenure with Kashf.

Key Features and Specifications:

1. Term: The Kashf Sahulat Karza comes with a fixed term of six months, providing clients with a manageable timeframe to repay the loan.

2. Installments: Borrowers are required to make six monthly installments, ensuring a structured and convenient repayment schedule.

3. Loan Amount: This loan product offers a fixed loan amount of PKR 5,000. While it may seem modest in comparison to other loans, it serves a critical purpose by offering immediate financial relief during emergencies.

4. Documentation: To further facilitate access to this essential financial support, there is no processing fee involved. This eliminates any additional financial burden for clients in urgent need.

5. Insurance: Unlike some other loan products, the Kashf Sahulat Karza does not include insurance provisions. It focuses solely on providing swift financial assistance without additional insurance costs.

Recommended Reading: International NGOs In Islamabad (100+) [Country-Wise]

Kashf Foundation Loan Application Process

The Kashf Foundation loan application process is a streamlined and accessible journey designed to help individuals access the financial support they need for various purposes.

Here is a step-by-step breakdown of the Kashf Foundation Loan process:

- Find Your Nearest Kashf Center: To begin the application process, individuals are encouraged to locate their nearest Kashf Center.

- Visit The Kashf Center: Once the nearest Kashf Center is identified, applicants visit the center to initiate their loan application.

- Attend the Session: Kashf Foundation often conducts informational sessions to educate applicants about the available loan products, their features, and the application requirements.

- Receive Form and Fill Form: After attending the session, applicants receive the Kashf Foundation Loan application form.

- Provide Required Documents: Along with the completed form, applicants must submit the necessary documentation, which may include proof of identity, income, residence, and any other documents specific to the chosen loan product.

- Interview: The Kashf Foundation Loan Scheme may interview with the applicant to assess their financial situation and understand their repayment capacity.

- Loan Approval: Following the interview and document verification process, the Kashf Foundation reviews the application and decides on loan approval.

- Loan Repayment: Regular monthly installments or other repayment arrangements must be followed to ensure the successful repayment of the loan.

Kashf Foundation Loan Scheme Pros And Cons

Kashf Foundation Loan Scheme Pros

The Kashf Foundation Loan Scheme offers several significant advantages that contribute to its positive impact on individuals and communities in need. Here are the key pros of this Kashf Foundation Loan scheme:

- Interest-Free Loan: One of the most notable advantages of the Kashf Foundation Loan Scheme is that it provides interest-free loans.

- Support for Poor Families: The Kashf Foundation Loan scheme plays a pivotal role in assisting poor families in their journey toward economic stability.

- Loan for Income Generation: Kashf Foundation Loans are not just for consumption; they are primarily intended to support income-generating activities.

- Easy Approval Process: Kashf Foundation Loan simplifies the loan approval process, making it more accessible to clients.

- Easy Repayment System: The Kashf Foundation Loan scheme incorporates an easy repayment system, often structured with manageable monthly installments.

- Financial Inclusion: The Kashf Foundation Loan Scheme promotes financial inclusion by extending credit to marginalized and underserved populations who may have limited access to traditional banking services.

- Empowering Women: The foundation has a strong focus on women’s economic empowerment, recognizing that women often play a central role in family finances.

- Community Development: As borrowers succeed in their businesses and repay their loans, the Kashf Foundation Loan Scheme fosters economic growth at the community level.

- Interest-Free Insurance: Some Kashf Foundation loan products include insurance coverage, providing borrowers with a safety net in case of unforeseen circumstances, without additional interest costs.

Kashf Foundation Loan Scheme Cons

While the Kashf Foundation Loan Scheme offers several advantages, it also has certain limitations and drawbacks to consider:

- Limited Amount: One of the primary cons of the Kashf Foundation Loan Scheme is the limitation on the loan amount.

- Small Business Amount: The loan amounts offered by the Kashf Foundation may be too small for individuals with ambitious entrepreneurial aspirations or those seeking to expand their existing businesses significantly.

- Some Charges: While the foundation strives to keep costs low, there may still be some charges associated with the loan application process or specific loan products.

- Geographical Limitation: The Kashf Foundation Loan primarily operates in specific regions of Pakistan.

Recommended Reading: NGO Contact Number In Pakistan (500+) [Helpline+Address]

Kashf Foundation Contact Number

Phone: +92-42-111-981-981

Email: info@kashf.org

Address: 1 C Shahrah Nazaria-e-Pakistan, Lahore, Pakistan

Kashf Foundation Loan | FAQs

What is the Kashf Foundation?

Kashf Foundation is a microfinance organization in Pakistan that provides financial services, including interest-free loans, to low-income individuals and micro-entrepreneurs to help them improve their financial well-being.

Who is eligible to apply for a Kashf Foundation Loan?

Eligibility criteria may vary depending on the specific loan product, but typically, low-income individuals and micro-entrepreneurs in Pakistan are eligible to apply for Kashf Foundation loans.

What can I use a Kashf Foundation Loan for?

Kashf Foundation Loan can be used for various purposes, including starting or expanding a small business, education expenses, healthcare costs, home improvement, and other income-generating or essential needs.

What is the Kashf Easy Loan scheme?

The Kashf Easy Loan is designed to meet the immediate financial needs of clients requiring small loan amounts for any purpose.

How much loan can I get through the Kashf Easy Loan scheme?

Applicants can access loans of up to PKR 15,000 through the Kashf Easy Loan scheme.

What is the loan term for Kashf Easy Loan?

The loan term for Kashf Easy Loan is typically one year (12 months).

What is the Kashf Karobar Karza scheme?

Kashf Karobar Karza is a loan product aimed at supporting small businesses and micro-entrepreneurs in their business endeavors.

The loan amount may vary, but it can go up to PKR 100,000 in the first loan cycle.

The loan term for Kashf Karobar Karza varies, typically between 12 to 18 months, depending on the specific product.

What is the Kashf School Sarmaya scheme?

Kashf School Sarmaya is a credit facility designed to support low-cost private schools and provide training to teachers and school management personnel.

Schools can access loans ranging from PKR 60,000 to PKR 150,000, depending on the specific loan option.

The loan term for Kashf School Sarmaya varies, with options ranging from 12 to 18 months.

How much loan can female livestock managers access through Kashf Mahweshi Karza?

Loan amounts can range from PKR 30,000 to PKR 150,000, depending on the specific purpose and loan option. The loan term for Kashf Mahweshi Karza varies, with options ranging from 6 to 18 months.

How much loan can I get through the Kashf Marhaba Loan scheme?

The loan amount can go up to PKR 75,000 for the first loan cycle and may vary for subsequent cycles. The loan term for the Kashf Marhaba Loan is typically one year.

What is the Kashf Sahulat Karza scheme?

Kashf Sahulat Karza provides existing clients with quick access to cash for emergency expenses or needs.

The loan amount for Kashf Sahulat Karza is typically PKR 5,000.

The loan term for Kashf Sahulat Karza is six months.

What types of loans does the Kashf Foundation offer?

Kashf Foundation offers various interest-free loan schemes, including Kashf Easy Loan, Kashf Karobar Karza, Kashf School Sarmaya, Kashf Mahweshi Karza, Kashf Marhaba Loan, and Kashf Sahulat Karza. like Kashf School Sarmaya Loan Scheme supports low-cost private schools, offering flexible loan terms, documentation charges, insurance charges, and training fees.

What is the Kashf Marhabah Product Scheme?

Kashf Marhabah is a financial product designed for clients in the Khyber Pakhtunkhwa (KPK) province, offering a fixed one-year term, monthly installments, and a loan amount ranging from PKR 35,000 to 75,000.

What are the limitations of the Kashf Foundation Loan Scheme?

Limitations include a capped loan amount, amounts may be small for ambitious businesses, some associated charges, and geographical limitations as the foundation primarily operates in specific regions of Pakistan.

What is the loan term for Kashf Foundation loans?

The loan term varies depending on the loan scheme. For instance, Kashf Easy Loan operates on a one-year term, while Kashf School Sarmaya offers flexible terms ranging from 12 to 18 months.

Is there an age limit for applicants seeking Kashf Foundation Loans?

Yes, there is an age limit for clients and their nominees. The age range typically falls between 18 to 63 years and 5 months for an 18-month loan tenure or 18 to 63 years and 11 months for a 12-month loan tenure.

What is the documentation fee for Kashf Foundation Loans?

The documentation fee for Kashf Foundation Loans varies depending on the scheme. For instance, Kashf Easy Loan requires a documentation fee of PKR 250, while Kashf School Sarmaya has a one-time documentation fee of PKR 500.

Recommended Reading: Top 10 International NGOs In Pakistan [Helpline+Address]

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment