SECP has just updated the list of top online loan apps in Pakistan for 2026 and onwards, that are authorized for digital lending services in Pakistan.

These loan apps provide applicants with urgent online loans of Rs. 20,000 to Rs. 100,000 (or more for repeated users), using their mobile phones 24/7 from anywhere in Pakistan.

Among the list of Best Loan Apps for 2026, SECP has included the following nano lending apps:

In this article, we will explore key details about these online loan apps, like maximum loan amounts, terms & conditions, and application process in a brief. Let’s get started!

(Note: Some of these online loan apps may collect your key details like payment info and contact details etc. and share this information with third-party ventures. Moreover, some of these applications include high interest rates especially, for long-term lending. So, before getting any lending services from any of these online loan apps you are highly recommended to read their terms and conditions especially, repayment terms. Also, use any of these nano loan apps in situations of most emergency cases to avoid any sort of additional financial burden.)

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

Best Online Loan Apps In Pakistan | Fori Loan Apps In Pakistan

Table Of Contents

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

What Are Nano Loan Apps And How They Work?

List Of Loan Apps Approved By SECP (Whitelisted Apps)

Here is the list of online loan apps that are verified by SECP:

- Barwaqt Loan App

- Paisayaar Loan App

- Abhi- Your Salary Now! Loan App

- Zoodpay Loan App

- Muawin Loan App

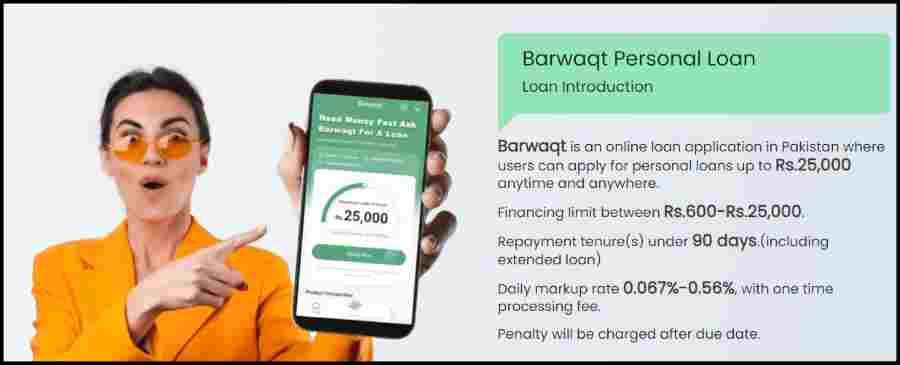

Barwaqt Loan App

Barwaqt is an online loan app in Pakistan where you can get a personal loan online, up to Rs.25,000. You can get this loan from anywhere and at any time. It’s easy and quick, you just fill out a simple application. This loan app is verified by SECP Pakistan.

Recommended Reading: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

Barwaqt Loan Amount

Barwaqt is a service that offers loans in Pakistan, and they provide a range of loan amounts starting from Rs.600, up to Rs.25,000.

Barwaqt Loan Interest Rate

Barwaqt charges a daily interest rate between 0.067% and 0.56% and a one-time processing fee. It’s important to note that penalties will be imposed if the payment is made after the due date.

Barwaqt Loan Eligibility Criteria+Loan Duration

Eligibility Criteria:

- Age: Applicants aged between 18 and 60 years old are eligible.

- Citizenship: Applicants must be Pakistani citizens.

- Monthly Income: Eligibility is determined by considering the applicant’s monthly income.

Loan Duration:

You need to pay back the loan within 90 days, including any extended periods if applicable.

Recommended Reading: Top 7 Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

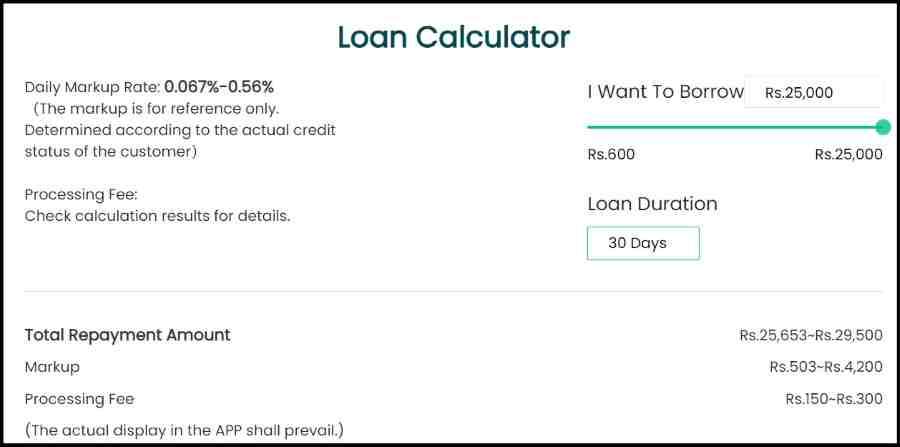

Barwaqt Loan Amount Calculator

If you get a loan of Rs.25,000 from Barwaqt, you’ll need to pay back:

Total Repayment:

- Markup: Between Rs.503-Rs.4,200

- Processing Fee: Between Rs.150-Rs.300

- Total Repayment Amount: Between Rs.25,653-Rs.29,500

Contact Details Of Barwaqt

Location: LDA Community Centre, near the Barkat Market Passport Office in Lahore.

Email: you can email us at cs@seedcredfintec.com.

Phone: call at 021-36495000 or 021-36494000.

Recommended Reading: Top 3 Loan Apps In Pakistan (50K-100K Urgent Cash Loan)

Paisayaar

Paisayaar is an online loan app in Pakistan where you can easily apply for a loan ranging from Rs.1000 to Rs.25,000. You can get this loan anytime and from anywhere. This loan app is verified by SECP.

Loan Amount

You can get loans through the Paisayaar app ranging from 1,000 and 25,000. This loan amount is not Interest-free. Paisayaar charge on this loan.

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

Interest Rate+Overdue Charges

The interest you pay on the loan every day can be between 0% and 0.6%. If you’re late in repaying the loan, additional daily charges may apply, ranging from 0% to 2.2%. It’s important to pay on time to avoid these extra fees.

Loan Duration

The loan Duration of the Paisayaar loan is 90 days or 3 Months.

Paisayaar Loan Calculator

If you get a loan of Rs. 25,000 from the Paisa Yaar app for 90 days, you’ll need to pay an extra amount of around Rs.13,500 as interest. The total amount you have to pay is Pkr.38,500.

If you don’t pay back the loan on time, you’ll be charged an additional 2% to 2.5% interest on the total loan amount every day.

Recommended Reading: Fori Loan In Pakistan (20K-2Lakh) | Emergency Cash Loan In Pakistan

Contact Details Of Paisayaar

How To Contact Us:

Email: support@paisayaar.pk

Address: Fortune Residency, Ground Floor, Street no. 26, National Police Foundation, E11/4, Islamabad.

Phone:

- 051-111-883-883 (Service Hotline)

- 051-884-127-0 (Service Hotline)

- 03088888260 Grievance Redressal Officer

Abhi- Your Salary Now!

Abhi Your Salary Now is a loan app, you can get loans from 1,000 to 30,000 rupees. It’s good to know that this loan app is verified by SECP.

Loan Amount

Abhi- Your Salary Now app gives loans ranging from Pkr. 1000 to Pkr. 30,000. This loan amount is not Interest-Free. This loan app is verified by SECP. So, you can get a loan easily from this app.

Interest Rate

Abhi – Your Salary Now! Secure a microloan ranging from 1,000 to 30,000 rupees. Enjoy daily interest rates as low as 0% and up to 0.6%.

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

Loan Duration

With Abhi – Your Salary Now, you have a repayment period of 90 days for the loan duration.

Contact Details Of Abhi Your Salary Now!

Here are the Contact details of Abhi Your Salary Now App:

Address: 505A, 5th Floor Fortune Towers, Shahrah-e-Faisal, Karachi Office # 5, Floor 6, Askari Corporate Tower, Lahore.

Email: connect@abhi.com.pk.

Phone: +92 304 111 5276.

Zoodpay

Zoodpay is an international loan app available in various countries, including Pakistan. They offer ZoodPay Credit, a payment solution where you can pay back a loan in 6 or 12 equal installments with interest.

The highest amount you can get a loan is $1,500 in your country’s currency. Operating in places like Uzbekistan, Lebanon, and Pakistan, ZoodPay aims to assist over 300 million individuals and 5 million SMEs. ZoodPay makes it easy for you to shop online or in stores and pay in 4, 6, or 12 installments.

Loan Amount

Zoodpay is an online loan app in Pakistan. You can get loan amounts ranging from $15-$1,500 or the same amount in your local money. This loan app is verified by SECP. So, you can get a loan easily from this app.

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | 30K Advance Salary Loan

Interest Rate

The interest rate on ZoodPay is 3.5% of the total loan amount every month.

Loan Duration

With ZoodPay, you have the flexibility to repay your loan in 4, 6, or 12 installments!

Eligibility Criteria

To qualify for ZoodPay:

- Be at least 18 years old.

- Hold an eligible debit/credit card with a valid expiry date of at least 3 months.

- ZoodPay will verify your eligibility through a credit reference agency for quick approval.

- Your order should be within the range of 15 USD to 1,500 USD.

ZoodPay Contact Details

Email: compliance@zoodpay.com

Phone Number: 042-111-839-839

Address: 1st Floor, Plot No. 8 & 9, Mai Kolachi Bypass, Intelligence Colony, Karachi

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

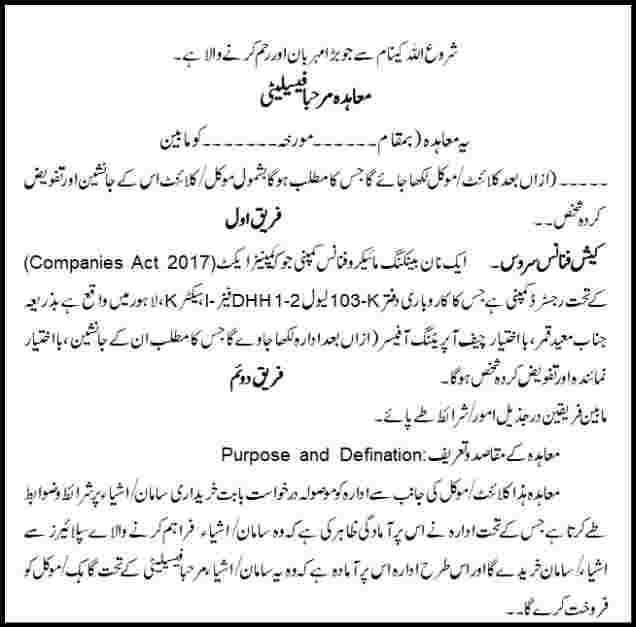

Muawin

Muawin offers business loans in Pakistan through a best option called “buy now pay later.” They have stores where you can get assets for your business on loan.

This means you can get what you need for your business now and pay back the loan later. This app is verified by SECP.

Loan Amount

Muawin provides business loans in Pakistan, typically ranging from 20,000 to 100,000 and more. The loan amount depends on the specific needs of the applicant’s business.

Muawin Agreement Form

You can also download this Muawin Agreement Form by Clicking here https://uploads-ssl.webflow.com/62024c64cb8c0b59d8fa7067/643443c19e5887aa7822c0bd_Urdu%20Murabaha.pdf.

Muawin Contact Details

Address: 103-K, DHA Phase 1-C, Lahore, Pakistan

Call: +92 304 1110494

WhatsApp: +92 301 0544713

Email: contact@muawin.com

Benefits Of Online Loan Apps In Pakistan

Benefits of Online Loan Apps in Pakistan:

- Get a Loan Through App: Applying for a loan is easy through the app. You can just download the app, sign up, and then apply for a loan.

- Loan Get Online: You can just get a loan online through online these apps.

- Urgent Loan: Get approval for your loan in just 5 minutes, providing you with an immediate loan for your needs.

- Get a loan at Home: Applying for a loan directly from your home. These loans offer a very easy application process.

- Generous Loan Limit: Online loan apps often offer loan limits, allowing you to get a loan of up to 100,000.

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | 30K Advance Salary Loan

FAQs | Online Loan Apps In Pakistan

What are Online Loan Apps In Pakistan?

Online Loan Apps In Pakistan are those apps where you can get loans easily through online mobile apps. You can get this loan anywhere anytime etc.

List of top SECP verified Online Loan Apps In Pakistan?

Top SECP verified Online Loan Apps In Pakistan:

Barwaqt

Paisayaar

Abhi- Your Salary Now!

Zoodpay

Muawin

What is the maximum loan amount get from Barwaqt, and provide information about the interest rates and repayment duration?

What is the maximum loan amount available from Barwaqt online loan apps, and could you provide information about the interest rates and repayment duration:

Loan Amount: Barwaqt offers loans ranging from Rs.600 to Rs.25,000.

Repayment Tenure: The repayment tenure is under 90 days, including extended loans.

Interest Rate: The daily markup rate varies from 0.067% to 0.56%.

What is the maximum loan amount get from Paisayaar online loan apps, and provide information about the interest rates and repayment duration?

Paisayaar Loan amount + Loan Duration + Repayment Duration:

Loan Amount: You can get loans from Paisayaar ranging from Rs.1000 to Rs.25,000.

Repayment Tenure: The loan Duration of the Paisayaar loan is 90 days or 3 Months.

Interest Rate: The interest you pay on the loan every day can be between 0% and 0.6%. If you’re late in repaying the loan, additional daily charges may apply, ranging from 0% to 2.2%. It’s important to pay on time to avoid these extra fees.

What is the maximum loan amount get from Abhi Your salary Now?

The maximum loan amount gets from Abhi Your salary Now online loan apps:

Loan Amount: Microloans are available from Rs.1,000 to Rs.30,000.

Repayment Tenure: The repayment period is up to 90 days.

Interest Rate: Abhi – Your Salary Now! Secure a microloan ranging from 1,000 to 30,000 rupees. Enjoy daily interest rates as low as 0% and up to 0.6%.

What is the maximum loan amount you get from ZoodPay?

The maximum loan amount you get from ZoodPay:

Loan Amount: Zoodpay is an online loan app in Pakistan. Where you can get loan amounts ranging from $15-$1,500 or the same amount in your local money.

Repayment Tenure: The repayment period is mentioned as 6 or 12 equal installments.

Interest Rate: ZoodPay interest rate is 3.5% of the total loan amount per month.

What is the maximum loan amount you get from Muawin?

The maximum loan amount you get from Muawin online loan apps:

Loan Amount: Muawin is an online loan app that provides business loans in Pakistan, typically ranging from 20,000 to 100,000 or more. The loan amount depends on the specific needs of the applicant’s business.

Repayment Tenure: The specific repayment tenure is not provided. But usually, it is a 6-12 month duration.

What types of loans are typically offered by online loan apps?

Online loan apps commonly provide various types of loans, including personal loans, microloans, and business loans, according to financial needs.

What are the eligibility criteria required for online loan apps?

Eligibility criteria required for online loan apps:

Age: Applicants aged between 18 and 60 years old are eligible.

Citizenship: Applicants must be Pakistani citizens.

Monthly Income: Eligibility is determined by considering the applicant’s monthly income.

What happens if I miss the repayment date?

Different Penalty charges for these apps:

Like Paisayaar Loan App: If you don’t pay back the loan on time, you’ll be charged an additional 2% to 2.5% interest on the total loan amount every day.

Can I download agreement forms for these loan apps?

Yes, you can download agreement forms for Muawin by visiting their website or following the provided link. Other apps may have similar processes for accessing agreement forms

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment