Introducing Meezan Bank’s remarkable solar panel on installment scheme, a Shariah-compliant initiative that brings the promise of sustainable and eco-friendly energy solutions to the forefront.

Getting Solar Panel On Installment empowers individuals and businesses alike, through a net metering system, individuals not only reduce their electricity bills but also can sell excess electricity back to the national grid.

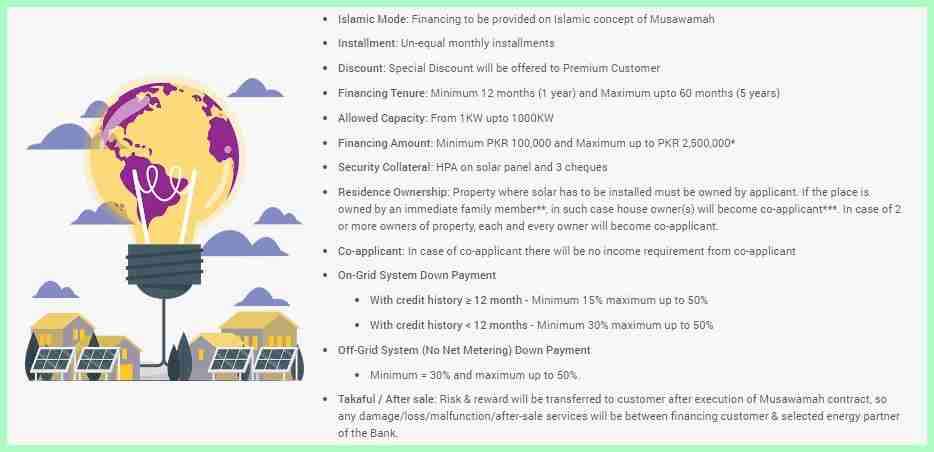

Key details of this scheme of Solar Panel On Installments include:

Financing Limit= PKR 100,000-PKR2,500,000 (25 Lakh)

Solar Installation Capacity= 1KW-1000KW

Tenure of Financing= 12 Months (1 year)-60 Months (5 years)

Financing Model= Shariah Complaint (Musawamah).

Key details of the Meezan Bank Solar Panel On Installment Scheme are given in the following image:

Now, let’s explore eligibility, requirements for this scheme, and the step-by-step process for getting Solar Panel On Installment by Meezan Bank (Interest-free). So, let’s start our guide!

Recommended Reading: Personal Loan For Overseas Pakistani | Loan For Overseas Pakistani Online Apply

Solar Panel On Installment Meezan Bank | Meezan Bank Solar Financing

Table of Contents

- Solar Panel On Installment Meezan Bank | Meezan Bank Solar Financing

- Meezan Bank Solar Financing | Solar Panel On Installment

- Eligibility Criteria

- Documents Required To Get Interest-Free Loan For Solar Panels

- How To Apply For Solar Panel On Installment By Meezan Bank

- Step 1: Visit the Meezan Bank Branch or Contact the Helpline

- Step 2: Obtain a Quotation from a Registered Meezan Solar Energy Partner

- Step 3: Obtain and Fill Application Form

- Step 4: Submit the Application Form Along with the Necessary Documents

- Step 5: Wait for Approval

- Step 6: Account Opening (if applicable)

- Step 7: Financing and Solar Panel Installation

- Step 8: Repayment

- Meezan Bank Solar Financing Calculator

- Solar Panel On Installment | FAQs

Recommended Reading: List Of Top 10 Insurance Companies In Pakistan {Secure+Certified}

Meezan Bank Solar Financing | Solar Panel On Installment

Meezan Solar provides comprehensive financing solutions for complete home solar panel systems.

By opting for their interest-free solar financing, homeowners can potentially reduce their monthly electricity bills by up to 50%.

Meezan Solar caters to a wide range of capacity needs, offering systems from 1KW to an impressive 1000KW, with interest-free loans available for solar panel installations ranging from 1 Lakh to 25 Lakh PKR.

Moreover, through net metering, surplus power generated by solar energy can be fed back into the national electricity grid, contributing to a more environmentally friendly energy landscape.

Meezan Bank offers flexible payment options, competitive pricing, and expert guidance, making the transition to solar power a seamless and financially sound choice for homeowners.

Recommended Reading: Loan For Overseas Pakistani Online Apply

Eligibility Criteria

Solar Panel On Installment: To be eligible for Meezan Bank’s Solar Panel On Installment scheme, applicants must meet certain criteria. Firstly, applicants should be permanent residents of Pakistan and CNIC holders.

The primary applicant’s age should fall within the range of 20 to 60 years, while the co-applicants age should not exceed 75 years.

Moreover, the minimum monthly gross salary of the primary applicant should be at least PKR 100,000, while contractual employees with five years of experience need to have a monthly gross salary of PKR 200,000.

Businessmen applicants are required to have a monthly gross income of PKR 500,000, and pensioners should receive a monthly gross pension of at least PKR 100,000.

Being an active taxpayer with a valid National Tax Number (NTN) is also essential for eligibility. Lastly, the applicant must provide two guarantees with valid ID cards and clean financial records.

Recommended Reading: Paypal Stripe To Launch In Pakistan Soon | Paypal Stripe In Pakistan As Soon

Documents Required To Get Interest-Free Loan For Solar Panels

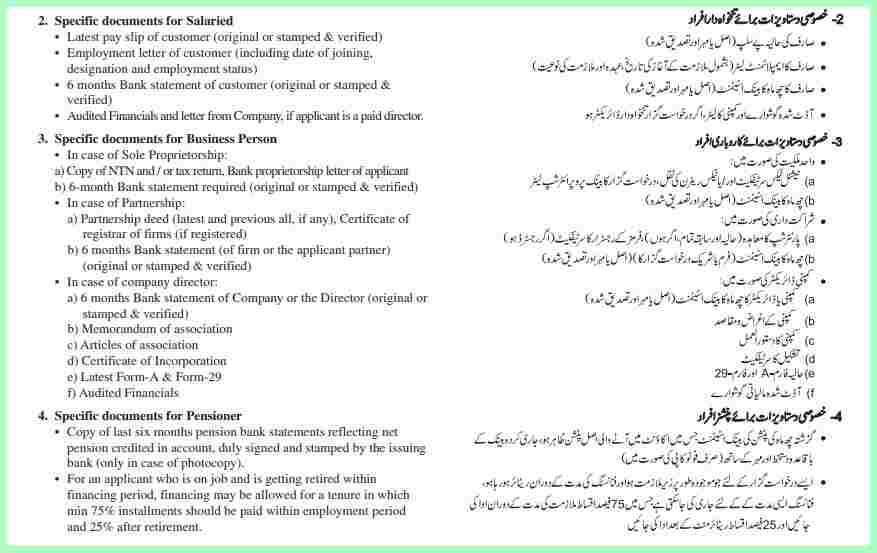

- To apply for Meezan Bank’s interest-free loan for solar panels to get Solar Panel On Installment, applicants need to provide specific documents for verification and processing purposes.

- Firstly, two sets of ID card copies for the primary applicant, co-applicant, and guarantors are required to verify their identity.

- Proof of tax returns with a valid National Tax Number (NTN) is essential to demonstrate the applicant’s tax-paying status and financial credibility.

- Income or salary slips and bank statements for the last six months are necessary to validate the applicant’s income and assess their repayment capacity.

- Residency ownership documents are also required to confirm the ownership of the applicant’s residence and ensure that they are permanent residents.

- Additionally, having a bank account in Meezan Bank is mandatory for the application process.

- After the sale, providing proof of Takaful (Islamic insurance) coverage is required to ensure the financed solar panel system’s protection and the applicant’s peace of mind.

Recommended Reading: 3 Penny Cryptos That Will Make You Rich In 2024 | Penny Cryptos That Will Explode

How To Apply For Solar Panel On Installment By Meezan Bank

Solar Panel On Installment: If you are interested in availing of Meezan Bank’s Solar Panel On Installment scheme, you can follow a straightforward application process outlined below:

Step 1: Visit the Meezan Bank Branch or Contact the Helpline

- You can begin the application process by either visiting your nearest Meezan Bank branch in person or reaching out to their helpline at 111-331-331 or 111-331-332. The bank representatives will guide you through the initial steps and provide relevant information.

Step 2: Obtain a Quotation from a Registered Meezan Solar Energy Partner

- Obtain a detailed quotation for the solar panels from a registered Meezan Solar Energy Partner. This quotation will outline the cost and specifications of the solar panel system you wish to install.

Recommended Reading: Personal Loan For Overseas Pakistani | Loan For Overseas Pakistani Online Apply

Step 3: Obtain and Fill Application Form

- Obtain the application form either from the Meezan Bank branch or their website. Duly fill the form with accurate information, ensuring that all details are correctly provided.

Step 4: Submit the Application Form Along with the Necessary Documents

- Attach all the required documents along with the filled application form. The bank will require these documents for verification and processing purposes. The necessary documents include two sets of ID card copies for the applicant, co-applicant, and guarantors, proof of tax returns with NTN number, income/salary slips and bank statements for the last 6 months, residency ownership documents, and proof of bank account in Meezan Bank.

Step 5: Wait for Approval

- Once your application and documents are submitted, the bank will review and process your request.

Step 6: Account Opening (if applicable)

- If you currently do not have an account with Meezan Bank, the bank will open an account for you to facilitate the financing process.

Step 7: Financing and Solar Panel Installation

- Upon approval, the bank will provide you with the financing to proceed with the solar panel installation. You can then work with the registered Meezan Solar Energy Partner to install the solar panels as per the approved quotation.

Step 8: Repayment

- After the installation is complete, you will be required to make regular monthly installments as per the agreed-upon financing terms until the loan is fully repaid.

Recommended Reading: List Of Top 10 Insurance Companies In Pakistan {Secure+Certified}

Meezan Bank Solar Financing Calculator

Solar Panel On Installment: The Meezan Bank Solar Financing Calculator is a powerful tool that allows individuals to estimate their installment plan and repayment terms for solar panel financing.

By visiting the link provided, which is https://www.meezanbank.com/solar-panel-calculator/, users can easily access the calculator and input the following details:

- Financing Amount: Users can enter the amount they wish to finance for their solar panel installation. This could be within the range of 1 Lakh to 25 Lakh, as per the eligibility criteria.

- Down Payment: Users can specify the down payment they are willing to make towards solar panel financing. The down payment amount may vary depending on the applicant’s status and the nature of the program.

- Tenure: Users can select the preferred tenure for repaying the solar panel financing. The tenure can be extended up to a maximum 5-year term, offering flexibility in the repayment plan.

Recommended Reading: 3 Penny Cryptos That Will Make You Rich In 2024 | Penny Cryptos That Will Explode

Solar Panel On Installment | FAQs

What is the maximum amount of Interest-Free Loan For Solar Panels in Pakistan?

The maximum financing limit For Solar Panels in Pakistan is about PKR 2,500,000 (25 Lakhs) by Meezan Bank (interest-free)

How can I apply for Meezan Bank’s Solar Panel On Installment scheme?

To apply for the Solar Panel On Installment, you have two options: you can visit your nearest Meezan Bank branch in person or call their helpline at 111-331-331 or 111-331-332.

What documents are required to apply for the Solar Panel On Installment?

To apply, you need to provide two sets of ID card copies for the applicant, co-applicant, and guarantors. You also need to submit proof of tax returns with a valid NTN number, income/salary slips, and bank statements for the last six months.

Can I choose the financing limit and tenure for repayment?

Yes, you can select the financing limit based on your requirements, which ranges from 1 Lakh to 25 Lakh. The tenure for repayment is flexible and can be extended up to a maximum 5-year term.

Is the scheme available for businesses and pensioners as well?

Yes, the Solar Panel On Installment scheme is available for both individuals and businesses, including salary persons, businessmen, and pensioners.

Can I sell excess electricity back to the national grid with this scheme?

Yes, the scheme allows participants to sell excess electricity back to the national grid through a net metering system, providing an opportunity for energy conservation and cost savings.

What is the down payment requirement?

The down payment ranges from 15% to 50%, depending on the applicant’s status and the nature of the program.

How long does the approval process take?

The approval or rejection of the application usually takes place within two weeks from the submission date.

Are there specific representatives for solar financing in different regions?

Yes, dedicated representatives for solar financing are available in various regions, including Karachi, Islamabad, and Lahore, to provide personalized assistance and guidance.

What is the solar installation capacity range covered by Meezan Bank’s Solar Panel On Installment scheme?

The scheme covers solar installation capacities ranging from 1KW to an impressive 1000KW.

What is the financing model used by Meezan Bank for the Solar Panel On Installment scheme?

Meezan Bank adopts a Shariah-compliant financing model known as Musawamah for the Solar Panel On Installment scheme.

What is the potential reduction in monthly electricity bills for homeowners opting for Meezan Bank’s interest-free solar financing?

Homeowners can potentially reduce their monthly electricity bills by up to 50% by choosing Meezan Bank’s interest-free solar financing.

What are the eligibility criteria for Meezan Bank’s Solar Panel On Installment scheme?

To be eligible, applicants must be permanent residents of Pakistan, aged between 20 to 60 years, with a minimum monthly gross salary ranging from PKR 100,000 to PKR 500,000 based on occupation.

What documents are required to apply for Meezan Bank’s interest-free loan for solar panels?

Required documents include ID card copies, proof of tax returns with NTN, income/salary slips, bank statements, residency ownership documents, and proof of a Meezan Bank account.

Is there a Solar Financing Calculator available for estimating installment plans?

Yes, Meezan Bank offers a Solar Financing Calculator on their website (https://www.meezanbank.com/solar-panel-calculator/) to help individuals estimate installment plans based on financing amount, down payment, and preferred tenure.

What are the main components of the Solar Financing Calculator, and what details can users input to customize their financing estimate?

The calculator allows users to input the financing amount (ranging from 1 Lakh to 25 Lakh), specify the down payment, and select the preferred tenure for repayment (up to 5 years).

Recommended Reading: Paypal Stripe To Launch In Pakistan Soon | Paypal Stripe In Pakistan As Soon

If you find the information in this article valuable, we would greatly appreciate it if you could take a moment to comment and share it with others. Your support helps us reach more people with important information.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment