Loan For Overseas Pakistani: As the world becomes more connected through globalization, more and more Pakistani entrepreneurs are looking for opportunities outside their home country.

Whether they want to further their education, explore business opportunities, or just create a better life in a foreign land, the dreams of overseas Pakistanis are varied and limitless.

Fortunately, there are various established methods for Loan Overseas Pakistanis to secure loans for personal or business needs, and many banks and organizations are willing to provide these loans for that purpose.

These Banks and Organizations give Loan For Overseas Pakistanis like:

- Meezan Bank Loan For Overseas Pakistani

- PM Loan Scheme For Overseas Pakistani

- Roshan Apna Ghar Scheme For Overseas

Recommended Reading: How To Get Solar Panel On Installment Meezan Bank {25 Lakh Loan}

Personal Loan For Overseas Pakistani | Online Loan For Overseas Pakistani

Table of Contents

- Personal Loan For Overseas Pakistani | Online Loan For Overseas Pakistani

Recommended Reading: Get Solar Panel On Installment {25 Lakh Loan}

Loan For Overseas Pakistani

If you’re living in another country and want to return to Pakistan but don’t have the funds to start your own business or build a home, some banks and organizations can assist you in achieving your goals.

They offer interest-free loans to support your future success.

These Loan For Overseas Pakistanis are completely interest-free and come with an easy repayment process, making it more accessible for you to realize your dreams of establishing your own business or owning a home in Pakistan.

Recommended Reading: List Of Top 10 Insurance Companies In Pakistan {Secure+Certified}

Meezan Bank Loan For Overseas Pakistani

Meezan Bank extends its support to Overseas Pakistanis through its dedicated loan program, the “Meezan Bank Housing Loan For Overseas Pakistani”.

Recognizing the distinct financial needs of those living abroad, Meezan Bank has tailored this loan solution to cater to their specific requirements.

The Meezan Bank Easy Home Scheme is a noteworthy offering, presenting a completely interest-free financing option for Overseas Pakistanis.

This loan enables you to turn your dreams of owning a home or starting a business into reality. Importantly, this scheme is available to both residents of Pakistan and Overseas Pakistanis, making it an inclusive and accessible opportunity.

Meezan Bank Loan for Overseas Pakistani Key Feature

- Invest directly from your Meezan Roshan Digital PKR account, with a fully digital and hassle-free processing experience.

- Enjoy the convenience of seamless currency conversion between foreign currencies (USD, EUR, & GBP) and PKR.

- Access maximum financing options with competitive pricing, including variable and five-year fixed rates*.

- Benefit from a low processing fee of just Rs. 4000 (excluding FED).

- Experience flexibility with the ability to make partial unit purchases without incurring early termination profit after the first year. A 1% extra profit applies for terminations within the first year.

- Opt for optional life Takaful coverage, which includes protection against death (due to any cause) and accidental/natural disability.

- Receive Property Takaful coverage for the financing amount at no additional cost.

- Qualify for financing under the State Bank of Pakistan’s Mera Pakistan Mera Ghar Housing Scheme, provided you meet the criteria for the respective tiers.

- Terms and conditions apply. Please refer to the Eligibility Criteria for further details.

Recommended Reading: Paypal Stripe To Launch In Pakistan Soon | Paypal Stripe In Pakistan As Soon

Meezan Bank Loan For Overseas Pakistani Eligibility Criteria

Eligibility Criteria for Meezan Bank loan for overseas Pakistani:

- Citizenship: Applicants must be Pakistani nationals, whether residents or non-residents, as per policy.

- Age:

- Primary applicant: Minimum age of 25 years and a maximum of 65* years at financing maturity.

- Co-applicant: Minimum age of 21 years and a maximum of 70* years at financing maturity.

- Customer/Applicant: Both primary (or single) and co-applicants are allowed, with the co-applicant required to be an immediate family member.

- Income:

- Salaried Individuals: Minimum Gross Income of PKR 40,000 per month. In the case of a spouse, 100% of their income may be clubbed.

- Self-Employed/Business Persons: Minimum Gross Income of PKR 75,000 per month.

- Employment Tenure:

- Salaried Individuals: Permanent job with a minimum of 2 years of continuous work history in the same industry/field.

- Self-Employed/Business Persons: A minimum of 3 years in the current business/industry.

Recommended Reading: 3 Penny Cryptos That Will Make You Rich In 2024 | Penny Cryptos That Will Explode

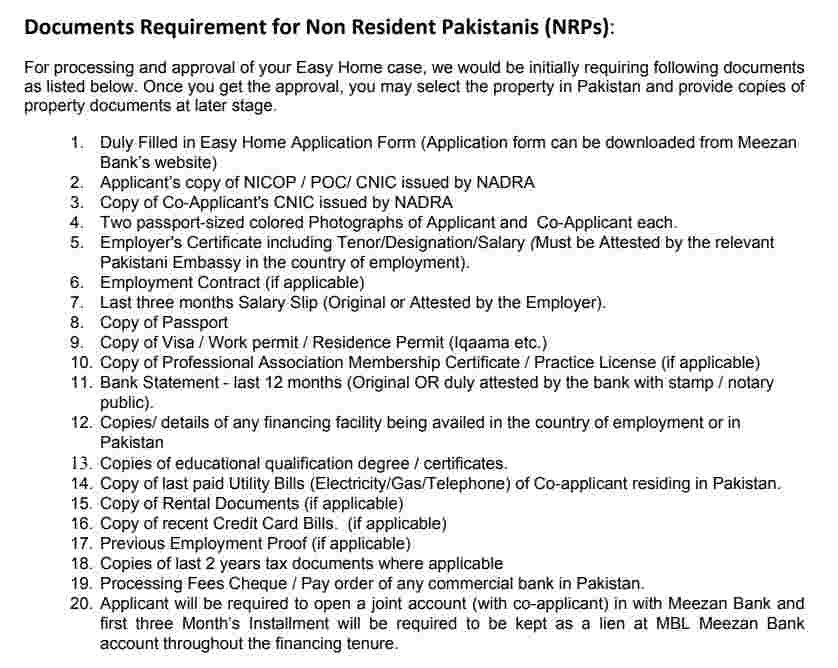

Meezan Bank Loan For Overseas Pakistani Documents Required

Documents Required for loan for overseas Pakistani (NRPs):

- Duly Filled Easy Home Application Form (You can download the application form from Meezan Bank’s website).

- Copy of the Applicant’s NICOP / POC / CNIC issued by NADRA.

- Copy of the Co-Applicant’s CNIC issued by NADRA.

- Two passport-sized colored photographs of both the Applicant and Co-Applicant.

- Employer’s Certificate, including Tenor/Designation/Salary (Must be attested by the relevant Pakistani Embassy in the country of employment).

- Employment Contract (if applicable).

- Original or Employer-attested last three months’ salary slips.

- Copy of Passport.

- Copy of Visa / Work permit / Residence Permit (e.g., Iqama).

- Copy of Professional Association Membership Certificate / Practice License (if applicable).

- Original bank statements for the last 12 months OR bank statements duly attested by the bank with a stamp/notary public.

- Copies or details of any financing facility being availed in the country of employment or in Pakistan.

- Copies of educational qualification degrees/certificates.

- Copy of the last paid Utility Bills (Electricity/Gas/Telephone) of the Co-Applicant residing in Pakistan.

- Copy of Rental Documents (if applicable).

- Copy of recent Credit Card Bills (if applicable).

- Proof of Previous Employment (if applicable).

- Copies of tax documents for the last 2 years where applicable.

- Processing Fees Cheque / Pay order from any commercial bank in Pakistan.

- The Applicant will be required to open a joint account (with the co-applicant) at Meezan Bank, and the first three months’ installments will need to be kept as a lien in the Meezan Bank account throughout the financing tenure.

How To Apply For Meezan Bank Home Loan Scheme

Application Process of Meezan Bank Home Loan For Overseas Pakistani For Both Pakistani and Overseas Pakistani:

- Begin by submitting a duly filled and signed application form to Meezan Bank. Ensure that you include the required processing fee and external agency costs in the form of a cheque.

- Attach all the necessary documents as per the provided checklist.

- Meezan Bank will conduct address verification for your residential and office locations.

- For salaried individuals, self-employed professionals, or businesspersons, Meezan Bank will perform essential credit assessments and due diligence based on the information you’ve provided.

- Meezan Bank will seek a legal opinion on the property documents you’ve submitted.

- An appointed valuation agency from Meezan Bank will evaluate the property to determine its market value.

- Once you’ve met all of Meezan Bank’s credit requirements, you will receive a conditional offer letter.

- Upon case approval, it’s necessary to open an account at Meezan Bank.

- After completing these steps and receiving approval for your case, you’ll be required to visit Meezan Bank for the signing of the Islamic House Finance Agreement and other relevant legal documents.

- A Meezan Bank officer and an authorized lawyer will accompany you and the property seller to the appropriate bank or registrar’s office (in case of BFT) for property transfer. The original property documents will be handed over to the lawyer who will, after verifying the documents, facilitate the pay-order transfer to the banker or seller and complete the necessary legal formalities on behalf of Meezan Bank.

Recommended Reading: List Of Top 10 Insurance Companies In Pakistan {Secure+Certified}

Roshan Apna Ghar Loan For Overseas Pakistani

Standard Chartered Bank also offers the Roshan Apna Ghar Loan For Overseas Pakistanis. In this program, the bank provides an interest-free loan for you to have your own home.

There are various established methods to obtain a loan for Overseas Pakistanis, making it accessible for those seeking financial support for their aspirations.

Recommended Reading: How To Get Solar Panel On Installment Meezan Bank {25 Lakh Loan}

Roshan Apna Ghar Scheme Featured

- No Processing Charges: You won’t incur any processing fees, making it a cost-effective choice.

- Fixed & Floating Financing Options: You have the flexibility to choose between fixed and floating financing rates, catering to your financial preferences and needs.

- Up to 50% Financing: You can access financing of up to 50% of the property’s value, providing substantial support for your property acquisition or investment.

- Home Finance Facility for Non-Resident Pakistanis with PKR RDA accounts.

- Co-borrowing Option: You can apply for the loan with a co-borrower, facilitating joint ownership.

- Income Clubbing: The option to combine incomes for enhanced eligibility.

- Financing Flexibility: Choose between lien-backed or non-lien-backed financing options.

- Islamic Mode: Offered by Islamic principles through the Diminishing Musharakah mode.

- Home Purchase: Access the opportunity to purchase a new home at competitive prices, making homeownership more attainable.

- Home Credit: Secure financing to enhance or extend your existing home, offering the flexibility to invest in improvements.

- Flexible Pricing: Choose between hybrid and floating pricing options that suit your financial preferences.

- Extended Tenor: Enjoy a financing tenor of up to 25 years, providing ample time to repay your home loan comfortably.

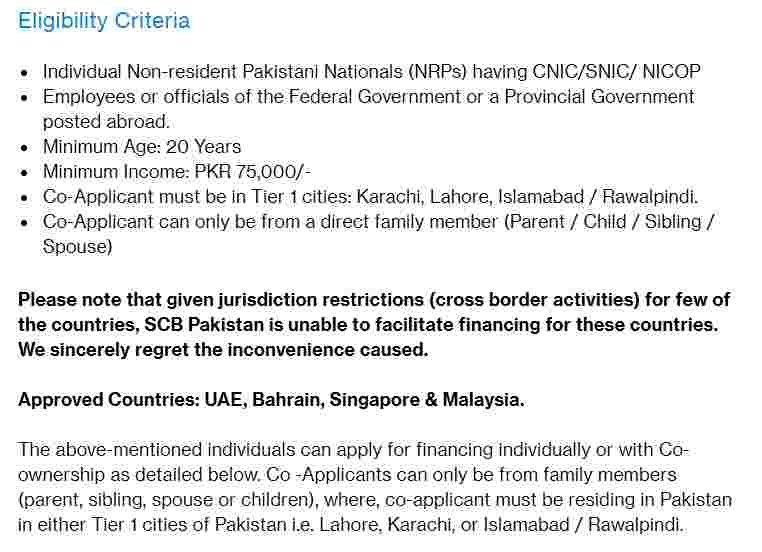

Roshan Apna Ghar Scheme Eligibility Criteria

Eligibility Requirements:

- Non-resident Pakistani Nationals (NRPs) with valid CNIC/SNIC/NICOP documentation.

- Federal or Provincial Government employees stationed overseas.

- Minimum age requirement: 20 years.

- Minimum monthly income: PKR 75,000/-

- Co-applicant must reside in Tier 1 cities: Karachi, Lahore, Islamabad / Rawalpindi.

- Co-applicant eligibility is limited to direct family members (Parent, Child, Sibling, or Spouse).

Recommended Reading: How To Get Solar Panel On Installment Meezan Bank {25 Lakh Loan}

Roshan Apna Ghar Scheme For Overseas Pakistani Documents Required

Required Documents:

- Original scanned copy of valid CNIC/SNIC/NICOP/POC (Both sides – front & back).

- Upload the original scanned copy of the first 2 pages of your valid Passport.

- Proof of Non-Resident Pakistani (NRP) status, including Passport with visa, entry/exit stamps, or related documentation.

- Proof of Profession and Source of Income/Funds, which may include a job certificate, tax return, rent agreement, and recent 3-month salary slips, among others.

- Scanned Signature: Please provide your signature as per the Identity document submitted on white paper or a scanned image of your signature.

Recommended Reading: How To Get Solar Panel On Installment Meezan Bank

PM Housing Loan Scheme | Mera Pakistan Mera Ghar Scheme

Numerous banks participate in the PM Housing Loan Scheme | Mera Pakistan Mera Ghar Scheme and one such bank is Standard Chartered.

This bank also extends this loan opportunity to overseas Pakistanis, offering them an accessible path to realize their dream of owning a home.

PM Housing Loan Scheme Benefits

Benefits of the PM Housing Loan For Overseas Pakistani:

- Initial 5% Rental Rate: Benefit from a favorable rental rate of 5% for the first five years, making your initial home ownership more affordable.

- Up to PKR 10 Million Financing Limit: Access financing options of up to PKR 10 million, providing substantial support for your housing needs.

- Zero Processing Charges: Enjoy the advantage of no processing charges, minimizing the financial burden of acquiring your dream home.

PM Housing Loan Scheme Key Features

Government Subsidy Scheme Features:

- Three Product Offerings: The scheme provides three distinct product offerings:

- Tier 1 (NAPHDA): Designed for specific criteria set by NAPHDA (National Affordable Housing Program and Development Authority).

- Tier 2: Offers benefits to a broader range of applicants.

- Tier 3 (Non-NAPHDA): Extends eligibility even further, encompassing various segments of the population.

- Maximum Price of Housing Units: The scheme offers flexibility in the price of housing units:

- Tier 1: Housing units capped at a maximum price of PKR 3.5 million.

- Tier 2 & Tier 3: No price cap, allowing for a wider range of housing choices.

- Financing Tenor: Applicants can select a financing tenor that suits their financial situation, with options ranging between 5 to 20 years. This flexibility ensures manageable repayment terms.

- Maximum Financing: Depending on the tier selected:

- Tier 1: Maximum financing of up to PKR 6.0 million.

- Tier 2 & Tier 3: Maximum financing extended to PKR 10.0 million, providing substantial support for housing needs.

Recommended Reading: 3 Penny Cryptos That Will Make You Rich In 2024 | Penny Cryptos That Will Explode

PM Housing Loan Scheme Eligibility Criteria

Application Eligibility for PM Housing Loan For Overseas Pakistani:

- All individuals with a valid CNIC (Computerized National Identity Card) are eligible to apply.

- First-Time Homeowner: This scheme is specifically designed for those who are purchasing a home for the first time, providing them with an opportunity to become homeowners.

- Single Opportunity: Each individual is eligible to avail of the subsidized house finance facility under this scheme only once, ensuring equitable access to the benefit.

PM Housing Loan Scheme Documents Required

Required Documents for PM Housing Loan For Overseas Pakistani:

- Copy of Valid CNIC: A copy of your valid national identity card is necessary to confirm your identity and citizenship to apply for a loan for overseas Pakistani.

- Salary Slip/Bank Statement: This financial documentation helps assess your income and financial stability, whether you are employed or running a business.

- Employment Letter: An employment letter is typically required for salaried individuals. It confirms your employment status, designation, and income details.

- Application Form for Formal Business (Blue): If you are a formal business owner, the blue application form is necessary to provide essential business information.

- Application Form for Informal Income (Pink): For those with informal sources of income, the pink application form is required to capture relevant income details.

- Application Form for Salaried (Green): Salaried individuals need the green application form, which is tailored to gather information specific to their employment.

- Urdu Application Form for Formal Business (Blue): An Urdu version of the formal business application form is available for convenience.

- Urdu Application Form for Informal Income Person: Similarly, an Urdu application form is provided for individuals with informal income sources.

- Urdu Application Form for Salaried (Green): The Urdu version of the green application form caters to salaried individuals more comfortable with this language.

Recommended Reading: How To Get Solar Panel On Installment {Interest-Free}

Loan For Overseas Pakistani | FAQs

What is a Loan for Overseas Pakistanis?

Loans for Overseas Pakistanis are financial products specifically designed to cater to the needs of Pakistani citizens living abroad, commonly referred to as Non-Resident Pakistanis (NRPs).

Can Overseas Pakistanis Get Home Loans?

Yes, Overseas Pakistanis can obtain home loans even while residing abroad through government initiatives such as the Naya Pakistan Housing Scheme and Roshan Apna Ghar Schemes.

Who qualifies as an Overseas Pakistani for these loans?

Loans for Overseas Pakistanis typically include individuals who are Pakistani citizens but reside in other countries for work, study, or other reasons.

Top 4 Best Banks Give Loans for Overseas Pakistani?

Following are the best banks for giving Loan to overseas Pakistanis to the best of our knowledge

Standard Chartered

Allied Bank

Faisal Bank

HBL Bank

What types of available loans for overseas Pakistanis?

Loans for Overseas Pakistanis cover a wide range of financial products, including home loans, personal loans, car loans, business loans, and investment loans.

What are the common eligibility criteria for these loans for Overseas Pakistanis?

Eligibility criteria of loans for Overseas Pakistanis include factors such as a valid passport, CNIC/NICOP, proof of income, employment details, and compliance with specific scheme requirements, depending on the loan type.

What are the benefits of a Loan For Overseas Pakistanis?

Loan For Overseas Pakistani benefits can include competitive interest rates, flexible repayment terms, higher financing limits, and access to various financial opportunities in Pakistan.

Are there any special schemes or loans for Overseas Pakistanis when applying for loans?

Yes, the government often offers special schemes and loans for Overseas Pakistanis to invest in Pakistan, such as the Roshan Apna Ghar Scheme.

What is the maximum financing tenure for loans available to Overseas Pakistanis?

Loan for overseas Pakistani financing tenure can vary but typically ranges from 5 to 20 years, depending on the loan type and lender.

Is it possible to have a co-applicant for a Loan For Overseas Pakistani?

Yes, many loan program allows for co-applicants, often family members, to join the application, enhancing eligibility and sharing responsibilities.

What is the maximum price of the housing unit I can avail of under this program?

loan for overseas Pakistani: For housing units/apartments of up to 125 square yards (equivalent to 5 Marla) with a maximum covered area of up to 850 square feet, the maximum price is capped at PKR 3.5 million.

However, for Tier 2 and Tier 3 applicants, there is no maximum price cap, offering greater flexibility and options for housing units or apartments.

What is the maximum financing limit available through this program?

The loan for overseas Pakistani financing limits vary based on the size and type of property:

For housing units/apartments of up to 125 square yards with a maximum covered area of up to 850 square feet, the limit is PKR 2.7 million.

For houses up to 125 sq yards (5 Marla) or flats/apartments with a maximum covered area of 1,250 sq ft, the limit is PKR 6.0 million.

For houses up to 250 sq yards (10 Marla) or flats/apartments with a maximum covered area of 2,000 sq ft, the limit is PKR 10.0 million.

What types of loans are available for Overseas Pakistanis at Meezan Bank?

loan for overseas Pakistani: Meezan Bank provides a range of loans, including home loans, personal loans, and business loans tailored to the unique requirements of Overseas Pakistanis.

What are the key benefits of the PM Loan Scheme for Overseas Pakistani applicants?

Loan for overseas Pakistani benefits may include lower interest rates, longer repayment tenors, and support for investments in Pakistan.

What is the Roshan Apna Ghar Loan For Overseas Pakistani, and what does it offer?

The Roshan Apna Ghar Loan For Overseas Pakistani is a housing finance initiative that provides financing solutions for Overseas Pakistanis to purchase homes in Pakistan with favorable terms.

Are there any maximum price limits on properties that can be financed under the Roshan Apna Ghar Scheme?

The maximum property price limits may vary, but typically, there is no price cap for Tier 2 and Tier 3 applicants, offering greater flexibility.

What are the key loan options available for Overseas Pakistanis?

Overseas Pakistanis can explore loan options from banks and organizations like Meezan Bank, and Standard Chartered (Roshan Apna Ghar Scheme), and participate in government initiatives like the PM Loan Scheme for Overseas Pakistanis.

What are the key features of Meezan Bank’s Roshan Apna Ghar Scheme?

The features include digital and free processing, seamless currency conversion, competitive financing options, low processing fees, flexibility in unit purchases, optional life Takaful coverage, and qualification for financing under the State Bank of Pakistan’s Mera Pakistan Mera Ghar Housing Scheme.

What documents are required for Meezan Bank’s Easy Home Scheme for NRPs?

Required documents include a filled application form, valid CNIC/SNIC/NICOP, passport, proof of profession and income, employment-related documents, bank statements, and additional documents depending on the applicant’s status.

What benefits does the Roshan Apna Ghar Scheme by Standard Chartered offer to Overseas Pakistanis?

Standard Chartered’s Roshan Apna Ghar Scheme provides an interest-free loan, offers lien-backed or non-lien-backed financing options, Islamic mode of financing, extended tenor of up to 25 years, and flexibility in pricing.

Recommended Reading: How To Get Solar Panel On Installment Meezan Bank {25 Lakh Loan}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment