Despite the challenges posed by geographical limitations, Pakistanis can open a Skrill account in Pakistan online for free to send, receive, and manage funds with efficiency and peace of mind.

In this guide, we’ll walk you through the step-by-step process of setting up a Skrill account in Pakistan, so, that individuals and businesses doing global commerce can receive and send money anywhere in the world within a few minutes 24/7.

So, here are a few things that you going to learn from this guide:

- What Is Skrill And How Does It Work?

- Skrill Digital Wallet Benefits

- Skrill Account Eligibility

- Skrill Account Opening Process (Step-By-Step)

- How To Add A Bank Account To Your Skrill Account?

- Which Bank Supports Skrill In Pakistan?

- How To Withdraw Money From Skrill In Pakistan?

- Fee/Charges Involved While Making Transaction With Skrill Account.

- Frequently Asked Questions (FAQs) About Skrill In Pakistan.

Having said that, let’s get started!

Recommended Reading: International Payment Gateways In Pakistan 2024 (Shopify+Woocommerce)

How To Create A Skrill Account In Pakistan Online | How To Open A Skrill Account In Pakistan

Table Of Contents

- How To Create A Skrill Account In Pakistan Online | How To Open A Skrill Account In Pakistan

- What Is Skrill And How Does It Work?

What Is Skrill And How Does It Work?

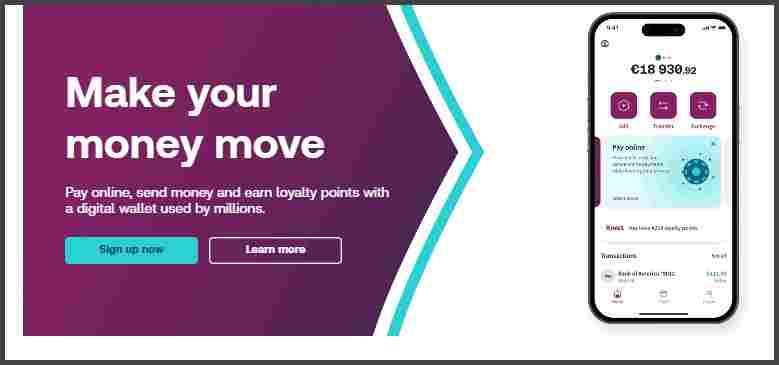

Skrill, a prominent digital wallet brand under Paysafe Limited, serves as a global payments platform offering diverse online payment and money transfer services. Skrill was established in 2001, Skrill operates in over 100 countries and supports transactions in more than 40 currencies including Pakistan.

Key Features of Skrill:

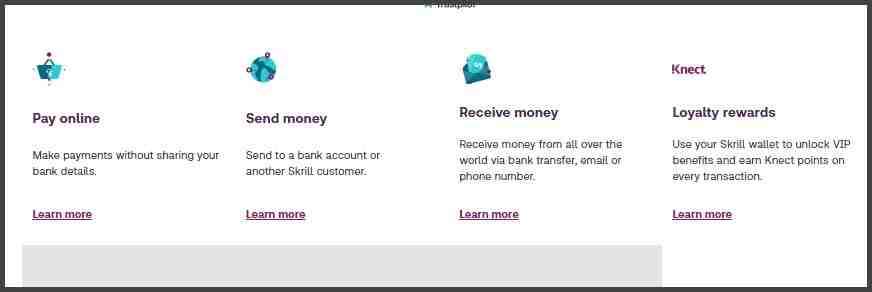

- Payment Gateway: Skrill provides a secure payment gateway, allowing users to make transactions with ease and confidence.

- Digital Wallet: With Skrill’s digital wallet, users can store funds securely and access them conveniently for online purchases and transfers.

- Prepaid Card: Skrill offers a prepaid card option, enabling users to make purchases in stores or online using their Skrill balance.

- Payment Service Provider (PSP): As a PSP, Skrill facilitates payments for merchants, offering them a reliable platform to accept transactions from customers.

- Cryptocurrencies: Skrill supports cryptocurrency trading, allowing users to buy, sell, and hold various digital currencies within their Skrill account.

- Money Transfer: Skrill facilitates fast and cost-effective international money transfers, making it an ideal solution for individuals and businesses needing to send funds across borders.

Skrill’s versatility and reliability make it a preferred choice for online payments, whether you’re purchasing goods and services, trading cryptocurrencies, or sending money internationally.

Benefits Of Skrill In Pakistan | Skrill Digital Wallet Benefits

Fast and Cost-Effective Payments:

- Skrill provides the fastest and most cost-effective option to pay various merchants, whether for online purchases, gaming, betting, or other transactions.

Smart Money Management:

- With Skrill, users can manage their money wisely by easily tracking their transactions, setting spending limits, and organizing their finances efficiently within the digital wallet.

Convenient Fund Transfers:

- Skrill allows users to send funds to friends, relatives, or colleagues with ease, whether for personal reasons or to fulfill financial obligations promptly.

Effortless Fund Reception:

- Users can receive money from friends, relatives, employers, or clients seamlessly via Skrill, whether it’s for monthly payments, contractual work, or freelance services rendered.

Quick Access to Gaming Winnings:

- Skrill enables users to swiftly receive their winnings from a diverse range of gaming merchants, ensuring instant access to their funds for further use or withdrawal.

Instant Cash Access with Skrill Card:

- By using the Skrill Card*, users can instantly access their funds in cash from ATMs or make purchases at stores, providing unparalleled convenience and flexibility.

Local Rates for International Transfers:

- Skrill allows users to make international transfers at local rates, ensuring that they get the best exchange rates and minimize transfer fees for cross-border transactions.

Rewards and Discounts:

- Users can earn rewards and enjoy discounts with multiple retailers by leveraging Skrill’s partnerships and promotions, maximizing the value of their digital wallet usage.

Recommended Reading: Shopify Payment Methods In Pakistan 2024 (Shopify+Woocommerce)

Skrill Account Eligibility

Registered Business Entity or Sole Proprietor:

- To open a Skrill account, you must be registered as a business entity or a sole proprietor, and provide the relevant certificate of incorporation or similar documentation to verify your business status.

Proof of Address and Identification:

- Each business owner must furnish proof of address and identification as part of the account verification process, ensuring compliance with regulatory requirements and enhancing account security.

Operational Website Requirement:

- Your website must be at least in beta version at the time of your application for Skrill account approval. This allows Skrill to review the services or goods offered on your website to ensure alignment with their policies and guidelines.

Multiple Website Applications:

- If you wish to apply for Skrill accounts for more than one website, it’s essential to inform your Sales Manager of the URLs associated with each website. This facilitates a smooth application process and ensures timely account setup for all your online ventures.

How To Open A Skrill Account In Pakistan? (Step-By-Step)

Here is a step-by-step guide on how to open a Skrill Account In Pakistan online:

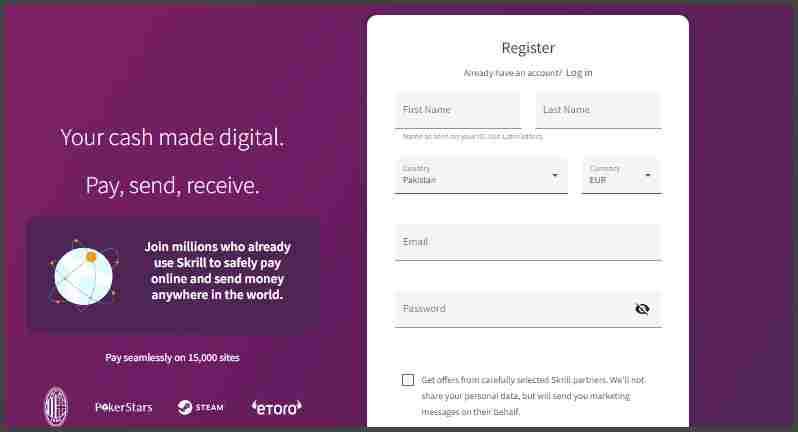

Visit the Skrill Website or Download the App

To initiate the Skrill account creation process in Pakistan, you can visit the Skrill website (at https://account.skrill.com/wallet/account/sign-up?locale=en) directly or download the Skrill app from the Google Play Store (at https://play.google.com/store/apps/details?id=com.moneybookers.skrillpayments&hl=en&gl=US).

Click on Sign up (For App Users)

If you opt to use the Skrill app, launch the app and click on the “Sign up” button to begin the account registration process.

Provide Personal Information

Enter your first and last name, ensuring that the information matches the details on your identification document.

Select Country and Currency

From the country drop-down list, select Pakistan as your country of residence. Additionally, choose the currency in which you prefer to operate your Skrill account.

Enter Your Email Address and Password

Input your valid email address, which will serve as your primary contact for Skrill account-related notifications. Create a secure password to protect your account.

Complete Registration

Follow the prompts to complete the registration process, including any additional verification steps required by Skrill to authenticate your identity.

Recommended Reading: Top 5 Payment Gateways In Pakistan 2024 (Shopify+Woocommerce)

How To Verify Skrill Account In Pakistan? | Skrill Account Verification

By following these steps, you can swiftly verify your Skrill account in Pakistan:

- Log in to Your Account: Access your Skrill account by entering your credentials on the Skrill website or mobile app.

- Navigate to Settings > Verification: Once logged in, locate and click on the “Settings” option. Within the Settings menu, find the “Verification” section.

- Complete the Verification Process: Follow the prompts to complete the verification process. You will be required to provide identification documents such as your passport, ID card, or driver’s license, along with proof of address issued in the past three months. Once you submit all the necessary documents, your account can typically be verified within minutes.

How To Add A Bank Account To Your Skrill Account?

Here is a step-by-step to add/link your bank account to your Skrill Account:

1. Log in to Your Skrill Account:

- Access your Skrill account by logging in using your credentials on the Skrill website or mobile app.

2. Navigate to Withdraw Section:

- From the left panel of your Skrill account dashboard, locate and select the “Withdraw” option.

3. Choose Bank Account:

- Within the withdrawal options, select “Bank Account” to proceed with adding your bank details.

4. Add Bank Account Details:

- Click on the “Add a Bank Account” button to input the necessary information. This includes selecting your country, entering your account number, and providing your bank details accurately.

5. Review and Confirm:

- Carefully review the details you’ve entered to ensure accuracy. Once verified, check the acknowledgment box to confirm that the information provided is correct.

6. Complete the Process:

- Finally, click on the “Add Bank Account” button to complete the process. Skrill will then verify your bank account details to ensure seamless transactions.

Which Bank Supports Skrill In Pakistan?

Skrill services are accessible to residents of Pakistan, allowing individuals to utilize its platform for digital payments and money transfers.

- No Affiliation with Local Banks:

- Skrill operates independently and is not directly affiliated with any specific local bank in Pakistan.

- Wide Range of Bank Support:

- While Skrill is not tied to any particular bank in Pakistan, it is designed to be compatible with most banks operating within the country.

- Support for Deposits and Withdrawals:

- Pakistani users can typically make deposits to and withdrawals from their Skrill accounts using their local bank accounts.

- My Take:

(In my personal experience, I have tried Meezan Bank, and it worked for me very well.)

How To Withdraw Money From Skrill In Pakistan?

1. Account Verification:

- Ensure that your Skrill account is successfully verified to enable withdrawal transactions.

2. Access Your Skrill Account:

- Log in to your Skrill account using your credentials.

3. Navigate to Settings:

- From the account dashboard, locate and select the “Settings” option.

4. Choose Withdraw:

- Within the Settings menu, choose the “Withdraw” option to initiate the withdrawal process.

5. Provide Account Details:

- Enter the necessary details of your local bank or mobile account where you wish to transfer the funds.

6. Enter Withdrawal Amount:

- Specify the amount you wish to withdraw from your Skrill account.

7. Confirm Transaction:

- Review the withdrawal details and confirm the transaction to proceed.

8. Transfer to Local Bank:

- Upon confirmation, the withdrawn amount will be transferred to your designated local bank account in Pakistan within a few minutes.

Recommended Reading: Shopify Payment Methods In Pakistan 2024 (Shopify+Woocommerce)

Skrill Dollar Rate In Pakistan

Skrill Dollar Rate in Pakistan:

- The Skrill dollar rate in Pakistan is dependent on the current market exchange rate of the dollar. Skrill adjusts its exchange rate accordingly to reflect the prevailing market conditions.

Transaction Fees for Local Payment Methods:

- For transactions made through local payment methods, Skrill charges a fee of 0.00%.

Skrill Crypto Withdrawals (via a Merchant):

- When withdrawing funds via a merchant using Skrill crypto, a fee of 1.75% is applicable.

Bank Transfer Fees:

- For bank transfers, Skrill imposes a fee of 1.99% on the transaction amount.

Card Mastercard and Card Visa Fees:

- Using Mastercard or Visa cards for transactions incurs a fee of 2.00%.

Withdrawal to Crypto Fees:

- Withdrawals to cryptocurrency wallets are subject to a fee of 3.49%.

NETELLER Fees (Global Payment Methods):

- For global payment methods like NETELLER, Skrill charges a fee of GBP 4.70 or EUR 5.50.

Additional Notes:

- It’s important to note that network fees, also known as mining fees, and other charges related to currency conversion may apply depending on the transaction.

- For Skrill crypto withdrawals, a minimum fee of EUR 3.50 is applicable, but the actual fee may vary depending on the transaction amount.

- Maximum and minimum withdrawal limits are applicable as per clause 12.2 of Skrill’s Terms of Use.

Recommended Reading: International Payment Gateways In Pakistan 2024 (Shopify+Woocommerce)

Frequently Asked Questions (FAQs) | Skrill Account

How much does it cost to open a business account with Skrill?

You can open a business account with Skrill for free. There is no startup fee.

What are the different types of Skrill accounts available, and which one should I open?

There are three types of Skrill accounts: Full Merchant Account, Expense Account (send payments only), and Wallet to Wallet.

Depending on your needs, you can select the appropriate account type. For e-commerce businesses, it’s recommended to open a Full Merchant Account to receive payments via your online store.

How long does it take before I can start accepting payments with Skrill?

Once we receive your documents, we will promptly review your registration and confirm it or request any additional paperwork needed.

Which currencies can I use with Skrill?

Skrill offers support for over 40 different currencies. During registration, you can set up your primary and additional currencies. You can also add more currencies later if needed.

What are the costs associated with accepting payments through Skrill?

Skrill offers tailored pricing based on your business needs. You can apply for a merchant account to receive an offer that matches your requirements. If you use a shopping cart partner of ours, you can benefit from reduced fees.

Is Skrill legal in Pakistan, and can I hold Pakistani Rupees in my Skrill account?

Skrill is available for Pakistani residents, but you cannot hold money in Pakistani Rupees in your Skrill account. Any funds added to your Skrill wallet will be converted into one of the global currencies supported by Skrill.

How does Skrill compare to Payoneer in terms of currency support and transaction fees?

Skrill offers more global currencies than Payoneer and generally has lower transaction fees, including zero fees for money transfers abroad.

What is the conversion fee for currency exchanges on Skrill?

Skrill charges a foreign exchange fee of 3.99% for currency conversions. You can check the Skrill exchange rate for specific currency pairs on their website.

Can I transfer money from Skrill to Easypaisa or Jazzcash?

Yes, you can transfer money from Skrill to Easypaisa or Jazzcash. Simply follow the exchange process on the Skrill website and provide your Skrill username, password, and security pin to complete the transfer.

Is Skrill cheaper than PayPal for online transactions?

Yes, Skrill generally has lower service fees compared to PayPal. Skrill charges a 2.99% service fee for online payments, while PayPal charges a 4.50% service fee.

What are the most common reasons for rejection when applying for a Skrill merchant account?

The most common reasons for rejection include providing non-existent or fake details, having a non-operational website, or having an unsupported business model.

Can I convert my personal Skrill account into a business one?

No, personal accounts cannot be converted into business accounts. You can apply for a new business account using a different email address and mobile number. If you need assistance, you can contact your Sales Manager for support.

Are there any additional charges or limits for Skrill transactions in Pakistan?

Yes, there may be additional charges for network fees, currency conversion fees, and minimum withdrawal fees for Skrill crypto withdrawals. Additionally, there are maximum and minimum withdrawal limits as per Skrill’s Terms of Use.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Do you have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment