With the integration of Shopify and WooCommerce platforms becoming increasingly prevalent among entrepreneurs, reliable payment gateways with local preferences, and regulatory frameworks are of significant importance.

In this article, we will explore the top 5 payment gateways in Pakistan, compatible with Shopify and WooCommerce, providing merchants with streamlined transactions and enhancing customer satisfaction in this rapidly expanding market.

We have selected the following payment solutions specifically for Shopify and wooCommerce payments in Pakistan:

- PayPak

- Safepay

- bSecure

- GoPayFast

- SadaPay

Having said that, let’s get started with our list!

Recommended Reading: Shopify Payment Methods In Pakistan 2024 (Shopify+Woocommerce)

Best Online Payment Gateways In Pakistan | International Payment Gateways In Pakistan

Table Of Contents

- Best Online Payment Gateways In Pakistan | International Payment Gateways In Pakistan

Recommended Reading: How To Create a Skrill Account In Pakistan 2024

PayPak

PayPak: Empowering Domestic Transactions:

- Domestic Pioneering: PayPak stands as a pioneering force in Pakistan’s Payment Gateways landscape, being the nation’s inaugural and sole domestic payment scheme (DPS), marking Pakistan’s entry into the league of 28 countries worldwide with such a scheme.

- 1LINK’s Operation: Operating under the umbrella of 1LINK, PayPak emerged with the backing of the State Bank of Pakistan, aiming to catalyze financial inclusivity and digitalization throughout the country by providing Payment Gateways solutions.

- Accessible Finances: With a PayPak debit card, users gain unrestricted access to their funds anytime, anywhere. The card facilitates transactions at all ATMs nationwide and at various dining venues, retail stores, shopping centers, and e-commerce platforms.

- Localized Security: Prioritizing customer data security, PayPak ensures all transactions remain within Pakistan’s borders, eliminating the need for cross-border data transfers and safeguarding sensitive personal information.

Products And Services Offered By PayPak

Products and Services Offered by PayPak Include:

- Inter Bank Fund Transfer (1IBFT)

- 1BILL

- Shared ATM Services

- IPS Connectivity

- Fraud Risk Management Services (FRMS)

- 1LINK Open APIs

- Fraudulent Transaction Dispute Handling (FTDH)

- Cyber Threat Intelligence Platform (1TIP)

- Switch Dispute Resolution System (SDRS)

- 1LINK Hosted Services Platform

- Tokenization Service

- 1QR

- 1ID

- Perso Bureau

Contact Information

- Phone: +92 21 11 11 1LINK (15465)

- Address: 1LINK 1HQ LG 11 / 11-A, Lower floor Park Towers, Clifton Block 5, Karachi, Pakistan.

Recommended Reading: International Payment Gateways In Pakistan 2024 (Shopify+Woocommerce)

Safepay

Safepay App Simplifying Secure Transactions:

- Versatile Payment Acceptance: Safepay facilitates seamless transactions by accepting payments from various sources, including credit cards, debit cards, bank accounts, and mobile wallets, ensuring convenience for both businesses and customers by providing a Payment Gateways solution.

- Endorsement by Industry Leaders: Backed by industry-leading support, Safepay provides a hassle-free and instant Payments experience, bolstered by robust security measures to safeguard sensitive financial information.

- Flexible Payment Options: Businesses can securely accept customer payments through digital payment channels, fostering growth opportunities while enjoying hassle-free, instant, and secure Payment Gateway transactions.

- Streamlined Payment Processes: With powerful payment APIs, Safepay simplifies payment procedures, offering checkout solutions, quick links, invoicing tools, and comprehensive API integration to cater to diverse business needs.

Products And Services Offered By Safepay

Products And Services Offered by Safepay include:

- Payment solutions tailored for businesses of all sizes

- Checkout options

- Quick link generation

- Invoicing capabilities

- API integration for seamless transaction processing

How Safepay Works

- Customers initiate payments through Safepay.

- Funds are promptly captured and securely held by Safepay’s trusted financial partners.

- Funds are disbursed to the linked bank account by Safepay’s settlement schedule.

Key Features Of Services Offered By Safepay

Efficient Payment Management Tools:

- Access detailed information on each payment transaction.

- Initiate refunds and reversals seamlessly.

- Stay updated with newly released features and functionalities.

- Developer and business-friendly interface to explore various use cases catering to freelancers, entrepreneurs, organizations, and non-profits.

Contact Safepay

- Email: support@getsafepay.com

- Live chat: support is available for merchants via a free Sandbox Account.

- Address: 42-c, South Park Avenue, Phase II Ext, DHA, Karachi, Pakistan – 75500

Recommended Reading: How To Create Skrill Account In Pakistan (For International Payments)

bSecure

bSecure: Revolutionizing Online Checkouts:

- Streamlined Checkout Solution: bSecure offers a one-click checkout Payment Gateways solution designed to simplify product sales worldwide, ensuring instant transactions and seamless purchasing process management. With a security-centric approach, every transaction is encrypted, prioritizing user transparency and satisfaction.

How bSecure Works?

- Phone Number Authentication: Users can log in seamlessly without passwords, verifying their identity through a one-time password (OTP) sent to their registered phone number.

- Address Management: Shipping and billing addresses are conveniently mapped geographically, with the option for live location sharing to enhance accuracy.

- Shipment Options: bSecure offers location-based shipment methods, providing estimated shipping times and costs to optimize the delivery experience.

- Payment Flexibility: Users enjoy a comprehensive array of local and international payment options, including Cash on Delivery, ensuring convenience and accessibility.

- Efficient Checkout: Custom invoices are generated for each transaction, accompanied by follow-up details to streamline the purchase process further.

Key Features of bSecure Products

- Boost Sales: Empower your online sales with a user-friendly checkout experience.

- Seamless Payment Acceptance: Easily accept payments without hassle.

- Instant Shopping: Integration of checkout functionality directly into your online store for instant transactions.

- BIN Discounts: Apply discounts based on Bank Identification Numbers (BINs) via secure.

- Reduced Rejection Rates: Minimize rejection at the doorstep with optimized processes.

- Multi-Store Management: Efficiently manage multiple stores within the secure platform.

- Language Customization: Communicate with customers in their preferred language to enhance engagement.

- Area-Based Shipments: Optimize shipment management based on geographical areas.

- Transaction Management: Capture, void, and refund transactions effortlessly.

- Website Accessibility: Overcome the hurdle of not having a website with bSecure’s inclusive solutions.

- Customer Retention: Keep customers engaged and prevent them from leaving your website with seamless checkout integration.

Target Customers of bSecure

- eCommerce & Retail Businesses

- Software as a Service (SaaS) Providers

- Freelancers

Contact bSecure

For inquiries, please visit the official website and utilize the contact form provided on the official website.

Recommended Reading: International Payment Gateways In Pakistan 2024 (Shopify+Woocommerce)

GoPayFast

GoPayFast: Empowering Business Digitization:

- Digital Onboarding: GoPayFast simplifies the registration process with a self-sign-up portal, enabling paperless and contact-free registration from anywhere, be it your office or home.

- Revenue Optimization: Seamlessly integrates with GoPayFast to expedite Payment Gateways acceptance, thereby optimizing revenue streams and facilitating business growth.

- Robust Security Measures: GoPayFast prioritizes the security of your transactions, boasting PCI-DSS compliance and employing a comprehensive Fraud Monitoring Solution, transaction monitoring system, and dedicated team to safeguard your business interests.

- Versatile Payment Acceptance: With GoPayFast’s Payment Links solution, customers can make payments using various modalities, including bank accounts, card-based transactions, and mobile wallets, ensuring convenience and accessibility to Payment Gateways solutions.

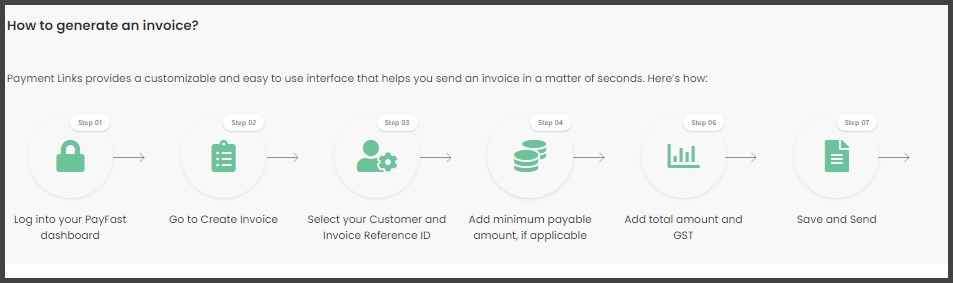

How to Generate An Invoice With GoPayFast?

- Log into your PayFast dashboard.

- Navigate to Create Invoice.

- Select your customer and invoice reference ID.

- Add the minimum payable amount, if applicable.

- Include the total amount and GST.

- Save and send the invoice seamlessly.

How Customers Can Pay Via PayFast?

Paying Bills with PayFast Billing: A Step-by-Step Guide To Payment Gateways Solutions

- Log in to Internet Banking or Mobile App: Access your bank’s internet banking website or mobile application and log in to your account securely.

- Navigate to Bill Payments: Once logged in, locate the option for bill payments within the banking interface.

- Select PayFast as Biller: From the list of available billers, choose PayFast as the designated biller for your payment.

- Enter Invoice Details: Input the relevant details for your invoice, including the invoice number and the amount due.

- Confirm Payment: Double-check the information provided, ensuring accuracy, then proceed to confirm the payment. Upon confirmation, the payment will be processed securely through PayFast Billing.

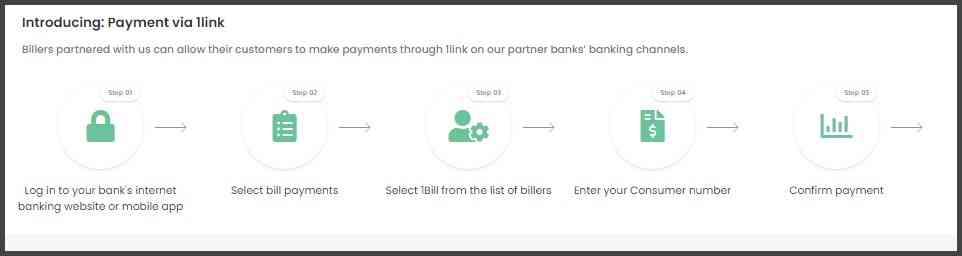

Making Payments via 1Link

- Access Banking Channels: Begin by logging in to your bank’s internet banking website or mobile application, ensuring secure access to your account.

- Navigate to Bill Payments: Within the banking interface, locate the section dedicated to bill payments.

- Select 1Bill as the Biller: From the list of available billers, choose 1Bill as the designated biller for your payment transaction.

- Enter Consumer Number: Input your unique consumer number associated with the bill or service you are paying for.

- Confirm Payment: Review the details provided, ensuring accuracy, and proceed to confirm the payment. Upon confirmation, the payment will be processed securely via 1Link’s payment gateways, facilitating seamless transactions for billers and customers alike.

Contact GoPayFast

- Email: info@gopayfast.com

- Phone: +92 21 37132793

- Head Office: National Aerospace Science and Technology Park (NASTP), V4P99G3, Faisal Cantonment, Karachi, Karachi City, Sindh

- Lahore Office: Street 31, Kashmir Block Allama Iqbal Town, Lahore, Punjab 54000

Recommended Reading: Shopify Payment Methods In Pakistan 2024 (Shopify+Woocommerce)

SadaPay

SadaPay: Redefining Financial Freedom

- Seamless Transactions: With SadaPay, sending money, paying bills, requesting funds, and topping up mobile balances become effortless tasks, empowering users with unparalleled Payment Gateways convenience.

- Instant Access: Enjoy the convenience of instant arrivals for remittances, ensuring swift access to your funds whenever needed.

- Global Accessibility: Whether you’re in Pakistan or abroad, SadaPay offers account sign-ups tailored to meet the diverse needs of freelancers and individuals alike.

- Security Measures: SadaPay prioritizes the safety of your funds with biometric access, AI fraud detection, and robust encryption protocols, ensuring peace of mind for users.

- International Payment Acceptance: Accepting international payments is simplified through SadaPay’s platform, offering easy generation and sharing of payment links for swift transactions.

How to Accept International Payments Via SadaPay?

- Generate Payment Link: Create a payment link effortlessly through the SadaPay platform.

- Share the Link: Share the generated payment link with the payer.

- Get Paid: Receive payments swiftly, directly into your SadaBiz account.

Save In USD, Spend In PKR

- By bypassing intermediaries, SadaPay enables direct Payment Gateway solutions, helping users avoid excessive platform fees that could eat away at their earnings.

- Enjoy higher transaction limits of up to Rs. 500,000 per month, directly credited to your SadaBiz account.

- Benefit from the lowest fees available on the market, maximizing the value of your transactions.

Accepted Payment Methods for Invoices At SadaPay

Payment methods accepted for invoices include Apple Pay, G Pay, and Mastercard or VISA cards (credit/debit), simplifying the Payment Gateways process without the need for SWIFT codes.

Contact SadaPay

- For inquiries, please visit the official website and utilize the contact form provided.

- Head Office: Ufone Tower, 9th Floor, Jinnah Avenue, Block F-7/1, Blue Area, Islamabad.

Recommended Reading: How To Create a Skrill Account In Pakistan (For International Payments)

FAQs | Payment Gateways In Pakistan

What makes PayPak unique in the Payment Gateways landscape

PayPak stands out as one of Pakistan’s first domestic Payment Gateways, contributing to the nation’s digitalization efforts.

How can I access funds with PayPak?

You can access funds conveniently using a PayPak debit card, accepted at ATMs, restaurants, shops, malls, and e-commerce websites across Pakistan.

What security measures does PayPak employ?

PayPak ensures customer data security by routing all transactions locally within Pakistan, eliminating the need for cross-border data transfers for Payment Gateways solutions.

What products and services does PayPak offer?

PayPak provides a range of Payment Gateways services including Inter-Bank Fund Transfer, Fraud Risk Management, Tokenization Service, and more to facilitate seamless transactions.

What is Safepay’s primary focus in the digital payment landscape?

Safepay aims to simplify and secure online transactions, enabling businesses to thrive in Pakistan’s evolving digital marketplace of Payment Gateways.

How can Safepay help businesses optimize revenue streams?

Safepay offers seamless integration and secure payment acceptance, streamlining the checkout process for businesses and customers.

What are the key features of Safepay’s payment solutions?

Safepay offers powerful payment APIs, customizable checkout options, and comprehensive invoicing tools to cater to diverse business needs.

What sets GoPayFast apart in Pakistan’s digital payment sphere?

GoPayFast provides a one-click checkout Payment Gateways solution, simplifying product sales and expanding businesses’ reach in the online marketplace.

How does GoPayFast streamline the registration process for businesses?

GoPayFast offers a self-sign-up portal, enabling paperless and contact-free registration from anywhere, enhancing convenience for businesses related to Payment Gateways.

What payment modalities are supported by GoPayFast’s Payment Links solution?

GoPayFast’s Payment Links solution allows customers to make payments using bank accounts, card-based transactions, and mobile wallets, ensuring versatility.

How can users access their funds with SadaPay?

SadaPay allows users to access their funds instantly, with arrivals for remittances and tailored accounts for freelancers, ensuring swift and tailored Payment services.

What security measures does SadaPay implement to safeguard transactions?

SadaPay ensures transaction security with biometric access, AI fraud detection, and encryption protocols, providing users with peace of mind while using Payment Gateways solutions.

How does SadaPay facilitate international payments for users?

SadaPay simplifies international payments with easy generation and sharing of payment links, enabling swift transactions directly into users’ accounts.

What makes bSecure a standout choice for online transactions in Pakistan?

bSecure offers a one-click checkout solution, simplifying product sales and enabling businesses to tap into untapped online markets with ease.

What security measures does bSecure implement to protect transactions?

bSecure ensures transaction security with PCI-DSS compliance, Fraud Monitoring Solutions, and encryption protocols, safeguarding businesses from potential threats.

What payment methods are supported by bSecure’s Payment Links solution?

bSecure’s Payment Links solution allows customers to make payments using bank accounts, card-based transactions, and mobile wallets, ensuring versatility.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Do you have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment