The Punjab Rozgar Scheme is an initiative launched by the Government of Punjab to support youth employment and provide financial help to businesses, by offering loans at subsidized rates for startups and existing businesses.

| Features | Details |

|---|---|

| Loan Range | Rs. 100,000 to Rs. 10 million |

| Markup Rates | 4% to 5% per annum |

| Loan Tenure | 2 to 5 years, including a 6-month grace period |

| Target Sectors | Trade, services, manufacturing, agriculture, and livestock |

| Special Focus | Startups and businesses affected by COVID-19, environmentally friendly enterprises |

Recommended Reading: CM Internship Program to Give Unemployed Youth PKR 25,000

Punjab Rozgar Scheme: Eligibility, Status, & Last Date

Table Of Contents

Recommended Reading: CM Punjab Green Tractor Scheme | Green Tractor Scheme Punjab

Punjab Rozgar Scheme | What is Punjab Rozgar Scheme?

The Punjab Rozgar Scheme 2024 is a program by the Punjab government to help young people find jobs and give financial loans to support their businesses, especially those impacted by COVID-19.

Punjab Green Development Program

This program helps businesses use cleaner and more efficient technologies. Its goal is to improve the environment by reducing air, water, and soil pollution, managing natural resources better, and saving energy.

Punjab Green Development Program (PGDP)

- Promotes cleaner production technologies

- Aims to improve environmental quality

- Focuses on:

- Air, water, and soil pollution

- Natural resource management

- Energy efficiency

Recommended Reading: Solar Panel On Installments In Pakistan (Top 7 Banks) | Solar Financing Pakistan

Punjab Small Industries Corporation (PSIC)

| Service | Details |

|---|---|

| Loans and Credit Guarantees | Financial help for small businesses |

| Business Guidance | Expert advice for entrepreneurs |

| Support for Growth | Help with infrastructure and marketing |

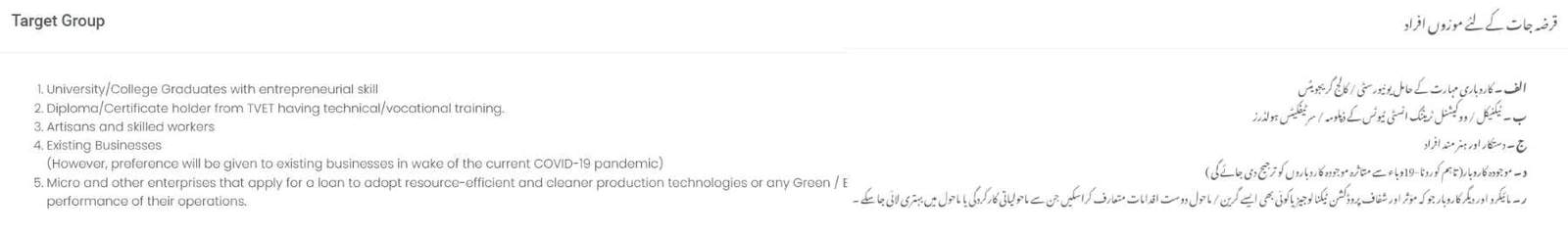

Who Can Apply For the Punjab Rozgar Scheme?

| Who Can Apply | Details |

|---|---|

| University/College Graduates | Those with entrepreneurial skills |

| Technical/Vocational Diploma Holders | Certificate holders from technical/vocational training institutes |

| Skilled Workers and Artisans | Artisans and other skilled workers |

| Existing Businesses | Businesses impacted by COVID-19 |

COVID-19 Response

The scheme aims to minimize the pandemic’s impact on businesses and lives by:

- Providing livelihood opportunities

- Restoring economic activity

Scope

The scheme will:

- Support startups and existing businesses in Punjab

- Focus on COVID-19 affected businesses

- Emphasize trade, service, manufacturing, agriculture, and livestock sectors

Recommended Reading: Prime Minister Solar Panel Scheme | Solar Tubewell Scheme

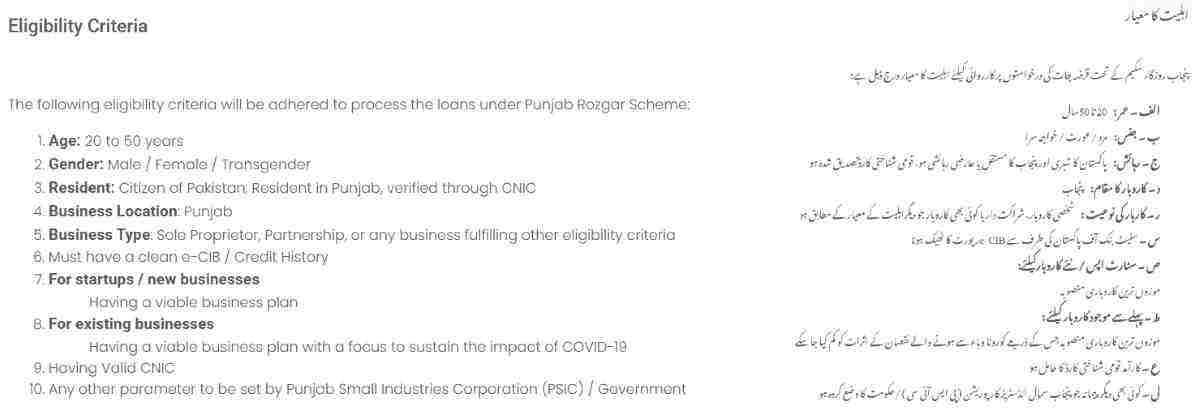

Punjab Rozgar Scheme Eligibility Criteria

The Punjab Rozgar Scheme provides financial loan support to individuals and businesses. The following eligibility criteria are required:

Eligibility Criteria

| Criteria | Details |

|---|---|

| Age | Applicants must be between 20 to 50 years old. |

| Gender | Open to male, female, and transgender individuals. |

| Citizenship | Must be a citizen of Pakistan and a resident of Punjab, verified through CNIC. |

| Business Location | The business must be located in Punjab. |

| Business Type | Eligible business types include sole proprietorships, partnerships, or any other business that meets the criteria. |

| Credit History | Applicants must have a clean e-CIB (Electronic Credit Information Bureau) / Credit History. |

| CNIC | Must have a valid CNIC (Computerized National Identity Card). |

| Other Parameters | Any other conditions set by Punjab Small Industries Corporation (PSIC) or the government. |

Criteria for Startups / New Businesses:

- Viable Business Plan: Applicants must present a viable business plan that shows the business can be successful.

Recommended Reading: Solar Tubewell Subsidy In Pakistan | Solar Tubewell+Biogas Plants

Criteria for Existing Businesses:

- Viable Business Plan: Businesses must have a viable plan to sustain operations, particularly focusing on overcoming the impacts of COVID-19.

Punjab Rozgar Scheme Eligibility Criteria Details Information

- Age Limit (20 to 50 years): Applicants must be at least 20 years old and no older than 50 years at the time of application.

- Gender Inclusivity: The scheme is open to everyone, including male, female, and transgender applicants, ensuring equal opportunities for all.

- Punjab Residency: Applicants must be residents of Punjab and must be able to verify their residency through a valid CNIC.

- Business Location in Punjab: The business must operate within Punjab to qualify for the scheme.

- Business Types Allowed: Eligible businesses include sole proprietorships, partnerships, or any entity that meets the other criteria.

- Clean Credit History: Applicants must have a clean credit history, verified through the Electronic Credit Information Bureau (e-CIB).

- For Startups / New Businesses: New businesses must provide a viable business plan that outlines how the business will operate successfully.

- For Existing Businesses: Existing businesses must also present a business plan with a focus on overcoming the impact of COVID-19 and ensuring the business’s sustainability.

- Valid CNIC: A valid Computerized National Identity Card is mandatory for all applicants.

Recommended Reading: Electric Bike Scheme For Students | Punjab e-bike Scheme Registration

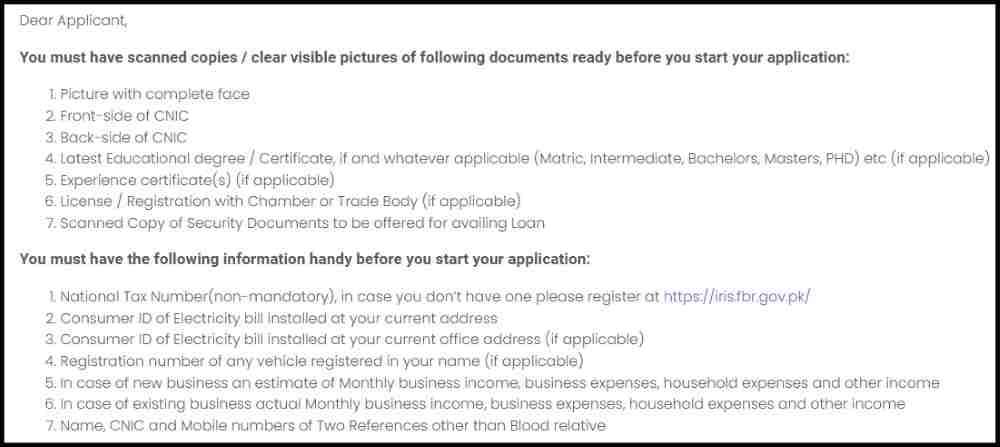

Required Documents for Punjab Rozgar Scheme Application

Before you start your application for the Punjab Rozgar Scheme, ensure you have scanned copies or clear pictures of the following documents ready:

| Document Type | Details |

|---|---|

| Profile Picture | A clear picture showing your complete face. |

| CNIC – Front Side | A clear image of the front side of your CNIC (Computerized National Identity Card). |

| CNIC – Back Side | A clear image of the back side of your CNIC. |

| Educational Degree/Certificate | Latest educational degree or certificate (Matric, Intermediate, Bachelors, Masters, PhD, etc.) if applicable. |

| Experience Certificate | Any experience certificates, if applicable. |

| License/Registration | License or registration with a Chamber or Trade Body, if applicable. |

| Security Documents | Scanned copies of the security documents you will offer for the loan. |

Additional Document Required

You should also have the following information ready before starting your application:

| Information Type | Details |

|---|---|

| National Tax Number (NTN) | Not mandatory, but if you don’t have one, register at FBR. |

| Consumer ID (Current Address) | The consumer ID of the electricity bill at your current home address. |

| Consumer ID (Office Address) | The consumer ID of the electricity bill at your current office address. |

| Vehicle Registration Number | Registration number of any vehicle in your name (if applicable). |

| Monthly Business Estimates (New Business) | Estimated monthly business income, expenses, household expenses, and other income. |

| Monthly Business Actuals (Existing Business) | Actual monthly business income, expenses, household expenses, and other income. |

| References | Name, CNIC, and mobile numbers of two references (not blood relatives). |

Recommended Reading: DAP Subsidy Registration Online | DAP Subsidy Check Online

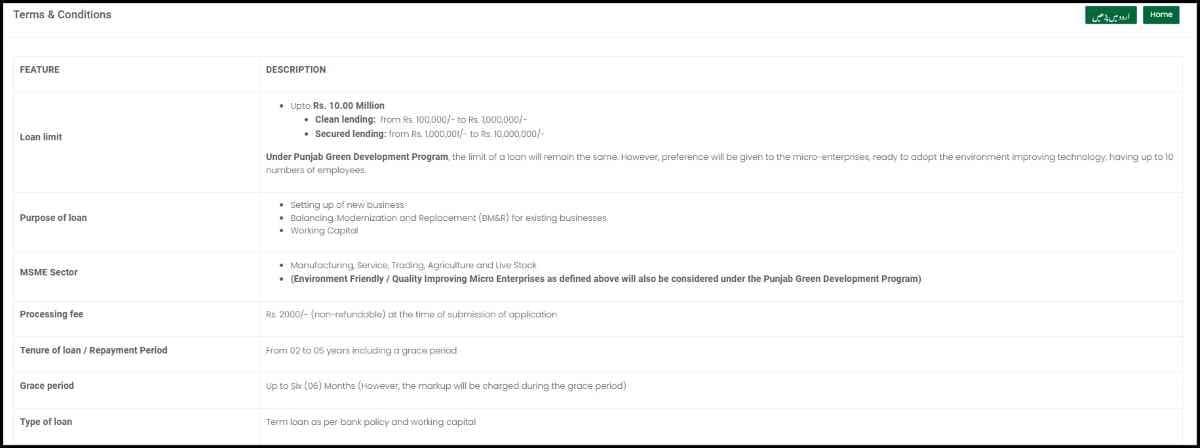

Punjab Rozgar Scheme Loan Details+Terms & Conditions

The Punjab Rozgar Scheme offers financial loans to help their businesses to grow up. Here is the detailed information about the Punjab Rozgar Scheme Loan Details and Terms & Conditions.

| Loan Details | Details |

|---|---|

| Loan Limit | Up to Rs. 10 million. Clean lending: Rs. 100,000 to Rs. 1 million. Secured lending: Rs. 1 million to Rs. 10 million. |

| Purpose of Loan | For starting new businesses, upgrading or modernizing existing businesses, or for working capital needs. |

| Target Sectors | Manufacturing, Services, Trading, Agriculture, and Livestock. Environment-friendly enterprises are also prioritized. |

| Processing Fee | Rs. 2,000 (non-refundable), paid when applying. |

| Loan Tenure / Repayment | 2 to 5 years, including a grace period of up to 6 months. |

| Grace Period | Up to 6 months. Note: Interest will be charged during this period. |

| Type of Loan | Term loan or working capital loan, based on the bank’s policy. |

| Cost of Capital | 4% for clean lending; and 5% for secured lending. |

| Debt: Equity Ratio | For loans from Rs. 100,000 to Rs. 500,000: Borrower’s guarantee and net worth statement. For loans from Rs. 500,001 to Rs. 1 million: Borrower’s personal guarantee and third-party guarantor (net worth equal to loan amount) or guarantee of a government employee (BS-10 or above) along with personal guarantee. |

| Disbursement of Loans | Loans will be given in installments as per the approved business plan. |

| Security for Clean Lending | For loans from Rs. 100,000 to Rs. 500,000: Borrower’s guarantee and net worth statement. For loans from Rs. 500,001 to Rs. 1 million: Borrower’s personal guarantee and third-party guarantor (net worth equal to loan amount) or guarantee of a government employee (BS-10 or above) along with personal guarantee. |

| Security for Secured Lending | For loans from Rs. 1 million to Rs. 10 million: Mortgage of assets, including property or vehicles, owned by the borrower or a close relative. |

Recommended Reading: Top 15 Real Estate Companies In Pakistan (Buy+Sell+Rent)

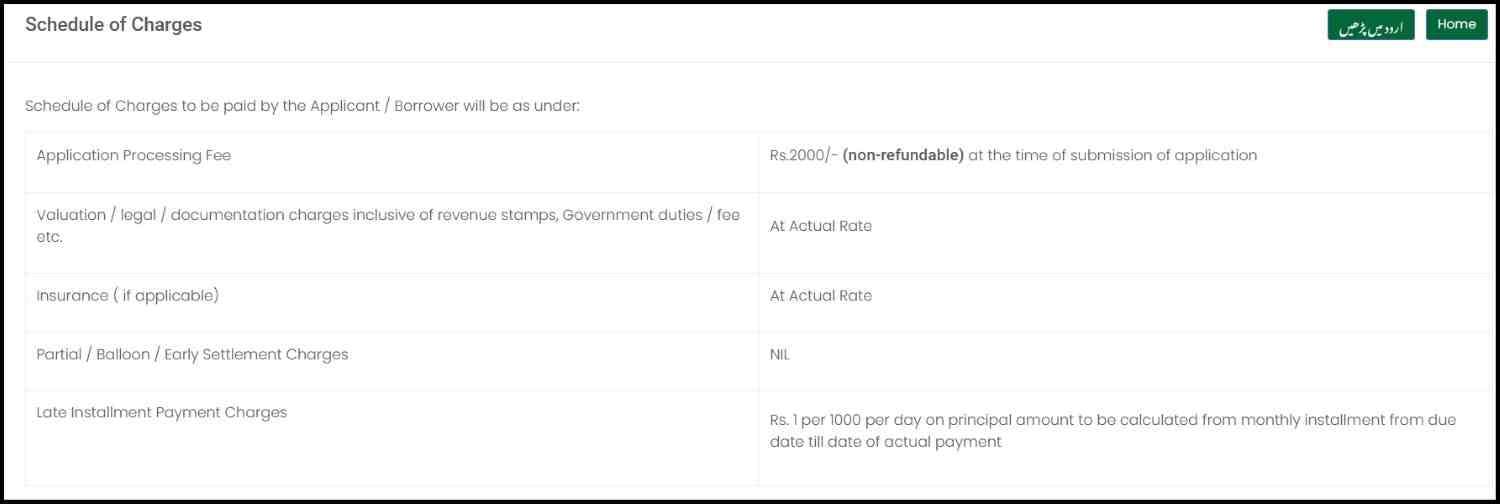

Schedule of Charges for Punjab Rozgar Scheme

| Charge Type | Details |

|---|---|

| Application Processing Fee | Rs. 2000/- (non-refundable) paid at the time of application submission. |

| Valuation/Legal/Documentation Charges | Charges will be at actual rates, including revenue stamps and government duties/fees. |

| Insurance (if applicable) | Charges will be at actual rates based on the insurance policy. |

| Partial/Balloon/Early Settlement Charges | NIL (no charges for early settlement). |

| Late Installment Payment Charges | Rs. 1 per Rs. 1000 of the principal amount per day, calculated from the due date until actual payment is made. |

Recommended Reading: Turkey Visit Visa Price In Pakistan {e-Visa Fee+Documents}

Who Can Apply For the Punjab Rozgar Scheme+Target Group

The Punjab Rozgar Scheme is open to various groups of individuals and businesses who meet specific criteria. Below is a detailed table and points outlining who can apply:

| Applicant Category | Eligibility Criteria |

|---|---|

| University/College Graduates | – Must hold a degree from a recognized university/college. – Must possess entrepreneurial skills. – Must be interested in starting or expanding a business. |

| Technical/Vocational Training Certificate Holders | – Must hold a diploma/certificate from a Technical and Vocational Education and Training (TVET) institution. – Must have received technical/vocational training. – Must be interested in starting or expanding a business. |

| Artisans and Skilled Workers | – Must possess specialized skills or expertise. – Must be interested in starting or expanding a business. – Must have a viable business plan. |

| Existing Businesses | – Must be registered and operational in Punjab. – Must have been impacted by the COVID-19 pandemic (priority given). – Must be interested in expanding or revitalizing their business. |

| Micro and Other Enterprises | – Must be interested in adopting resource-efficient and cleaner production technologies. – Must seek to improve environmental performance. – Must be willing to implement green/environment-friendly interventions. |

Recommended Reading: Prime Minister Solar Panel Scheme | Solar Tubewell Scheme

Who To Apply For Punjab Rozgar Scheme

Here is the complete video information about how to apply for the Punjab Rozgar Scheme.

Recommended Reading: Governor Sindh Initiative For Artificial Intelligence | Governor Sindh IT Program

FAQs | Punjab Rozgar Scheme Online Apply

What is the Punjab Rozgar Scheme?

The Punjab Rozgar Scheme is a program that provides loans to individuals in Punjab who want to start or expand their businesses. It aims to help create job opportunities and support economic growth.

Who can apply for a loan?

Anyone aged 20 to 50 years can apply, including men, women, and transgender individuals. You must be a resident of Punjab and have a viable business plan.

Anyone can apply if they are a university graduate, have a technical/vocational training certificate, are an artisan or skilled worker, or own an existing business in Punjab. You should also have a good business plan.

What types of businesses are eligible?

You can apply if your business is a sole proprietorship, partnership, or any other type that meets the scheme’s criteria. This includes startups and existing businesses affected by COVID-19.

What documents do I need to apply?

You will need a profile picture, CNIC (front and back), educational certificates, experience certificates, and any relevant licenses. You will also need information like your electricity consumer IDs and references.

How much money can I borrow?

You can borrow up to Rs. 10 million under the Punjab Rozgar Scheme.

Clean Lending: You can borrow between Rs. 100,000 and Rs. 1,000,000.

Secured Lending: You can borrow between Rs. 1,000,001 and Rs. 10,000,000.

What is the interest rate on the loans?

The interest rate is 4% for clean lending and 5% for secured lending.

What is the repayment period for the loan?

The repayment period is from 2 to 5 years, including a grace period of up to 6 months where you may not have to make payments.

Is there a fee to apply?

Yes, there is a processing fee of Rs. 2,000, which is non-refundable and must be paid when you submit your application.

What happens if I miss a payment?

If you miss a payment, you will be charged Rs. 1 per Rs. 1,000 per day on the unpaid principal amount until you make the payment.

How can I check the status of my application?

After you submit your application, you will receive an Application Registration Number (ARN). You can use this ARN to check the status of your application on the Punjab Rozgar Scheme website.

What is the purpose of the loans?

The loans can be used to start a new business, modernize existing businesses, or for working capital to cover operational costs.

What is the Punjab Rozgar Scheme?

The Punjab Rozgar Scheme is a government program that helps people start or grow their businesses by providing loans. It also supports those affected by COVID-19.

What do I need to apply?

You need to have some documents ready, such as your CNIC (ID card), educational certificates, and a business plan. You also need a clear picture of yourself.

Is there any special support for women or marginalized groups?

Yes, the program gives priority to women, transgender people, and differently-abled individuals when reviewing loan applications.

Do I need to provide a business feasibility study?

Yes, providing a business feasibility study or a solid business plan is important for evaluating your application.

Recommended Reading: Solar Tubewell Subsidy In Pakistan | Solar Tubewell+Biogas Plants

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Do you have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment