Bank Alfalah Freelancer Account allows freelancers to manage their finances efficiently, receive payments from global clients, and access a wide range of digital banking features.

Freelancer accounts can be opened in both of the currencies i.e. PKR and USD with an initial deposit of 100 Rupees only.

Bank Alfalah Freelancer Account has a daily withdrawal limit of Rs. 500,000/day or equivalent and a debit and credit limit of USD 5,000 or equivalent per month.

To open a Bank Alfalah Freelancer Account you need the following two items only:

Valid CNIC (or Pharm-B)

Proof of income i.e. income slips/screenshots of Fiverr, Upwork, or Guru.com.

Additionally, you will get the following key benefits once you open a freelancing account:

- Free Debit Card

- Free Chequebook

- Free Internet Banking

- Free e-statements

- Free SMS Alerts on every transaction and many more.

Now, let’s explore eligibility, document requirements, and the step-by-step process of Bank Alfalah Freelancer Account opening Online in detail. Here we go!

Recommended Reading: Free! How To Make a Standard Chartered Freelancer Account

How To Open Bank Alfalah Freelancer Account

Table of Contents

- How To Open Bank Alfalah Freelancer Account

- What Is Bank Alfalah Freelancer Account?

- Eligibility Criteria for Bank Alfalah Freelancer Account:

- Bank Alfalah Freelancer Account Benefits

- Bank Alfalah Freelancer Account Features

- Bank Alfalah Freelancer Account Opening Online

- Pros And Cons | Bank Alfalah Freelancer Account

- Bank Alfalah Contact Details

- Bank Alfalah Freelancer Account | FAQs

Recommended Reading: How To Get Solar Panel On Installment Meezan Bank {25 Lakh Loan}

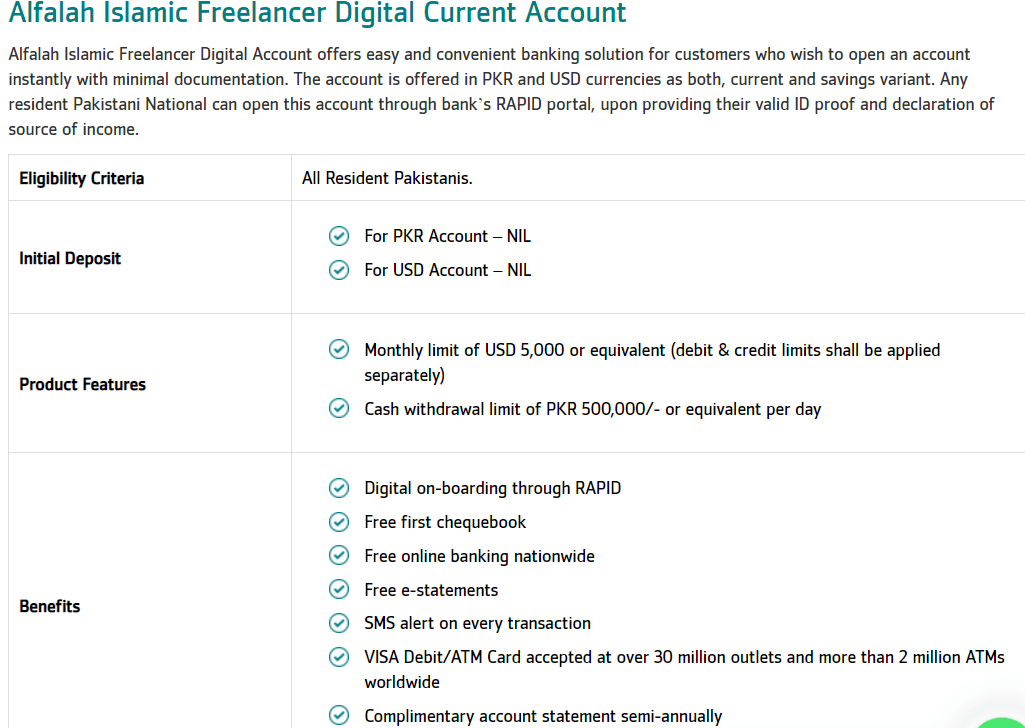

What Is Bank Alfalah Freelancer Account?

Bank Alfalah’s Freelancer Account is available in both local currency (LCY) and foreign currency (FCY), specifically in USD. What sets it apart is its flexibility and tailored features.

Additionally, account holders have the opportunity to receive a Bank Alfalah Debit Card, exclusively for PKR Accounts, enabling seamless access to their funds.

Furthermore, this freelancer-centric account provides essential tools to manage finances effectively, including the issuance of a Chequebook and the provision of free SMS alerts and e-statements.

For international transactions and financial flexibility, account holders enjoy a generous monthly limit of USD 5,000 or its equivalent, with separate debit and credit limits.

Lastly, with a daily cash withdrawal limit of Rs. 500,000 or its equivalent, freelancers can access their funds conveniently as needed.

Having stated above, You can say this account is a one-stop solution for all of your freelancing needs!

Recommended Reading: Free! How To Make A Standard Chartered Freelancer Account

Eligibility Criteria for Bank Alfalah Freelancer Account:

- Citizenship: The applicant must be a Pakistani citizen or a foreigner residing in Pakistan.

- Occupation: The applicant must be a freelancer or a self-employed individual who earns income through freelance work.

- Age Requirement: The applicant must be at least 18 years old.

- Identification: The applicant must have a valid CNIC (Computerized National Identity Card) or passport.

- Contact Information: The applicant must have a valid email address and a phone number for communication purposes.

- Proof of Income: The applicant must provide documentation or proof of their income earned through freelance work.

- Compliance: The applicant must comply with Bank Alfalah’s Anti-Money Laundering (AML) and Know Your Customer (KYC) policies, which may include providing additional identification documents or information as required.

Recommended Reading: Top 15 Car Leasing Companies In Pakistan {Tested+Reviewed}

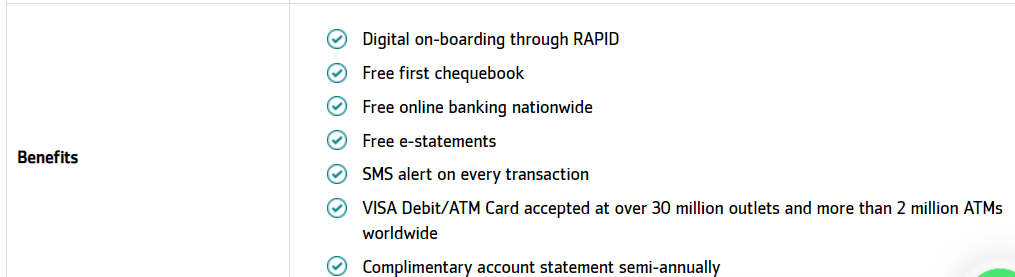

Bank Alfalah Freelancer Account Benefits

Bank Alfalah Freelancer Account offers a range of exclusive benefits tailored to meet the specific needs of freelancers and self-employed individuals.

- Digital Onboarding through RAPID: Bank Alfalah provides a hassle-free and convenient digital account opening process through its RAPID platform. This allows you to open your Freelancer Account online, eliminating the need for lengthy paperwork and in-person visits to the bank.

- Free First Chequebook: As a Freelancer Account holder, you are entitled to receive your first checkbook at no additional cost. This feature enables you to conveniently issue and receive cheques for your financial transactions.

- Free Online Banking Nationwide: Bank Alfalah offers free online banking facilities to all Freelancer Account holders. You can securely access and manage your account online, perform fund transfers, pay bills, and avail of various other banking services from anywhere in Pakistan.

- Free e-Statements: With a Bank Alfalah Freelancer Account, you will receive free electronic statements. These e-statements provide a detailed summary of your account transactions, allowing you to conveniently track and manage your finances.

- SMS Alert on Every Transaction: Bank Alfalah ensures that you stay informed about all your account activities. You will receive SMS alerts for every transaction made through your Freelancer Account, enabling you to monitor your financial transactions in real-time.

- VISA Debit/ATM Card Acceptance: Bank Alfalah’s Freelancer Account comes with a VISA Debit/ATM card that is accepted at over 30 million outlets and more than 2 million ATMs worldwide. This provides you with easy access to your funds and the convenience of making purchases or withdrawing cash globally.

- Complimentary Account Statement Semi-Annually: As an added benefit, Bank Alfalah offers complimentary semi-annual account statements for Freelancer Account holders. These statements provide a comprehensive overview of your account activity over six months, helping you track your financial progress.

Additionally, Bank Alfalah provides special benefits based on your average monthly balance:

- Free Accidental Death and Permanent Disability Takaful Coverage: By maintaining an average monthly balance of PKR 10,000/– in your checking account, you can avail of free accidental death and permanent disability takaful coverage of up to PKR 2 Million.

- Preferred Banking Services: If you maintain a minimum monthly average balance of PKR 1 million or equivalent in foreign currency deposits in your current/savings/term deposit accounts, Bank Alfalah offers a host of additional free services under their Preferred Banking Services, providing you with a more personalized banking experience.

Recommended Reading: Personal Loan For Overseas Pakistani | Loan For Overseas Pakistani Online Apply

Bank Alfalah Freelancer Account Features

Bank Alfalah Freelancer Account offers a range of features specifically designed to cater to the unique needs of freelancers and self-employed individuals. These features include:

- Available in both LCY and FCY (USD only): The Bank Alfalah Freelancer Account is available in both local currency (LCY) and foreign currency (FCY), with the FCY option limited to USD only. This allows freelancers to conveniently manage their funds in their preferred currency.

- No Minimum Balance Requirement: Unlike many traditional bank accounts, Bank Alfalah Freelancer Account does not have a minimum balance requirement. This provides flexibility for freelancers to manage their finances without the obligation of maintaining a specific balance.

- Issuance of Bank Alfalah Debit Card (only for PKR Accounts)*: For PKR (local currency) accounts, Bank Alfalah issues a debit card that enables freelancers to access their funds conveniently. The debit card can be used for purchases at various outlets and online transactions.

- Issuance of Cheque Book*: Freelancers with a Bank Alfalah Freelancer Account can request a checkbook for their financial transactions. This facilitates the issuance of cheques for payments and other business-related purposes.

- Free SMS Alerts: Bank Alfalah provides free SMS alerts for Freelancer Account holders. These alerts notify freelancers about their account activities, including transactions, balance updates, and other important account-related information.

- Free E-statements: Freelancer Account holders receive free electronic statements. These e-statements provide a detailed summary of their account transactions, helping freelancers track their financial activities and maintain accurate records.

- Monthly Limit of USD 5,000 or Equivalent: The Bank Alfalah Freelancer Account has a monthly limit of USD 5,000 or its equivalent in other currencies. This limit applies separately to debit and credit transactions, allowing freelancers to manage their cash flow effectively.

- Cash Withdrawal Limit: The cash withdrawal limit for Bank Alfalah Freelancer Account is set at Rs. 500,000 or its equivalent per day. This provides freelancers with flexibility and accessibility to their funds when needed.

Recommended Reading: How To Get Solar Panel On Installment Meezan Bank {25 Lakh Loan}

Bank Alfalah Freelancer Account Opening Online

Opening a Bank Alfalah Freelancer Account online is a convenient and straightforward process. Here is a step-by-step guide to help you through the account opening procedure:

Step 1: Visit the Bank Alfalah website: Go to the official Bank Alfalah website using a web browser on your computer or mobile device.

Step 2: Navigate to the Freelancer Account section: Locate the Freelancer Account section on the Bank Alfalah website. It may be found under the “Accounts” or “Banking” section of the website.

Step 3: Click on “Open an Account”: Look for the option to “Open an Account” or a similar phrase associated with opening a new account.

Step 4: Select the Account Type: Choose the type of Freelancer Account you want to open, such as PKR (local currency) or FCY (foreign currency) if applicable.

Step 5: Fill out the Application Form: You will be asked to provide personal details, including your full name, contact information, CNIC or passport number, and occupation as a freelancer.

Step 6: Review and Agree to Terms and Conditions: Carefully read through the terms and conditions associated with opening a Freelancer Account.

Step 7: Submit the Application: After filling in the required information and agreeing to the terms and conditions, submit your application by clicking the “Submit” or “Apply” button.

Step 8: Verification and Documentation: Bank Alfalah may require additional verification and documentation to complete the account opening process.

Step 9: Follow-Up and Communication: Keep an eye on your email inbox and phone for any communication from Bank Alfalah regarding the status of your account opening.

Step 10: Account Activation and Welcome Kit: Once your account is approved, you will receive an activation notification along with a welcome kit containing your account details, debit card (if applicable), and any other relevant information.

Recommended Reading: Top 15 Car Leasing Companies In Pakistan {Tested+Reviewed}

Pros And Cons | Bank Alfalah Freelancer Account

Pros of Bank Alfalah Freelancer Account

- Multi-currency Account: Bank Alfalah Freelancer Account offers the convenience of maintaining multiple currencies. This feature is beneficial for freelancers who work with international clients and receive payments in different currencies.

- No Minimum Balance Requirement: Unlike many traditional bank accounts, Bank Alfalah Freelancer Account does not impose a minimum balance requirement. This provides flexibility for freelancers to manage their finances without the pressure of maintaining a specific balance.

- Debit Card and Chequebook Issuance: Freelancer Account holders have access to a debit card, which allows them to conveniently withdraw cash and make purchases at various outlets and online platforms. Additionally, the option to request a checkbook facilitates business transactions that require cheque payments.

- Free SMS Alerts and E-statements: Bank Alfalah provides free SMS alerts for Freelancer Account holders. These alerts keep freelancers informed about their account activities, including transactions, balance updates, and other important information. Additionally, free e-statements offer a detailed summary of account transactions, enabling freelancers to track their financial activities easily.

- High Daily Cash Withdrawal Limit: The Bank Alfalah Freelancer Account comes with a high daily cash withdrawal limit, allowing freelancers to access their funds conveniently when needed.

Recommended Reading: List Of Top 10 Insurance Companies In Pakistan {Secure+Certified}

Cons of Bank Alfalah Freelancer Account:

- Limited Availability of Foreign Currencies: While the Bank Alfalah Freelancer Account offers multi-currency functionality, it is limited to specific currencies, with the FCY (foreign currency) option available only in USD. This may be a limitation for freelancers who frequently work with clients in currencies other than USD.

- Account-Specific Fees: While Bank Alfalah offers various features and services with the Freelancer Account, it is important to know that certain account-specific fees may apply for specific transactions or services. It is advisable to review the fee structure provided by the bank to understand any potential charges.

- Limited Branch Network: Although Bank Alfalah has a wide network of branches across Pakistan, the accessibility of physical branches may be limited in certain areas. This could be a potential inconvenience for freelancers who prefer in-person banking services or face-to-face interactions.

- Potential Additional Documentation Requirements: Depending on the circumstances, Bank Alfalah may request additional verification and documentation during the account opening process. This could add an extra step and potential delay in the account opening procedure.

Bank Alfalah Contact Details

Official Website: https://www.bankalfalah.com/

Address : Bank AlFalah Limited, 8th Floor, Business Avenue, Main Shahrah-e-Faisal, Karachi,

Phone: 021-111-225-111

E-mail: inamul.h@bankalfalah.com

Recommended Reading: How To Get A Used Car On Installments In Pakistan | Second Hand Cars On Installments

Bank Alfalah Freelancer Account | FAQs

What is Bank Alfalah Freelancer Account?

Bank Alfalah Freelancer Account is a specialized banking account designed for freelancers and self-employed individuals. It offers features and services to cater to the unique needs of individuals who earn income through freelance work.

Who is eligible to open a Bank Alfalah Freelancer Account?

To open a Bank Alfalah Freelancer Account, you must be a Pakistani citizen or a foreigner residing in Pakistan. You need to be a freelancer or self-employed individual earning income through freelance work.

Can I open a Bank Alfalah Freelancer Account if I am not a Pakistani citizen?

Yes, the Bank Alfalah Freelancer Account is available to both Pakistani citizens and foreigners residing in Pakistan.

Can I open a Freelancer Account in both PKR and USD?

Yes, the Bank Alfalah Freelancer Account can be opened in both local currency (PKR) and foreign currency (USD), with an initial deposit of only PKR 100.

What are the withdrawal limits for the Bank Alfalah Freelancer Account?

The daily withdrawal limit is Rs. 500,000 or equivalent, and there is a monthly debit and credit limit of USD 5,000 or its equivalent.

Are there any fees for SMS alerts and e-statements?

No, Bank Alfalah offers free SMS alerts and e-statements to Freelancer Account holders.

Can I access my Bank Alfalah Freelancer Account online?

Yes, Bank Alfalah provides free online banking facilities for Freelancer Account holders. You can securely manage your account, perform transactions, and avail of various banking services online.

Is there any takaful coverage provided with the Freelancer Account?

Yes, by maintaining an average monthly balance of PKR 10,000/- in your checking account, you can avail of free accidental death and permanent disability takaful coverage of up to PKR 2 Million.

What documents are required to open a Freelancer Account?

To open a Bank Alfalah Freelancer Account, you need a valid CNIC (or Pharm-B) and proof of income, such as income slips or screenshots from freelance platforms like Fiverr or Upwork.

What benefits do I get with a Bank Alfalah Freelancer Account?

Some key benefits include a free debit card, free checkbook, free internet banking, free e-statements, free SMS alerts on every transaction, and a monthly limit of USD 5,000 or equivalent.

How much monthly limit for international transactions?

Yes, there is a generous monthly limit of USD 5,000 for international transactions, with separate debit and credit limits.

How much is the daily cash withdrawal limit?

The daily cash withdrawal limit for the Bank Alfalah Freelancer Account is Rs. 500,000 or its equivalent.

What are the eligibility criteria for opening a Freelancer Account?

To be eligible, you must be a Pakistani citizen or a foreigner residing in Pakistan, at least 18 years old, and a freelancer or self-employed individual earning income through freelance work.

What is the process for opening a Bank Alfalah Freelancer Account online?

The process involves visiting the Bank Alfalah website, navigating to the Freelancer Account section, selecting the account type, filling out the application form, agreeing to terms, submitting the application, and providing necessary verification and documentation.

How can I contact Bank Alfalah for more information?

You can visit the official website at https://www.bankalfalah.com/ or contact Bank Alfalah at their address on the 8th Floor, Business Avenue, Main Shahrah-e-Faisal, Karachi. For phone inquiries, you can call 021-111-225-111 or email at inamul.h@bankalfalah.com.

Recommended Reading: Personal Loan For Overseas Pakistani | Loan For Overseas Pakistani Online Apply

If you find the information in this article valuable, we would greatly appreciate it if you could take a moment to comment and share it with others. Your support helps us reach more people with important information.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment