There are many avenues to get a micro loan in Pakistan ranging from PKR 30,000 to PKR 50,000, especially if you are a permanent employee of a govt. or private organization.

In this article, we are going to review your salary Now! You can get a microloan of at least Rs. 10,000 to Rs. 30,000 by this nano lending app within 5 minutes only for 30-90 days repayment duration.

Now, here is how you can get an advance salary loan from Abhi-Your Salary Now!

Simply,

- Go to the Google Play Store from your mobile.

- Install Abhi-Your Salary Now! loan app.

- Register yourself by providing your mobile number and CNIC details.

- Select your desired loan of Rs. 30K-50K by filling out a simple form on this app.

- After successful application submission loan amount would be transferred within 5 minutes into your Easypaisa, Jazz Cash, or bank account provided by you during application submission.

- All done! you have to return this loan amount within 30-90 days.

Now, let’s explore the terms & conditions, interest rates, maximum loan limits, and repayment terms of getting a microloan from Abhi-Your Salary Now! in detail. Here we go!

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

How To Get 30,000 Micro Loan In Pakistan Online | 30K Digital Loan In Pakistan

Table Of Contents

Recommended Reading: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

What is Abhi Your Salary Now App?

Abhi Your Salary Now! is a unique micro loan in Pakistan service that helps people with their money. It’s like having your salary in your pocket all the time.

About 80% of people in Pakistan get their salary and quickly spend it all. With ABHI micro loan in Pakistan, you can get your money whenever you need it, using the ABHI App, SMS, or WhatsApp.

You can take out some of your advance salary, pay your bills, and send money to your family or friends whenever you want.

Recommended Reading: Top 7 Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

Micro Loan Amount Provided By Abhi – Your Salary Now!

Amount

With Abhi Your Salary Now app, you can quickly and easily get a micro loan in Pakistan online, ranging from 1,000 to 30,000 rupees, in just a few minutes.

Interest Rate

Abhi – Your Salary Now! you can get a micro loan in Pakistan of 1,000 to 30,000 rupees, and you get up to 90 days to return it. The interest you pay each day can be as low as 0% and up to 0.6%.

But these rates and the number of days may vary a bit. When you borrow, they’ll provide you with all the details you need to know.

Recommended Reading: Top 3 Loan Apps In Pakistan (50K-100K Urgent Cash Loan)

Late Fee

If you’re late with your payment, there’s a penalty of 2% to 2.5% per day, but these rates and the number of days may vary a bit.

SECP Verified App

Abhi Your Salary Now micro loan in Pakistan is verified by SECP and it is one of 3 microloan apps that have been verified and allowed by SECP for online lending services in Pakistan.

The SECP has stated that only these three small-scale lending applications have successfully met the regulatory criteria (outlined in Circular 10). These micro-lending apps have been officially announced by SECP.

- Abhi – Your Salary Now!

- Paisayaar

- SmartQarza.

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

How To Get Loan From Abhi Your Salary Now App?

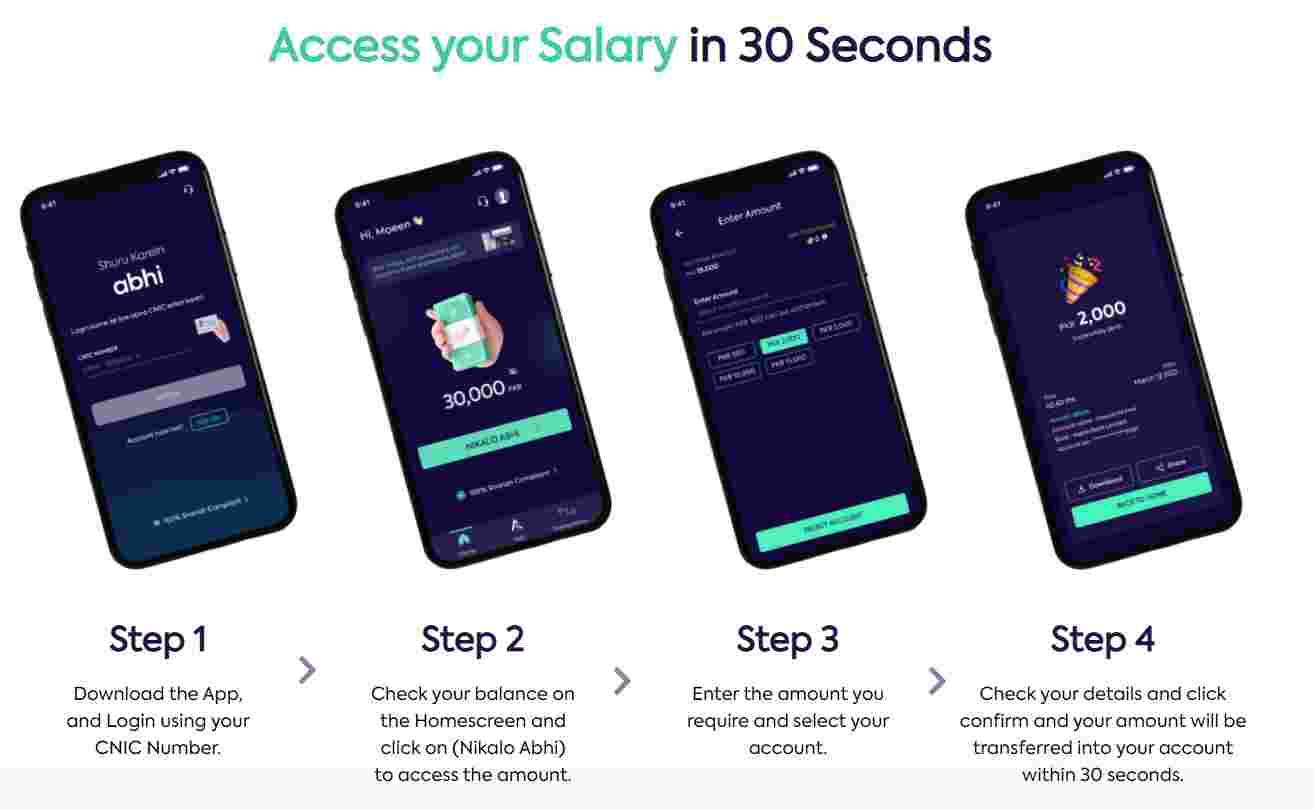

Here’s a detailed step-by-step guide on how to get a micro loan in Pakistan from the Abhi Your Salary Now App:

Step 1: Download and Login

- Start by downloading the “Abhi Your Salary Now” app from your app store.

- After installation, open the app and log in using your CNIC Number. This step is essential for verification and access.

Step 2: Check Your Balance

- Once you’re logged in, you’ll land on the app’s home screen. Here, you can check your existing balance.

Step 3: Request a Loan

- To access a loan, tap on the “Nikalo Abhi” option on the home screen. This will initiate your loan request.

Step 4: Specify Loan Amount and Account

- You’ll be prompted to enter the amount you require as a loan. Type in the desired loan amount that you need.

- Next, choose the account where you want the loan amount to be deposited.

Step 5: Confirm and Receive Funds

- After specifying the loan amount and selecting your account, please review all the details you’ve entered to ensure they are accurate.

- Once you’ve verified the information, click the “confirm” button. Your microloan request will be processed.

Step 6: Loan Transfer

- After confirming, the loan amount will be transferred to your selected account swiftly, usually within 30 seconds.

Recommended Reading: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

How To Get 30K-50K Micro Loan From Abhi – Your Salary Now! App?

Here is the Working Process Of Abhi Your Salary Now micro loan in Pakistan:

- Sign Up and Download: Your company teams up with Abhi, and as an employee, you grab the Abhi mobile app.

- Check Your Money: When you open the app, it shows how much money you have, which grows every day.

- Use Your Cash: If you need to spend some of this money, just type in how much you want.

- Fast Money Move: The money you asked for is sent to your chosen account super quick, in just 30 seconds.

- Small Charge: Remember, there’s a 100 rupees fee for every micro loan transaction you make.

- Automatic Money Moves: The fee is taken out of your account automatically, and your salary at work is adjusted to match.

- The Rest of Your Salary: Your company gives you the rest of your salary like usual, and it goes into your account just like before.

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

Why It’s Important To Financially Empower Employees

Low Incomes: Approximately 50% of the employed population earns 76,900 PKR or less, which often falls short of covering their full range of financial needs.

Unexpected Expenses: Nearly 55% of employees encounter unforeseen expenses that exceed their typical monthly salary. This situation can lead to financial stress.

Interest in Earned Wage Access: An impressive 85% of employees have shown keen interest in gaining a microloan whenever required. This access can significantly enhance their ability to manage their finances effectively.

Employee Well-being: The inability to access the microloan amounts during emergencies can have a detrimental impact on employees’ overall well-being and morale.

Approximately 81% of employers recognize this influence, underscoring the significance of financial empowerment in providing employees with a greater sense of security and contentment.

Recommended Reading: Fori Loan In Pakistan (20K-2Lakh) | Emergency Cash Loan In Pakistan

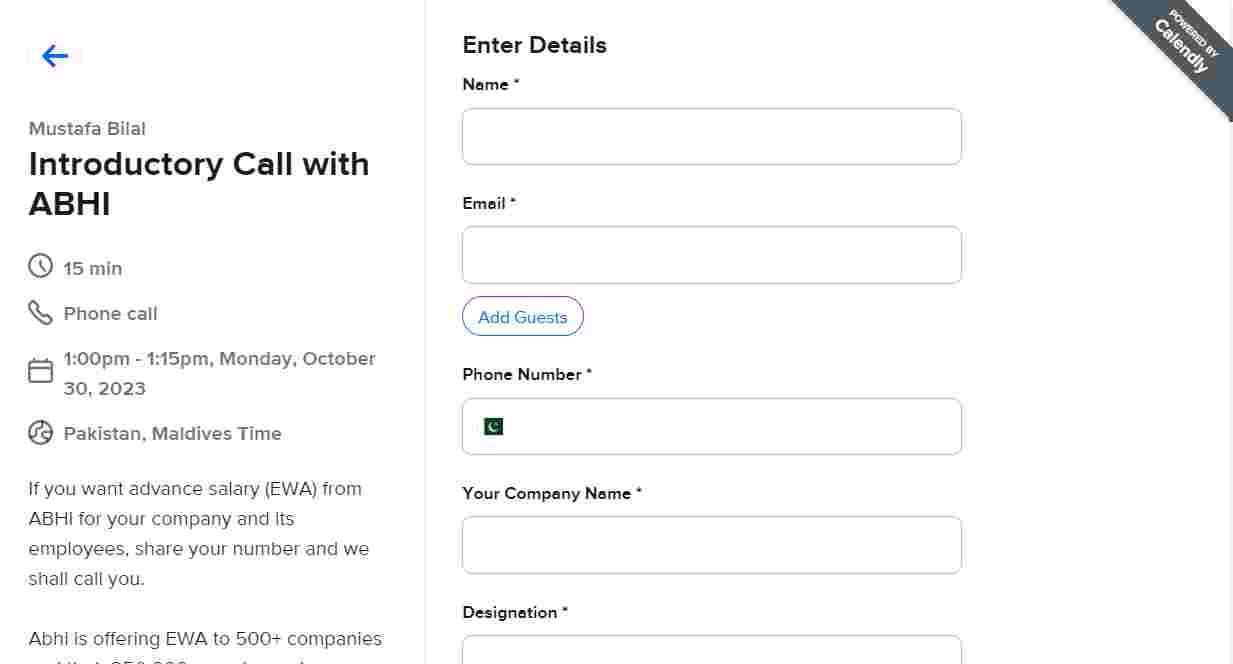

How To Contact With Abhi Salary Now App?

You can also get in touch with this app for an introductory call.

Introductory Call with ABHI

- Duration: 15 minutes

- Type: Phone call

- Schedule: Monday, October 30, 2023, from 1:00 pm to 1:15 pm (Pakistan, Maldives Time)

Abhi is providing EWA services to over 500 companies and their 250,000+ employees!

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

Contact Details Of Abhi Your Salary Now App

Here are the Contact details of Abhi Your Salary Now App:

- Address: 505A, 5th Floor Fortune Towers, Shahrah-e-Faisal, Karachi Office # 5, Floor 6, Askari Corporate Tower, Lahore.

- Email: connect@abhi.com.pk.

- Phone: +92 304 111 5276.

Recommended Reading: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

FAQs | Micro Loan In Pakistan

What is the Abhi Salary Now App?

The Abhi Salary Now micro loan in Pakistan is a financial empowerment platform that allows salaried individuals to access their earned but unpaid salaries at any time as a microloan. It provides a convenient way to access and manage your money.

How does the Abhi Salary Now App work?

The micro loan in Pakistan works by displaying your available balance, which grows daily and reaches its maximum at the end of the month. You can request to withdraw money from this balance whenever you need it.

How can I download and get started with the Abhi Salary Now App?

To get started, you can download the Abhi Salary Now micro loan in Pakistan from your Play Store/App Store. After installation, you can log in using your CNIC Number and get a microloan of 30K within seconds.

How quickly can I access the money I request through the Abhi Salary Now App?

The requested microloan in Pakistan is typically transferred to your selected account within just 30 seconds.

Are there any fees associated with using the Abhi Your Salary Now App?

Yes, there is a 100 rupees charge for each time you get a micro loan in Pakistan from Abhi-YourSalary Now! App

How is the transaction fee deducted, and what about the rest of my salary?

The transaction fee is automatically deducted from your account, and the remaining part of your salary is credited through your regular payroll.

How can I contact Abhi for further information or support?

If you need more information or assistance, you can request an introductory call with Abhi through the app. The call typically lasts for 15 minutes and can be scheduled at your convenience.

How many employees have shown interest in accessing their earned wages on-demand, and what percentage is this?

An impressive 85% of employees have expressed interest in having access to their earned wages whenever needed.

What are the Top 3 microloan apps verified Apps by SECP?

Here are the names of the Top 3 microloans in Pakistan verified by SECP:

1. Abhi – Your Salary Now!

2. Paisayaar

3. SmartQarza.

What is the maximum loan amount I can request through the Abhi App?

The maximum loan amount available through the Abhi Salary Now micro loan in Pakistan is typically between 1,000 PKR to 30,000 PKR, depending on your specific financial situation and eligibility.

Can I access my earned salary 24/7, or are there specific hours for transactions?

You can access your earned salary at any time, 24/7, through the Abhi Salary Now micro loan in Pakistan, providing flexibility for your financial needs.

What is the late fee charged on loans obtained through the Abhi Salary Now App?

If you’re late with your payment, there’s a penalty of 2% to 2.5% per day, but these rates and the number of days may vary a bit. When you borrow any amount of micro loan, they’ll provide you with all the details you need to know.

Contact details of Abhi Your Salary Now App?

Here are the Contact details of Abhi Your Salary Now micro loan in Pakistan:

Address: 505A, 5th Floor Fortune Towers, Shahrah-e-Faisal, Karachi Office # 5, Floor 6, Askari Corporate Tower, Lahore

Email: connect@abhi.com.pk

Phone: +92 304 111 5276.

How can I apply for a microloan from Abhi Your Salary Now micro loan in Pakistan?

To apply for a micro loan in Pakistan, follow these steps:

Download and install the Abhi Your Salary Now app from the Google Play Store.

Register using your mobile number and CNIC details.

Choose your loan amount (PKR 30,000 to PKR 50,000) by filling out a simple form.

To apply for a microloan, follow these steps:

After submission, the loan amount will be transferred within 5 minutes to your Easypaisa, Jazz Cash, or bank account.

How many companies and employees does the Abhi Your Salary Now micro loan in Pakistan serve?

Abhi is currently providing Earned Wage Access (EWA) services to over 500 companies and their 250,000+ employees in Pakistan.

Why is it crucial for employees to have access to micro-loans in Pakistan, as emphasized by the SECP?

The Securities and Exchange Commission of Pakistan verifies and approves the Abhi micro loan in Pakistan as one of the three microloan apps meeting regulatory criteria, highlighting the significance of financial empowerment.

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment