The National Bank of Pakistan (NBP) has a special program called the Cash n Gold Loan, where you can get loan money by using your gold as security.

With this program, you can get a loan ranging from Rs. 50,000 to Rs. 7,000,000 to meet your various needs. Whether it’s for education, weddings, medical bills, or anything else, this loan can help you out.

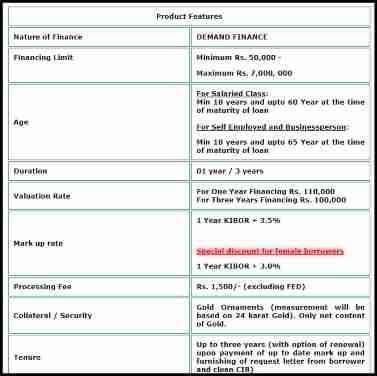

Here are the details of the National Bank Cash n Gold Loan Program:

Loan Amount: Minimum Rs. 50,000-Maximum Rs. 7,000, 000

Duration: 01 year / 3 years

Mark up rate: 1 Year KIBOR + 3.5%, Special discount for female borrowers1 Year KIBOR + 3.0%

Security: Gold Ornaments (measurement will be based on 24-karat Gold). Only net content of Gold.

In this article, we discuss Gold Loan eligibility criteria, Processing fee, documents required, the application process, how to apply, and how to get a gold loan from NBP Bank. So, let’s discuss it!

Recommended Reading: NBP Al-Ghazi Tractor Loan Scheme | NBP Kisan Tractor Scheme 2024

Gold Loan In Pakistan (Get PKR 50K-70Lakh Gold Loan-NBP) [Sharia-Compliant]

Table of Contents

Recommended Reading: HBL Salary Loan (Get PKR 25K-30Lakh Salary Loan In Pakistan) [Sharia-Compliant]

What is a Cash n Gold Loan?

The National Bank of Pakistan (NBP App) presents the Cash n Gold Loan, a Sharia-compliant financing alternative secured by the pledge of gold ornaments.

This initiative supports such as education, marriage, medical expenses, or any other lawful purpose.

Purpose: The Cash n Gold Loan is expressly designed to address various domestic needs, encompassing but not limited to education, marriage, medical expenses, or any other lawful purpose.

Loan Range: Borrowers have the flexibility to access the Cash n Gold Loan with a minimum amount of Rs. 50,000, making it an adaptable choice catering to a range of financial requirements.

Maximum Limit: The loan extends up to an impressive Rs. 7,000,000, providing substantial financial backing for individuals seeking higher amounts to fulfill their specific needs.

Recommended Reading: Advance Salary Loan (Get PKR 25K-30Lakh Salary Loan) [Sharia-Compliant]

Eligibility Criteria For Gold Loan

For Salaried Class:

- Age Range: Applicants are required to be a minimum of 18 years old and up to 60 years old at the time of loan maturity.

- For Self-Employed and Businessperson:

- Age Range: Individuals falling under the self-employed and business categories should be a minimum of 18 years old and up to 65 years old at the time of loan maturity.

- Loan Duration Options: The loan duration options offer flexibility with both a one-year and three-year term.

- Financing Amounts:

- For One-Year Financing: The sanctioned amount stands at Rs. 105,000.

- For Three-Year Financing: The approved amount is Rs. 97,000.

- Markup Rates: The Markup rate is determined as 1 Year KIBOR + 3.5% for male borrowers.

- Special Discount for Female Borrowers: Female borrowers benefit from a special discount, with the Markup rate set at 1 Year KIBOR + 3.0%.

- Processing Fee: The processing fee for the loan is Rs. 1,500 (excluding FED), contributing to transparency in the overall cost structure.

Recommended Reading: Top 3 Banks To Get Gold Loan In Pakistan (Get 50K-1Crore Gold Loan)

Security/Collateral Requirements

Type of Collateral

The security for the Cash n Gold Loan takes the form of gold ornaments, with the measurement based on 24-karat gold. Valuation is determined by the net content of gold present in the provided ornaments.

Collateral Duration:

The collateral is accepted for a period of up to three years, with the option for renewal. loan duration has the flexibility to extend the arrangement by keeping markup payments up-to-date and submitting a request letter.

Recommended Reading: Ehsaas Kafalat Program Registration PKR 12,000 (SMS CNIC 8171) {Updated}

Benefits of Cash and Gold Loans

No Minimum Income Requirement: Unlike certain loan programs, the Cash n Gold Loan adopts an inclusive approach by not imposing a minimum income requirement.

Flexible Markup Servicing: Markup servicing is structured with flexibility, allowing borrowers to choose between quarterly or annual basis payments.

Free Insurance Coverage: Borrowers enjoy a valuable perk with free insurance coverage for the net gold ornaments pledged as collateral.

Transparent Charges: Documentation charges associated with the Cash n Gold Loan are transparently assessed at actual rates.

Recommended Reading: NBP Al-Ghazi Tractor Loan Scheme | NBP Kisan Tractor Scheme 2024

Required Documents for Cash and Gold Loan

- Identification Documents: Submission of a copy of CNIC/SNIC (Computerized National Identity Card/Smart National Identity Card) is mandatory for the Applicant, Nominee, and Introducer.

- Original CNICs must be presented before a Bank Officer for verification.

- Photographs: Three recent passport-size photographs of the Applicant and Nominee(s) are essential for documentation purposes.

- Nomination Form: Applicants are required to submit a completed Nomination Form following the attached format; compliance with this requirement is mandatory.

- CF-1 Undertaking: Submission of a CF-1 Undertaking, as per the format provided by the State Bank of Pakistan (SBP), is necessary to ensure adherence to regulatory guidelines.

- Proof of Address: Providing a current utility bill serves as proof of address for the applicant.

- Salaried Individuals: Salaried individuals need to include a copy of their salary slip as part of the documentation process.

- Business Persons: Business persons are required to provide their bank statements as part of the documentation process, facilitating a comprehensive assessment of the financial standing of self-employed individuals.

Recommended Reading: HBL Salary Loan (Get PKR 25K-30Lakh Salary Loan In Pakistan) [Sharia-Compliant]

Contact Information

Authorized Branch Visits: Applicants have the flexibility to visit any authorized National Bank of Pakistan (NBP) branch for inquiries and to apply for the Cash n Gold Loan.

Meet with the Branch Manager or Operations Manager: Upon reaching the branch, individuals are encouraged to seek assistance from the Branch Manager for guidance on the Cash n Gold Loan application. In the absence of the Branch Manager, the Operations Manager is available to address inquiries and guide applicants through the loan application process.

- Official Website: https://www.nbp.com.pk/

- Phone: (+92-021)111-627-627

- Address: NBP Building, I.I. Chundrigar Road, Karachi, Pakistan.

Recommended Reading: Advance Salary Loan (Get PKR 25K-30Lakh Salary Loan) [Sharia-Compliant]

FAQs | NBP Gold Loan In Pakistan

What is the loan range offered by the National Bank of Pakistan’s Cash n Gold Loan?

![Gold Loan In Pakistan (Get PKR 50K-70Lakh Gold Loan-NBP) [Sharia-Compliant] 1 Loan-Detail](https://governmentschemes.pk/wp-content/uploads/2024/03/Loan-Detail-150x150.jpg)

The loan range spans from Rs. 50,000 to Rs. 7,000,000, providing a versatile financial solution for varying needs.

What are the eligibility criteria for the Cash n Gold Loan for the salaried class?

Salaried individuals must be a minimum of 18 years old and up to 60 years old at the time of loan maturity.

How about the eligibility criteria for self-employed and businesspersons under the Cash n Gold Loan program?

![Gold Loan In Pakistan (Get PKR 50K-70Lakh Gold Loan-NBP) [Sharia-Compliant] 2 Cash-n-Gold-Loan](https://governmentschemes.pk/wp-content/uploads/2024/01/Cash-n-Gold-Loan-150x150.jpg)

Individuals in the self-employed and business categories should be a minimum of 18 years old and up to 65 years old at the time of loan maturity.

Can you provide details about the financing amounts for one-year and three-year terms?

![Gold Loan In Pakistan (Get PKR 50K-70Lakh Gold Loan-NBP) [Sharia-Compliant] 3 Required-Documents-for-Cash-n-Gold-Loan](https://governmentschemes.pk/wp-content/uploads/2024/01/Required-Documents-for-Cash-n-Gold-Loan-150x150.jpg)

For one-year financing, the sanctioned amount is Rs. 105,000, while for three-year financing, the approved amount is Rs. 97,000.

How can applicants apply for the Cash n Gold Loan, and where can they get more information?

![Gold Loan In Pakistan (Get PKR 50K-70Lakh Gold Loan-NBP) [Sharia-Compliant] 2 Cash-n-Gold-Loan](https://governmentschemes.pk/wp-content/uploads/2024/01/Cash-n-Gold-Loan-150x150.jpg)

Applicants can visit any authorized National Bank of Pakistan (NBP) branch to inquire about and apply for the Cash n Gold Loan. They can also explore the official website https://www.nbp.com.pk/ or contact the bank at (+92-021)111-627-627 for further details.

Recommended Reading: Advance Salary Loan (Get PKR 25K-30Lakh Salary Loan) [Sharia-Compliant]

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment