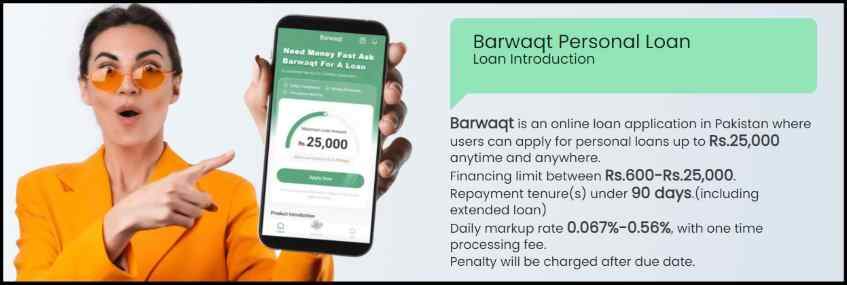

Barwaqt is an online loan app in Pakistan where you can easily apply for loans. It’s a good online loan platform that uses advanced technology to protect your privacy and offers high-quality smart credit loan services.

You can request personal loans of up to Rs.25,000, applying whenever and wherever you need. Repayment is flexible, up to 90 days, with a daily interest rate of 0.067%-0.56% and a one-time processing fee.

Remember, there’s a penalty for late repayment, so be cautious. Barwaqt is a genuine and SECP-verified loan app, always use the Token ID for repayment (personal bank account / Easypaisa / Jazz Cash account, etc.), and never transfer the amount to personal accounts or mobile wallets.

In this article, we discuss about Barwaqt Loan App, eligibility criteria, documents required, loan details, interest rate, application fee, application process, how to apply for a loan, and how to get a loan.

Recommended Readings: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

Get 20,000 To 30,000 Rupees Loan Urgently| Barwaqt Loan App SECP

Table Of Contents

Recommended Readings: Top 3 Loan Apps In Pakistan (50K-100K Urgent Cash Loan)

What is the Barwaqt App?

Barwaqt is an online loan app in Pakistan where you can request up to Rs.25,000 personal loans. The best part is you can apply for this loan whenever and wherever you need it.

The loan amount can be between Rs.600 and Rs.25,000, and you have up to 90 days to pay it back, including any extended period. The daily interest rate is between 0.067% and 0.56%, with a one-time processing fee.

Be careful about repayment, as a penalty will be charged if you miss the due date. Unlike some fake loan apps, Barwaqt is a real and SECP-verified loan app in Pakistan. Always use the Token ID for repayment and never pay the loan amount to any personal bank account, Easypaisa, Jazz Cash, etc.

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

Barwaqt Loan Amount

Barwaqt is an app in Pakistan where you can ask for a personal loan online, and you can get up to Rs. 25,000. You can apply whenever you need it, and anywhere in Pakistan.

Barwaqt Loan Interest-Rate

Loan Details:

- Loan Amount: You can get a loan amount from PKR 1,500 to PKR 25,000.

- Loan Term: Choose a repayment period between 61 days to 90 days.

- APR (Annual Interest Rate): The annual interest rate is 24%.

- Maximum APR: The highest interest rate is also 24%.

- Other Fees: No additional fees.

(The APR is related to the risk profile of each customer depending on their income, credit history, other borrowings, re-payment history with us, and the result received from the Credit Bureau.)

Recommended Reading: Get 25K Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

Barwaqt Loan Calculator | Barwaqt Loan Interest-Rate On 50,000

Certainly, let’s example of a Barwaqt loan for PKR 6,000 over 3 months:

- Monthly Markup Rate Calculation:

- Barwaqt’s annual interest rate is 24%. To find the monthly interest rate, divide this by 12 (the number of months in a year): 24% / 12 = 2%.

- Total Markup Calculation:

- To find the total markup for the entire loan period, multiply the loan amount (PKR 6,000) by the monthly interest rate (2%) and then multiply by the number of months (3):

- Total Markup = PKR 6,000 * 2% * 3 = PKR 360.

- To find the total markup for the entire loan period, multiply the loan amount (PKR 6,000) by the monthly interest rate (2%) and then multiply by the number of months (3):

- Total Repayment Amount:

- Add the total markup to the loan amount to get the total repayment amount:

- Total Repayment Amount = PKR 6,000 + PKR 360 = PKR 6,360.

- Add the total markup to the loan amount to get the total repayment amount:

- Monthly Payment Amount:

- Divide the total repayment amount by the number of months to find the monthly payment:

- Monthly Payment Amount = PKR 6,360 / 3 = PKR 2,120.

- Divide the total repayment amount by the number of months to find the monthly payment:

So, for a Barwaqt loan of PKR 6,000 over 3 months, the borrower would pay PKR 6,360, with monthly payments of PKR 2,120.

Recommended Reading: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

Barwaqt Loan App Is Real Or Fake?

Barwaqt Loan App is a real and approved online loan app in Pakistan. Barwaqt loan is verified by SECP Pakistan. You can trust this app for loans, but remember, there are fees attached to the loan amount, and it’s not interest-free. These loan processes are not according to Islamic principles.

Top SECP Verified Loan Apps:

Recommended Reading: Top 7 Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

Barwaqt Loan App Eligibility Criteria For Loan Application

These criteria are in place to ensure that loan applicants fall within a specific age range, possess Pakistani citizenship, and maintain a steady monthly income, making them suitable candidates for Barwaqt’s loan services.

Eligibility Criteria for Barwaqt Loans:

- Age: Applicants must be between 18 and 60 years old.

- Nationality: Only Pakistani citizens are eligible.

- Income: A minimum monthly income of 30,000 PKR is required.

Barwaqt Loan App Download

Barwaqt is an online loan application in Pakistan, that provides users with a convenient platform to apply for loans. It employs advanced big data risk control technology for credit scoring assessments, ensuring the protection of your privacy.

Barwaqt serves as an excellent financial service platform in Pakistan, offering high-quality online smart credit loan services. The platform provides hassle-free online loans without any mortgage, and its installment loan options aim to reduce user repayment pressures.

Recommended Reading: Fori Loan In Pakistan (20K-2Lakh) | Emergency Cash Loan In Pakistan

Barwaqt Loan App Download For PC

Barwaqt Loan App Download For PC:

- Open the Google on your PC/Laptop device.

- Search for “Barwaqt”.

- Select the Barwaqt app.

- Click on the “Install” button to download and install the app.

Barwaqt Loan App For Android

Fr Android User:

- Open the Google Play Store on your Android device.

- Search for “Barwaqt”.

- Select the Barwaqt app.

- Click on the “Install” button to download and install the.

Barwaqt Loan App Download For iPhone

For Apple User:

- Open the Apple App Store on your iOS device.

- Search for “Barwaqt”.

- Locate the Barwaqt app.

- Tap on the “Download” or “Get” button to install the app on your device.

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

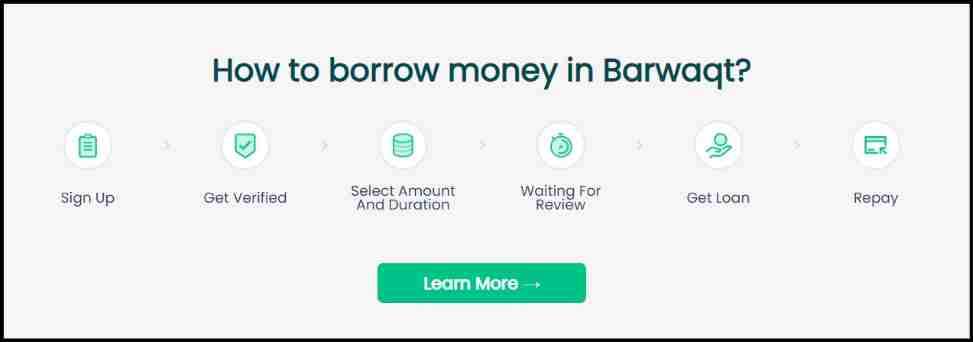

How To Get Urgent Cash Loan From Barwaqt Loan App?

How To Get Cash Loan From Barwaqt Loan App:

Total Time: 2 minutes

Download Barwaqt:

Go to the Google Play Store on your phone.

Search for “Barwaqt” and download the app.

Register:

Sign up using your mobile phone number.

Complete Application:

Fill in your details.

Take a clear photo.

Submit your application.

Wait for Approval:

After submission, wait for your loan to be approved.

Disbursement:

Once approved, the loan amount will be given to you.

Barwaqt Loan App Helpline Number

- Barwaqt Loan WhatsApp Number: 021-36495000

- Barwaqt Helpline Number: 021-36494000

- Email: cs@barwaqtfintec.com

- Address: LDA Community Centre, Near Barkat Market Passport Office, Lahore

- Service Timing: 9 AM-9 PM, 7 days a week.

Recommended Reading: Get 50K-1Lakh Digital Loan In Pakistan | SECP Registered Loan Apps

Barwaqt Loan App Owner

Owner/Chief Executive Officer: Muhammad Abrar Ameen

Muhammad Abrar Ameen CEO, Barwaqt: Safe, flexible online loans. No hidden fees. Your info is secure. We assess risk and credit for your loan. Vision: Inclusive digital credit for all in Pakistan. Mission: Empower those without traditional bank access with easy, reliable micro-credit solutions.

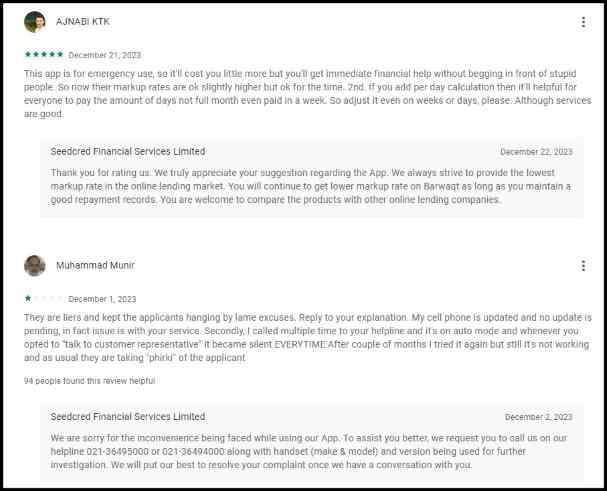

Barwaqt Loan App Reviews

User Reviews:

AJNABI KTK: This app is for emergencies, so it might cost a bit more, but you get quick financial help without having to ask annoying people. The interest rates are a bit higher, but okay for urgent needs. Also, if they calculate per day, it would be better for everyone, especially if you want to pay for just the days you used, not the whole month. Please consider adjusting for weeks or days. Overall, the services are good.

Muhammad Munir: They are not honest and leave applicants waiting with lame excuses. In response to your explanation, my phone is updated, and there’s no issue on my end. I’ve called multiple times, and the helpline is always in auto mode. When I choose to talk to a customer representative, it goes silent EVERY TIME. After a couple of months, I tried again, but it’s still not working, and they are still giving lame excuses.

Barwaqt Loan App

Barwaqt cares about your safety. If you face any issues like rude language or privacy threats from our staff, keep proof and complain to us. We don’t tolerate such behavior.

Your loan from Barwaqt needs your confirmation. You can cancel during the application. We never give a loan without your permission. If you applied by mistake, repay the principal and fees within 24 hours, costing 100 PKR. If you want to cancel, contact us, and we’ll help. Use the Token ID for repayment – it’s the only secure way. Don’t pay to personal accounts; we don’t take responsibility for payments outside the Barwaqt token.

List Of Registered Loan Apps In Pakistan | Loan Apps In Pakistan 2024

List Of Registered and SECP Verified Loan Apps In Pakistan:

- Barwaqt

- Paisayaar

- Abhi- Your Salary Now!

- Zoodpay

- Muawin

Recommended Reading: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

Loan Apps Banned In Pakistan

Here is the list of Loan Apps Banned In Pakistan:

- PK Loan

- AiCash

- Asan Qarz

- B Cash

- Credit Cat

- Easy Loan

- Kredit

- Bonga

- Udhar Paisa

- Plati Loans

- Mrloan

- Fast Loan

- Easy Money

- CashBeam

- CashMate

- Zenn Park -Easy Instant Help

- Bee Cash

- Asaan Qarza- credit loans

Recommended Reading: Top 7 Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

FAQs | Barwaqt Loan App

What is the Barwaqt Loan App?

Barwaqt offers real and SECP-verified online loans in Pakistan, up to Rs.25,000. Apply anytime, and repay within 90 days, with daily interest (0.067%-0.56%) and a processing fee. Use Token ID for repayment; avoid personal accounts. No responsibility for payments outside Barwaqt.

How much loan amount given by the Barwaqt Loan App?

Barwaqt Loan App amounts range from Rs.600 and Rs.25,000, and you have up to 90 days to pay it back, including an extended period. The daily interest rate is between 0.067% and 0.56%, with a one-time processing fee.

Loan details of the Barwaqt loan App?

Barwaqt is an online loan application in Pakistan that allows users to request personal loans up to Rs. 25,000. You can apply anytime and anywhere through the app. Barwaqt offers personal loans ranging from PKR 1,500 to PKR 25,000. A repayment period between 61 days to 90 days for a Barwaqt loan App. Barwaqt charges an annual interest rate of 24%.

How is the monthly markup rate calculated for Barwaqt loans?

The monthly markup rate for Barwaqt loan App is calculated by dividing the annual interest rate (24%) by 12, resulting in a monthly rate of 2%.

Here is an example of a loan calculation for PKR 6,000 over 3 months.

Let’s take an example of a Barwaqt loan App for PKR 6,000 over 3 months:

Monthly Markup Rate Calculation: Barwaqt charges an annual interest rate of 24%. To find the monthly rate, divide this by 12 (the number of months): 24% / 12 = 2%.

Total Markup Calculation: To calculate the total markup for the entire loan period, multiply the loan amount (PKR 6,000) by the monthly interest rate (2%), then multiply by the number of months (3):

Total Markup = PKR 6,000 * 2% * 3 = PKR 360.

Total Repayment Amount: Add the total markup to the loan amount:

Total Repayment Amount = PKR 6,000 + PKR 360 = PKR 6,360.

Monthly Payment Amount: Divide the total repayment amount by the number of months to find the monthly payment:

Monthly Payment Amount = PKR 6,360 / 3 = PKR 2,120.

So, for a Barwaqt loan of PKR 6,000 over 3 months, the borrower pays PKR 6,360, with monthly payments of PKR 2,120.

What are the eligibility criteria for a Barwaqt loan App?

To be eligible for Barwaqt loan App, applicants must be between 18 and 60 years old, Pakistani citizens, and have a minimum monthly income of 30,000 PKR.

How do I apply for a Barwaqt loan App?

To apply for a Barwaqt loan App, download the app from the Google Play Store or Apple App Store, register with your mobile number, fill in your details, and apply. Wait for approval, and once approved, the loan amount will be disbursed.

What are the top 5 SECP Verified Loan Apps in Pakistan?

Here is also the List of Top SECP Verified Loan Apps in Pakistan:

Barwaqt

SmartQarza Loan App

Paisayaar Loan App

Abhi-Your Salary Now! Loan App.

Muawin

What are the Banned Loan Apps in Pakistan?

Here is the list of the Banned Loan Apps in Pakistan:

PK Loan, AiCash, Asan Qarz, B Cash, Credit Cat, Easy Loan, Kredit. Bonga. Udhar Paisa, Plati Loans, Mrloan, Fast Loan, Easy Money, CashBeam, CashMate, Zenn Park -Easy Instant Help, Bee Cash, Asaan Qarza- credit loans.

What reviews do people show about the Barwaqat app?

AJNABI KTK: This app is designed for emergencies, so it may cost a bit more. The interest rates are acceptable, slightly higher but reasonable for urgent needs. It would be better if they calculate on a per-day basis, especially if you only want to pay for the days you use, not the entire month. Consider adjusting for weeks or days. Overall, the services provided are good.

Muhammad Munir: Unfortunately, they are not transparent and leave applicants waiting with weak excuses. Despite their explanation, my phone is updated, and there’s no issue on my end. I’ve made several calls, but the helpline is always in auto mode. Every time I try talking to a customer representative, it goes silent. Even after a few months of trying again, it still doesn’t work, and they continue providing weak excuses.

What is the recommended method for loan repayment with Barwaqt?

It is recommended to use the Token ID provided by Barwaqt for loan repayment and avoid transferring funds to personal accounts or mobile wallets. like (personal bank account / Easypaisa / Jazz Cash account etc.).

What precautions should borrowers take regarding payments and communication with Barwaqt?

Borrowers should use the Token ID for repayment to ensure security. Payments should not be made to personal accounts, and any communication issues or concerns should be promptly reported to Barwaqt.

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment