Many organizations in Pakistan have taken a significant step by extending interest-free agricultural loans to farmers In Pakistan.

These loans are Interest-Free, offering a financial lifeline to those engaged in agriculture.

The loan amounts made available through this program range from PKR 5 lakhs to as much as 75 lakhs, and the application process ensures swift disbursement within just a few weeks.

This is a big opportunity for farmers in Pakistan to expand their agricultural businesses.

These Organizations and Banks that give this loan:

- Zarai Taraqiati Bank (ZTBL) Agriculture Loan

- National Bank of Pakistan (NBP) Agriculture Loan

- PM Youth Business and Agriculture Loan

- Pakistan Poverty Alleviation Authority Agriculture Loan

- Alkhidmat Foundation Business and Agriculture Loan

- Akhuwat Agriculture Loan

So, Let’s discuss it!

Recommended Reading: Interest-Free Marriage Loan In Pakistan (35K-2Lakh) | Marriage Grant

Interest-Free Agriculture Loan In Pakistan | Agriculture Loan Schemes

Table Of Contents

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

Zarai Taraqiati Bank (ZTBL) Agriculture Loan

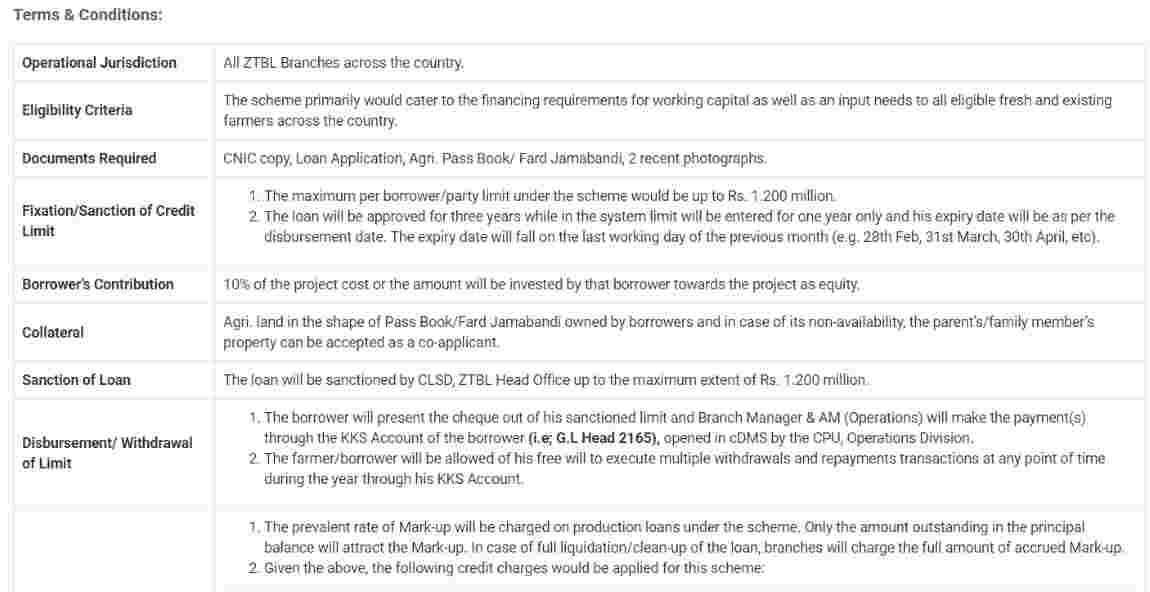

ZTBL bank is working hard to give farmers the credit they need on time. They understand the real needs of the farming community. To make things easier for farmers, they’re introducing a new scheme.

This scheme will let farmers get credit easily, and they only need to do paperwork once every three years.

After one year, they need to pay back the loan. They can take out money when they need it and put it back when they have extra funds. This way, it’s more convenient for farmers.

Loan Amount

Zarai Taraqiati Bank plays a vital role in supporting farmers with their agricultural needs. The scheme’s maximum limit per party is set at Rs. 1.200 million.

One significant aspect of this support is the provision of agricultural loans, with a substantial maximum limit of 12 lakh rupees. This amount is noteworthy as it can make a significant impact on a farmer’s operations and investments in their agricultural endeavors.

Recommended Reading: 10 Lakh Loan Without Interest In Pakistan Online Apply {Interest-free}

Zarai Taraqiati Bank Agriculture Loan Eligibility Criteria+Documents+Requirements

- Eligibility Criteria: This program is designed to address the financial needs of both new and existing farmers throughout the country, primarily focusing on providing funds for their working capital and agricultural input requirements.

- Documents Required:

- CNIC Copy: A copy of your Computerized National Identity Card (CNIC) is needed for identification and to verify your details.

- Loan Application: You will need to complete a loan application form, which provides information about the type of loan you’re requesting, the purpose of the loan, and other relevant details.

- Agri. Pass Book/Fard Jamabandi: This document, which is an Agricultural Pass Book or Fard Jamabandi, is used to confirm your ownership or tenancy of agricultural land.

- Two Recent Photographs: These passport-sized photographs are typically required for record-keeping and identification purposes.

How To Apply For ZTBL Agriculture Loan

To apply for the loan, follow these steps:

- Visit the Nearest ZTBL Branch: Begin by visiting the nearest ZTBL branch. You can locate the closest branch by visiting the official ZTBL website at https://ztbl.com.pk/ztbl-islamic-banking-branches/ to find branch locations.

- Obtain Application Form: Once at the branch, request the loan application form.

- Fill it and Attach Documents: Carefully fill out the application form, providing accurate and complete information.

- Submit It: Once you have filled out the form and attached the necessary documents, submit your loan application to the ZTBL branch.

- Application Status: After all of that inform you whether your application is accepted or not.

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

ZTBL Contact Number

- Phone: 051- 111-30-30-30

- Email: contactus@ztbl.com.pk

- Headquarters: 1 Faisal Ave, Near Zero Point Interchange, G-7/1, Islamabad Capital Territory, P.O Box 1400.

National Bank of Pakistan (NBP) Agriculture Loan

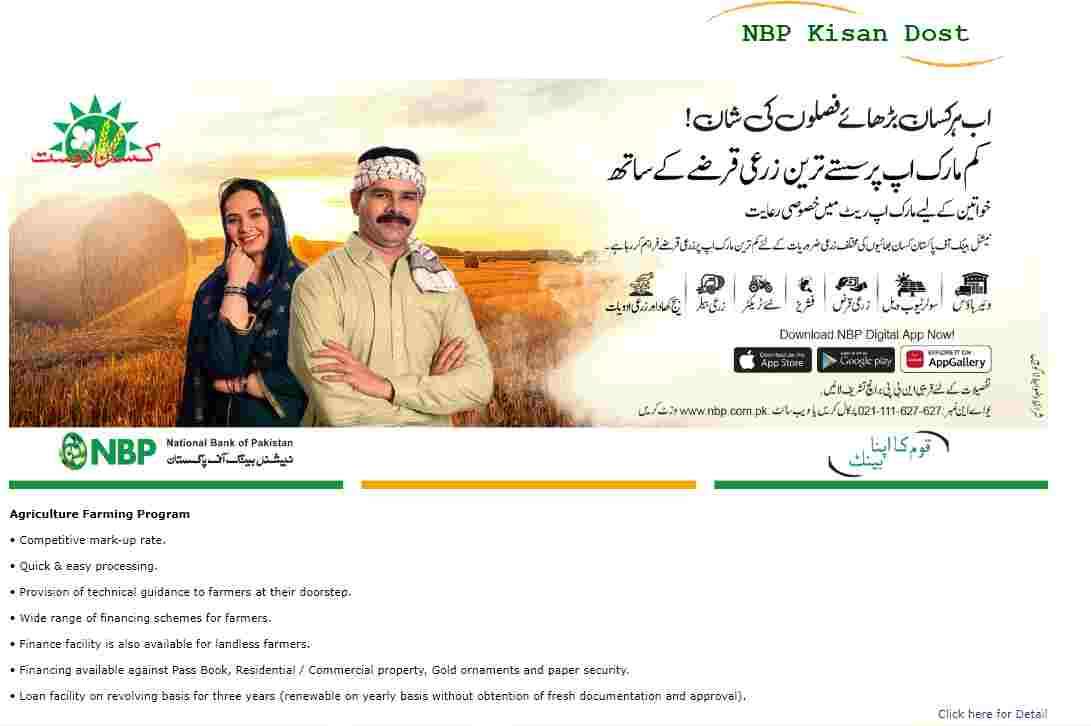

The National Bank of Pakistan also gives Agriculture Loans to farmers, offering them a big opportunity to support their agricultural businesses.

This interest-free loan program is a valuable resource for Kisans (farmers) to invest in and enhance their agricultural ventures, contributing to the growth and prosperity of the agricultural sector.

NBP Agriculture Loan Eligibility Criteria+Documents+Requirements

- Eligibility Criteria:

- The NBP Agriculture Loan is available to all farmers, whether they are landowners or tenants. Both can apply for this Agriculture Loan.

- Documents Required:

- For all farmers, whether landowners or tenants, accessing financing is made accessible through various assets, including passbooks, residential or commercial properties, gold (with a minimum of 21 karats purity), and paper security.

- Filled Application Form: A completed loan application form is essential to provide the necessary information and details about the purpose of your loan request.

- Two CNIC Copies: You will need to submit two copies of CNIC for identification and verification purposes.

- Two Recent Photographs: Attach two recent passport-sized photographs to your application, helping the lender maintain records and verify your identity.

Recommended Reading: How To Get A 5 Lakh Loan Without Interest In Pakistan {5-10 Lakh Loan}

How To Apply For NBP Agriculture Loan

To apply for an NBP Agricultural Loan, follow these simple steps:

- Visit the official website of NBP at https://www.nbp.com.pk/BRNTWRK/DomesticBrLocator.aspx to locate the nearest NBP branch in your area.

- Visit the Nearest NBP Branch: Once you’ve identified the nearest branch, pay a visit to that NBP branch in person.

- Collect Application Form: Request the loan application form from the bank’s staff at the branch.

- Fill and Attach Documents:

- Submit It: After filling out the form and attaching the required documents, submit your loan application to the NBP branch. The bank staff will guide you through this process.

- Wait for Acceptance or Rejection Application: Following your submission, the bank will review your application.

NBP Agricultural Loan Features

NBP Agricultural Loan offers several distinctive features:

- Competitive Mark-up Rate: The loan comes with a competitive interest rate, ensuring affordability for farmers.

- Quick & Easy Processing: The application process is designed for speed and simplicity, making it convenient for farmers to access the funds they need.

- Provision of Technical Guidance: Farmers receive expert guidance and support right at their doorstep, helping them make informed decisions about their agricultural ventures.

- Wide Range of Financing Schemes: NBP provides a variety of financing schemes tailored to meet the diverse needs of farmers, ensuring that they can access the right financial solution.

- Inclusive Approach: Landless farmers are also eligible for this financing program, promoting inclusivity and support for all types of farmers.

- Diverse Collateral Options: NBP accepts a range of collateral options, including passbooks, residential or commercial properties, gold ornaments, and paper security, providing flexibility to borrowers.

- Revolving Loan Facility: Borrowers can benefit from a revolving loan facility that spans three years, with the option to renew every year without the need for fresh documentation and approval.

Recommended Reading: Loan For Business In Pakistan Without Interest (25K-5Lakh)

NBP Contact Number

- Phone: (021) 111 627 627

- Address: National Bank of Pakistan Head Office NBP Building, I.I. Chundrigar Road Karachi

PM Youth Business and Agriculture Loan

The Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS) encourages youth entrepreneurship by offering accessible business loans with favorable terms and lower interest rates through a network of 15 Commercial, Islamic, and SME banks.

Any Pakistani resident between the ages of 21 and 45, showing potential for entrepreneurship, can apply for this loan program.

For those interested in IT/E-Commerce ventures, the minimum age requirement is reduced to 18 years. Applications must be exclusively submitted online through our dedicated website.

PM Youth Business and Agriculture Loan Amount

- Tier 1 offers loans ranging from 0.5 million PKR with no interest charged (0% markup).

- Tier 2 extends loans above 0.5 million up to 1.5 million PKR with a minimal interest rate of 5% markup.

- Tier 3 provides loans exceeding 1.5 million up to 7.5 million PKR with a competitive interest rate of 7% markup.

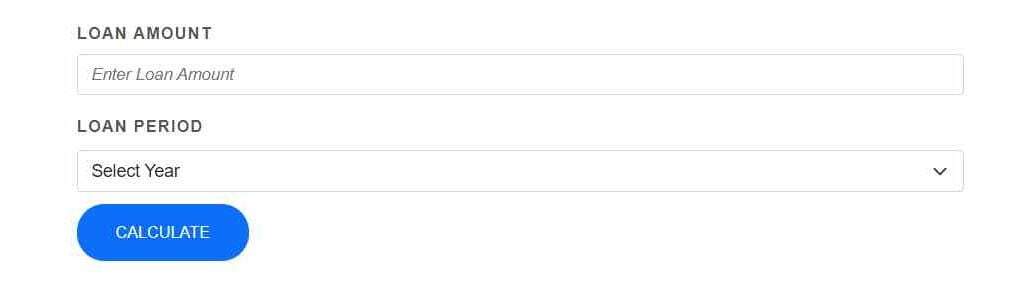

Loan Amount Calculator

Loan Amount Calculator:

- Loan Amount: Users can enter the desired loan amount, with a maximum limit of 7.5 million PKR, tailored to their financial needs.

- Loan Period: Users can select the loan period in years, offering a maximum of an 8-year installment plan to manage repayments easily.

Recommended Reading: 10 Lakh Loan For Business In Pakistan | Insaf Rozgar Scheme

How To Online Apply For PM Youth Business and Agriculture Loan

To apply online for the PM Youth Business and Agriculture Loan, please follow these steps:

- Visit the official website of the PM Youth Loan Scheme at https://pmyp.gov.pk/BankForm/newApplicantForm.

- Start by selecting your desired tier and providing your CNIC number and its issue date.

- Once you’ve entered this information, the application form will become accessible.

- Fill out the form, providing the following details: A. Personal Information: This includes your name, father’s name, CNIC details, and other personal particulars.B. Business Information: Specify the category of your business, industry category, industry name, and related details.C. Loan Details: Indicate the desired loan period, loan amount, and loan size as required.D. Financing Details: Enter the name of the bank, monthly installment amount (in PKR), and other relevant financial information.

- After completing all the necessary sections of the form, submit your application.

Akhuwat Foundation Agriculture Loan

The Akhuwat Foundation has been chosen as a participating financial institution to execute a scheme aimed at benefitting smallholding farmers and tenants with landholdings of up to 2.5 acres in specific districts of Punjab.

This initiative not only presents a significant opportunity for these farmers but also extends support in the form of small business loans.

Akhuwat Foundation Agriculture Loan Amount

The loan amount in question is designed to support small farmers, including both landholders and tenants.

This particular loan ranges from 10,000 to 50,000 rupees, and the remarkable aspect is that it comes completely interest-free.

The convenience of a repayment period spanning 4 to 8 months, makes it a valuable financial resource for those engaged in small-scale agriculture.

Recommended Reading: How To Get An Interest-free Loan Online {20K-1 Lakh}

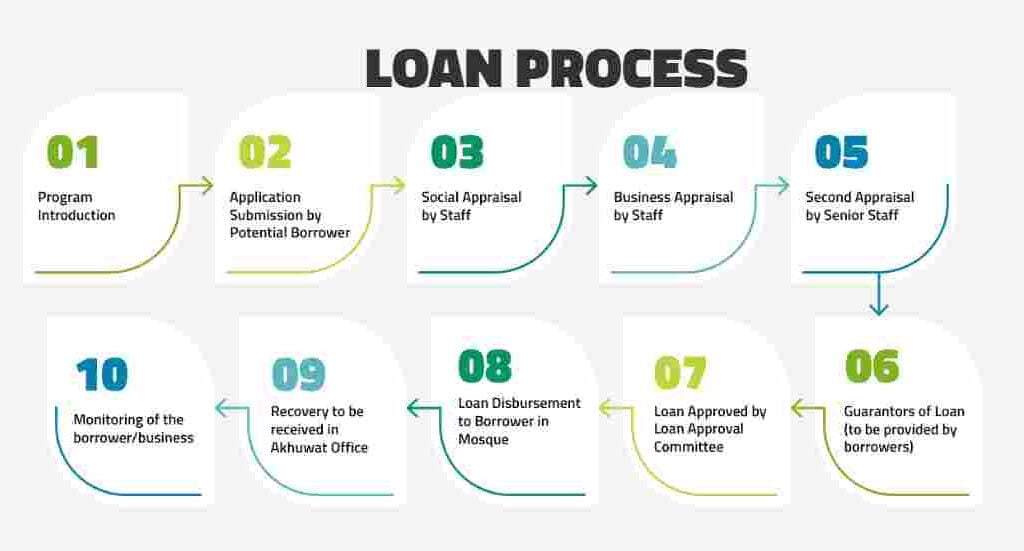

How To Apply For Akhuwat Foundation Loan | Application Process

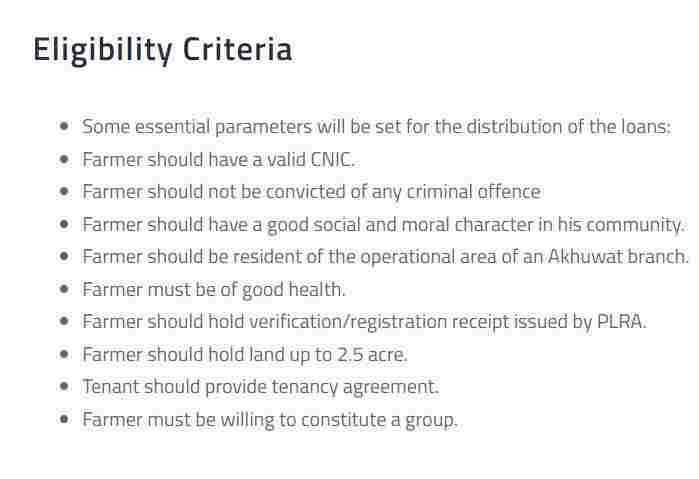

Akhuwat Foundation Agriculture Loan Eligibility Criteria

The eligibility criteria for Akhuwat Foundation’s Agriculture Loan include:

- Land Ownership: Applicants must possess a minimum of 2.5 acres of land, demonstrating a commitment to agriculture.

- Tenancy Agreement: Tenants with a valid tenancy agreement may also qualify for the loan, ensuring inclusivity for those who cultivate leased land.

- Valid CNIC: Applicants are required to provide a valid Computerized National Identity Card (CNIC) for identification and documentation purposes.

- Registration with Punjab Land Record Authority (PLRA): Ensuring that land-related records are accurately documented and updated is crucial for eligibility.

- Residency in the Operational Area: Applicants must reside within the operational area of the Akhuwat Branch to access this loan program, ensuring accessibility for the local community.

Recommended Reading: Mobile On Installment Without Interest (Range 10K-1Lakh) [Smartphone For All Scheme]

Alkhidmat Foundation Business Agriculture Loan

The Alkhidmat Foundation plays a significant role in supporting small farmers by providing business and agricultural loans through its Mawakhat program.

Grounded in the Islamic principle of Qarze-e-Hasna, this program embodies the idea of offering interest-free loans to assist those in need.

Recommended Reading: Khud Mukhtar Program (72K-1.5 Lakh Interest-Free Loan For Business)

Alkhidmat Foundation Business Agriculture Loan Amount

Alkhidmat Foundation Business Agriculture Loan Amount program, you can access an interest-free Small Business Loan of PKR 150,000. This loan amount is an interest-free and easily repayable process.

How To Apply For Alkhidmat Foundation Business Agriculture Loan

To apply for the Alkhidmat Foundation Business Agriculture Loan, follow these steps:

- Visit the Alkhidmat Website: Start by visiting the Alkhidmat Foundation’s official website at https://alkhidmat.org/ to learn more about the loan program and its specific details.

- Visit a Nearby Office: Locate and visit the nearest Alkhidmat Foundation office or branch to begin your application process.

- Select Loan Type: Identify the loan type you wish to apply for, in this case, the “Mawakhat Program,” to business and agriculture.

- Obtain the Application Form: Request the loan application form from the foundation’s office or website.

- Fill and Attach Documents: Carefully complete the application form, ensuring all necessary details are accurate. Attach the required documents as specified in the guidelines.

- Submit Your Application: Submit your completed application form along with the attached documents to the Alkhidmat Foundation office or through their online portal.

- Wait for Approval: Once your application is submitted, patiently await the foundation’s review and approval process. They will notify you of the outcome of your loan application.

Recommended Reading: 10 Lakh Loan Without Interest In Pakistan Online Apply {Interest-free}

Benefits of Interest-Free Agriculture Loan In Pakistan

Interest-free agricultural loans in Pakistan offer numerous benefits:

- Support for Farmers: These loans provide crucial financial support to farmers, whether they own land or are tenants, ensuring that a broader segment of the agricultural community can access funding.

- Expansion of Agricultural Business: Farmers can use these interest-free loans to expand their agricultural enterprises, invest in equipment, and adopt modern farming techniques, ultimately increasing their productivity.

- Large Loan Amounts: Schemes like the PM Loan scheme offer substantial loan amounts, such as up to 75 lakhs, enabling farmers to make significant investments in their businesses.

- Opportunity for Businessmen: These loans present a valuable opportunity for aspiring entrepreneurs to enter the agricultural sector, fostering economic growth.

- Explained Business: The loans support farmers in diversifying their agricultural businesses, exploring new ventures, and enhancing their overall profitability.

- Easy Repayment Process: Interest-free loans often come with manageable repayment terms, reducing the financial burden on farmers.

- Simple Application Process: The application process for these loans is typically straightforward, making it accessible to a wide range of individuals.

- No Taxes: These loans are free from additional taxes, ensuring that the farmer’s amount can be used entirely for agricultural purposes.

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

FAQs | Interest-Free Agriculture Loan

What is an interest-free agriculture loan?

An interest-free agriculture loan is a financial arrangement where Farmers receive funds for agricultural purposes without any interest charges.

Which Top 5 Organizations that Give Interest-Free Agriculture Loans in Pakistan?

Top 5 Organizations that give interest-free agriculture loans in Pakistan.

1. Zarai Taraqiati Bank (ZTBL) Agriculture Loan

2. National Bank of Pakistan (NBP) Agriculture Loan

3. PM Youth Business and Agriculture Loan

4. Pakistan Poverty Alleviation Authority Agriculture Loan

5. Alkhidmat Foundation Business and Agriculture Loan

6. Akhuwat Agriculture Loan

Which Organization gives 75 lakh agriculture loans in Pakistan?

The Organization that gives 75 lakh agriculture loans in Pakistan.

The PM Loan scheme offers substantial loan amounts, such as up to 75 lakhs, enabling farmers to make significant investments in their businesses.

What are the benefits of interest-free agriculture loans?

Interest-free loans reduce the financial burden on Farmers, promote agricultural growth, and empower Farmers to invest in their businesses.

What can I use the loan amount for?

Interest-free agriculture loans can be used for various agricultural purposes, including purchasing equipment, seeds, livestock, and other inputs, as well as expanding farming operations.

What is the maximum loan amount offered by ZTBL for agriculture?

Zarai Taraqiati Bank ZTBL offers a maximum loan amount of up to Rs. 1.200 million for agriculture.

What is the minimum loan amount available through NBP’s agriculture loan program?

NBP offers agriculture loans starting from 10 lahks PKR and upwards.

What is the maximum loan amount under the PM Youth Business and Agriculture Loan scheme?

the maximum loan amount under the PM Youth Business and Agriculture Loan scheme:

Tier 1 offers loans ranging from 0.5 million PKR with no interest charged (0% markup).

Tier 2 extends loans above 0.5 million up to 1.5 million PKR with a minimal interest rate of 5% markup.

Tier 3 provides loans exceeding 1.5 million up to 7.5 million PKR with a competitive interest rate of 7% markup.

Are there any age restrictions for applicants?

Generally, applicants need to be between 21 and 45 years old, but for IT/E-Commerce businesses, the lower age limit is reduced to 18 years.

What is the loan amount provided by the Alkhidmat Foundation for business and agriculture purposes?

Alkhidmat Foundation Loan for Business and Agriculture offers an interest-free loan of 150,000 PKR.

What are the eligibility criteria for the Alkhidmat Foundation for business and agriculture loan program?

Alkhidmat Foundation Loan for business and agriculture Eligibility criteria include factors such as land ownership or tenancy agreements, as well as CNIC and PLRA registration.

What is the maximum loan amount available through Akhuwat’s agriculture loan program?

Akhuwat’s agriculture loan program offers agriculture loans with amounts typically ranging from 10,000 PKR to 50,000 PKR.

What is the loan amount range for interest-free agriculture loans in Pakistan?

The loan amounts for interest-free agriculture loans in Pakistan vary among different schemes. For example, the PM Youth Business and Agriculture Loan scheme has three tiers with loan amounts ranging from PKR 500,000 to PKR 7,500,000.

What is the repayment period for Akhuwat Foundation’s interest-free agriculture loan?

The Akhuwat Foundation’s interest-free agriculture loan offers a convenient repayment period that spans from 4 to 8 months, providing flexibility for farmers engaged in small-scale agriculture.

What are the key features of the NBP Agricultural Loan?

The National Bank of Pakistan (NBP) Agricultural Loan offers features such as a competitive interest rate, quick and easy processing, provision of technical guidance, a wide range of financing schemes, an inclusive approach, diverse collateral options, and a revolving loan facility.

Recommended Reading: Interest-Free Marriage Loan In Pakistan (35K-2Lakh) | Marriage Grant

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment