Want to get a 10 Lakh Loan Without Interest In Pakistan and don’t know where to get it? Then we will guide you to the top sources in Pakistan where you can get this loan not only on easy terms but also without paying any interest (Riba).

In this article, we will discuss the top 2 sources that are sponsored by the government and are already giving more than 10 Lakh Loan Without Interest In Pakistan. Our list includes:

- 1. Prime Minister Youth Interest-Free Loan Scheme: Every applicant can get up to PKR 0.5 Million (Rs. 5 Lakh) to PKR 7.5 Million (Rs. 75 Lakh) loan on easy terms under this scheme.

- 2. Pakistan Poverty Alleviation Fund (PPAF) Interest-Free Loan: PPAF provides interest-free loans of up to PKR 75,00 to PKR 10 Lakh Loan Without Interest In Pakistan on easy installments to start new business or to fulfill any urgent needs.

Through our research, we have found the above two sources as authenticated and reliable ways to get a 10 Lakh Loan Without Interest In Pakistan. Let’s discuss their eligibility and application process in detail to get our desired loan. Here we go!

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

10 Lakh Loan Without Interest In Pakistan

Table Of Contents

Recommended Reading: How To Get A 5 Lakh Loan Without Interest In Pakistan {5-10 Lakh Loan}

Pakistan Poverty Alleviation Fund Interest-Free Loan

The Pakistan Poverty Alleviation Fund is an organization committed to addressing poverty and empowering marginalized communities in Pakistan.

As part of their efforts, the PPAF offers loans to individuals in need, with a special focus on empowering women.

Through its loan program, the PPAF provides loans of varying sizes, with an average loan size of Rs. 30,000. However, it’s worth noting that loan sizes can reach up to Rs. 75,000.

What makes the PPAF particularly unique is its commitment to gender equality and women’s empowerment.

The organization reserves 50% of the loans specifically for women, recognizing the vital role they play in socioeconomic development.

With an estimated 2.8 million interest-free loans set to be disbursed over the four-year program period, benefiting around 1.28 million households, the initiative demonstrates the government’s unwavering commitment to poverty alleviation and inclusive growth.

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

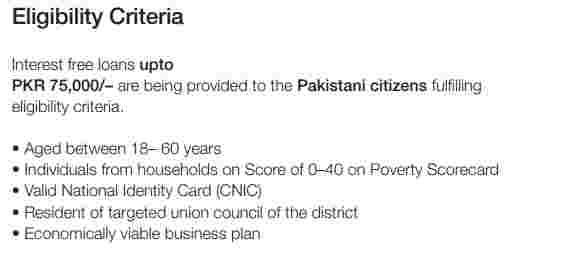

Pakistan Poverty Alleviation Fund Eligibility Criteria

The eligibility criteria for obtaining interest-free loans of up to PKR 75,000/- from the Pakistan Poverty Alleviation Fund (PPAF) are as follows:

- Age Requirement: Applicants must be between the ages of 18 and 60 years.

- Poverty Scorecard: Individuals from households that score between 0 and 40 on the Poverty Scorecard are eligible to apply.

- Valid National Identity Card (CNIC): Applicants must possess a valid National Identity Card issued by the government of Pakistan.

- Residency: The applicant should be a resident of the targeted union council within the respective district.

- Economically Viable Business Plan: Applicants are required to present an economically viable business plan.

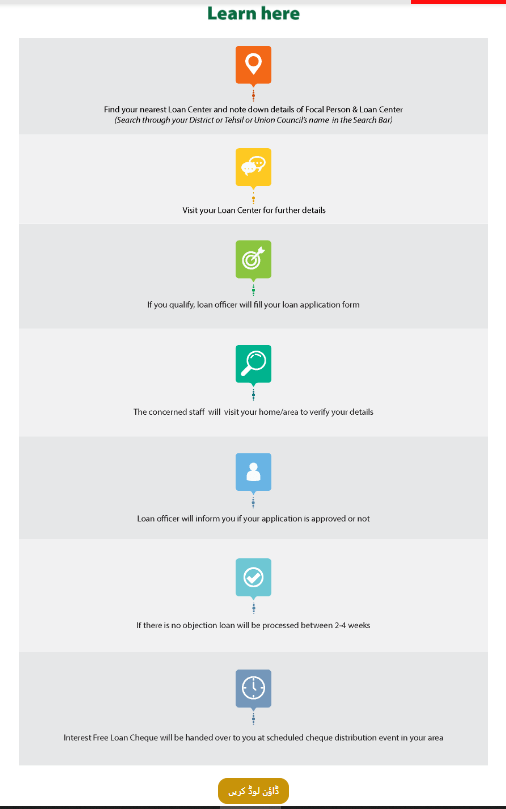

www.ppaf.org.pk Loan Online Apply

To apply for a 10 Lakh Loan Without Interest In Pakistan through the PPAF online application process, follow the steps below:

- Identify the Nearest PPAF Center: Determine the PPAF center closest to your location. This information can be obtained from the PPAF website or by contacting their helpline.

- Visit the Loan Center: Pay a visit to the designated PPAF Loan Center to gather further details about the application process.

- Loan Officer Assistance: If you meet the eligibility criteria, a loan officer will assist you in filling out the application form.

- Home Visit: The concerned PPAF staff may schedule a home visit to verify the details provided in your application.

- Application Approval: Once your application has been reviewed, the loan officer will inform you whether it has been approved or not.

- Loan Processing: If there are no objections or issues with your application, the loan processing will take place within a timeframe of 2-4 weeks.

- Loan Disbursement: Upon approval, an interest-free loan cheque will be handed over to you at a scheduled appointment or designated location.

- Download: If any documents need to be downloaded, the loan officer will guide you through the process, ensuring that you have access to all relevant information and forms.

Pakistan Poverty Alleviation Fund Contact Number

- Official Website: https://www.ppaf.org.pk/

- Phone: +92 (51) 8439450 – 79

- Email: info@ppaf.org.pk

- Address: Plot No. 14, Street 12, G 8/1, Islamabad, Pakistan.

Prime Minister Youth Interest-Free Loan Scheme

The Prime Minister Youth Interest-Free Loan Scheme is a remarkable initiative introduced by the Government of Pakistan, providing an incredible opportunity for Pakistani citizens to obtain a 10 Lakh Loan Without Interest In Pakistan.

This scheme, which will be implemented in 2023, aims to empower individuals by offering loan amounts ranging from 0.5 million PKR (10 Lakh Loan Without Interest In Pakistan) to a substantial 7.5 million PKR (75 Lakhs).

Recommended Reading: 10 Lakh Loan For Business In Pakistan | Insaf Rozgar Scheme

Prime Minister Youth Loan

The Prime Minister Youth Interest-Free Loan Scheme 2024 offers different tiers based on loan amounts and corresponding markups:

Tier 1: Under this tier, the loan range is from 0.5 million PKR (10 Lakh Loan Without Interest In Pakistan) with 0% markup. This means that borrowers within this tier will not be charged any interest on their loan amount.

Tier 2: The loan range in Tier 2 extends from above 0.5 million (10 Lakh Loan Without Interest In Pakistan) PKR up to 1.5 million PKR (15 Lakhs) with a 5% markup. Borrowers in this tier will have a nominal markup rate of 5% on their loan amount.

Tier 3: For larger loan requirements, Tier 3 offers a range of loan amounts from above 1.5 million PKR up to 7.5 million PKR (75 Lakhs) with a 7% markup. Borrowers in this tier will be subject to a markup rate of 7% on their loan amount.

Prime Minister Youth Loan Eligibility Criteria

Under the Prime Minister’s Youth Business Loan and Entrepreneurship Scheme (PMYB&ALS), individuals with entrepreneurial potential can apply for business loans with simplified terms and lower markups through 15 commercial, Islamic, and SME banks.

- Pakistani Residency: Applicants must be residents of Pakistan.

- Age Requirement: The age range for applicants is between 21 and 45 years. However, for IT/E-commerce-related businesses, the lower age limit is 18 years.

- Entrepreneurial Potential: Applicants should demonstrate entrepreneurial potential and a strong business idea.

- Online Application: Applications for the loan must be submitted online through the official website of PMYB&ALS.

PM Youth Loan Online Apply

To apply for the PM Youth 10 Lakh Loan Without Interest In Pakistan online, please follow the steps below:

- CNIC: Enter your 15-digit CNIC number in the provided field. Ensure that you enter the number without any dashes or spaces (e.g., xxxxx-xxxxxxx-x should be entered as xxxxxxxxxxxxxx).

- CNIC Issue Date: Input the date of issue of your CNIC in the format mm-dd-yyyy. Make sure to enter the correct date on which your CNIC was issued.

- Select Tier: Choose the appropriate tier based on your loan requirements. Select the tier that aligns with your desired loan amount and associated terms.

- Personal Information: Provide your details, including your full name, date of birth, gender, marital status, and contact information (such as phone number and email address).

- Business Information: If you have an existing business or are planning to start one, provide relevant details about your business, including its name, nature of the business, address, and years in operation (if applicable).

- Loan Details: Enter the requested information regarding the loan, such as the loan amount you are seeking, the purpose of the loan, and any collateral or security you are willing to provide (if applicable).

- Financing Details: Provide information about your current financing needs, including details about existing loans (if any) and the desired repayment period for the loan you are applying for.

Recommended Reading: Interest-Free Marriage Loan In Pakistan (35K-2Lakh) | Marriage Grant

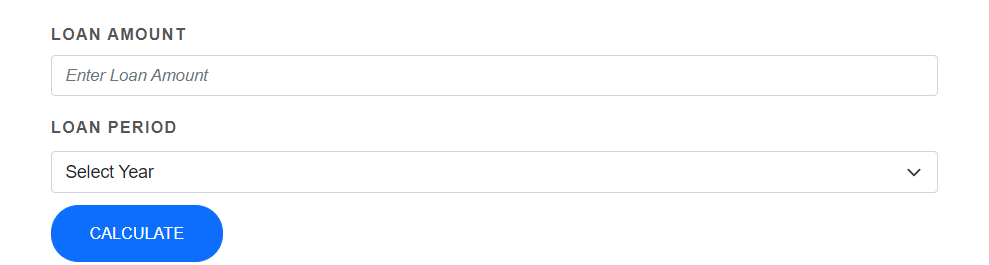

PM Youth Loan Calculator

To calculate the PM Youth Loan amount and loan period, please follow these steps:

- Visit the official website of the PM Youth Loan scheme by accessing https://pmyp.gov.pk/.

- On the website’s homepage, locate and select the “Calculator” option. This will direct you to the loan calculator page.

- On the loan calculator page, you will find different input fields to determine the loan amount and loan period. (10 Lakh Loan Without Interest In Pakistan)

- Loan Amount: Enter the desired loan amount you wish to calculate. Input the numerical value in the provided field.

- Loan Period: Select the loan period in years from the drop-down menu. Choose the appropriate duration for the loan repayment.

- Calculate: Once you have entered the loan amount and selected the loan period, click on the “Calculate” button. The loan calculator will process the information and provide the calculated results.

- Total: The loan calculator will display the calculated details, such as the estimated monthly installment amount, interest rate, and the total repayment amount based on the loan amount and loan period entered.

PM Youth Program Contact Number

Official Website: https://pmyp.gov.pk/pmyphome/PMYBALS

Phone: (042) 111-111-456, 99204701-12

Address: 4th Floor, 3rd Building, Aiwan-e-Iqbal Complex Egerton Road, Lahore

Pros and Cons Of 10 Lakh Loan Without Interest In Pakistan

Here we discuss about Pros and cons of a 10 lakh loan without interest in Pakistan:

Pros of 10 Lakh Loan Without Interest In Pakistan:

- Financial Support: A 10 Lakh Loan Without Interest In Pakistan provides significant financial support for individuals and entrepreneurs to pursue their personal or business goals.

- Interest-Free: One of the major advantages of this 10 Lakh Loan Without Interest In Pakistan. Borrowers are not burdened with the additional cost of interest payments, making the loan more affordable and manageable. 10 Lakh Loan Without Interest In Pakistan

- Accessibility: The availability of a 10 Lakh Loan Without Interest In Pakistan opens up opportunities for individuals who may not meet the strict criteria set by traditional financial institutions.

- Empowerment: By providing access to funds, a 10 Lakh Loan Without Interest In Pakistan empowers individuals and entrepreneurs to pursue their aspirations and make significant progress toward their goals.

Cons of 10 Lakh Loan Without Interest In Pakistan:

- Repayment Responsibility: Borrowers need to be responsible for repaying the loan amount within the specified timeframe.

- Eligibility Requirements: Although the loan aims to be inclusive, there may still be specific eligibility criteria that applicants need to fulfill.

- Loan Limitations: The loan amount of 10 Lakh Loan Without Interest In Pakistan may not be sufficient for certain business ventures or larger-scale investments.

- Availability Constraints: Depending on the specific program or organization offering the loan, there may be limitations on the availability of funds or geographical restrictions.

Recommended Reading: How To Get Interest-Free Agriculture Loan In Pakistan {5-75Lakh}

10 Lakh Loan Without Interest In Pakistan FAQs

Which Organization gives 10 lakh loans without interest in Pakistan?

Here are the Organizations that give 10 lakh loans without interest in Pakistan:

1. Prime Minister Youth Interest-Free Loan Scheme: Every applicant can get up to PKR 0.5 Million (Rs. 5 Lakh) to PKR 7.5 Million (Rs. 75 Lakh) loan on easy terms under this scheme.

2. Pakistan Poverty Alleviation Fund (PPAF) Interest-Free Loan: PPAF provides interest-free loans of up to PKR 75,00 to PKR 10 Lakh Loan Without Interest In Pakistan on easy installments to start new business or to fulfill any urgent needs.

What is a 10 Lakh loan without interest in Pakistan?

A 10 lakh loan without interest in Pakistan refers to a loan of 1 million Pakistani Rupees that is provided to an applicant without any interest charges.

What is the maximum loan amount offered under the Prime Minister Youth Interest-Free Loan Scheme?

The Prime Minister Youth Interest-Free Loan Scheme offers loan amounts ranging from PKR 0.5 Million (Rs. 5 Lakh) to a substantial PKR 7.5 Million (Rs. 75 Lakh), providing individuals with significant financial support.

How does the Pakistan Poverty Alleviation Fund contribute to poverty reduction in Pakistan?

The PPAF contributes to poverty reduction by providing interest-free loans to individuals in need, with a special focus on empowering marginalized communities. With an estimated 2.8 million interest-free loans set to be disbursed, the PPAF aims to benefit around 1.28 million households over a four-year program period.

What are the eligibility criteria for obtaining an interest-free loan from the Pakistan Poverty Alleviation Fund (PPAF)?

The eligibility criteria include being between the ages of 18 and 60, having a Poverty Scorecard score between 0 and 40, possessing a valid National Identity Card (CNIC), being a resident of the targeted union council, and presenting an economically viable business plan.

What percentage of loans does the Pakistan Poverty Alleviation Fund (PPAF) reserve for women applicants?

The PPAF reserves 50% of its interest-free loans specifically for women applicants, recognizing the vital role of women in socio-economic development and promoting gender equality.

What are the three tiers and associated markups under the Prime Minister Youth Interest-Free Loan Scheme?

The three tiers are:

Tier 1: Loan range from 0.5 million PKR with 0% markup.

Tier 2: Loan range above 0.5 million PKR up to 1.5 million PKR with a 5% markup.

Tier 3: Loan range above 1.5 million PKR up to 7.5 million PKR with a 7% markup.

What is the age range for eligibility under the Prime Minister Youth Interest-Free Loan Scheme?

Applicants must be between the ages of 21 and 45 to be eligible for the Prime Minister Youth Interest-Free Loan Scheme. However, for IT/E-commerce-related businesses, the lower age limit is 18 years.

How can one apply for a loan under the Prime Minister Youth Interest-Free Loan Scheme?

Here are the details of how to apply PM 10 lakh loan without interest in Pakistan:

Applicants can apply online through the official website of PMYB&ALS (https://pmyp.gov.pk/pmyphome/PMYBALS), providing personal information, business details, and loan requirements. The application process involves entering CNIC details, selecting the loan tier, and providing necessary information about the business.

What is the contact information for the Prime Minister Youth Program?

The contact information for the Prime Minister Youth Program is (042) 111-111-456, 99204701-12. The address is 4th Floor, 3rd Building, Aiwan-e-Iqbal Complex Egerton Road, Lahore.

What is the contact information for the Pakistan Poverty Alleviation Fund (PPAF)?

The official website of PPAF is https://www.ppaf.org.pk/, and you can contact them via phone at +92 (51) 8439450 – 79, or through email at info@ppaf.org.pk. The address is Plot No. 14, Street 12, G 8/1, Islamabad, Pakistan.

What are the pros and cons of obtaining a 10 Lakh Loan Without Interest In Pakistan?

Pros and Cons of obtaining a 10 lakh loan without interest in Pakistan:

Pros: Financial support for personal and business goals, interest-free nature making it affordable, increased accessibility for individuals who may not meet traditional criteria, empowerment for pursuing aspirations.

Cons: Repayment responsibility, specific eligibility criteria, limitations on the loan amount for certain ventures, and potential availability constraints depending on the program or organization offering the loan.

Recommended Reading: Loan For Business In Pakistan Without Interest (25K-5Lakh)

If you find the information in this article valuable, we would greatly appreciate it if you could take a moment to comment and share it with others. Your support helps us reach more people with important information.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment