10 Lakh Loan For Business: Insaf Rozgar Scheme, under this scheme every applicant has the opportunity to get a 10 Lakh Loan For Business without interest in Pakistan.

The government of Pakistan has launched this scheme across the KPK province which would be facilitated by the Bank Of Khyber.

So, in this article, we discuss about Insaf Rozgar Scheme loan process, which includes eligibility criteria, application process, how to apply, loan amount, loan period, etc.

Recommended Reading: Loan For Business In Pakistan Without Interest (25K-5Lakh)

10 Lakh Loan For Business | 10 Lakh Loan For Business In Pakistan

Table Of Contents

Recommended Reading: 10 Lakh Loan Without Interest In Pakistan Online Apply {Interest-free}

What Is Insaf Rozgar Scheme?

The Government of Pakistan has launched the “Insaf Rozgar Scheme,” which offers financial support to people who want to start a business in Pakistan.

Under this program, applicants can receive a 10 Lakh Loan For Business (1 million rupees) to start their business.

The best part is that this 10 lakh loan for business comes with 0% interest, which means there’s no extra amount to pay back.

It’s a fantastic opportunity to start a business in Pakistan with a big amount of 1 Million rupees (10 Lakh Loan For Business), it is also good news that this loan is interest-free.

Recommended Reading: How To Get Interest-Free Agriculture Loan In Pakistan {5-75Lakh}

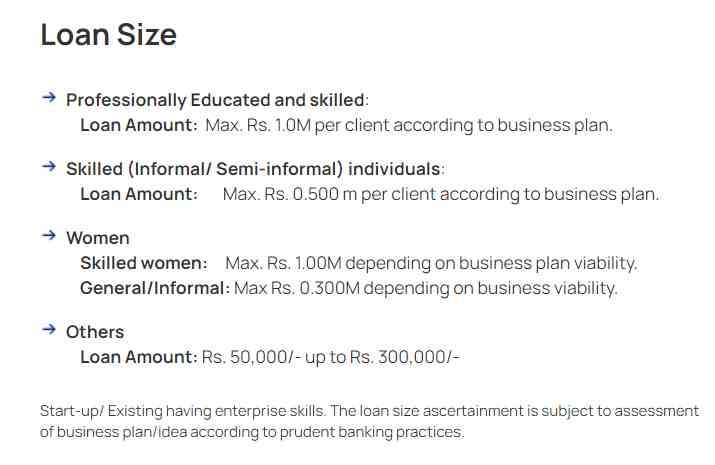

Loan Amount

Loan Amount Under the Insaf Rozgar Scheme is different for different applicant business plans. So, this 10 lakh loan for business divided this Amount into different categories:

Loan Categories Under Insaf Rozgar Scheme:

Professionally Educated and Skilled:

- Loan Amount: Up to a maximum of Rs. 1.0 million per client based on their business plan.

Professionally Educated and Skilled individuals can access a maximum loan amount of up to Rs. 1.0 million or 10 lakh loan for business based on their business plan.

This category allows individuals with professional qualifications and skills to secure loans up to this specified amount to support their business ventures. The loan amount granted is contingent upon the feasibility and viability outlined in their proposed business plan.

Recommended Reading: Interest-Free Marriage Loan In Pakistan (35K-2Lakh) | Marriage Grant

Skilled (Informal/Semi-Informal) Individuals:

- Loan Amount: Up to a maximum of Rs. 0.500 million per client, depending on their business plan.

Individuals with practical skills, falling under the Skilled (Informal/Semi-informal) category, can access a maximum loan of Rs. 0.500 million per client, as determined by their business plan.

This specific category is designed for those possessing hands-on expertise, even if they lack formal professional qualifications.

The loan amount is subject to the particulars specified in their business proposal, ensuring that the funding is in harmony with the practicality and extent of their planned business endeavors.

Women:

- Skilled Women:

- Loan Amount: Up to a maximum of Rs. 1.00 million, assessed based on the viability of the business plan.

- General/Informal:

- Loan Amount: Up to a maximum of Rs. 0.300 million, determined by the viability of the business.

The scheme provides different loan amounts for women entrepreneurs. Skilled women can get up to Rs. 1.00 million or 10 lakh loan for business, depending on their business plan’s viability, while those in general or informal businesses can access a maximum of Rs. 0.300 million, determined by their business plan’s feasibility.

Others:

- Loan Amount: Ranging from Rs. 50,000 to Rs. 300,000, depending on individual circumstances.

Under the category of “Others,” individuals can avail themselves of loan amounts ranging from Rs. 50,000/- to Rs. 300,000/-.

This inclusive range accommodates a variety of business plans and ideas, offering financial support tailored to the specific needs and scopes of entrepreneurs falling under this category.

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

Start-up/Existing Enterprises with Skills:

- The loan amount for these applicants is determined through a careful evaluation of the business plan or idea, following responsible banking practices.

This is an interest-free loan means that no extra charges are applied.

Eligibility Criteria For the Insaf Rozgar Scheme

To qualify for the Insaf Rozgar Scheme (10 Lakh Loan For Business) in the Newly Merged Districts of Khyber Pakhtunkhwa, you should:

- Live in the Area: You must be a permanent resident of these districts and have a valid ID card.

- Stay Put: You need to have lived at the same address for at least two years.

- Age Range: Your age should be between 18 and 50 years.

- Business Plan: You should have a practical business idea that matches your skills and can be put into action.

- Small Businesses: This scheme is for people who want to start or support small businesses in these areas.

- Skillful Candidates: Those who’ve graduated from GoKP development programs or related institutes get priority. It’s a way to support skilled individuals in the community.

- Women Entrepreneurs: Ladies, including widows, are encouraged to apply.

- Job Seekers: If you’re currently unemployed, especially if you come from a labor background, you can benefit from this scheme.

- Traders and Craftsmen: Small traders, artisans, and people involved in making things like handicrafts and clothes are eligible.

- New Graduates: If you’ve recently finished your training from skill institutes or vocational centers and don’t have the money to start a small business, you can apply.

- Official Business: Your business should be legally registered.

Recommended Reading: 10 Lakh Loan Without Interest In Pakistan Online Apply {Interest-free}

Documents Required For Insaf Rozgar Scheme

Pre-Approval Stage Requirements

To initiate the approval process for your application for a 10 lakh loan for business, you are required to submit the following documents for 10 lakh loan for business Application:

- Completed Application Form: Ensure that all the necessary information in the application form is accurately filled out.

- Identification: Include a copy of your valid CNIC (Computerized National Identity Card) and the CNIC of your guarantor. These will be electronically verified by e-NADRA.

- Photographs: Include two passport-sized photographs, both for yourself and your guarantor.

- Educational and Skill Certification: If applicable, provide a copy of your degree, diploma, or skill certification from a recognized institute.

- Government Guarantor’s Details: If your guarantor is a government employee, they should furnish their salary slip and a letter of comfort from their department, specifying their BPS (Basic Pay Scale).

- Private Guarantor’s Financial Documentation: If your guarantor is from the private sector, you should provide verifiable evidence of their income and ensure they submit an undertaking on stamped paper

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

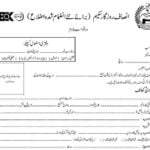

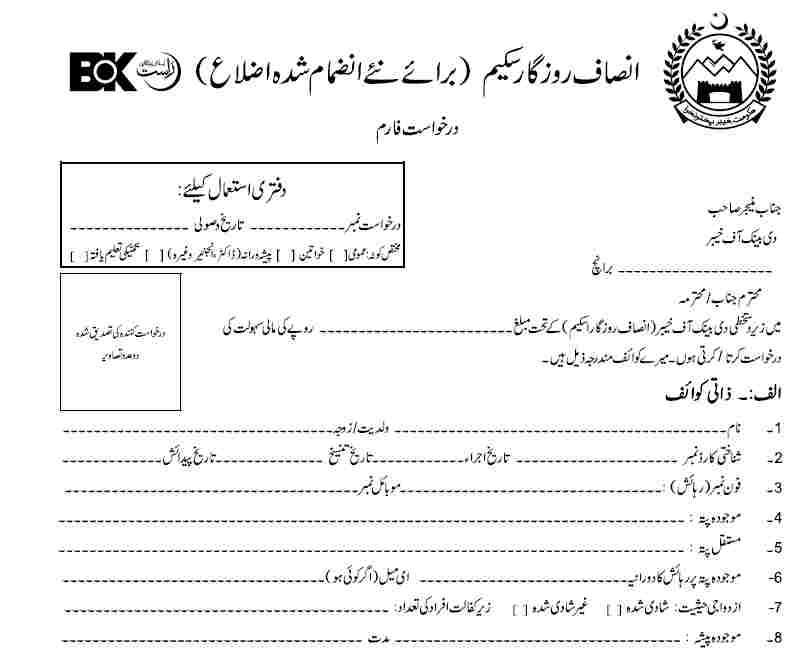

Insaf Rozgar Loan Application Form

You can download this form by clicking this image or clicking https://www.bok.com.pk/sites/default/files/inline-files/Final-Insaf-Rozgar-Form-Approved.pdf.

The Insaf Rozgar Loan Scheme Application Form is the essential step to apply for this chance to get a 10 Lakh Loan For Business. This form is simple and lists all the things you need.

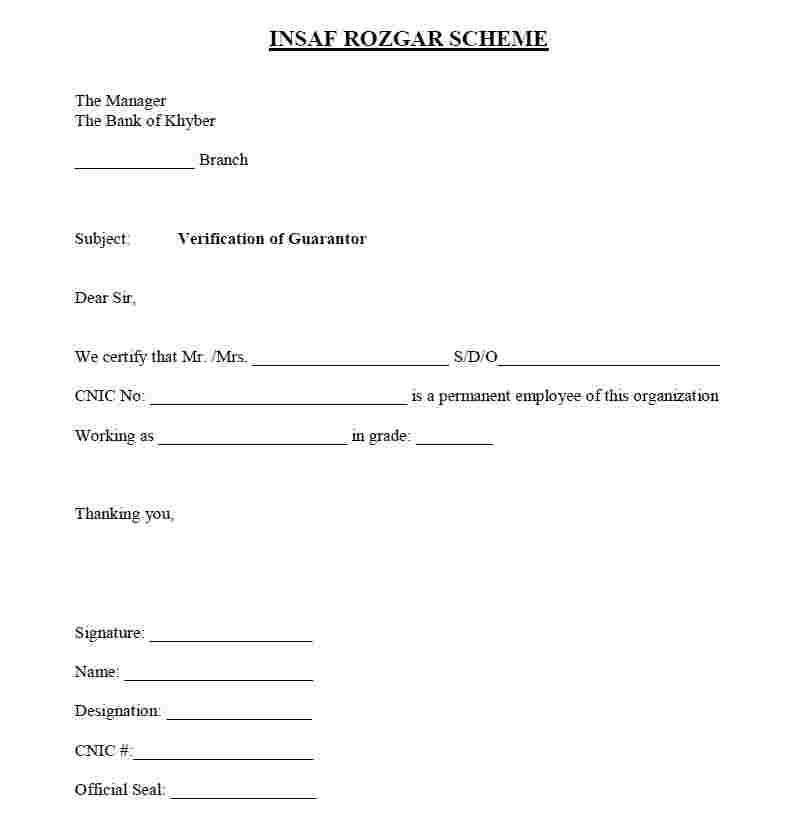

Khyber Bank Insaf Rozgar Loan Guarantee Form

You can download this form by clicking here https://www.bok.com.pk/sites/default/files/inline-files/Guarantor-Verification-IRS.pdf.

To apply for the 10 lakh loan for business, you must have two people who guarantee for you, and one of them should be a government employee with a position of BPS 07 or higher.

Recommended Reading: How To Get A 5 Lakh Loan Without Interest In Pakistan {5-10 Lakh Loan}

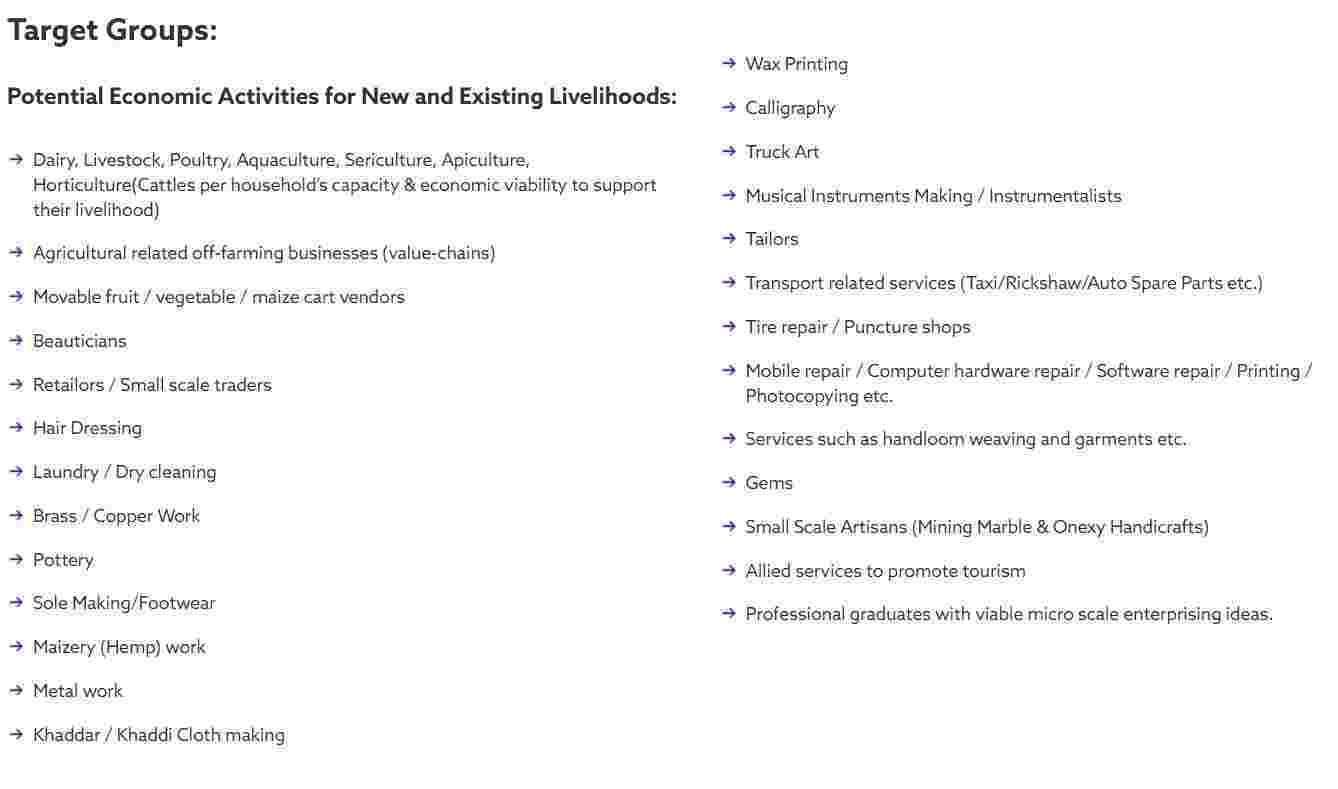

Loan For Such Type of Business

This 10 lakh loan for business program is designed to support a wide range of businesses and skills, including:

These types of businesses are included in 10 lakh loans for business.

- Farming & Animal Husbandry: This encompasses dairy, livestock, poultry, aquaculture, sericulture, apiculture, and horticulture based on your resources and livelihood requirements.

- Agriculture-Related Businesses: Businesses that are connected to the agricultural value chains.

- Mobile Vendors: Individuals selling fruits, vegetables, or maize from movable carts.

- Beauty Services: Supporting beauticians who provide their services.

- Retailers & Small Traders: Small shop owners and traders.

- Hair Salons: Businesses in the field of hairdressing.

- Laundry & Cleaning: Services related to laundry and dry cleaning.

- Craftsmanship: Including brass and copper work, pottery, shoemaking, and more.

- Traditional Arts: This covers activities like khaddar/khaddi cloth making, wax printing, calligraphy, and truck art.

- Musical Instruments: Both craft musical instruments and instrumentalists.

- Tailoring: Tailors and dressmakers.

- Transport Services: This includes taxis, rickshaws, auto spare parts, and related services.

- Repair Shops: Covering tire repair, mobile, computer hardware, software repair, printing, and photocopying.

- Handloom Weaving & Garments: Services like handloom weaving and garment making.

- Gems & Mining: Supporting small-scale artisans involved in mining marble and onyx handicrafts.

- Tourism Promotion: Businesses that offer services to enhance tourism.

- Professional Graduates: Graduates with ideas for small businesses.

Professionally Potential Economic Activities for New and existing Entrepreneurs:

This 10 lakh loan for the business program is open to a diverse group of individuals, including:

- Doctors, Engineers, and Technical Graduates: Whether you are a medical professional, an engineer, or a recent graduate from technical colleges, TEVT centers, or vocational centers.

- Skilled Professionals: Those who have practical business ideas after obtaining professional qualifications.

- Persons with Disabilities: Individuals with disabilities who have acquired skills certification from Special Skills Institutes.

- Agricultural Businesses: People involved in any type of business related to agriculture, excluding direct farming.

- Beauty Experts: Beauticians who provide various beauty services.

- Artisans: Small-scale artisans engaged in activities such as mining marble, crafting onyx handicrafts, and more.

- Light Engineering Professionals: Individuals working in the field of light engineering services.

- Electrical and Electronics Experts: Electricians, electronics specialists, and technicians.

- Technicians & Mechanics: Skilled professionals in technical, mechanical, or plumbing work.

- Medical Services Providers: Businesses linked to the medical field.

- Photographers & Filmmakers: Aspiring photographers and filmmakers.

- Woodworkers: Those engaged in furniture making and wood carving.

- Handicrafts & Garment Workers: Artisans with expertise in handicrafts, garments, embroidery, dyeing, and related skills.

- Artisanal Workers: Individuals participating in various artisanal trades.

- Skilled Women Entrepreneurs: Women who run home-based businesses utilizing their skills.

Recommended Reading: How To Get An Interest-free Loan Online {20K-1 Lakh}

Who is In-Eligible For The Insaf Rozgar Scheme

To qualify for this 10 lakh loan for the business program, here are the requirements:

- Not a Government Employee: You can’t be employed by any government, semi-government, or autonomous body.

- Not a Full-Time Student: You mustn’t be studying as a full-time student.

- No Unsettled Loans: You should have no unpaid loans from other government programs, donor schemes, or banks. Your credit history, as reported by the Credit Information Bureau (e-CIB), should be clear of unpaid debts.

- No Previous Loans: You should not have previously received loans from specific programs like BKKRS, PHRS, RHRS, KKS, YCF, or Wasila-e-Haq through the Benazir Income Support Program, NRSP, or SRSP.

Recommended Reading: Mobile On Installment Without Interest (Range 10K-1Lakh) [Smartphone For All Scheme]

How To Apply For a 10 Lakh Loan For Business under the Insaf Rozgar Scheme

These are the following processes to Apply for a 10 lakh loan for business Under the Insaf Rozgar 10 lakh loan for business Scheme:

- Visit the Bank of Khyber Website: first visit the Bank of Khyber’s official website and read the Insaf Rozgar Scheme section.

- Locate the Nearest Bank of Khyber Branch: Identify the Bank of Khyber branch nearest to you. You can typically find branch locations on the bank’s official website.

- Get the Application Form: When you visit the selected Bank of Khyber branch, ask the bank staff for the Insaf Rozgar Scheme application form.

- Obtain the Granted Form: Then request the granted form, which is part of your application process.

- Gather Your Documents: Collect all the required documents, including your CNIC, educational or skill certificates, your business plan, and any other documents specified in the application form.

- Fill Out the Application Form: Carefully complete the application form with the correct information.

- Submit Your Application: Submit your completed application form and supporting documents to the Bank of Khyber branch.

By following this process you can get a 10 lakh loan for business.

FAQs | 10 Lakh Loan For Business By Government Of Pakistan

What is the Insaf Rozgar Scheme?

The Insaf Rozgar Scheme is a government initiative in Pakistan aimed at providing interest-free 10 Lakh loans for Businesses to support and promote small businesses and entrepreneurship. Under this scheme give a 10 lakh loan for business.

Who is eligible for the 10 Lakh Loan For Business under the Insaf Rozgar Scheme?

Eligibility criteria for a 10 lakh loan for the business scheme, Pakistani residents living in specific areas, including Newly Merged Districts of Khyber Pakhtunkhwa, can apply. Specific qualifications include being between 18 and 50 years old and having a viable business idea.

What is the maximum loan amount available under this scheme?

The scheme offers a maximum loan of up to 10 Lakh Loan For businesses to support small businesses in Pakistan.

Is the loan truly interest-free?

Yes, one of the key features of the Insaf Rozgar Scheme is that the 10 lakh loan for business is interest-free, meaning you won’t be charged any interest on the amount.

Can I use the loan for any type of business?

The scheme supports a diverse range of businesses and skills, including farming, animal husbandry, mobile vendors, beauty services, retail and small traders, hair salons, laundry and cleaning, craftsmanship, traditional arts, musical instruments, tailoring, transport services, repair shops, handloom weaving, and garments, among others.

What is the repayment period for this loan?

The loan term for the Insaf Rozgar Scheme is three years (3 years), which includes a grace period of three months. This grace period is provided for new businesses, allowing them time to establish themselves before beginning loan repayments.

Is there a requirement for guarantors in this scheme?

To secure a 10 lakh loan for business, you’ll need two personal guarantors (PGs), and at least one of them should be a government employee with a rank of BPS 07 or higher. This means that one of your guarantors should hold a government job with a relatively senior position.

Can I apply for this loan if I already have other loans or outstanding debts?

Applicants are generally expected to have no outstanding loan exposure from other government schemes or banks and should have a clean Credit Information Bureau (e-CIB) record.

Who is eligible for the highest loan amount of Rs. 1.0M?

Applicants falling under the category of “Professionally Educated and Skilled” can be eligible for a maximum loan of Rs. 1.0 million based on their business plan.

Who is eligible for the loan under this scheme?

Eligibility varies depending on your skills and business plan. It’s open to professionally educated and skilled individuals, skilled (informal/semi-informal) persons, women with various skills, and others who aim to start or expand their businesses

What is the maximum loan amount I can receive as a professionally educated and skilled individual?

If you fall under the “Professionally Educated and Skilled” category, you can receive a maximum loan of Rs. 1.0 million based on your business plan.

How much can I take a loan if I’m a skilled (informal/semi-informal) individual?

For skilled (informal/semi-informal) individuals, the maximum loan amount is Rs. 0.500 million, subject to your business plan. Maximum giving 10 lakh loan for business but this loan purpose giving only Rs. 0.500 million.

What are the loan amounts available for women entrepreneurs?

Women with specific skills can secure up to Rs. 1.0 million, depending on their business plan viability. Women engaged in general or informal businesses can access up to Rs. 0.300 million.

What about those who don’t fall into these categories?

If you don’t fit into the above categories, you can still access a loan ranging from Rs. 50,000 to Rs. 300,000. Maximum giving 10 lakh loan for business but this loan purpose giving loan ranging from Rs. 50,000 to Rs. 300,000.

What is the 10 Lakh Loan For Business Interest-Free?

This loan is a financial opportunity provided to entrepreneurs for business purposes, offering a maximum amount of 10 lakh Loan For Business is Interest-Free or markup charges.

What types of businesses can benefit from this loan?

The loan is designed to support a wide range of business types, including agriculture-related ventures, artisans, beauticians, professionals, and various other business categories.

What are the documents required during the pre-approval stage of the loan application?

Here’s a list of the required documents during the pre-approval stage of the loan application:

1. A completed application form.

2. A copy of the applicant’s valid CNIC (Computerized National Identity Card) and the guarantor’s CNIC with e-NADRA verification.

3. Two passport-size photographs of the applicant and guarantors.

4. An attested copy of the degree, diploma, or skill certification from a recognized institute, if applicable.

5. The government guarantor’s salary slip.

6. A Letter of Comfort from the concerned department, specifying the Basic Pay Scale (BPS) for the government guarantor.

7. Documentary proof of the private guarantor’s income, accompanied by an undertaking on stamp paper.

What is the Insaf Rozgar Scheme, and how does it provide financial support to entrepreneurs in Pakistan?

The Insaf Rozgar Scheme is a government initiative in Pakistan that offers financial support to individuals interested in starting a business. Under this scheme, applicants can avail of a 10 Lakh Loan for Business with 0% interest, facilitating entrepreneurship and economic growth, particularly in the Khyber Pakhtunkhwa (KPK) province.

Can individuals from specific professional backgrounds or recent graduates apply for the 10 Lakh Loan for Business under the Insaf Rozgar Scheme?

Yes, individuals from specific professional backgrounds or recent graduates are eligible to apply for the 10 Lakh Loan for Business under the Insaf Rozgar Scheme. This includes professionals such as doctors, engineers, technical graduates, skilled professionals, persons with disabilities, agricultural business operators, beauty experts, artisans, light engineering professionals, electrical and electronics experts, technicians, medical service providers, photographers, filmmakers, woodworkers, handicraft and garment workers, and skilled women entrepreneurs.

Recommended Reading: Khud Mukhtar Program (72K-1.5 Lakh Interest-Free Loan For Business)

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment