Student Loan In Pakistan: In this article, we are going to highlight the two best institutions that provide student loans in Pakistan, they are:

- Kashf Foundation Student Loan

- National Bank of Pakistan Student loan

Kashf Foundation provides interest-free student loans of PKR 60,000 to PKR 300,000 on easy terms for a maximum of 12-18 months installment plan.

The National Bank of Pakistan provides student loans in collaboration with other commercial banks. NBP Student Loan Scheme includes full-fee payment along with residence and daily meal expenses.

NBP provides student loans ranging from Rs. 500,000 to Rs. 2,000,000 (20 Lakh) at maximum depending upon the type and level of student education.

Now, let’s explore eligibility, document requirements, and a step-by-step guide on how to get a student loan in Pakistan from the above-mentioned institutions. Here we go!

Recommended Reading: Student Loan In Pakistan {PKR 3-30 Lakh} [Mobilink Bank]

Interest-free Student Loan In Pakistan | Student Loan Scheme 2023 Pakistan

Table of Contents

- Interest-free Student Loan In Pakistan | Student Loan Scheme 2023 Pakistan

Kashf Foundation Student Loan

Kashf Foundation Student Loan is a prominent organization in Pakistan that plays a pivotal role in providing financial support to students pursuing higher education in the country.

Kashf Foundation offers a student loan scheme in Pakistan, providing loan amounts ranging from 60,000 to 300,000 rupees.

Students can pay back this loan in easy monthly installments over 12 to 18 months. What’s great is that this loan is completely interest-free, with no additional markup charges.

Kashf Foundation offers student loans to help cover various academic expenses, including tuition fees, books, and living costs.

Recommended Reading: Student Loan In Pakistan For Abroad Study 2024 [Get 5-50Lakh Study Loan]

Features Of Kashf Foundation Student Loan Program

Kashf Foundation Student Loan offers a range of features and specifications to facilitate access to financial assistance for students in Pakistan. Here’s a breakdown of its key attributes:

- Loan Term:

- The loan term typically spans from 12 to 18 months.

- Monthly Installments:

- Borrowers have the flexibility to repay the loan through 12 to 18 monthly installments.

- Loan Amount:

- The minimum loan amount for the first loan cycle is PKR 60,000 for a 12-month tenure and PKR 75,000 for an 18-month tenure.

- The maximum loan amount for the first loan cycle is capped at PKR 200,000.

- For the second loan cycle, the maximum loan amount increases to PKR 300,000.

- Documentation Charges:

- A nominal documentation fee of PKR 500 is applicable.

- Insurance Charges:

- Insurance charges are 2% on PKR 20,000 and 1% on the remaining loan amount.

- Training Fees:

- A training fee of Rupees 1,000 is required, and this fee is paid along with the first installment.

- Insurance:

- Insurance is not applicable in this loan program.

- School Profit:

- The loan program provides a School Profit ranging from Rupees 8,000 to 70,000.

- Age Limit:

- Both the client and the nominee must fall within the age range of 18 to 63 years and 5 months for an 18-month loan tenure.

- For a 12-month loan tenure, the age limit for both the client and the nominee is between 18 and 63 years and 11 months.

Eligibility Criteria

Kashf Foundation Student Loan has specific eligibility criteria that applicants must meet to qualify for financial assistance:

Academic Merit:

Applicants are typically evaluated based on their academic performance and achievements. Meeting certain academic criteria may be required for eligibility.

Financial Need:

Financial need is a crucial factor in determining eligibility. Applicants should demonstrate that they require financial assistance to pursue their education.

Age Limit:

The age limit for eligibility ranges from 18 to 65 years. Applicants should fall within this age bracket to apply for the loan.

Marital Status:

Some programs may have marital status requirements. Applicants may need to be married to qualify for the loan, depending on the specific program’s guidelines.

Nationality:

Eligibility may be restricted to Pakistani nationals. Non-Pakistani applicants may need to check if they meet any additional requirements.

Documents Required

To apply for a Kashf Foundation Student Loan, you will typically need to provide the following documents:

Photograph:

Recent passport-sized photographs are usually required. Ensure that they meet the specified size and format requirements.

CNIC:

A copy of your CNIC, which serves as proof of your identity and nationality, is typically mandatory.

Education Documents:

Copies of your educational documents, such as transcripts and certificates, are essential to demonstrate your academic qualifications and enrollment in an educational institution.

Income Proof:

You will need to provide income proof, which may include salary slips, bank statements, or income tax returns, to establish your financial need and repayment capacity.

Proof of Residence:

A document verifying your current residence, such as a utility bill or a rental agreement, is often required to confirm your address.

Application Process For Student Loan

The application process for a Kashf Foundation Student Loan typically involves the following steps:

Visit the Kashf Foundation Website:

Start by visiting the official Kashf Foundation website (https://kashf.org/) to gather information about the student loan programs they offer. Familiarize yourself with the eligibility criteria, terms, and conditions.

Visit a Nearby Kashf Center:

At the center, you can inquire about the specific student loan program you’re interested in and request an application form.

Receive the Application Form:

Collect the loan application form from the Kashf Foundation Center.

Fill Out the Application Form:

Carefully fill out the application form with accurate and complete information.

Attach Required Documents:

Gather all the necessary documents, such as your photograph, CNIC, educational certificates, income proof, and proof of residence, as mentioned in the eligibility criteria. Attach these documents to your completed application form.

Submit Your Application:

Return to the Kashf Foundation center where you received the form and submit your completed application along with the required documents.

Wait for Approval:

After submitting your application, it will go through a review process. Kashf Foundation will assess your eligibility based on the provided information and documents.

Receive Loan Approval:

Once your application is approved, you will be notified by Kashf Foundation.

Receive the Loan:

After accepting the loan offer, you will receive the approved loan amount, which can be used to cover your educational expenses.

Recommended Reading: Student Loan In Pakistan {PKR 3-30 Lakh} [Mobilink Bank]

National Bank of Pakistan NBP Student loan

NBP Student loan

The National Bank of Pakistan (NBP) Student Loan is an initiative that emerged as a result of the Federal Finance Minister’s announcement in the 2001-2002 budget speech.

This scheme was developed in collaboration with major commercial banks in Pakistan, including NBP, HBL, UBL, MCB, and ABL.

Its primary aim is to provide crucial financial support to meritorious students who face financial constraints while pursuing scientific, technical, and professional education within Pakistan.

Under the scheme, interest-free loans are extended to eligible students, enabling them to access quality education without the burden of interest charges.

Loan Details

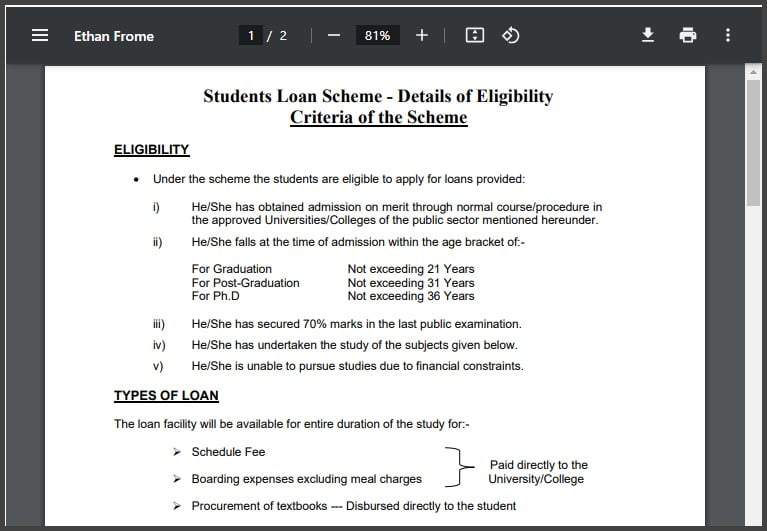

Eligibility Criteria

Eligibility criteria for the National Bank of Pakistan (NBP) Student Loan scheme are designed to ensure that the financial assistance reaches deserving and capable students pursuing higher education.

To be eligible for this loan program, applicants must meet the following criteria:

Admission on Merit:

Eligible students should have gained admission to approved universities or colleges within the public sector through the standard admission process. Merit-based admission is a key requirement.

Age Limit:

- The age of the applicant at the time of admission plays a crucial role in determining eligibility:

- For Graduation: The applicant must not exceed 21 years of age.

- For Post-Graduation: The applicant must not exceed 31 years of age.

- For Ph.D.: The applicant must not exceed 36 years of age.

Academic Performance:

Applicants must have a strong academic track record, having secured a minimum of 70% marks in their last public examination.

Approved Study Subjects:

The student’s chosen field of study should fall within the subjects that are covered under the scheme.

Types Of Loan

The National Bank of Pakistan (NBP) Student Loan program offers various types of loans to support students throughout their educational journey.

These loans are designed to cover specific expenses related to their studies. The types of loans available under this program include:

- Schedule Fee Loan:

- This loan covers the scheduled fees required by the university or college.

- Boarding Expenses Loan (Excluding Meal Charges):

- Students often require financial assistance to cover their boarding expenses, which include accommodation costs but exclude meal charges.

- Procurement of Textbooks Loan:

- Textbooks are an essential part of a student’s academic journey. This loan is disbursed directly to the student to help them purchase the necessary textbooks for their courses.

Repayment Period

Repayment terms for the National Bank of Pakistan (NBP) Student Loan program are structured to provide flexibility and support for borrowers as they transition into the workforce after completing their studies. Here are the key repayment details:

- Maximum Repayment Period:

- Borrowers have a maximum of 10 years from the date of the disbursement of the first installment to repay the loan in full.

- Monthly Installments:

- Repayment is carried out through monthly installments. Borrowers are required to make regular monthly payments.

- Commencement of Repayment:

- Repayment begins either after six months from the date of the borrower’s first employment or one year from the date of completion of their studies, whichever occurs earlier. This provision allows borrowers some time to secure employment before initiating loan repayment.

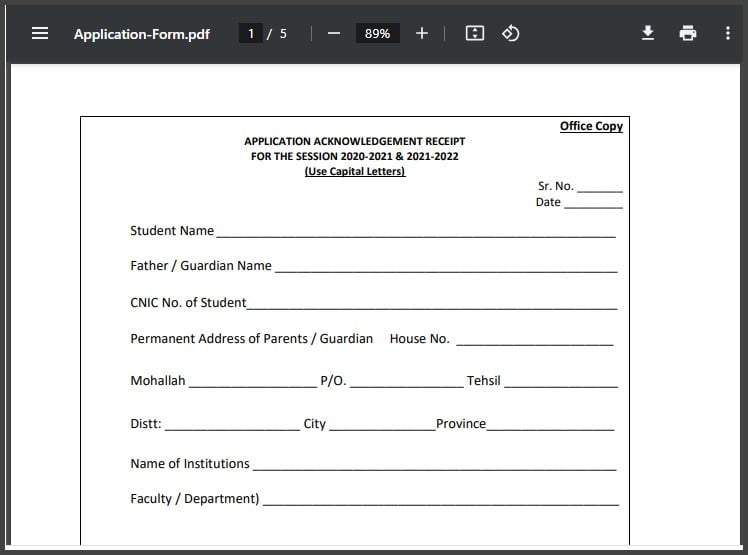

Application Process

The application process for the National Bank of Pakistan (NBP) Student Loan Scheme is straightforward and can be done online. Here are the steps involved:

- Visit the NBP Website: Start by visiting the official website of the National Bank of Pakistan at www.nbp.com.pk.

- Select “Student Loan Scheme”: On the website’s homepage, you will typically find a dedicated section or option for the “Student Loan Scheme.” Click on this option to access the application process.

- Read Instructions: Before initiating the online application, take the time to carefully read and understand the instructions provided on the webpage. This step is crucial to ensure that you complete the application accurately.

- Click on “Apply Now”: Once you have familiarized yourself with the instructions, click on the “Apply Now” button to begin the application process.

- Complete the Application Form: Fill out the online application form with the required information. This typically includes personal details, educational history, and information related to the loan you are applying for.

- Upload Required Documents: As part of the application process, you will need to upload essential documents. These often include your Computerized National Identity Card (CNIC), educational certificates, admission letter from your university or college, and proof of income or financial need.

- Review and Submit: Carefully review all the information you have provided in the application form.

- Confirmation: After submitting your application, you may receive an acknowledgment or confirmation email.

- Wait for Loan Approval: The final step in the application process is to patiently wait for the loan approval.

Recommended Reading: Student Loan In Pakistan {PKR 3-30 Lakh} [Mobilink Bank]

Application Form

Benefits Of Student Loan In Pakistan

- Interest-Free Loan with 0% Markup: One of the key benefits of student loans in Pakistan is that they are typically interest-free, with no markup charges. This eases the financial burden on students and their families.

- Access to Education: Student loans provide aspiring students with the opportunity to pursue higher education, ensuring that financial constraints do not hinder their academic ambitions.

- Ease of Application: The process of obtaining a student loan is often streamlined and straightforward, making it accessible to a wide range of students.

- Manageable Repayment: Student loans often come with flexible and manageable repayment options, allowing graduates to pay back the borrowed amount without excessive financial strain.

Recommended Reading: Student Loan In Pakistan For Abroad Study 2024 [Get 5-50Lakh Study Loan]

Student Loan In Pakistan | FAQs

What is a student loan in Pakistan?

A student loan in Pakistan is a financial assistance program designed to help students cover the costs of higher education, including tuition fees, living expenses, and other educational expenses.

Who offers student loans in Pakistan?

Student loans in Pakistan are typically offered by various financial institutions, government programs, and non-profit organizations. Some well-known providers include the National Bank of Pakistan and the Kashf Foundation.

What are the eligibility criteria for student loans in Pakistan?

Eligibility criteria can vary depending on the loan provider and program. Common eligibility factors include academic merit, financial need, nationality, and specific age limits. Applicants should check the requirements of the specific loan program they are interested in.

What expenses do student loans in Pakistan cover?

Student loans in Pakistan can cover a range of expenses, including tuition fees, books, accommodation, transportation, and sometimes even meal charges.

How much loan amount does the Kashf Foundation Student Loan Scheme offer?

The loan amount offered by the Kashf Foundation Student Loan Scheme can vary based on the specific program and cycle. For the first loan cycle, the minimum loan amount for a 12-month tenure is PKR 60,000, and for an 18-month tenure, it’s PKR 75,000. The maximum loan amount for the first cycle is PKR 200,000, while for the second cycle, it can go up to PKR 300,000.

Is the Kashf Foundation Student Loan Scheme interest-free?

Yes, the Kashf Foundation Student Loan Scheme typically offers interest-free loans, making it more affordable and accessible for students.

What is the Kashf Foundation Student Loan program?

Kashf Foundation Student Loan is a financial assistance program in Pakistan providing interest-free loans ranging from PKR 60,000 to PKR 300,000. It offers flexible repayment terms of 12 to 18 months. The scheme often covers a range of educational expenses, including tuition fees, textbooks, and sometimes accommodation costs.

What are the key features of the Kashf Foundation Student Loan program?

The program offers a loan term of 12 to 18 months, flexible monthly installments, and amounts ranging from PKR 60,000 to PKR 300,000. There are nominal documentation charges, insurance charges, and a training fee.

What eligibility criteria and documents are required to apply for the Kashf Foundation Student Loan?

Eligibility: Applicants are evaluated based on academic merit, financial need, age limit (18 to 65 years), marital status, and Pakistani nationality.

Documents: Applicants need to provide recent passport-sized photographs, a copy of CNIC, educational documents, income proof, and proof of residence.

What is the National Bank of Pakistan (NBP) Student Loan Scheme?

NBP Student Loan is a collaborative initiative with major commercial banks in Pakistan. It provides interest-free loans to meritorious students pursuing scientific, technical, and professional education.

What are the eligibility criteria for the NBP Student Loan scheme?

Eligibility includes admission on merit, age limits (21 for graduation, 31 for post-graduation, 36 for Ph.D.), academic performance (minimum 70% marks), and approval of study subjects.

What types of loans are offered under the NBP Student Loan program?

NBP offers Schedule Fee Loans, Boarding Expenses Loan, and Procurement of Textbooks Loans to cover specific study-related expenses.

What is the repayment period for the NBP Student Loan?

Applicants have a maximum of 10 years to repay the loan, with monthly installments. Repayment begins six months from the borrower’s first employment or one year from the completion of studies.

What are the benefits of student loans in Pakistan?

Benefits include interest-free loans with 0% markup, access to education, ease of application, and manageable repayment options, easing the financial burden on students and their families.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment