The Ehsaas Interest-Free Loan Scheme was introduced by the government, under this scheme interest-free loans ranging from PKR 20,000 to PKR 100,000 are given to poor families across Pakistan.

Ehsaas Interest-Free Loan Scheme is conducted or implemented through partner organizations, some of the key partners include:

Akhuwat Foundation

Agahe Foundation

Punjab Rural Support Program

Now, the question is; how to get an urgent cash loan via the Ehsaas Interest-Free Loan Scheme?

All you need is to visit the nearest office/center of one of the partners’ organizations (list is given below), get the loan application form, after filling and attaching the required documents submit the loan application form and receive your cash amount within a few days.

Having stated that, now, let’s discuss the eligibility requirements and application process for Ehsaas Interest-Free Loan Scheme to get urgent cash without interest. Here we go!

Recommended Reading: Ehsaas Program Registration {8171 احساس پروگرام} (اپنے گھرانے کی اہلیت جانئے)

Ehsaas Interest-Free Loan Scheme In Pakistan | Ehsaas Loan 75000 Online Registration

Table of Contents

- Ehsaas Interest-Free Loan Scheme In Pakistan | Ehsaas Loan 75000 Online Registration

- What Is Ehsaas Interest-Free Loan Scheme?

- Ehsaas Interest-free Loan Scheme Key Features

- Partner Of Ehsaas Loan Program

- Ehsaas Interest-Free Loan Scheme Eligibility Criteria

- How To Apply For Ehsaas Interest-Free Loan Scheme

- Documents Required For Ehsaas Interest-Free Loan Scheme

- Pros and Cons Of Ehsaas Interest-Free Loan Scheme

- Ehsaas Interest-Free Loan Scheme FAQs

What Is Ehsaas Interest-Free Loan Scheme?

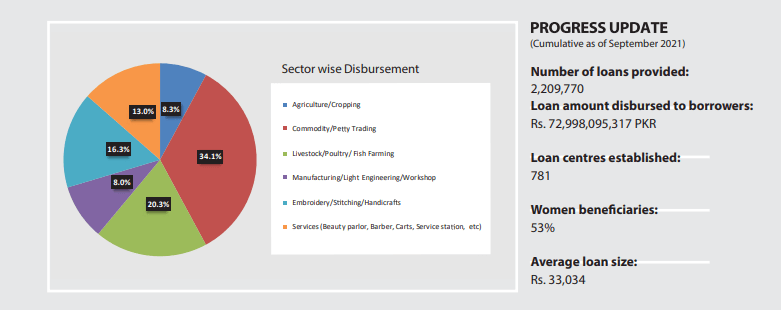

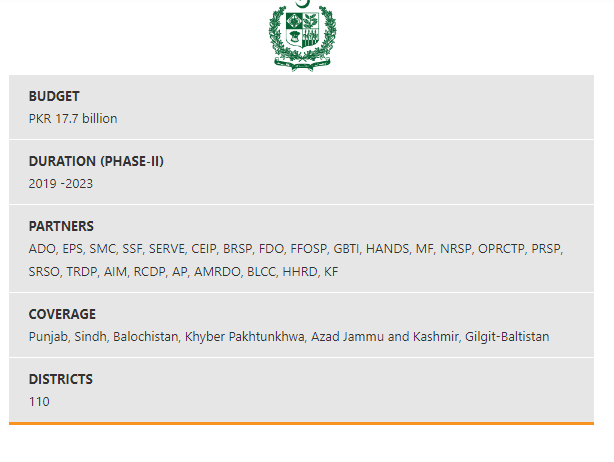

The Ehsaas Interest-Free Loan Scheme is an innovative poverty alleviation program introduced by the Pakistan Poverty Alleviation Fund (PPAF), a non-profit organization established by the Pakistani government.

This scheme offers financial support to eligible individuals, providing them with interest-free loans that range from PKR 20,000 to PKR 100,000.

The loan amount granted is determined based on the applicant’s financial requirements and their ability to repay.

This interest-free feature significantly eases the financial burden on recipients and empowers them to improve their economic prospects.

Recommended Reading: Ehsaas Rashan Program CNIC Check 8123 (احساس راشن پروگرام)

Ehsaas Interest-free Loan Scheme Key Features

The Ehsaas Interest-Free Loan Scheme offers a range of key features to empower individuals in Pakistan:

- Interest-Free Loans: Borrowers receive loans without any interest, alleviating the financial burden associated with traditional loans.

- Loan Amounts: The loan range extends from PKR 20,000 to PKR 100,000, providing flexibility to suit varying financial needs.

- Repayment Period: Borrowers enjoy a convenient repayment window, spanning from 6 months to 2 years, allowing them to repay at their own pace.

- Eligibility Criteria: The scheme is open to individuals between the ages of 18 and 65 years, ensuring inclusivity across a broad age range.

- Business Development Support: Besides financial aid, the scheme offers business development support, enabling borrowers to strengthen or establish their ventures.

- Quick Processing: The loan application process is streamlined, ensuring quick and efficient processing to provide timely assistance to applicants.

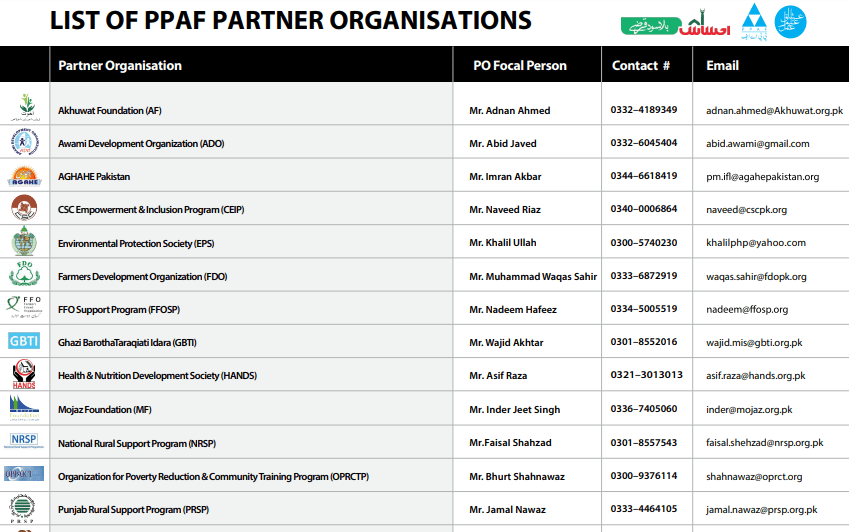

Partner Of Ehsaas Loan Program

Recommended Reading: HEC Ehsaas Scholarship Program Apply Online (2024) {New Registration}

The Ehsaas Interest-Free Loan Scheme is implemented through partnerships with various organizations selected by the Poverty Alleviation and Social Safety Division in Pakistan. The partners of the program include:

- Akhuwat

- Kashf Foundation

- NRSP Microfinance Bank

- First Women Bank

- Telenor Microfinance Bank

- FINCA Microfinance Bank

- The Punjab Provincial Cooperative Bank Ltd

- Khushhali Microfinance Bank

- Apna Microfinance Bank

- Jubilee Life Insurance Company Limited

Ehsaas Interest-Free Loan Scheme Eligibility Criteria

Ehsaas Interest-Free Loan Scheme Eligibility Criteria:

- Age Range: The Ehsaas Interest-Free Loan Scheme is available to individuals within the age bracket of 18 to 65 years, ensuring inclusivity and enabling a diverse range of potential beneficiaries to access the program.

- Citizenship: The program is exclusively designed for Pakistani citizens, aiming to empower and uplift local communities by providing them with accessible financial support.

- Loan Purpose: Prospective applicants are required to clearly articulate the purpose for which they seek the loan. This criterion ensures that borrowers have a well-defined plan for utilizing the funds, whether it’s for business expansion, education, healthcare, or other essential needs.

- Income Evaluation: As part of the eligibility assessment, the applicant’s income level is considered. While this criterion does not exclude individuals with lower incomes, it helps to determine the loan amount that can be feasibly repaid based on the applicant’s financial capacity.

- Business Plan (For Entrepreneurs): For entrepreneurs seeking a loan, a comprehensive and feasible business plan is required.

- Repayment Capacity: Ensuring the borrower’s ability to repay the loan is critical to the program’s success.

- Credit History: While a strict credit history check may not be applicable in an interest-free loan scheme, the applicant’s financial conduct may be considered, particularly if they have previously availed of loans from similar schemes.

Recommended Reading: Ehsaas Kafalat Program Registration PKR 12,000 (SMS CNIC 8171)

How To Apply For Ehsaas Interest-Free Loan Scheme

To apply for the Ehsaas Interest-Free Loan Scheme in Pakistan, follow these general steps:

- Determine Eligibility: The first step is to check whether you meet the eligibility criteria set by the Ehsaas Interest-Free Loan Scheme. Ensure you fall within the specified age range (18-65 years) and possess Pakistani nationality.

- Develop a Business Plan (For Entrepreneurs): If you intend to use the loan for business purposes, prepare a comprehensive business plan. Your plan should outline your business idea, its objectives, market analysis, budget, and financial projections.

- Identify Partner Organization: Once you are eligible and have a viable business plan (if applicable), find a partner organization affiliated with the Ehsaas Interest-Free Loan Scheme.

- Submit Loan Application: Approach the chosen partner organization and submit your loan application. Provide all required documents, including identification, proof of nationality, income details, and your business plan.

- Sign the Loan Agreement: Before receiving the loan amount, you will need to sign a loan agreement outlining the terms and conditions of the loan. Review the agreement carefully and seek clarification on any clauses you do not understand.

- Repayment Process: After receiving the loan, follow the repayment schedule provided in the loan agreement.

Recommended Reading: Ehsaas Emergency Cash Program 12,000-25,000 (SMS-8171)

Documents Required For Ehsaas Interest-Free Loan Scheme

To apply for the Ehsaas Interest-Free Loan Scheme in Pakistan, you will typically need to gather and provide the following documents:

- National Identity Card (NIC): A valid National Identity Card is a primary document required for the application process. It serves as proof of your identity, citizenship, and age. Ensure that your NIC is up to date and not expired.

- Proof of Income: You will need to provide documentation that demonstrates your income level. This can include salary slips, income certificates, or any other official documents that validate your earnings.

- Residence Proof: You may be required to submit proof of your residence, such as a utility bill or rent agreement, to establish your residential address.

- Bank Account Details: You will typically need to provide your bank account details, including the account number and bank name.

- Business or Employment Details: If you are applying for a loan for a business venture or self-employment purposes, you may be required to submit additional documents related to your business, such as business registration certificates, trade licenses, or tax registration documents.

- Loan Purpose Documentation: Depending on the specific purpose for which you are applying for the loan, you may need to provide supporting documentation.

Pros and Cons Of Ehsaas Interest-Free Loan Scheme

Pros of Ehsaas Interest-Free Loan Scheme

- Access to Credit: One of the most prominent advantages of the Ehsaas Interest-Free Loan Scheme is that it provides access to credit for individuals who may otherwise have limited or no access to traditional financial institutions.

- Poverty Alleviation: The scheme specifically targets individuals and families facing financial hardships, helping them overcome poverty by providing access to interest-free funds.

- Financial Inclusion: The Ehsaas Interest-Free Loan Scheme aims to include individuals who may not have access to traditional banking services.

- Interest-Free Financing: One of the major advantages of the scheme is that the loans are interest-free.

Cons of Ehsaas Interest-Free Loan Scheme

- Limited Loan Amount: One significant drawback of the Ehsaas Interest-Free Loan Scheme is the limitation on loan amounts. While the loans offered range from PKR 20,000 to PKR 100,000, some applicants with more substantial financial needs may find the loan amounts insufficient to address their requirements adequately.

- Limited Loan Purpose: The scheme’s focus on specific loan purposes may restrict the options available to applicants.

- Limited Repayment Period: The predetermined repayment period, ranging from 6 months to 2 years, might place additional financial strain on borrowers.

- Dependency on Partner Organizations: The program’s effectiveness relies heavily on the efficiency and reach of partner organizations.

Ehsaas Interest-Free Loan Scheme FAQs

What is the Ehsaas Interest-Free Loan Scheme?

The Ehsaas Interest-Free Loan Scheme is a government-supported initiative in Pakistan that provides interest-free loans to eligible individuals to support their business development, education, healthcare, and other essential needs.

What is the Ehsaas Interest-Free Loan Scheme, and how does it operate?

The Ehsaas Interest-Free Loan Scheme is a government initiative providing interest-free loans ranging from PKR 20,000 to PKR 100,000 to needy families in Pakistan. It is implemented through partner organizations such as Akhuwat Foundation, Agahe Foundation, and Punjab Rural Support Program.

What documents are required to apply for the Ehsaas Interest-Free Loan Scheme?

The required documents typically include a valid National Identity Card (NIC), proof of income, residence proof, bank account details, and any additional documentation related to the purpose of the loan (such as business registration certificates, employment certificates, or vocational training enrollment confirmation).

How much loan amount can I apply for?

The loan amounts available under the scheme range from PKR 20,000 to PKR 100,000, depending on the applicant’s financial needs and repayment capacity.

What is the repayment period for interest-free loans?

The repayment period for the interest-free loans offered by the Ehsaas scheme varies from 6 months to 2 years, providing borrowers with a flexible timeline to repay the loan.

How can I apply for an urgent cash loan through the Ehsaas Interest-Free Loan Scheme?

To apply, visit the nearest office of partner organizations like Akhuwat Foundation, Agahe Foundation, or Punjab Rural Support Program. Obtain the loan application form, fill it out, attach the required documents, and submit the form. The cash amount will be disbursed within a few days.

What are the key features of the Ehsaas Interest-Free Loan Scheme?

The scheme offers interest-free loans from PKR 20,000 to PKR 100,000 with a repayment period of 6 months to 2 years. Eligibility criteria include age (18-65), Pakistani citizenship, and a well-defined loan purpose. Business development support is also provided.

Who are the partners involved in the implementation of the Ehsaas Interest-Free Loan Scheme?

Partner organizations include Akhuwat Foundation, Agahe Foundation, Punjab Rural Support Program, and others as listed.

What are the eligibility criteria for the Ehsaas Interest-Free Loan Scheme?

Eligibility criteria include age (18-65), Pakistani citizenship, a clear loan purpose, consideration of income, business plan (for entrepreneurs), repayment capacity, and credit history.

What documents are required to apply for the Ehsaas Interest-Free Loan Scheme?

Required documents typically include a valid NIC, proof of income, residence proof, bank account details, and, if applicable, additional documents related to the loan purpose or business details.

What are the pros and cons of the Ehsaas Interest-Free Loan Scheme?

Pros include access to credit, poverty alleviation, financial inclusion, and interest-free financing. Cons involve limited loan amounts, specific loan purposes, a predetermined repayment period, and dependency on partner organizations.

Is there a specific age range for applicants of the Ehsaas Interest-Free Loan Scheme?

Yes, the scheme is available to individuals within the age range of 18 to 65 years, ensuring inclusivity across a broad age spectrum.

Recommended Reading: Ehsaas Rashan Program CNIC Check 8123 (احساس راشن پروگرام)

If you find the information in this article valuable, we would greatly appreciate it if you could take a moment to comment and share it with others. Your support helps us reach more people with important information.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment