Personal Loan Via Mobile In Pakistan: Paisayaar is one of the best and most authenticated loan apps available in Pakistan. It gives PKR 5,000 to PKR 25,000 Personal Loan Via Mobile Application anywhere in Pakistan 24/7.

It is licensed by NBFC and approved & verified by SECP i.e. user’s data and privacy are fully protected and secured.

Now, the question is; How to get a PKR 25,000 urgent cash loan by using the loan app?

Simply, download the official app from the Google Play Store, sign up via your registered mobile number, select your desired loan amount, and click “Confirm”. The loan amount would be transferred into your Easy Paisa, Jazz Cash, or your bank account within 5 minutes.

Now, let’s discuss eligibility, maximum loan limits, terms and conditions, and the step-by-step process to get a Rs. 5K-25K loan via mobile by using the loan app anywhere, anytime in Pakistan.

Recommended Reading: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

Personal Loan Via Mobile In Pakistan | Paisayaar-Best Loan App

Table Of Contents

Paisayaar loan app

Paisayaar, a product of JINGLECRED DIGITAL FINANCE LIMITED, is your go-to online solution for hassle-free loans. With Paisayaar, you have access to secure and adaptable lending options.

Whether you need funds for an unexpected expense or a planned purchase, Paisayaar offers you the flexibility you need. It’s a convenient way to borrow money from the Paisayaar app.

The best part? It’s easy to use, and there are no secret charges. You can get a loan between 1,000 and 25,000, making it a great solution for your financial needs.

Recommended Reading: Top 7 Urgent Loan Apps In Pakistan Without Interest | 50K-2Lakh Urgent Loan

Loan Amount

You can get money through this app ranging from 1,000 and 25,000, and you have up to 90 days to pay it back.

The interest you’ll be charged each day falls between 0% to 0.6%. If you’re late with your repayment, there’s a penalty interest of 2% to 2.5% per day.

Interest Rate On Loan Amount

The interest rate you’ll be charged each day ranges from 0% to 0.6% of the total loan amount you get from this App.

Recommended Reading: Top 3 Loan Apps In Pakistan (50K-100K Urgent Cash Loan)

Late Fee On Loan

If you don’t repay your loan amount on time, you’ll face a daily late fee of 2% to 2.5% on the total loan amount that you get from this loan app.

Eligibility Criteria

The eligibility criteria for obtaining a loan through the App:

- Citizen of Pakistan: You must be a citizen of Pakistan to be eligible for a loan.

- 18 years of age or older: You need to be at least 18 years of age or older to apply for a loan.

- Own Bank Account or Mobile Wallet: You should have your bank account or a mobile wallet to receive and manage the loan funds.

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | 30K Advance Salary Loan

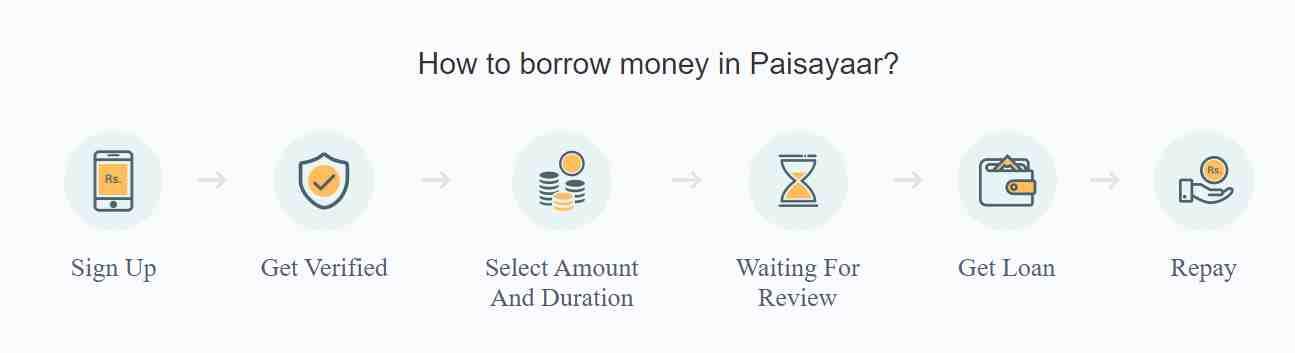

How To Get a Loan From the Paisayaar App?

Here are the details of how to get a loan from this Loan App:

- Download the App: First, download this App on your mobile device.

- Sign Up: After installing the app, sign up by providing the required information.

- Get Verified: Complete the verification process as requested by the app to confirm your identity.

- Select Amount and Duration: Once you’re verified, choose the loan amount you need, which can be anywhere between 1,000 and 25,000. You can also select the duration of your loan, which can range from 1 to 90 days.

- Waiting For Review: After selecting your loan details, your application will be reviewed by this app. You’ll need to wait for their approval.

- Get a Loan: Once your application is approved, you’ll receive the loan amount in your account.

- Reply: It’s important to repay the loan amount on time otherwise a daily penalty interest of 2% to 2.5% will be charged.

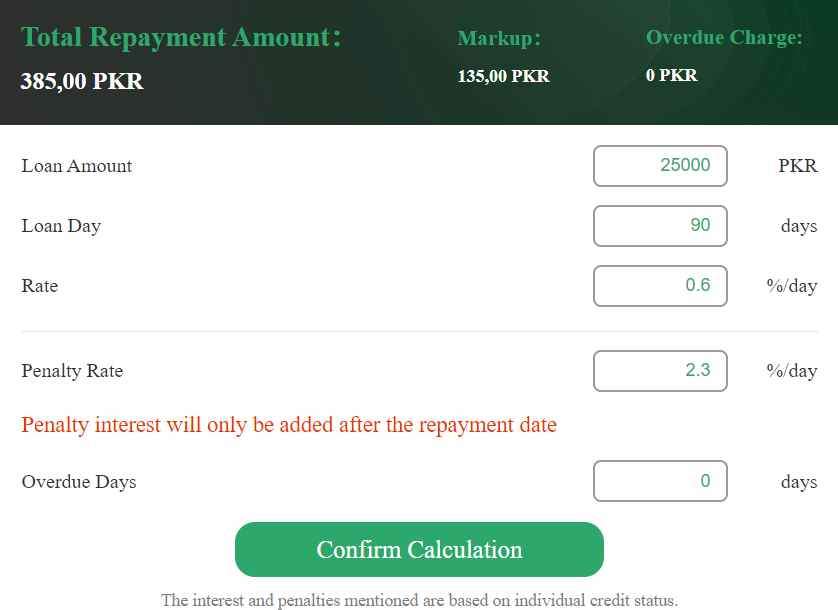

Paisayaar Loan Calculator

r.

If you get a Pkr. 25000 loan amount for 90 days from the Paisa yaar app. You have to pay an interest amount of an estimated Pkr. 13500 additionally.

If you do not pay this loan amount on time then you also pay a daily penalty interest of 2% to 2.5% will be charged on the total loan amount.

Features Of Paisayaar App

Here are the features of this App:

- 24-Hour Loan Service: You can apply for a loan at any time, day or night. Paisa yaar App is available 24/7, so you can get the funds you need when it’s convenient for you.

- No Collateral: You don’t need to provide any collateral or security to get a loan from Paisa Yaar App. Your loan is based on your eligibility and application.

- Flexible Loan Amount and Duration: The Paisa yaar App offers flexibility in choosing your loan amount, allowing you to borrow what you need, ranging from 1,000 to 25,000. You can also select the duration of your loan, with options from 1 to 90 days.

- Relatively Low Fees: Paisa yaar App offers loans with comparatively affordable fees. The daily interest rate is between 0%-0.6%.

Recommended Reading: Top Online Loan Apps In Pakistan (For 2024) | Best Loan Apps 2024

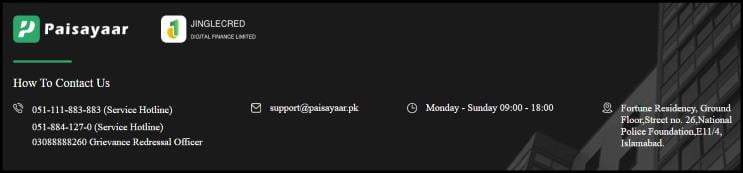

Contact Details

Address: Fortune Residency, Ground Floor, Street no. 26, National Police Foundation, E11/4, Islamabad.

Email: For any support or inquiries, you can email them at support@paisayaar.pk.

Phone Numbers:

- Service Hotline: 051-111-883-883

- Service Hotline: 051-884-127-0

Grievance Redressal Officer: If you have any concerns or grievances, you can contact the Grievance Redressal Officer at 03088888260.

SECP Approved App

The SECP (Securities and Exchange Commission of Pakistan) has announced that only three nano lending apps, namely ‘SmartQarza,’ ‘Paisayaar,’ and ‘Abhi Your Salary Now,’ have met all the necessary regulations as per Circular 10.

These three apps have been officially approved by SECP, and their names are listed on the commission’s website.

This means that these loan apps are genuine and not scams because they have received the approval of SECP, ensuring their legitimacy.

Recommended Reading: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

Benefits Of Paisayaar App

Here are the benefits of using the Paisayaar App:

- Easy Loan Access: You can easily and quickly obtain a loan without the hassle of providing extensive private information.

- Urgent Loans: When you need funds urgently, Paisayaar is there to help you secure a loan promptly.

- Loan Amount Range: You can borrow any amount between 1,000 to 25,000, providing flexibility to meet your specific financial needs.

- Maximum Duration: You have the option to choose a loan duration of up to 3 months or 90 days.

- Anytime, Anywhere: Paisayaar allows you to access loans anytime and from anywhere, providing convenient financial support when you need it most.

- Simple Application and Repayment: The process for both applying for and repaying loans is straightforward and user-friendly, ensuring a hassle-free experience.

Recommended Reading: 25,000 Urgent Cash Loan | Barwaqt Loan App: Fastest Loan App In Pakistan

Cons Of Paisayaar app

- Not According to Islamic Principles: The Paisa yaar app is not giving interest-free loans. This loan app charges interest amounts ranging from 0%-0.6% on the total amount that you get from this app. So this app is not according to Islamic Principles.

- Higher Interest Rates: The app has relatively high daily interest rates, ranging from 0% to 0.6%, which can result in higher borrowing costs over time.

- Limited Loan Amount: The maximum loan amount available through Paisayaar is 25,000, which may not be sufficient for larger financial needs.

- Additional Late Fees: If you fail to make loan repayments on time, you may incur daily penalty interest charges of 2% to 2.5%, which can add up and make the loan more expensive.

Recommended Reading: Fori Loan App In Pakistan (Get 10K-2Lakh Urgent Cash Loan) | Urgent Cash Loan App In Pakistan

FAQs | Personal Loan App

What is the Paisayaar app?

Paisa Yaar is an online loan app in Pakistan that provides interest-free personal loans ranging from PKR 5,000 to PKR 25,000. It operates 24/7 and is licensed by NBFC, approved, and verified by SECP for data privacy and security.

What are the eligibility criteria for using the Paisayaar app?

Here are the eligibility criteria for the Paisa Yaar app:

1. Citizen of Pakistan.

2. 18 years of age or older.

3. Person having their own Bank Account / Mobile Wallet.

How can I apply for a loan using the Paisa Yaar app?

To apply for a loan:

1. First download app:

2. Sign Up:

3. Get Verified:

4. Select Amount:

5. Duration:

6. Waiting For Review:

7. Waiting for approval Get a Loan:

8. Repay:

What is the maximum loan amount I can request through the Paisayaar app?

You can get money through the PaisaYaar app ranging from 1,000 and 25,000, and you have up to 90 days to pay it back.

What are the loan late fee charges on the Paisayaar app?

If you don’t repay your loan on time, you may be subject to daily penalty interest charges, typically between 2% and 2.5%.

Is this app available 24/7 for loan applications?

Yes, you can apply for a loan through the Paisayaar app at any time, as it offers a 24-hour loan service.

What is the daily interest rate for loans from Paisayaar?

The daily interest rate on Paisa yaar loans ranges from 0% to 0.6%.

What is the maximum loan duration on Paisayaar?

You can choose a loan duration of up to 3 months or 90 days.

How can I contact Paisayaar’s customer support?

You can reach Paisayaar’s customer support at 051-111-883-883 or 051-884-127-0. For grievance redressal, you can contact them at 03088888260.

Is collateral required to get a loan from Paisayaar?

No, this app does not require collateral or security for loans.

What are the main benefits of using the Paisayaar app?

Some benefits of the Paisayaar app include easy and quick access to loans, the option to get loans urgently, flexible loan amounts, and simple application and repayment processes.

Can I access Paisayaar’s loan services 24/7?

Yes, you can apply for a loan through Paisayaar at any time since they offer a 24-hour loan service.

How can I get an urgent cash loan of PKR 25,000 from Paisayaar via the mobile app?

To get a loan, download the official Paisayaar app from the Google Play Store, sign up with your registered mobile number, select your desired loan amount, and confirm. The loan amount will be transferred to your Easy Paisa, Jazz Cash, or bank account within 5 minutes.

What are the eligibility criteria for obtaining a loan through the Paisayaar app?

The eligibility criteria include being a citizen of Pakistan, 18 years or older, and having your bank account or mobile wallet to receive and manage the loan funds.

What is the interest rate on the loan amount from Paisayaar, and are there any late fees?

The daily interest rate ranges from 0% to 0.6%, and if the loan is not repaid on time, a daily penalty interest of 2% to 2.5% is charged on the total loan amount.

Can I access Paisayaar loans anytime and from anywhere?

Yes, Paisayaar allows users to access loans 24/7, providing convenient financial support whenever needed.

Recommended Reading: Get 30K-50K Micro Loan In Pakistan Online | 30K Advance Salary Loan

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment