The Solar Panel Scheme, offers a remarkable opportunity for eligible applicants, with the Prime Minister’s endorsement, to secure substantial funding ranging from Rs. 400 million to an impressive Rs. 6 billion.

A markup rate of 6% and a repayment period of up to 12 years makes the Solar Panel Scheme | Solar Tubewell Scheme even more appealing for those interested in investing in solar energy projects.

The question is; what exactly is the solar panel scheme for? Is it for common people or businessmen only?

The answer is; as you can guess from the amount of funding involved (PKR 400 Million-PKR 6 Billion), this scheme is good for businesses, and for those investors who want to invest in clean and green energy projects.

Having stated all, now, let’s explore the eligibility requirements and the process of taking part in the Solar Panel Scheme | Solar Tubewell Scheme. Here we go!

Recommended Reading: Solar Tubewell Subsidy In Pakistan | Solar Tubewell+Biogas Plants

Prime Minister Solar Panel Scheme | PM Solar Panel Scheme

Table Of Contents

Recommended Reading: Governor Sindh Initiative For Artificial Intelligence | Governor Sindh IT Program

What Is the Prime Minister Solar Panel Scheme?

The Prime Minister’s Solar Panel Scheme also known as PM Solar Panel Scheme is a groundbreaking initiative aimed at promoting renewable energy adoption across the country.

Under this scheme, the Prime Minister has introduced a remarkable opportunity for citizens to acquire solar panels through easy installment plans, completely free of interest charges.

This scheme empowers individuals to embrace solar energy without the burden of additional financial expenses, making it accessible and affordable for a wider range of households.

By facilitating the purchase of complete solar panels, this initiative not only supports sustainable energy practices but also contributes to reducing the carbon footprint of the nation, aligning with the global push towards cleaner and greener energy sources.

Recommended Reading: DAP Subsidy Registration Online | DAP Subsidy Check Online

Prime Minister Solar Panel Scheme Categories | Govt Solar Panel Scheme

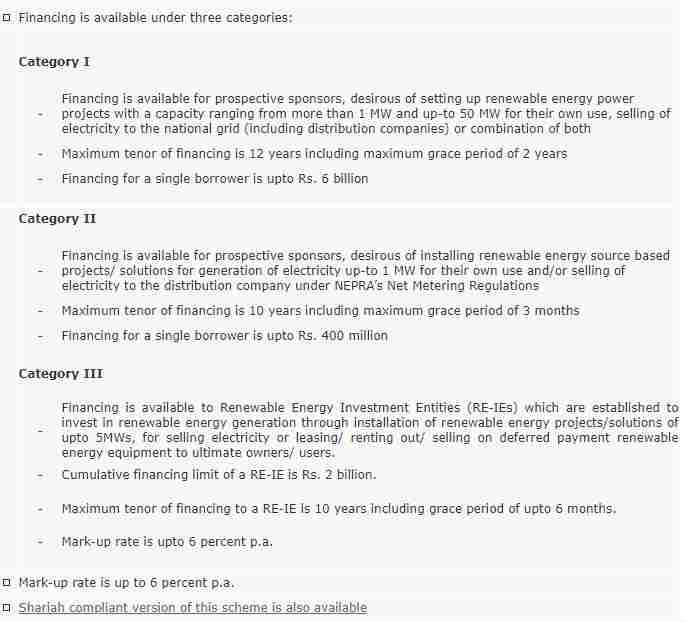

There are three types of Prime Minister Solar Panel Scheme. Here are the details for each category:

- Category I

- Category II

- Category III

Category I

The first category of the Prime Minister Solar Panel Scheme is specifically tailored for applicants who are interested in establishing renewable energy power units.

This category focuses on large-scale solar projects with significant capacity, ranging from 1 MW (megawatt) to a maximum of 50 MW.

The government aims to encourage the development of substantial solar power projects to contribute significantly to the national energy grid and reduce the country’s dependence on non-renewable energy sources.

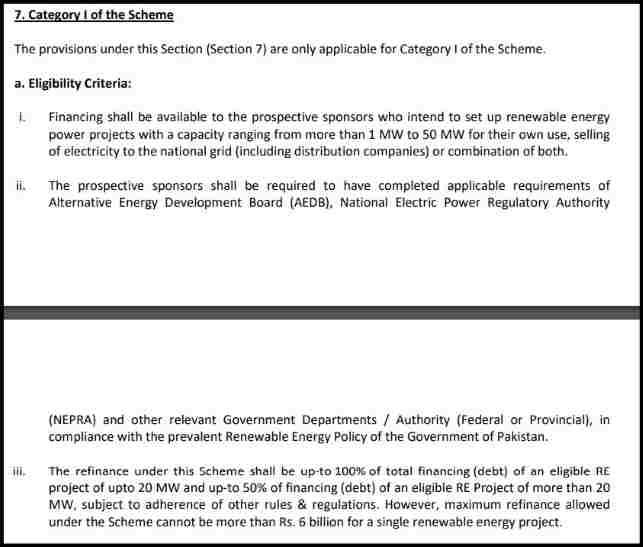

Category I Eligibility Criteria

Category I Eligibility Criteria Details:

- Who Can Apply:

- If you want to build a renewable energy power project, you can apply.

- Your project should generate more than 1 megawatt (MW) and less than 50 MW of electricity.

- You can use the electricity for yourself, sell it to the national grid, or do both.

- Requirements:

- You must finish all the necessary paperwork with organizations like the Alternative Energy Development Board (AEDB), the National Electric Power Regulatory Authority (NEPRA), and other government departments.

- This should follow the current Renewable Energy Policy of the Government of Pakistan.

- How Much Money You Can Get:

- You can get up to 100% of the financing (the money you need) for a renewable energy project that’s up to 20 MW.

- For projects bigger than 20 MW, you can get up to 50% of the financing.

- But the maximum amount of money you can get for one project is Rs. 6 billion.

Details of Category I:

- Capacity Range: The solar projects falling under this category must have a minimum capacity of 1 MW and can go up to an impressive 50 MW. This allows for the establishment of substantial solar power plants capable of generating a significant amount of electricity.

- Financing Period: To facilitate the implementation and long-term success of these projects, the financing period extends up to 12 years.

- Grace Period: Applicants in Category I are granted a considerable grace period of 2 years. During this period, the beneficiaries are not required to start repaying the funding received, providing them with some breathing space to set up and optimize the solar power facilities.

- Funding Limit: The government has set a substantial funding limit of up to PKR 6 billion for projects falling under this category.

Recommended Reading: Turkey Visit Visa Price In Pakistan {e-Visa Fee+Documents}

Category II

The second category of the Prime Minister Solar Panel Scheme is specifically designed for sponsors interested in installing renewable energy source-based projects.

This category focuses on smaller-scale solar projects, with a capacity limit of 1 MW, in compliance with the Net Metering Regulations established by NEPRA (National Electric Power Regulatory Authority).

The objective of this category is to encourage broader participation of businesses and sponsors in the adoption of solar energy solutions.

Category II Eligibility Criteria

Category II Eligibility Criteria Details:

- Who Can Apply:

- If you’re a domestic, agricultural, commercial, or industrial borrower, you can apply.

- Your project should be renewable energy-based and generate up to 1 megawatt (MW) of electricity.

- You can install more than one project, but they shouldn’t be next to each other.

- What You Can Do:

- The electricity you generate can be for your use or sold to the distribution company, following NEPRA’s Net Metering Regulations.

- How Much Money You Can Get:

- You can get refinancing for 100% of the financing provided by banks/DFIs.

- But the most you can loan for one project is Rs. 400 million.

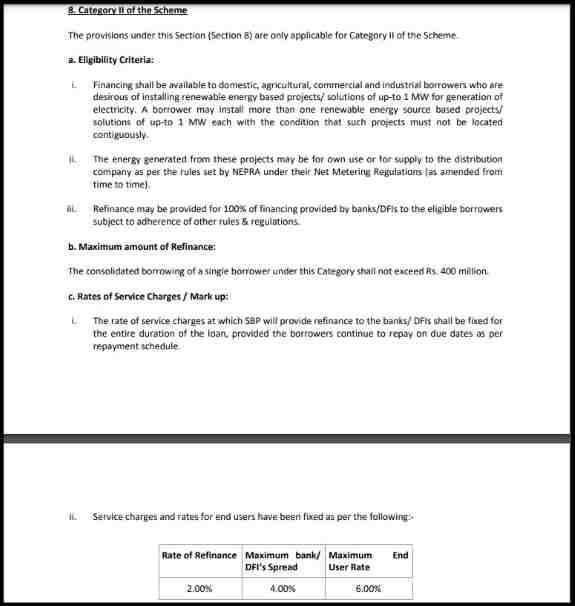

- Service Charges and Interest Rates:

- The service charges for the refinance provided by SBP to banks/DFIs will stay the same throughout the loan term if you repay on time.

- The service charges and interest rates for end users are fixed at 6.00%, with banks/DFIs adding a maximum of 4.00% to this rate.

Details of Category II

- Capacity Limit: Category II is suitable for renewable energy projects with a capacity of up to 1 MW. This ensures that even smaller businesses and individual sponsors can participate in the scheme and contribute to the expansion of solar energy adoption across various sectors.

- Financing Period: The maximum financing tenor for projects falling under Category II is set at 10 years.

- Grace Period: Applicants in Category II are granted a grace period of 3 months. During this time, the sponsors are not required to make repayments on the received funding.

- Funding Limit: Under Category II, sponsors can secure financing of up to PKR 400 million.

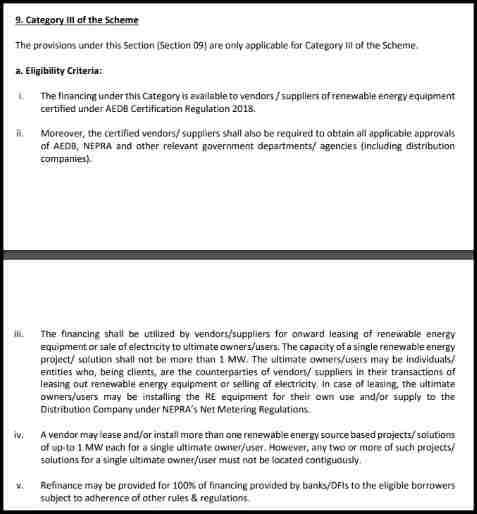

Category III

Category III of the Prime Minister Solar Panel Scheme is tailored to meet the needs of Renewable Energy Investment Entities (RE-IEs) looking to secure funding for their renewable energy projects.

This category aims to facilitate larger-scale solar installations and encourage the active participation of specialized entities dedicated to renewable energy development.

Category III Eligibility Criteria

Category III Eligibility Criteria Details:

- Who Can Apply:

- Vendors or suppliers of renewable energy equipment certified under AEDB Certification Regulation 2018 can apply.

- They must also get approvals from AEDB, NEPRA, and other government departments.

- What You Can Do:

- Vendors/suppliers can use the financing to lease renewable energy equipment or sell electricity to users.

- Each project’s capacity shouldn’t be more than 1 megawatt (MW).

- Users could be individuals or entities who lease the equipment or buy electricity. They can also supply electricity to distribution companies under NEPRA’s Net Metering Regulations.

- How Much Money You Can Get:

- You can get refinancing for 100% of the financing provided by banks/DFIs.

- But the most you can loan as a vendor/supplier is Rs. 1 billion.

- Banks/DFIs can form groups to finance larger projects.

- Getting the Money:

- Each user should apply separately for financing.

- The money goes to the vendor/supplier, within their loan limit, after completing the necessary paperwork.

- If the money exceeds the loan limit, banks/DFIs have to pay it back immediately and may face penalties.

- Documentation:

- You need agreements between the vendor/supplier and the user, along with payment schedules.

- For leasing, proof of upfront payment and a security deposit are required.

- Users must agree to pay through the bank/DFI.

- There should be agreements with suppliers and approvals from relevant authorities.

- Service Charges and Interest Rates:

- Service charges for the refinance stay the same if payments are on time.

- The interest rates for end users are 6.00%, with banks/DFIs adding 3.00%.

Details of Category III:

- Allowable Capacity: Category III allows for renewable energy projects with a capacity of up to 5 MW. This higher capacity limit enables Renewable Energy Investment Entities to develop more substantial solar power projects, contributing significantly to the country’s renewable energy goals.

- Financing Period: The maximum financing tenor for projects falling under Category III is set at 10 years.

- Grace Period: Applicants in Category III are granted a grace period of 6 months. During this time, the Renewable Energy Investment Entities are not required to start repaying the received funding.

- Funding Limit: Renewable Energy Investment Entities under Category III can secure financing of up to PKR 2 billion.

Recommended Reading: Punjab Government E-bikes and Rickshaws Scheme

Pros And Cons Of Solar Panel Scheme

Recommended Reading: Governor Sindh Initiative For Artificial Intelligence | Governor Sindh IT Program

Pros of Solar Panel Scheme:

- Simplified Application Process: The Solar Panel Scheme offers a hassle-free application process, making it accessible to a wide range of individuals.

- Interest-Free Financing: One of its major benefits is the absence of interest charges, ensuring that participants can acquire solar panels without any additional financial burden.

- Significant Opportunities for Farmers: This initiative presents a substantial opportunity for farmers to harness solar energy, potentially reducing their energy costs and enhancing sustainability.

- Convenient Installment Plans: The scheme includes convenient installment plans, making it easier for participants to transition to renewable energy sources without immediate financial strain.

Cons of Solar Panel Scheme:

- Initial Down Payment Required: Participants may find it challenging to make the initial down payment, which can be a substantial sum, depending on the overall cost of the solar panel installation.

- Lengthy Application Process: The application process for the scheme can be time-consuming, leading to delays in acquiring the solar panels and reaping their benefits.

- Markup Rate: The scheme imposes a markup rate of 6%, which, while relatively low, adds to the overall cost of the solar panels over time.

- Waiting Period for Application Processing: Applicants may experience delays in the processing of their applications, which can be frustrating for those eager to implement solar energy solutions.

Recommended Reading: DAP Subsidy Registration Online | DAP Subsidy Check Online

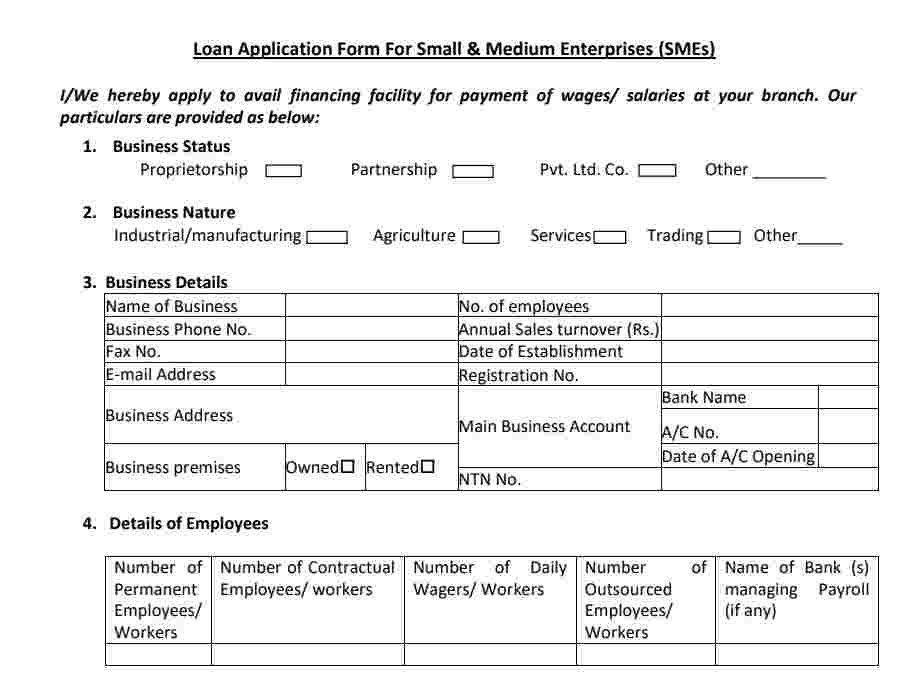

How To Apply For Solar Panel Scheme?

To apply for the Solar Panel Scheme, follow these steps:

- Visit the official website of the State Bank of Pakistan (SBP) at https://www.sbp.org.pk/ to access the scheme’s information and application details.

- Obtain the application form either by downloading it from the website or by contacting the designated authorities responsible for administering the scheme.

- Fill out the application form accurately, providing all the required information. Make sure to review the form thoroughly and ensure that all fields are properly filled.

- Prepare the necessary documents as mentioned in the application form or the scheme guidelines. This may include proof of identity, ownership or lease documents for the property, project feasibility study, financial statements, and any other supporting documents specified by the scheme.

- Submit the completed application form along with the required documents to the designated authorities or the specified submission channel as mentioned in the scheme guidelines.

- Await the approval process, during which the authorities will review your application, documents, and project details.

- If your application is approved, you will receive confirmation of the funding allocation and the next steps to proceed with the implementation of your solar panel project.

Benefits Of Prime Minister Solar Panel Schemes

The Prime Minister Solar Panel Schemes offer several top benefits to individuals, businesses, and Renewable Energy Investment Entities (RE-IEs) in Pakistan:

- Financial Incentives: The schemes provide substantial financial incentives, including funding ranging from Rs. 400 million to Rs. 6 billion, depending on the project category. This funding significantly reduces the financial burden for applicants, encouraging them to invest in solar energy projects.

- Attractive Markup Rate and Flexible Repayment: The schemes offer an attractive markup rate of 6% and a flexible repayment period of up to 12 years. This allows beneficiaries to manage their financial commitments more effectively and focus on harnessing solar energy without undue financial strain.

- Energy Cost Savings: By installing solar panels and generating their electricity, applicants can reduce their reliance on conventional energy sources and lower their energy costs significantly.

- Enhanced Energy Independence: Embracing solar energy enhances energy independence as applicants become less dependent on the national power grid.

- Environmental Impact: Solar energy is a clean and renewable energy source that helps reduce greenhouse gas emissions and combat climate change.

- Job Creation and Economic Growth: The widespread adoption of solar energy projects creates job opportunities in the renewable energy sector, fostering economic growth and contributing to the country’s overall development.

- Net Metering Benefits: By connecting solar energy projects to the national power grid through Net Metering, surplus electricity can be fed back to the grid, allowing applicants to earn revenue for the excess energy they generate.

- Diversified Participation: The schemes cater to different categories of applicants, including homeowners, businesses, and specialized Renewable Energy Investment Entities.

- Promoting Innovation: With large-scale and smaller-scale solar energy projects encouraged under different categories, the schemes promote innovation in renewable energy technologies and solutions.

Recommended Reading: Top 15 Real Estate Companies In Pakistan (Buy+Sell+Rent)

Solar Panel Scheme | FAQs

What is the Solar Panel Scheme?

The Solar Panel Scheme 2024, offers a remarkable opportunity for eligible applicants, with the Prime Minister’s endorsement, to secure substantial funding ranging from Rs. 400 million to an impressive Rs. 6 billion.

A markup rate of 6% and a repayment period of up to 12 years makes the Solar Panel Scheme | Solar Tubewell Scheme even more appealing for those interested in investing in solar energy projects.

Who is eligible to apply for the Solar Panel Scheme?

The scheme is open to a wide range of applicants, including homeowners, businesses, and specialized Renewable Energy Investment Entities (RE-IEs). Each category has specific eligibility criteria, such as capacity limits, project types, and compliance with NEPRA’s Net Metering Regulations.

What is the financing period and grace period under the Solar Panel Scheme?

For Category I and Category II, the financing period extends up to 10 years, while Category III has a maximum financing tenure of 12 years. Category II applicants are granted a grace period of 3 months, and Category III applicants receive a grace period of 6 months.

What is the maximum funding available under the Solar Panel Scheme?

Applicants can secure funding ranging from PKR 400 million to an impressive PKR 6 billion, depending on the category and the size of the renewable energy project.

How will the solar energy generated be utilized by the applicants?

The solar energy generated can be used to meet the electricity demands of residential properties, commercial buildings, agricultural operations, and industrial facilities.

What challenges might applicants face in implementing solar projects under the scheme?

Challenges may include the initial investment required for solar panel installation, technical expertise for system setup and maintenance, and managing the financial commitment associated with the funding’s markup rate.

How can applicants apply for the Solar Panel Scheme?

Applicants can apply by following the guidelines and procedures set by the government. They need to fulfill the eligibility criteria, provide the required documentation, and submit their applications through the designated channels.

What are the capacity boundaries within the Prime Minister Solar Panel Scheme categories?

The scheme encompasses three distinct categories, each with its capacity range: Category 1 facilitates projects ranging from 1 MW to 50 MW, Category 2 accommodates projects up to 1 MW, and Category 3 authorizes projects with capacities of up to 5 MW.

What is the duration of the financing period for projects under this initiative?

The financing duration varies depending on the category selected. Category 1 provides a financing period of up to 12 years, Category 2 offers a 10-year financing term, and Category 3 also extends a 10-year financing window.

Is there a grace interval for loan repayments across all categories?

Indeed, all categories extend a grace period. Category 1 provides a 2-year grace window, Category 2 offers a 3-month grace period, and Category 3 provides a notably generous grace period of 6 months.

What are the funding thresholds available for projects within this scheme?

The funding limits are category-specific. In Category 1, projects can secure funding of up to PKR 6 billion. Category 2 allows for financing of up to PKR 400 million, and Category 3 provides financing options of up to PKR 2 billion for more extensive projects.

What is the funding range offered by the Solar Panel Scheme?

The Solar Panel Scheme provides funding ranging from Rs. 400 million to an impressive Rs. 6 billion.

What is the markup rate associated with the Solar Panel Scheme?

The markup rate for the scheme is 6%

Is the Solar Panel Scheme primarily for common people or businesses?

Considering the funding range (PKR 400 million – PKR 6 billion), the scheme is more suitable for businesses and investors interested in clean energy projects.

What is the primary aim of the Prime Minister Solar Panel Scheme?

The primary aim is to promote the adoption of renewable energy across the country, making solar energy accessible and affordable.

What are the eligibility criteria for the Solar Panel Scheme?

Eligibility criteria include intending to set up renewable energy power projects with capacities ranging from 1 MW to 50 MW, completion of relevant requirements from AEDB, NEPRA, and other government departments, and compliance with the prevailing Renewable Energy Policy.

What percentage of refinancing is available for eligible renewable energy projects under 20 MW?

Refinance is available up to 100% for projects up to 20 MW, and up to 50% for projects over 20 MW under the Solar Panel Scheme.

Can a project under Category II generate surplus energy for sale back to the grid?

Yes, projects under Category II, with a capacity limit of 1 MW, can generate surplus energy that can be sold back to the grid.

Are there any downsides to participating in the Solar Panel Scheme?

While the scheme offers numerous advantages, participants may face challenges such as the initial down payment requirement, a potentially lengthy application process, a 6% markup rate, and waiting periods for application processing.

What is the financing period for projects in Category II of the Solar Panel Scheme?

The financing period for Category II projects is 10 years.

What are the categories under the Solar Panel Scheme?

The scheme offers three categories:

Category I: Large-Scale Renewable Energy Power Facilities – This category is tailored for ambitious renewable energy endeavors featuring substantial capacity, ranging from 1 MW to an impressive 50 MW. It targets those aiming to establish sizeable solar power plants capable of making a significant contribution to the national energy grid.

Category II: Small to Medium-Scale Projects – Category II accommodates projects with a capacity limit of 1 MW, making it an ideal choice for smaller businesses, individual sponsors, and entities interested in launching moderate-sized solar installations. It encourages broader participation in the adoption of solar energy.

Category III: Specialized Renewable Energy Investment Entities (RE-IEs) – Category III is geared towards specialized entities exclusively dedicated to renewable energy development. Projects within this category have a capacity of up to 5 MW, enabling RE-IEs to undertake medium-sized solar energy initiatives with government support.

What are the eligibility criteria for category I?

Who Can Apply: You can apply if you want to build a renewable energy project. Your project should produce between 1 MW and 50 MW of electricity. You can use the electricity for yourself, sell it to the grid, or both.

Requirements: Finish paperwork with AEDB, NEPRA, and other government offices. Follow Pakistan’s Renewable Energy Policy.

How Much Money You Can Get:

Up to 100% financing for projects up to 20 MW.

Up to 50% financing for projects over 20 MW.

Maximum Rs. 6 billion for one project.

What are the eligibility criteria for Category II?

Who Can Apply: Anyone in domestic, agricultural, commercial, or industrial sectors.

Projects should generate up to 1 MW of renewable energy. Multiple projects are allowed, but not side by side.

What You Can Do: Use electricity for yourself or sell it to the grid under NEPRA rules. How Much Money You Can Get: Get a refinance for 100% of bank/DFI financing. Maximum borrowing for one project is Rs. 400 million.

Service Charges and Interest Rates: Service charges stay the same if payments are on time. End user rates are 6.00%, with banks/DFIs adding 4.00% maximum.

Recommended Reading: Solar Tubewell Subsidy In Pakistan | Solar Tubewell+Biogas Plants

If you find the information in this article valuable, we would greatly appreciate it if you could take a moment to comment and share it with others. Your support helps us reach more people with important information.

Should you have any questions or need further details, please don’t hesitate to reach out to us at Governmentschemes.pk@gmail.com | Info@governmentschemes.pk! We’re here to assist you!

Add a Comment