The Bank of Punjab BOP has a special program called the Advance Salary Loan, where salaried person can easily get salary loans, With this program, you can get a loan ranging from PKR 25,000 to PKR 3,000,000 based on their salary.

Here are the details of the BOP Advance Salary Loan:

Loan Amount: Pkr. 100,000-200,000

Loan Duration: 1year-3year

Markup: 14% of the Loan amount or according to the Loan Duration

so, in this article, we discuss complete information on the BOP Advance Salary Loan.

Recommended Reading: NBP Al-Ghazi Tractor Loan Scheme | NBP Kisan Tractor Scheme 2024

Advance Salary Loan (Get PKR 25K-30Lakh Salary Loan) [Sharia-Compliant]

Recommended Reading: Gold Loan In Pakistan (Get PKR 50K-70Lakh Gold Loan-NBP) [Sharia-Compliant]

Table of Contents

BOK Advance Salary Loan Key Features

Bank of Punjab loan Features:

- Flexible Loan Tenure: Choose an Advance Salary Loan term ranging from 1 to 4 years according to your financial preferences.

- Fixed Mark-up Rate: Benefit from a consistent mark-up rate throughout the entire loan tenure, providing financial stability.

- Convenient Monthly Installments: Enjoy the ease of repaying the Advance Salary Loan through manageable monthly installments, ensuring a stress-free repayment process.

- Financing Limits: Access financing ranging from (50,000) to (1,500,000), allowing you to meet your diverse financial needs.

- No Pre-payment Charges: Take advantage of the flexibility to settle your loan early without incurring any pre-payment charges, promoting financial freedom.

- Minimal Documentation: Obtain the loan with minimal documentation requirements, streamlining the application process for your convenience.

- Life Assurance Coverage: Ensure financial security with the provision of life assurance, providing peace of mind during the loan period.

Recommended Reading: HBL Salary Loan (Get PKR 25K-30Lakh Salary Loan In Pakistan) [Sharia-Compliant]

Eligibility Criteria Of Advance Salary Loan

- Age Range: Applicants must fall within the age bracket of 19 to 59 years, with the upper limit applicable at the maturity of the facility.

- Minimum Gross Salary: Maintain a monthly gross salary of at least 17,500.

- Employment Tenure: A minimum service period of six months with the current employer is mandatory.

- Relationship with BOP: Applicants must establish a minimum one-month relationship with the Bank of Punjab (BOP).

Recommended Reading: Top 3 Banks To Get Gold Loan In Pakistan (Get 50K-1Crore Gold Loan)

Essential Documentation Of Advance Salary Loan

- Valid Identification: Submit a copy of your current Computerized National Identity Card (CNIC).

- Recent Salary Verification: Provide your latest salary slip to verify your income, ensuring transparency in the loan application process.

- Bank Statements: Furnish the last six months‘ bank statements, offering a comprehensive overview of your financial transactions and stability.

Recommended Reading: NBP Al-Ghazi Tractor Loan Scheme | NBP Kisan Tractor Scheme 2024

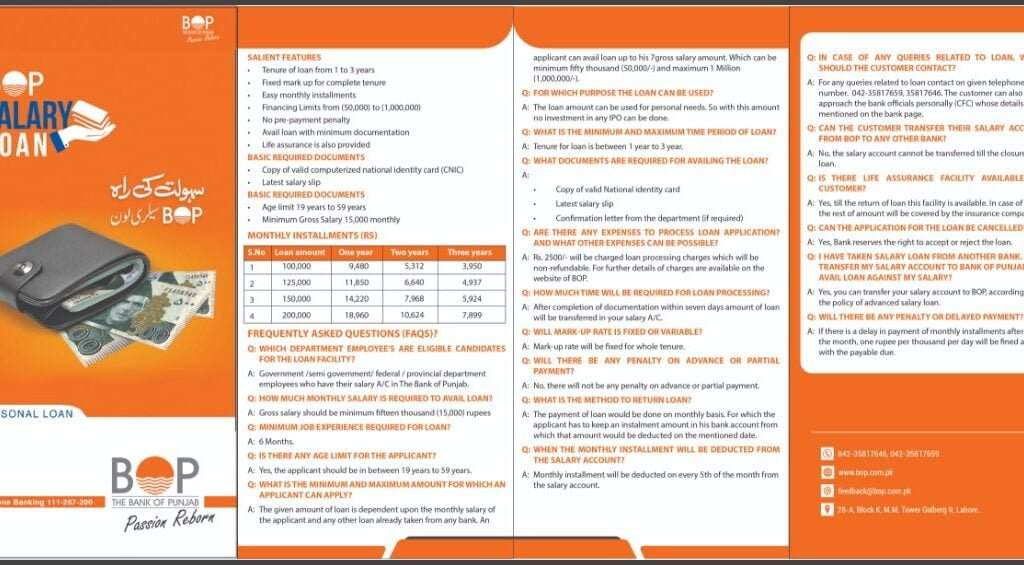

Monthly Installment Breakdown (in RS):

Advance Salary Loan Amount: 100,000

- One Year: 9,797

- Two Years: 5,642

- Three Years: 4,300

- Four Years: 3,658

Loan Amount: 125,000

- One Year: 12,247

- Two Years: 7,053

- Three Years: 5,374

- Four Years: 4,573

Loan Amount: 150,000

- One Year: 14,696

- Two Years: 8,464

- Three Years: 6,449

- Four Years: 5,488

Loan Amount: 200,000

- One Year: 19,595

- Two Years: 11,285

- Three Years: 8,599

- Four Years: 7,317

Contact Details Of Advance Salary Loan

- Website: https://www.bop.com.pk/

- Telephone Numbers: 042-35817661, 042-35817659.

- Email: personaloan@bop.com.pk

- Address: M.M Tower, 3rd Floor, 28-A, Block-K, Gulberg II, Lahore-54000.

Recommended Reading: Gold Loan In Pakistan (Get PKR 50K-70Lakh Gold Loan-NBP) [Sharia-Compliant]

FAQs | Advance Salary Loan

What are the key features of the Advance Salary Loan program?

![Advance Salary Loan (Get PKR 25K-30Lakh Salary Loan) [Sharia-Compliant] 1 BOK-Advance-Salary-Loan-Key-Features](https://governmentschemes.pk/wp-content/uploads/2024/02/BOK-Advance-Salary-Loan-Key-Features-150x150.jpg)

Tenure options: 1 to 4 years

Fixed mark-up rate for the entire tenure

Easy monthly installments

Financing limits ranging from (50,000) to (1,500,000)

No pre-payment charges

Minimum documentation required

Life assurance coverage provided

What are the eligibility criteria for a salary loan?

![Advance Salary Loan (Get PKR 25K-30Lakh Salary Loan) [Sharia-Compliant] 2 BOP-Advanve-Salary-Loan](https://governmentschemes.pk/wp-content/uploads/2024/02/BOP-Advanve-Salary-Loan-150x150.jpg)

Age limit: 19 to 59 years (at maturity of facility)

Minimum gross salary: 17,500 monthly

Minimum service period: Six months with the existing employer

Minimum relationship period with BOP: One month

What documents are required to apply for a salary loan?

1. Copy of valid CNIC

2. Latest salary slip

3. 6 months’ bank statement

What is the estimated cost of the loan in terms of mark-up rates and other charges?

![Advance Salary Loan (Get PKR 25K-30Lakh Salary Loan) [Sharia-Compliant] 3 Advanve-Salary-Loan-In-Pakistan](https://governmentschemes.pk/wp-content/uploads/2024/02/Advanve-Salary-Loan-In-Pakistan-150x150.jpg)

Mark-up rate: 30.99% per annum, 2.582% rate per month

Markup amount for the whole tenure: To be calculated

Other charges: One-time processing fee of Rs. 2,500/-

Can the loan be repaid before the maturity period?

![Advance Salary Loan (Get PKR 25K-30Lakh Salary Loan) [Sharia-Compliant] 4 Advance-Salary-Loan](https://governmentschemes.pk/wp-content/uploads/2024/02/Advance-Salary-Loan-150x150.jpg)

Yes, there is no pre-payment/partial payment penalty.

Early payments can be made by depositing principal, markup, and late payment charges (if any) in the account.

What are the consequences of default or late payments?

![Advance Salary Loan (Get PKR 25K-30Lakh Salary Loan) [Sharia-Compliant] 5 Advance-Salary-Loan](https://governmentschemes.pk/wp-content/uploads/2024/02/Advance-Salary-Loan-1-150x150.jpg)

Legal action may be taken, including FIR lodging and proceedings initiation.

The bank may contact the employer for a deduction of loan payment from the salary.

In case of the borrower’s death, what happens to the outstanding loan?

The outstanding loan shall be claimed from the Life Insurance Company.

What are the guarantor’s obligations for the salary loan?

Only the personal guarantee of the applicant is required.

Recommended Reading: HBL Salary Loan (Get PKR 25K-30Lakh Salary Loan In Pakistan) [Sharia-Compliant]

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment