A mobile wallet account is a digitalized version of your credit/debit card that enables you to make online payments from your mobile, tablet, or smartwatch without carrying your physical card or cash.

In this article, we will explore the top mobile wallet accounts available in Pakistan to help you better understand them so you can choose the best available options according to your needs.

Our list includes digital wallets | e-wallets of the following types/categories:

- Micro mobile wallets like EasyPaisa & JazzCash

- Bank mobile wallets e.g HBL Konnect

- International e-wallets like PayPal etc.

Let’s get started with our guide. Here we go!

Recommended Reading: How To Receive International Payment In Pakistan (Via Jazzcash) [Students+Freelancers]

Best Mobile Wallet Account In Pakistan | How To Open A Wallet Account In Pakistan?

Table Of Contents

Recommended Reading: Receive International Payment In Pakistan (Via Sadapay) [Students+Freelancers]

What Is A Mobile Wallet Account? (Types & Benefits)

A mobile wallet account is a digitalized version of your credit/debit card and has the functionalities of a full-fledged bank account.

With a mobile wallet app on your phone, you can make payments at stores, track your spending, and access various services without carrying around a bunch of physical cards and documents.

It’s like having all your important payment and membership information conveniently stored in one place on your smartphone.

Mobile wallets can store the following types of information, depending on their functionalities and the services they provide.

Here are some common types of information that a mobile wallet account can store:

- Payment Information (credit/debit cards, bank accounts, digital currency)

- Transaction History (date, time, amount, recipient)

- Loyalty Cards and Rewards Points

- Ticketing and Boarding Passes

- Coupons and Discounts

- Identification Documents (licenses, passports, membership cards)

- Personal Information (addresses, emails, contacts)

- Security Credentials (PIN, fingerprints, facial recognition)

- Cryptocurrencies and Tokens

- Health and Insurance Cards

- Digital Keys and Access Cards

- Receipts and Invoices

Recommended Reading: Digital Wallets In Pakistan (Authorized Mobile Wallets) | E-wallets In Pakistan

Best Mobile Wallets In Pakistan

EasyPaisa

Easypaisa is the first Pakistan Mobile Wallet Account, established in 2009, and holds the distinction of being Pakistan’s first mobile banking platform. It is the sole GSMA mobile money-certified service in the nation.

Originally designed for money transfers, Easypaisa aims to empower communities by offering convenience and flexibility in financial transactions.

Services Offered by Easypaisa

- Money Transfer: Easypaisa provides various options for money transfers, enabling users to send funds to any account or bank account, any of the network or mobile wallets they use. Options include bank accounts, mobile wallets like JazzCash and SadaPay, and even platforms like WhatsApp.

- Savings Plans: Easypaisa facilitates easy subscriptions to savings plans, offering annual profits ranging from 7% to 18% without documentation or fixed deposits. Users can choose from a variety of plans according to their preferences.

- Utility Bill Payments: With over 1500 billers payments into the Easypaisa app, users can conveniently pay utility bills such as electricity, gas, water, telephone bills, etc.

- Top-Up Wallets: Easypaisa users can enjoy exclusive discounts when topping up their Daraz or M-Tag Wallets.

- Invite & Earn: By inviting friends to register on Easypaisa, users can earn cashback rewards for themselves and their referrals.

- Insurance: Easypaisa offers affordable insurance plans starting from as low as Rs. 2, providing coverage for individuals and their families. Plans like Easypaisa Tahafuz offer coverage of up to Rs. 500,000 security for the future.

Key Features of Easypaisa

- High Account Limits: Easypaisa offers monthly account limits of up to Rs. 25 lakh, providing flexibility for users with their financial needs.

- Biometric Verification: Users can easily complete biometric verification within the Easypaisa app, ensuring security for their transactions.

- Transparent Pricing: Easypaisa prides itself on its transparent fee structure, with no hidden charges on transfers or payments, enabling users to manage their finances with clarity.

- Monthly Prizes: Easypaisa hosts monthly prize giveaways, offering users the chance to win exciting rewards.

Recommended Reading: How To Receive International Payment In Pakistan (Via Jazzcash) [Students+Freelancers]

JazzCash

JazzCash is like having a bank in your pocket, making life easier for millions of people in Pakistan. With the new JazzCash app, you can do so much pay bills, send money to friends and family, recharge your phone, and even subscribe to mobile packages.

The best part? You don’t need to go to a bank or fill out any paperwork. Your JazzCash Mobile Account is linked to your phone number and can be managed right from your phone. Plus, you don’t even need a fancy smartphone to use it it works on all types of mobile phones.

Instant Payment System

- Easy Deposits: Add money to your Mobile Account very simply and easily. You can deposit cash at any JazzCash Agent, Business Center, Franchise, or Mobilink Microfinance Bank Branch. Just give your Mobile number and cash to the Agent. Charges are as follows:

- For deposits from Rs. 50 to Rs. 20,000: 0.50% + FED

- For deposits of Rs. 20,001 & above: PKR 100 + FED

- Simple Withdrawals: Withdraw cash from your Mobile Account at any JazzCash Agent nationwide. Provide your Mobile number, confirm withdrawal with your MPIN, and collect cash. You can also use any ATM in Pakistan with a JazzCash ATM Card. Check withdrawal charges for details.

Payments with JazzCash

- Payment Options: Enjoy the freedom to make payments online securely and quickly. Choose from various channels like vouchers, Mobile Accounts, or Credit/Debit cards.

- Key Features:

- Access to a dedicated customer portal

- Pay bills hassle-free, with no queues required

- Participate in campaigns and earn cash rewards

- Buyer’s protection for secure transactions

- Invite friends to the JazzCash App and earn cashback rewards

- 24/7 customer support

- Exciting discount deals are available

- Compliant with international security standards

How JazzCash Works

- Simple Setup: Open a secure mobile account using any network’s mobile number and a valid CNIC. Verify your information using our built-in scanner.

- Deposits: Add money to your JazzCash account easily by linking any debit card or making a cash deposit at a nearby JazzCash agent.

- Instant Money Transfer: Send money to anyone in Pakistan.

- Payment Options: Choose between a physical or virtual Mastercard for in-store and online payments.

- All-in-One Solution: Pay utility bills or send money to friends directly from your mobile phone with just a few taps.

Recommended Reading: Receive International Payment In Pakistan (Via Sadapay) [Students+Freelancers]

JazzCash Wallet Features

Sufficient Balance:

- JazzCash Wallet: Pay using the money in your JazzCash Wallet if you’ve chosen this option.

- Debit Card: If you’ve linked a debit card, the payment will be made from that card.

- ReadyCash: For those with a ReadyCash loan, payments will be deducted from there.

Insufficient Balance (Split Payment):

- Users can split payments between their JazzCash Wallet and either their linked debit card or ReadyCash loan.

- The wallet balance will be used first, and the remaining balance can be covered by the additional payment method.

Examples:

- JazzCash Wallet & Debit Card: If the wallet doesn’t cover the full amount, users can split the payment between the wallet and their linked debit card.

- JazzCash Wallet & ReadyCash: Similarly, users can split the payment between the wallet and their ReadyCash loan if needed.

Insufficient Balance (Add Money):

- Users can add money to their JazzCash Wallet through various methods like depositing via debit card or bank account.

- They can select “add money” during the payment process and choose their preferred method to top up their wallet.

- Once the payment is made, the transaction will be completed.

UPAisa

UPaisa makes life easier offering you to pay bills, send money, and recharge your mobile balance with just a tap. It’s a partnership between U Microfinance Bank and Ufone, offering branchless banking since October 2013.

UPaisa aims to bring financial services to everyone, even in backward areas, so no one is left behind. With UPaisa, you can send and receive money, pay bills, shop using QR codes, and buy Super cards or phone credit for any network, from anywhere.

Services Offered by UPaisa

- Open UPaisa Wallet: Easily create your UPaisa Wallet to access a range of services such as fund transfers, bill payments, and mobile recharges.

- Mobile Recharge: Recharge your mobile balance very easily on any network by using UPaisa.

- Money Transfer: Send and receive money easily through your UPaisa Wallet, making transactions quick and easy.

- Bill Payment: Pay your utility bills on the go using UPaisa.

- UPaisa Debit Card: Switch to the UPaisa Debit Card for shopping, payments, and cash withdrawals.

- International Payments: Receive international Payments directly into your UPaisa Account, making it easier to access funds from abroad.

- Avail Offers: Stay updated with the latest deals and discounts at your favorite outlets through UPaisa.

- UPaisa Tahaffuz: Receive financial support during times of crisis through UPaisa Tahaffuz, in collaboration with Waada Pakistan.

- UPaisa Healthy Family: Ensure financial safety for medical purposes for you and your family across Pakistan with UPaisa Healthy Family.

- UPaisa Healthy Aap: Get additional income replacement and medical security when needed with UPaisa Healthy Aap.

Special Offers

- Account Opening: Get free 1000 MBs upon opening an account with UPaisa.

- Cashback Offer: Enjoy 10% cashback on transactions for Ufone customers.

- Cash Back on Debit Card Transactions: Earn cashback on your debit card transactions with UPaisa.

- Invite a Friend: Invite your friends and family to the UPaisa app and earn rewards.

- Cash Back on Wallet Activation: Receive cashback when you activate your UPaisa Wallet.

- PTCL Bill Payment: Pay your PTCL bills directly from your UPaisa Wallet.

Transaction Limits for UPaisa Wallet

- Level 0 Account:

- Rs. 25,000 per day

- Rs. 50,000 per month

- Rs. 200,000 per year

- Level 1 Account:

- Rs. 50,000 per day

- Rs. 200,000 per month

Recommended Reading: Digital Wallets In Pakistan (Authorized Mobile Wallets) | E-wallets In Pakistan

Best Bank Wallet Account In Pakistan

Meezan Smart Wallet (Current+Savings)

Meezan Bank provides Smart Wallet accounts, available in both types, offering easy and flexibility for your banking needs.

Types:

- Meezan Smart Wallet Current

- Meezan Smart Wallet Savings

Here are the details of these Meezan Bank Smart Wallet accounts details:

Recommended Reading: Digital Wallets In Pakistan (Authorized Mobile Wallets) | E-wallets In Pakistan

Meezan Smart Wallet Current

Open Meezan Smart Wallet Current quickly without paperwork. It’s an Islamic wallet based on the Qarz Contract, ensuring your money is safe and not used for non-Shariah activities.

Enjoy Riba-free banking with instant account opening, ATM access, biometric scanning, no minimum deposit, free internet banking, and instant utility bill payment.

Opening Process And Requirements

Get your Smart Wallet quickly and experience the advantages of a Riba-free current account. This Islamic wallet lets you open an account without paperwork. Just verify with your biometrics and start banking easily from home using the Meezan Mobile App.

Requirements:

- Smart Wallet can be opened in Pakistani Rupees (PKR) only.

- Valid CNIC holders are eligible to open this account.

- The Smart Wallet can be opened only after successful verification.

- Pay Pak Debit Cards issued upon request for Smart Wallet can only be used locally, with applicable charges.

Features

- Instant Account Opening: Get your account opened instantly without any delay.

- ATM Access: Enjoy nationwide ATM access through the Pay Pak Debit card issued with your Smart Wallet.

- Biometric Scanning: Withdraw cash from any Meezan branch after biometric verification.

- Deposit: No minimum deposit requirement for opening a Smart Wallet.

- Internet and Online Banking: Get free internet and mobile banking services.

- Bill Payment: Instantly pay your utility bills easily through your Smart Wallet.

Meezan Bank Smart Wallet Savings

When you agree to open a Meezan Bank Smart Wallet Savings Account, you’re joining a Mudarabah relationship with Meezan Bank. Here, you’re the Investor (Rab-ul-Maal), and the Bank acts as the Manager (Mudarib) of your deposited funds.

The Bank then uses these funds for Shariah-compliant investments or to provide Islamic financings, such as Murabaha, Ijarah, Istisna, and Diminishing Musharkah, benefiting both you and the Bank.

Opening Process And Requirements

Smart Wallet is a digital wallet designed for both banked and unbanked in the country. It allows you to open an account without the paperwork. Simply verify your identity through biometrics to open your Smart Wallet. Enjoy digital banking and start earning Halal monthly returns on your savings.

Requirements for Using Meezan Smart Wallet Savings:

- Smart Wallet accounts can only be opened in Pakistani Rupees (PKR).

- You need to have a valid CNIC to open this account.

- Your Smart Wallet account can only be activated after successful verification.

- Pay Pak Debit Cards issued for Smart Wallets can only be used locally, with applicable charges.

Recommended Reading: Receive International Payment In Pakistan (Via Sadapay) [Students+Freelancers]

Features

- Account Opening: Enjoy instant account opening with no delays.

- ATM Access: Access ATMs nationwide using the Pay Pak Debit card.

- Biometric Scanning: Withdraw cash from any Meezan branch after biometric verification.

- Deposit: No minimum deposit requirement to open your account.

- Online Banking: Access free internet and mobile banking services for easy banking from anywhere.

- Profit: Earn monthly profits calculated daily.

HBL Konnect

Konnect by HBL makes life easy and enjoyable with its all-in-one lifestyle solution. Whether you want to buy movie tickets, order food, send money, pay bills, top up your phone, or shop at Konnect Shop, Konnect has you covered.

Banking becomes fun with Konnect’s seamless Mobile Banking Experience. The new Konnect App acts as a digital bank account that you can open instantly. Just enter your basic CNIC information, and you’re ready to enjoy digital banking wherever you go. Konnect App is Habib Bank Limited’s branchless banking solution.

How To Open an HBL Konnect Account?

Registration Guide:

- Step 1: Download the Konnect Mobile App from the Google Play Store or Apple Store.

- Step 2: Choose the ‘Register New Account’ option.

- Step 3: Fill in all the required details.

- Step 4: Set up your login ID, password, and MPIN.

- Step 5: Wait for a successful account registration SMS alert on your Konnect registered mobile number from 8425.

How to deposit money?

Via Konnect Shop:

- Step 1: Visit your nearest Konnect Shop. Use the agent locator tool to find one.

- Step 2: Deposit money into your Konnect Account by providing your Konnect Account number and the amount at the Konnect Shop.

- Step 3: Wait for a successful transaction SMS alert on your Konnect registered mobile number from 8425.

Via Own Bank Account:

- Step 1: Visit your nearest ATM.

- Step 2: Choose ‘Funds Transfer.’

- Step 3: Select ‘Account at HBL’ as the beneficiary bank.

- Step 4: Enter your 11-digit Konnect Account number.

- Step 5: Wait for a successful transaction SMS alert on your Konnect registered mobile number from 8425.

Recommended Reading: Receive International Payment In Pakistan (Via Sadapay) [Students+Freelancers]

Via HBL Mobile/HBL InternetBanking:

- Step 1: Log in to your HBL Mobile/InternetBanking.

- Step 2: Go to ‘Funds Transfer within HBL.’

- Step 3: Select your Konnect Account if it’s already a beneficiary. Otherwise, register it as a beneficiary.

- Step 4: Enter the amount.

- Step 5: Review the transaction, enter your TPIN to validate, and wait for a successful transaction SMS alert on your Konnect registered mobile number from 8425.

Recommended Reading: Digital Wallets In Pakistan (Authorized Mobile Wallets) | E-wallets In Pakistan

Features and Benefits

- Funds Transfer: Easily transfer money to any bank account or CNIC, making transactions with friends and family hassle-free.

- Lifestyle Payments: Make payments for cinema tickets, food delivery, travel, education, and more, keeping you connected to life’s essentials.

- Mobile Recharge: Top-up your prepaid mobile or pay your postpaid bill with just a few taps.

- Available Cards: Enjoy the various mobile networks, including Jazz, Telenor Easy Card, Ufone Super Load, and Zong Bundles.

- Bill Payments: Pay your gas, electricity, water, or internet bills through the HBL Konnect App.

- Scan to Pay: Go cashless and cardless by using Konnect’s VISA-enabled Scan to Pay feature for your shopping needs.

- Invite & Earn: Invite friends to join Konnect and get rewarded for every referral.

- Link Accounts: Easily link your HBL Account to Konnect and transfer cash between your accounts for free.

my ABL Digital Wallet

The myABL Wallet app is a mobile banking service designed for people in Pakistan who don’t have a bank account. With this app, you can do lots of things like sending and receiving money and paying bills.

All you need is a valid CNIC and a working mobile number. Your mobile number becomes your account, and your phone turns into your digital wallet. It’s like having a bank account on your phone, making banking easy wherever you are. Just download the app, register with your CNIC, and start banking.

How To Register In My ABL Wallet?

- Download the myABL Wallet App from your app store.

- Open the app and click “Get Started” after seeing the promo screens.

- Accept the Terms & Conditions.

- Enter your mobile number and CNIC/SNIC number, then click Next.

- Verify your mobile number with the OTP sent via SMS.

- Fill in your city of residence and CNIC issuance date.

- Enter your details as per your CNIC/SNIC.

- Create a password for your account.

- You’re all set to start using my ABL Wallet.

myABL Wallet Features

In myABL Wallet, customers can easily transfer funds in different ways:

- Transfer money to other myABL Wallet accounts.

- Send funds to their ABL regular bank accounts.

- Transfer money to other bank wallets or accounts using IBFT.

- Send money to individuals without myABL Wallet or any bank account.

- Move money in and out between their linked ABL regular bank account and myABL Wallet.

Recommended Reading: How To Receive International Payment In Pakistan (Via Jazzcash) [Students+Freelancers]

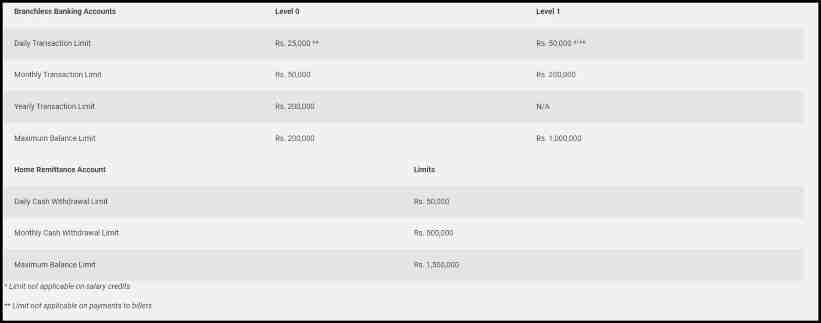

my ABL Wallet Limits

Types of Accounts:

- Level – 0: Basic branchless banking account with low transaction limits.

- Level – 1: Biometrically verified account with higher transaction limits.

- Home Remittance Account: Specialized L1 account for receiving money from abroad directly into the Wallet account.

Account Limits:

Branchless Banking Accounts:

- Level 0:

- Daily Transaction Limit: Rs. 25,000

- Monthly Transaction Limit: Rs. 50,000

- Yearly Transaction Limit: Rs. 200,000

- Maximum Balance Limit: Rs. 200,000

- Level 1:

- Daily Transaction Limit: Rs. 50,000

- Monthly Transaction Limit: Rs. 200,000

- Yearly Transaction Limit: N/A

- Maximum Balance Limit: Rs. 1,000,000

Home Remittance Account Limits:

- Daily Cash Withdrawal Limit: Rs. 50,000

- Monthly Cash Withdrawal Limit: Rs. 500,000

- Maximum Balance Limit: Rs. 1,500,000

Recommended Reading: How To Receive International Payment In Pakistan (Via Jazzcash) [Students+Freelancers]

International E-Wallets In Pakistan

SadaPay

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 1 SadaPay-Digital-Wallet](https://governmentschemes.pk/wp-content/uploads/2024/03/SadaPay-Digital-Wallet.jpg)

SadaPay wallet account is a company approved by the State Bank of Pakistan. Get your SadaPay wallet and Mastercard debit or virtual card to explore new opportunities. Enjoy spending, sending, and asking for money without any charges. We’re inviting people from our waitlist to join now.

Once you receive your invitation, you can sign up and start using the latest money technology. Easily ask your SadaPay friends for money. No need for awkward talks about paying back friends. Just ask for money through SadaPay.

You can ask for money from other SadaPay users, and soon, from bank accounts too. Your SadaPay card works globally, online and offline.

Pay Pak- 1 Link

PayPak is Pakistan’s first domestic payment scheme (DPS), operated by 1LINK under the State Bank of Pakistan’s supervision. It aims to promote financial inclusion and digitalization in the country.

With a Pay Pak wallet account, customers get a debit card accepted nationwide at ATMs, restaurants, shops, malls, and online stores. All transactions stay within Pakistan, ensuring privacy and security. Pay Pak wallet account also offers co-badged cards with UPI and JCB for international use. Its chip technology provides extra security, enabling convenient tap-and-pay transactions.

FirstPay

Introducing the FirstPay wallet account, powered by HBL Microfinance Bank, extending banking services beyond traditional branches. With a simple tap, you can transfer funds, flexible loans, settle bills, and recharge mobile credit, no matter where you are.

FirstPay Wallet Account Features

- Instant Money Transfers: Easily send and receive money to

- Your FirstPay wallet

- Bank accounts like Alfalah, UBL, Faysal Bank, and more across Pakistan

- Mobile wallets such as EasyPaisa, JazzCash, Zindigi, SadaPay, or NayaPay

- Mobile Top-Ups: Recharge prepaid and postpaid mobiles on any network.

- Utility Bill Payments: Instantly pay electricity, gas, water, internet, PTCL, and various other bills.

- Nano Loans: Apply for loans of up to Rs. 10,000 quickly, without the need for any documents.

- Account Linking/De-Linking: Conveniently manage your funds by linking or unlinking your conventional bank account with FirstPay.

- Debit Card: Get your FirstPay Debit card for easy cash withdrawals and enjoy discounts at numerous brands nationwide.

- Debit Card Management: Activate, generate PIN, temporarily block, change PIN, and access your account statement effortlessly with our Debit card management feature. Resolve transaction problems easily through your account statement.

- Invite Friends: Invite friends and family to join FirstPay and earn exciting rewards.

- Request Money: Easily request funds from friends and family. Instantly settle education fees, taxes, license fees, traffic challans, credit card bills, and more.

Recommended Reading: Digital Wallets In Pakistan (Authorized Mobile Wallets) | E-wallets In Pakistan

FAQs | Mobile Wallet Account

What is a Mobile Wallet Account?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 2 Mobile-Wallet-Account-In-Pakistan](https://governmentschemes.pk/wp-content/uploads/2024/03/Mobile-Wallet-Account-In-Pakistan-150x150.jpg)

A mobile wallet is like having your credit/debit card on your phone, tablet, or smartwatch. It lets you pay for things online without needing your physical card or cash. A mobile wallet is like a digital version of your credit/debit card, but it’s even more versatile. By using a mobile wallet app on your phone, you can pay for things at shops.

Which types of Mobile Wallet Accounts In Pakistan?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 3 How-To-Open-A-Mobile-Wallet-Account-In-Pakistan](https://governmentschemes.pk/wp-content/uploads/2024/03/How-To-Open-A-Mobile-Wallet-Account-In-Pakistan-150x150.jpg)

Our list includes digital Wallet Account of the following types:

Micro mobile Wallet Accounts like EasyPaisa & JazzCash

Bank mobile Wallet Account e.g HBL Konnect

International e-wallet Accounts like FirstPay etc

Which are the Top 3 Micro mobile wallets In Pakistan?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 4 Best-Mobile-Wallets-In-Pakistan](https://governmentschemes.pk/wp-content/uploads/2024/03/Best-Mobile-Wallets-In-Pakistan-150x150.jpg)

The top 3 Micro mobile wallets In Pakistan are:

1. JazzCash Wallet Account

2. EasyPiasa Wallet Account

3. UPaisa Wallet Account

What is the EasyPaisa Wallet account?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 5 EasyPaisa-Mobile-Wallet](https://governmentschemes.pk/wp-content/uploads/2024/03/EasyPaisa-Mobile-Wallet-150x150.jpg)

Easypaisa is the best mobile wallet account, established in 2009, is Pakistan’s first mobile wallet account and mobile banking platform. It offers various services including money transfers to any account, savings plans with annual profits, utility bill payments, exclusive discounts on the wallet, cashback rewards for referrals, and insurance plans. Easypaisa also provides high account limits, biometric verification, transparent pricing, and monthly prize giveaways for users.

What is a JazzCash Wallet account?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 6 JazzCash-Mobile-Wallet](https://governmentschemes.pk/wp-content/uploads/2024/03/JazzCash-Mobile-Wallet-150x150.jpg)

JazzCash is a mobile banking service in Pakistan, that allows users to handle financial tasks via smartphones. Users can pay bills, send money, recharge phones, and manage accounts. The account is linked to the phone number. Cash can be deposited and withdrawn at JazzCash agents or branches, and secure online payments can be made. Features like buyer’s protection, cashback rewards, and 24/7 support are available. JazzCash wallet account offers split payment options and allows adding money via debit card or bank account for transactions.

Which is the Best Bank For a Wallet Account In Pakistan?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 7 Best-Bank-Wallet-Account-In-Pakistan](https://governmentschemes.pk/wp-content/uploads/2024/03/Best-Bank-Wallet-Account-In-Pakistan-150x150.jpg)

The Best Bank For a Wallet Account In Pakistan are:

1. HBL Konnect Wallet Account

2. Meezan Bank Wallet Account

3. my ABL Digital Wallet Account

What are my ABL wallet account limits?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 8 myABL-Wallet-Limits](https://governmentschemes.pk/wp-content/uploads/2024/03/myABL-Wallet-Limits-150x150.jpg)

For Level 0 branchless banking accounts, the daily transaction limit is Rs. 25,000, the monthly limit is Rs. 50,000, and the yearly limit is Rs. 200,000. The maximum balance limit is Rs. 200,000.

For Level 1 accounts have a higher daily transaction limit of Rs. 50,000, a monthly limit of Rs. 200,000, and no yearly limit. The maximum balance limit for Level 1 accounts is Rs. 1,000,000.

For Home Remittance Accounts, the daily cash withdrawal limit is Rs. 50,000, the monthly limit is Rs. 500,000, and the maximum balance limit is Rs. 1,500,000.

What are International E-Wallets In Pakistan?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 9 International-E-Wallets-In-Pakistan](https://governmentschemes.pk/wp-content/uploads/2024/03/International-E-Wallets-In-Pakistan-150x150.jpg)

International E-Wallets In Pakistan:

1. SadaPay wallet account

2. Pay Pak- 1 Link wallet account

3. PayFast wallet account

What is a SadaPay Wallet account?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 10 SadaPay-Digital-Wallet](https://governmentschemes.pk/wp-content/uploads/2024/03/SadaPay-Digital-Wallet-150x150.jpg)

SadaPay wallet account, approved by the State Bank of Pakistan, offers a wallet and Mastercard for new opportunities. Spend, send, and request money without fees. Join our waitlist and start using our latest money tech once invited. Request money easily from SadaPay friends, avoiding awkward conversations. Use it globally online and offline.

What are FirstPay wallet account features?

![Mobile Wallet Account In Pakistan 2026 (9 Best) [E-Wallets In Pakistan] 11 FirstPay-Wallet](https://governmentschemes.pk/wp-content/uploads/2024/03/FirstPay-Wallet-150x150.jpg)

With a FirstPay wallet account, you can instantly transfer money to your wallet, bank accounts, or mobile wallets like EasyPaisa and JazzCash. You can also top up mobile credit, pay utility bills, and apply for quick loans of up to Rs. 10,000 without any paperwork. Manage your funds by linking or unlinking your bank account, and enjoy easy cash withdrawals with the FirstPay Debit card. Invite friends to join and earn rewards, and easily request money from family and friends for various expenses like education fees and bills.

How can I request money using the FirstPay wallet account?

You can easily request money from friends and family using the FirstPay wallet account. Simply select the ‘Request Money’ option in the app and follow the prompts to request funds.

Recommended Reading: How To Receive International Payment In Pakistan (Via Jazzcash) [Students+Freelancers]

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Do you have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment