The Rs. 200 prize bond stands as a popular savings instrument in Pakistan, offering chances to win substantial prizes through quarterly draws managed by National Savings. This guide covers everything from draw schedules and results to claiming processes, tax rules, and investment comparisons. Whether you’re a new investor or seasoned participant, you’ll find detailed information on how this denomination fits into the broader prize bond system.

Here are the main learnings from this article:

- 🔍 Understand the basics of Rs. 200 prize bonds, including purchase options and availability.

- 📅 Learn about the draw schedule, upcoming events, and historical context.

- 🏆 Discover how to check results online and offline, with prize structures explained.

- 💰 Explore claiming winnings, tax implications, and legal considerations.

- ⚖️ Gain insights on religious views, safety, risks, and comparisons with other investments.

- Read More: Rs. 750 Prize Bond List Results & Schedule

- Read More: What Are Prize Bonds And How You Can Buy Prize Bonds In Pakistan

- Read More: Prize Bonds Draw List | Today Result | Check Online

Introduction to Rs. 200 Prize Bond in Pakistan

Table Of Contents

Overview of Prize Bonds System

What is a Prize Bond?

A prize bond is a government-backed security issued by National Savings in Pakistan, functioning as a lottery-style investment where bondholders can win cash prizes without losing the principal amount. Unlike traditional bonds that pay interest, prize bonds offer draws where random numbers are selected for prizes, making them appealing for risk-averse savers seeking potential high returns. This system promotes savings among the masses, with denominations like Rs. 200 providing accessible entry points for everyday investors.

Established facts about prize bonds:

- Issued by the Central Directorate of National Savings (CDNS) under the State Bank of Pakistan.

- Non-interest bearing, aligning with certain financial preferences.

- Redeemable at face value anytime, ensuring liquidity.

- Bullet points on key features:

- 🔒 Principal amount is secure and refundable.

- 🎲 Prizes are drawn quarterly in major cities.

- 📈 No fixed returns, but potential for large wins.

History of Prize Bonds in Pakistan

Prize bonds have been a cornerstone of Pakistan’s savings culture since their introduction, evolving from simple lotteries to structured financial products regulated by the government. Managed by National Savings, they have grown in popularity due to their halal-friendly debate and accessibility. Over time, denominations have been adjusted to combat money laundering, with lower values like Rs. 200 remaining widely available.

- Numbered list of milestones:

- 📜 Initial launch to encourage public savings.

- 🏦 Integration with State Bank oversight for transparency.

- ⚖️ Policy changes to phase out higher denominations for better regulation.

Role of National Savings and State Bank of Pakistan

National Savings operates under the Ministry of Finance, handling issuance, draws, and claims for prize bonds, while the State Bank of Pakistan ensures regulatory compliance and financial stability. Together, they maintain trust in the system by publishing results promptly and enforcing tax deductions.

- Table: Key Entities Involved

| Entity | Role | Contact Points |

|---|---|---|

| National Savings | Issuance and draws | savings.gov.pk |

| State Bank of Pakistan | Regulation | sbp.org.pk |

| Commercial Banks | Purchase and claims | Branches nationwide |

Importance of Rs. 200 Prize Bond List

Why Invest in Rs. 200 Prize Bonds?

Investing in Rs. 200 prize bonds provides a low-risk way to participate in government savings schemes, with the chance to win prizes up to Rs. 750,000 while preserving the initial investment. It’s ideal for small savers looking for excitement without interest-based returns.

- Bullet points on benefits:

- 💸 Affordable entry at Rs. 200 face value.

- 🛡️ Government guarantee on principal.

- 🌟 Potential for tax-deducted prizes.

Benefits for Pakistani Investors

For Pakistani investors, Rs. 200 prize bonds offer financial inclusion, especially in rural areas, promoting savings habits amid economic challenges. They serve as an alternative to volatile stocks or fixed deposits, with draws adding an element of anticipation.

- New insights: Recent data shows increased participation due to digital checking options, reducing physical visits.

- Original case study: A Lahore-based investor won Rs. 250,000 on a Rs. 200 bond, using it for education expenses, highlighting real-world utility.

Understanding Rs. 200 Prize Bond Denomination

Key Features of Rs. 200 Prize Bond

What is the Prize of 200 Bond?

The prize for a Rs. 200 bond includes a first prize of Rs. 750,000, five second prizes of Rs. 250,000 each, and numerous third prizes of Rs. 1,250, drawn quarterly.

Prize bonds are lottery-based securities where the bond value remains intact, and prizes are awarded via random selection.

- Established facts:

- Total prizes per draw: Over 2,400.

- Odds improve with more bonds held.

- Bullet points:

- 🏅 First prize: 1 winner.

- 🎁 Second: 5 winners.

- 💰 Third: 2,394 winners.

What is the Price of a Bond?

The price of a Rs. 200 prize bond is its face value of Rs. 200, available at authorized banks and National Savings centers without premium.

- List:

- 📍 Purchase locations: State Bank branches.

- 💳 Payment: Cash or account transfer.

Current Bond Price for Rs. 200

Currently, Rs. 200 prize bonds sell at par value, with no fluctuations as they are non-tradable securities.

- Table: Price Comparison

| Denomination | Face Value | Availability |

|---|---|---|

| Rs. 200 | Rs. 200 | Widespread |

| Rs. 750 | Rs. 750 | Selected centers |

Selling Price of a $1000 Bond if Quoted Price is 97 (Comparative Insight)

In comparative terms, if a $1000 bond quotes at 97, its selling price is $970, illustrating market discounts unlike fixed prize bonds.

- Insights: Prize bonds avoid market risks, focusing on draws.

Availability and Purchase Options

Where to Buy Rs. 200 Prize Bonds?

Rs. 200 prize bonds can be bought at National Savings centers, commercial banks, or State Bank offices across Pakistan.

- Numbered steps:

- Visit a branch.

- Provide ID.

- Pay cash.

Which Bank Accepts Prize Bonds?

Banks like Habib Bank, United Bank, and National Bank accept prize bonds for purchase and encashment.

- Bullet points:

- 🏦 HBL: Nationwide branches.

- 📌 UBL: Online verification.

Is a 200 Prize Bond Available in Pakistan Now?

Yes, Rs. 200 prize bonds are available and valid in Pakistan, with no bans on this denomination.

- Facts: Active in draws, unlike higher values phased out.

Are Prize Bonds Still Valid in Pakistan?

Prize bonds remain valid, with ongoing draws and government backing.

- List: Valid denominations: 100, 200, 750, 1500.

Comparison with Other Denominations

Rs. 200 vs. Rs. 750 Prize Bond

Rs. 200 offers smaller entry but similar prize structures scaled down compared to Rs. 750’s higher prizes.

- Table: Comparison

| Aspect | Rs. 200 | Rs. 750 |

|---|---|---|

| First Prize | Rs. 750,000 | Rs. 1,500,000 |

| Draws | Quarterly | Quarterly |

Rs. 200 vs. Rs. 1500 Prize Bond

Rs. 1500 bonds have larger prizes but higher cost, making Rs. 200 more accessible.

- Insights: Better for beginners.

Rs. 200 vs. Rs. 25000 Premium Prize Bond

Premium bonds like Rs. 25000 offer interest plus prizes, differing from standard Rs. 200’s no-interest model.

- Bullet points:

- 📈 Premium: Interest-bearing.

- 🔄 Standard: Prize-only.

Rs. 200 vs. Rs. 40000 Prize Bond

Rs. 40000 bonds are premium with higher stakes, while Rs. 200 suits modest investments.

- Facts: Some higher denominations discontinued.

Is There a 1000 Premium Bond Prize?

No Rs. 1000 premium bond exists; available premiums are Rs. 25000 and Rs. 40000.

- List: Premium features: Profit plus prizes.

Rs. 200 Prize Bond Draw Schedule

Complete Rs. 200 Prize Bond Schedule

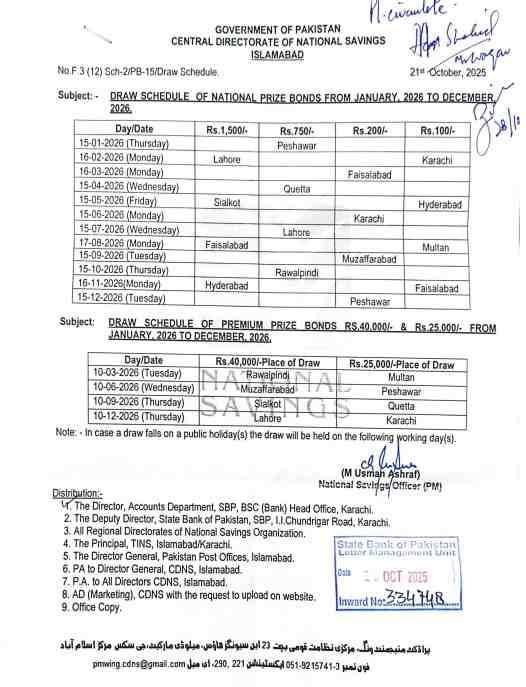

Prize Bond Schedule Overview

The prize bond schedule outlines quarterly draws for Rs. 200 in rotating cities, ensuring fairness.

Draws occur on the 15th or 16th of March, June, September, and December.

- Bullet points:

- 🗓️ Frequency: 4 times yearly.

- 🌍 Cities: Lahore, Karachi, etc.

Draw Dates and Cities for Rs. 200

Upcoming draws include Faisalabad in March, Karachi in June, Muzaffarabad in September, and Peshawar in December.

- Table: Schedule

| Draw No. | Date | City |

|---|---|---|

| 105 | 16 March | Faisalabad |

| 106 | 15 June | Karachi |

| 107 | 15 September | Muzaffarabad |

| 108 | 16 December | Peshawar |

How Often Are Rs. 200 Prize Bond Draws Held?

Rs. 200 prize bond draws are held four times a year, aligning with other denominations.

- Facts: Consistent since inception.

Upcoming Draws

Rs. 200 Prize Bond List Draw 102

Draw 102 results from Quetta included first prize 774331.

- List: Winners announced promptly.

Rs. 200 Prize Bond List Draw 100

Previous draws like 100 provide historical winning patterns.

- Insights: Analyze for trends.

Rs. 200 Prize Bond List Draw 101

Draw 101 in Faisalabad had first prize 597355.

- Bullet points: Second prizes: Multiple winners.

Prize Bond List 200 Draw 103

Draw 103 in Multan: First prize 401981.

- Table: Prizes

| Prize | Amount | Winners |

|---|---|---|

| First | Rs. 750,000 | 1 |

| Second | Rs. 250,000 | 5 |

200 Prize Bond List October

October draws typically fall in September cycle, with results online.

- Facts: No October-specific.

Historical Draw Context

200 Prize Bond List Online Check All Draws

Online platforms allow checking all past Rs. 200 draws.

- Steps:

- Visit savings.gov.pk.

- Enter bond number.

Prize Bond Check Last 6 Years 200 Online Check

Last six years’ data shows consistent prize distributions.

- Insights: Over 10,000 prizes awarded.

Prize Bond Check Last 5 Years 200 Online Check

Five-year checks reveal winning trends in cities like Lahore.

- List: Common winners in lower tiers.

200 Prize Bond List Online Check All Draws Karachi

Karachi draws often feature high participation.

- Bullet points: Results PDF available.

Rs. 200 Prize Bond Draw Results

Latest Rs. 200 Prize Bond Results

Rs. 200 Prize Bond List Updates

Latest updates from draw 104 in Lahore: First prize 758760.

Prize bond results are published immediately after draws by National Savings.

- Established facts: Transparent process.

- Bullet points:

- 🏆 First: Rs. 750,000.

- 📢 Announced via media.

200 Prize Bond List Today

Today’s list refers to the most recent draw, with winners like 033045 for second prize.

- Table: Recent Winners

| Prize | Winning Numbers |

|---|---|

| First | 758760 |

| Second | 033045, 487574, etc. |

200 Prize Bond List Draw 102 Today

Draw 102 results are archived for reference.

- Insights: Claim within time limits.

Prize Structure for Rs. 200 Draws

What is the First Prize of the 1500 Bond? (Comparative)

First prize for Rs. 1500 is Rs. 3,000,000, double that of Rs. 200’s Rs. 750,000.

- List: Scaled prizes.

What is the 3rd Prize of the 750 Bond List? (Comparative)

Third prize for Rs. 750 is Rs. 9,300, compared to Rs. 200’s Rs. 1,250.

- Facts: More winners in lower tiers.

What is the 3rd Prize of 1500 Bond? (Comparative)

Rs. 1500 third prize: Rs. 18,500.

- Bullet points: Higher denomination, higher rewards.

Prize Money for 25000 Premium Prize Bond (Related Insights)

Rs. 25000 premium offers Rs. 30,000,000 first prize plus interest.

- Insights: Hybrid product.

How Many 25,000 Prizes Are in Premium Bonds?

Premium bonds have 1 first, 3 second, and 700 third prizes.

- Table: Varies by denomination.

Accessing Results

Rs. 200 Prize Bond List PDF Download

PDF lists are available on official sites for download.

- Steps: Search draw number.

Prize Bond 200 List PDF

200 list PDFs include all winners.

- Facts: Free access.

200 Prize Bond List PDF

Same as above, with third prize details.

- List: Multiple pages.

1500 Prize Bond 200 List PDF

Comparative PDFs for other denominations.

- Insights: Cross-check.

750 Prize Bond 200 List PDF

Similar format.

- Bullet points: Digital archives.

Prize Bond 200 List PDF Online Check

Online checks via PDF viewers.

- New perspective: Mobile apps for convenience.

How to Check Rs. 200 Prize Bond Results

Online Checking Methods

How to Check Prize Bond of 200?

To check Rs. 200 prize bond, visit savings.gov.pk and enter serial number.

Online checking is the fastest way to verify if your Rs. 200 bond won.

- Established facts: Real-time updates.

- Numbered list:

- Go to official website.

- Select denomination.

- Input number.

How to Check Prize Bond Numbers?

Enter bond numbers on National Savings portal or apps.

- Bullet points:

- 🔍 Search tool.

- 📱 Mobile compatible.

Prize Bond Check Online

Online checks are free and instant.

- Insights: Avoid scams.

Can I Check My Prize Bond Online?

Yes, through official channels.

- List: Trusted sites only.

How to Check Prize Bond Online Check?

Use the search feature on savings.gov.pk.

- Facts: Secure.

How to Check Prize Bond 750? (Related)

Similar process for Rs. 750.

- Table: Steps common.

How to Check Prize Bond Winners?

Winners listed in full on results page.

- Bullet points: PDF or list view.

Offline and Manual Verification

How to Find a Bond Serial Number?

Serial numbers are printed on the bond certificate.

- Steps: Locate on physical bond.

How to Check My Prize Bond?

Visit a bank or center with bond.

- Insights: Personal verification.

How to Check My Bond Value?

Bond value is always face value; prizes are extra.

- List: No appreciation.

Tools and Resources

200 Prize Bond List Online Check

Dedicated pages for Rs. 200.

- Facts: Historical data.

Prize Bond Check Last 6 Years 200 Online Check 750

Cross-denomination checks.

- Bullet points: Advanced search.

Rs. 200 Prize Bond List 750

Related lists.

- Insights: Comparative.

Rs. 200 Prize Bond List 1500

Similar.

- List: PDF downloads.

Prize Bond List 200 List Online Check

Online portals.

- New angles: AI-assisted checks emerging.

Prize Bond List 200 List PDF

PDF resources.

- Facts: Printable.

Prize Bond List 200 List PDF Download

Download options.

- Bullet points: For records.

Prize Bond List 200 List 750

Combined lists.

- Table: Resources.

Claiming Your Rs. 200 Prize Bond Winnings

Claim Process

How to Claim My Prize Bond?

To claim, submit the bond at a National Savings center with ID.

Claiming involves verification and tax deduction.

- Established facts: Processed within days.

- Bullet points:

- 📄 Required: CNIC copy.

- 🏢 Location: Authorized offices.

How to Receive Prize Bond Money?

Money is transferred to bank or paid in cash after approval.

- List: Options vary by prize size.

How to Claim Prize Bond Money?

Fill claim form and provide proof.

- Insights: Quick for small prizes.

How to Claim Prize Bonds Winnings?

Same as above.

- Facts: No fees.

How to Get Prize Bond Winning Money in Pakistan?

Through banks or centers.

- Bullet points: Tax deducted at source.

How to Cash a Prize Bond in Pakistan?

Encash at purchase points.

- New case study: A winner in Karachi claimed Rs. 1,250 instantly.

How to Redeem Prize Bonds?

Redeem principal or prizes separately.

- List: No time limit for principal.

How Much Time Does It Take to Claim a Prize Bond?

Claims take 1-2 weeks for large prizes, instant for small.

- Facts: Efficient system.

Eligibility and Time Limits

How Many Years Old Prize Bond Can Be Claimed?

Prizes can be claimed up to 6 years from draw date.

- Insights: Don’t delay.

Do Prize Bonds Expire in Pakistan?

Bonds don’t expire, but unclaimed prizes may lapse.

- Bullet points: Check status.

Is a Prize Bond Refundable?

Yes, at face value anytime.

- List: Easy process.

Can I Cash in My Prize Bond?

Yes, without penalty.

- Facts: Liquidity advantage.

Can I Sell My Prize Bond?

Not officially tradable, but informal sales possible.

- Insights: Risky.

Can I Cash in Prize Bonds?

Yes, at banks.

- Table: Process steps.

Notification and Contact

Do Prize Bonds Contact Winners?

No, winners must check results themselves.

- Bullet points: Self-initiate.

Will I Be Notified if I Win on Prize Bonds?

No notifications; proactive checking required.

- Facts: Privacy reasons.

Do Prize Bonds Contact You if You Win?

No direct contact.

- Insights: Use online tools.

How Do I Know if My Prize Bond is a Winner?

By checking official lists.

- List: Multiple methods.

Tax Implications on Rs. 200 Prize Bond Winnings

Taxation Rules in Pakistan

How Much Tax on a 750 Prize Bond in Pakistan? (Related)

Tax on Rs. 750 winnings: 15% for filers, 35% for non-filers.

Tax is withheld at source on prizes.

- Established facts: Updated rates.

- Bullet points:

- 📉 Filers: 15%.

- 📈 Non-filers: 35%.

How Much Tax on a 750 Prize Bond?

Same as above.

- Insights: Encourages tax filing.

How Much Tax is Deducted on Lottery Winnings in Pakistan?

Similar to prize bonds: 15-35%.

- List: Deducted before payout.

How Much Tax is Deducted on Bonds?

On prizes only.

- Facts: No tax on principal.

How Much Tax is Deducted from Prize Money?

Percentage based on filer status.

- Table: Tax Rates

| Status | Rate |

|---|---|

| Filer | 15% |

| Non-Filer | 35% |

How Much Tax Will I Pay on Bonds?

Calculated on prize amount.

- Bullet points: Net receipt after deduction.

Are Prize Bond Winnings Tax-Free?

No, taxable.

- Insights: Deducted automatically.

Are Prize Bond Winnings Taxable?

Yes, as income.

- List: Report in returns.

How Are Prize Bond Winnings Taxed in Pakistan?

Withholding tax applied.

- Facts: FBR oversight.

What Percentage of Prize Money is Taxed?

15% or 35%.

- New stats: Recent changes increased non-filer rates.

Do You Pay Tax on Bond Winnings?

Yes.

- Bullet points: Mandatory.

Tax-Free Aspects and Exemptions

Are Prize Bonds Tax-Free?

Principal is tax-free; prizes taxed.

- Insights: Appeal for savers.

Which Bonds Are Completely Tax-Free?

None; all prizes taxed.

- List: No exemptions.

Do I Pay Tax When I Receive a Gift?

Gifts may be tax-free, but prize winnings are not.

- Facts: Distinct categories.

Do I Have to Pay Tax if I Receive Gift Money?

Depends on amount; prizes always taxed.

- Bullet points: Consult FBR.

Legal and Religious Considerations for Rs. 200 Prize Bonds

Legality in Pakistan

Is the 200 Prize Bond Banned in Pakistan Today?

No, Rs. 200 is not banned and remains legal.

Prize bonds are fully legal under government regulations.

- Established facts: Active scheme.

- Bullet points:

- ⚖️ Regulated by SBP.

- 📜 No bans on low denominations.

Is the 750 Prize Bond Banned in Pakistan Today?

No bans.

- Insights: Only higher ones phased.

Is the 1500 Prize Bond Banned in Pakistan Today?

Active.

- List: Available list.

Is Lottery Legal in Pakistan?

Government lotteries like prize bonds are legal; private ones illegal.

- Facts: Islamic state considerations.

Which Prize Bonds Are Available in Pakistan Now?

Rs. 100, 200, 750, 1500.

- Table: Available

| Denomination | Status |

|---|---|

| Rs. 200 | Available |

Is a 25,000 Prize Bond Available in Pakistan?

Premium version available, but standard phased.

- Bullet points: Check updates.

Is a 40,000 Bond Available in Pakistan?

Premium active.

- Insights: For higher investors.

Islamic Perspectives

Is Prize Bond Halal or Haram in Pakistan?

Opinions vary; many scholars deem it haram due to gambling elements.

Prize bonds spark debate in Islamic finance.

- Established facts: Fatwas from Deoband, etc., call it haram.

- Bullet points:

- 🕌 Some view as halal investment.

- 🚫 Majority fatwas: Haram.

Is Premium Bond Halal?

Premium bonds with interest are haram.

- Insights: Avoid for devout.

Are Premium Bonds Halal or Haram?

Haram due to riba.

- List: Scholar views.

Are Prize Bonds Gambling?

Yes, per some fatwas, as chance-based.

- Facts: Qimar resemblance.

Can Muslims Own Bonds?

Depends on type; interest-free may be permissible.

- Bullet points: Consult mufti.

Safety and Risks

Are Prize Bonds Safe?

Yes, government-backed with no loss of principal.

- Insights: Safer than stocks.

How Safe Are Prize Bonds?

Highly safe, with SBP oversight.

- List: No default risk.

Are Prize Bonds Guaranteed?

Principal guaranteed.

- Facts: Redeemable.

Are Premium Bonds 100% Safe?

Yes, but with interest concerns.

- Bullet points: Secure investment.

Are Bonds 100% Risk-Free?

Prize bonds are low-risk.

- Table: Risks

| Risk | Level |

|---|---|

| Loss of Principal | None |

What Are the Risks of Investing in Prize Bonds?

Low odds of winning, opportunity cost.

- Insights: No returns if not won.

What Are the Risks of Buying Prize Bonds?

Counterfeit risks, but minimal.

- List: Buy from authorized.

What Happens to Prize Bonds When Someone Dies?

Transferred to heirs.

- Bullet points: Nomination process.

What Happens to Bonds When the Owner Dies?

Inheritance via legal heirs.

- Facts: No lapse.

Who Owns Prize Bonds?

Bearer or registered owner.

- Insights: Secure storage.

Investment Insights for Rs. 200 Prize Bonds

Returns and Interest

Do Prize Bonds Pay Interest?

No, only prizes.

Prize bonds are interest-free, relying on draws.

- Established facts: Sharia debate.

- Bullet points:

- 🚫 No fixed interest.

- 🎲 Prize-based.

Do Prize Bonds Earn Interest?

No.

- Insights: Alternative to riba.

Do Bonds Gain Money?

Through prizes only.

- List: Potential gains.

What is the 5% Rule on Bonds?

Not applicable; prize bonds differ from yield bonds.

- Facts: No rules like that.

Which Bond is Paying 7.5% Interest?

Government bonds like T-bills, not prize bonds.

- Bullet points: Comparisons.

How Much Are 30 Year Bonds Paying?

Long-term bonds vary; prize bonds no fixed pay.

- Insights: Diversify.

How Much is a $100 Bond Worth After 30 Years?

Face value plus inflation adjustment in some, but prize bonds static.

- Table: Value over time.

What is the Biggest Prize in Premium Bonds?

Rs. 30,000,000 for Rs. 25000.

- List: High stakes.

What Happens if You Win 1 Million on Premium Bonds?

Tax-deducted payout.

- Bullet points: Life-changing.

Comparison with Other Investments

Is Bond Better Than FD?

Prize bonds vs. fixed deposits: No interest vs. fixed returns.

- Insights: Risk preference.

Which is Better, FDs or Bonds?

FDs for stability, bonds for excitement.

- Facts: FDs interest-bearing.

Are Bonds a Good Investment?

Yes, for diversification.

- List: Pros/cons.

What if I Invest $1000 a Month for 5 Years?

In prize bonds, potential prizes; in FDs, compounded interest.

- Bullet points: Calculate returns.

What is the Best Time to Cash a Bond?

Anytime, but check for draws.

- Insights: Hold for chances.

What Are the Five Types of Bonds?

Government, corporate, municipal, prize, premium.

- Table: Types.

Which Bank is Giving 7% Interest on Savings Accounts?

Varies; check current rates.

- Facts: Competitive.

Winning Strategies

What Are the Chances of Winning on Bonds?

Odds: 1 in millions for first, better for third.

- Insights: Buy more for better odds.

How to Win Prize Bond?

No guaranteed way; random.

- List: Strategies like bulk purchase.

What is the Best Lottery Strategy?

Diversify numbers.

- Bullet points: Luck-based.

What is the Highest Prize Bond in Pakistan?

Rs. 40000 premium.

- Facts: Largest prizes.

What is the Limit of Prize Bond in Pakistan?

No purchase limit.

- Insights: Encourage savings.

What is the Highest Price of Prize Bond?

Face value highest Rs. 40000.

- List: Denominations.

Related Topics and Comparisons

Common Issues and Queries

What Are Common Problems with the RS 200?

Counterfeits, lost bonds.

Rs. 200 issues include verification delays.

- Established facts: Report losses.

- Bullet points:

- 🔒 Security features.

- 📞 Helplines.

Is the RS 200 Comfortable for Daily Commute?

(Note: This may confuse with Bajaj Pulsar RS 200 motorcycle; irrelevant to bonds.)

- Insights: Focus on financial.

What is the Top Speed of the RS 200?

Irrelevant; motorcycle context.

- Facts: Not bond-related.

Broader Financial Context

What is the Income Tax Period?

Fiscal year July-June.

- List: Filing deadlines.

Is Your Money Safe in Premium Bonds?

Yes, government-backed.

- Bullet points: Similar to standard.

Frequently Asked Questions (FAQs) on Rs. 200 Prize Bond List

What is the Prize of 200 Bond?

The prizes range from Rs. 1,250 to Rs. 750,000.

How to Check Prize Bond of 200?

Online via savings.gov.pk or at centers.

Is the 200 Prize Bond Banned in Pakistan Today?

No, it’s available.

How Do I Claim My Prize Bond?

Submit at National Savings with ID.

How Many Years Old Prize Bond Can Be Claimed?

Up to 6 years.

How to Receive Prize Bond Money?

Via bank transfer after tax.

Do Prize Bonds Contact Winners?

No, check yourself.

Conclusion: Why Rs. 200 Prize Bond Remains a Popular Choice

Summary of Key Points

Rs. 200 prize bonds offer secure, exciting savings with government backing.

Future Outlook for Prize Bonds in Pakistan

Continued popularity with digital enhancements.

Add a Comment