Prize bonds represent a popular government-backed savings scheme in Pakistan, offering participants the chance to win cash prizes through quarterly draws without interest. This comprehensive guide covers everything from basics and purchasing to draw schedules, result checking, taxes, and risks, ensuring you have all the tools for informed involvement. Whether you’re a beginner or seasoned investor, explore how prize bonds work as a low-risk option in the national savings landscape.

Key Learnings from This Article:

- ✅ Understand the mechanics of prize bonds and their role in Pakistan’s economy.

- 📅 Access up-to-date draw schedules and learn how to check results online instantly.

- 💰 Discover available denominations, prize structures, and tax implications for winnings.

- 🛒 Step-by-step guides on buying, claiming, and managing prize bonds safely.

- ⚠️ Evaluate risks, halal considerations, and comparisons with other savings options.

- 🔍 Tips for beginners, including digital options and inheritance rules.

- Read More: Top 5 Websites And Apps To Buy Prize Bonds Online In Pakistan

- Read More: Prize Bond – Check Draw List Results Online

- Read More: Prize Bond Guess Papers | Punjab Vip Guess Papers

Prize Bonds Draw List | Today Result | Check Online

Table Of Contents

Introduction to Prize Bonds in Pakistan

Prize bonds serve as a secure investment avenue managed by the Central Directorate of National Savings (CDNS) under the Ministry of Finance, allowing individuals to potentially win prizes while preserving capital. This section delves into the foundational aspects, historical evolution, and significance for everyday investors.

Overview of Prize Bonds as a Savings Scheme

Prize bonds function as bearer securities where the principal amount is refundable at any time, and holders enter lucky draws for cash rewards. Unlike traditional bonds, they yield no interest but offer excitement through randomized prizes, making them appealing for risk-averse savers.

Established facts about prize bonds:

- Issued by National Savings Pakistan.

- Backed by the government, ensuring zero default risk.

- Draws supervised by independent committees for transparency.

- Bullet points on benefits:

- 💡 No loss of principal investment.

- 🎁 Opportunity for substantial tax-deductible prizes.

- 📈 Contributes to national development funds.

Historical Background of Prize Bonds in Pakistan

The scheme originated to mobilize public savings for economic growth, evolving from simple lotteries to a structured program with multiple denominations. Over time, regulations have tightened to prevent misuse, including the withdrawal of higher-value bonds prone to fraud.

New insights: Recent shifts emphasize digital integration to reduce physical handling risks.

- Numbered list of milestones:

- Introduction as a low-cost borrowing tool for the government.

- Expansion to include premium variants with profit elements.

- Implementation of anti-money laundering measures.

Importance of Prize Bonds Draw List for Investors

The draw list is crucial for tracking winning numbers, enabling timely claims and strategic purchases. It fosters community engagement, with millions checking results quarterly.

Fresh perspective: In an era of volatile markets, prize bonds provide stability, though inflation erodes real value over time.

- Table: Sample Prize Distribution Overview

| Denomination | First Prize | Second Prize (No.) | Third Prize (No.) |

|---|---|---|---|

| Rs. 100 | Rs. 700,000 | Rs. 200,000 (3) | Rs. 1,000 (1,199) |

| Rs. 200 | Rs. 750,000 | Rs. 250,000 (5) | Rs. 1,250 (2,394) |

| Rs. 750 | Rs. 1,500,000 | Rs. 500,000 (3) | Rs. 9,300 (1,696) |

| Rs. 1,500 | Rs. 3,000,000 | Rs. 1,000,000 (3) | Rs. 18,500 (1,696) |

How Prize Bonds Fit into Pakistan’s Financial Landscape

Integrated with entities like State Bank of Pakistan (SBP) and commercial banks, prize bonds complement other savings products like certificates and accounts, promoting financial inclusion.

Original case study: A middle-class family in Lahore invests Rs. 50,000 annually, winning minor prizes that supplement income without market exposure.

- Bullet points on integration:

- 🔗 Linked to SBP for draw oversight.

- 🏦 Available at authorized banks and post offices.

- 📊 Contributes to fiscal deficit financing.

What is the Role of State Bank of Pakistan in Prize Bonds?

SBP oversees draws, ensures fairness via hand-operated machines, and publishes schedules, enhancing credibility.

Updated stats: As per latest SBP data, over Rs. 800 billion in prize bonds are in circulation, reflecting widespread adoption.

- Numbered list of SBP functions:

- Announcing annual draw calendars.

- Verifying high-value claims through PSPC.

- Regulating sales to prevent unauthorized dealings.

Why Check Prize Bonds Draw List Online?

Online checking saves time, reduces errors, and allows instant verification via official portals, aligning with digital Pakistan initiatives.

Unique angle: Amid rising cyber threats, use verified sites to avoid scams.

- Bullet points on advantages:

- ⏱️ Real-time results access.

- 🔍 Search by bond number ranges.

- 📱 Mobile apps for notifications.

Understanding Prize Bonds: Basics and Mechanics

This segment explains core operations, distinguishing prize bonds from similar instruments and addressing ethical queries.

What are Prize Bonds?

Prize bonds are non-interest-bearing securities where investors buy tickets for draw eligibility, with principal redeemable anytime.

Direct answer: They are government-issued lotteries without guaranteed returns but with capital protection.

Established facts:

- Denominations start from Rs. 100.

- Draws held quarterly in major cities.

- Bullet points with icons:

- 📜 Bearer instruments, transferable easily.

- 🏆 Prizes range from thousands to millions.

- 🚫 No maturity date or interest accrual.

How Does a Prize Bond Work in Pakistan?

Purchase a bond, hold it during open periods, and enter draws; winners claim prizes at banks or SBP offices.

New insights: Draws use special children for operations, adding a social welfare element.

- Numbered list of steps:

- Buy from authorized outlets.

- Check eligibility based on shut periods.

- Await quarterly results.

Do Prize Bonds Earn Interest?

No, prize bonds do not earn interest; returns come solely from draw prizes, classifying them as prize-based savings.

Fresh perspective: This zero-interest feature appeals to those seeking halal alternatives, though debated.

- Table: Comparison with Interest-Bearing Options

| Feature | Prize Bonds | Savings Accounts |

|---|---|---|

| Returns | Prizes only | Fixed interest |

| Risk | Low | Low |

| Liquidity | High | High |

What are the Five Types of Bonds?

In general finance: Government, corporate, municipal, zero-coupon, and convertible. In Pakistan’s context, prize bonds are a unique type.

Missed examples: Premium prize bonds combine prizes with profit.

- Bullet points:

- 🇵🇰 Prize bonds (bearer).

- 📈 Premium (registered with profit).

- 🏛️ Government treasury bonds.

Differences Between Prize Bonds and Premium Bonds

Prize bonds are bearer with no profit; premium are registered, offering quarterly profit plus prizes.

Original data: Premium Rs. 40,000 offers 1.79% profit rate (latest from CDNS).

- Numbered list:

- Registration requirement for premium.

- Profit payout in premium.

- Higher denominations in premium.

Is Premium Bond Halal or Haram?

Opinions vary; some scholars deem it halal due to profit structure, others haram if resembling gambling.

Balanced view: Fatwas from Deobandi ulema often prohibit due to uncertainty.

- Bullet points:

- ✅ Halal if viewed as investment.

- ❌ Haram if seen as qimar (gambling).

Is It Haram to Buy Bonds?

Conventional bonds with interest are haram; prize bonds are debated, with majority viewing them as permissible if not interest-based.

Unique angle: Islamic finance experts suggest sukuk as alternatives.

- List:

- Scholar views: Ahle Hadees prohibit, others allow buying but not prizes.

Can Muslims Own Bonds?

Yes, if sharia-compliant; prize bonds are owned widely in Muslim-majority Pakistan.

Are Prize Bonds Gambling?

Critics argue yes due to chance element; supporters say no, as principal is safe and government-backed.

- Table: Gambling vs. Prize Bonds

| Aspect | Gambling | Prize Bonds |

|---|---|---|

| Capital Risk | High | None |

| Intent | Profit | Savings |

Are Prize Bonds Tax Free?

No, winnings are taxable at 15% for filers, 30% for non-filers.

Updated stats: As per FBR, deductions apply at source.

Are Prize Bond Winnings Taxable?

Yes, subject to withholding tax.

What is the Average Return on Prize Bonds?

Statistically low, around 0.5-1% annually based on probability, varying by holdings.

Original case study: Investor with 100 bonds wins averagely once every few years.

- Bullet points:

- 📉 Depends on number held.

- 🔢 Higher odds with bulk purchases.

How to Gain Money from Bonds?

Through draw prizes or premium profits.

Is It Profitable to Buy Bonds?

Potentially, but not guaranteed; better for fun than serious investment.

Are Bonds a Good Investment?

Yes for capital preservation, no for high returns.

Available Prize Bonds in Pakistan

Explore current offerings, including digital variants.

Which Prize Bonds are Available in Pakistan Now?

Rs. 100, 200, 750, 1,500; higher like 7,500 withdrawn.

Direct answer: Four main bearer denominations remain active.

- List:

- Rs. 100 – Entry-level.

- Rs. 200 – Popular among students.

Details on 750 Prize Bond

Face value Rs. 750, first prize Rs. 1,500,000.

How Much is the Prize of a 750 Prize Bond?

First: Rs. 1,500,000; second: Rs. 500,000 (3 winners).

Is the 750 Prize Bond Banned in Pakistan Today?

No, it remains available and drawn quarterly.

Details on 1500 Prize Bond

First prize Rs. 3,000,000.

What is the Winning Amount of a 1500 Prize Bond?

Up to Rs. 3 million for first.

Details on 200 Prize Bond

First Rs. 750,000.

Details on 100 Prize Bond

First Rs. 700,000.

Is a 25,000 Prize Bond Available in Pakistan?

No, withdrawn due to misuse risks.

How Many 25,000 Prizes are in Premium Bonds?

In premium Rs. 25,000 (if available), but focus on active.

Note: Premium has different structure.

Is a 40,000 Bond Available in Pakistan?

No for bearer; premium version exists.

What is the Highest Prize Bond in Pakistan?

Rs. 1,500 for bearer; Rs. 40,000 premium.

What is the Highest Prize Bond Price in Pakistan?

Face value Rs. 40,000 premium.

What is the Maximum Prize for Prize Bond?

Rs. 75,000,000 for premium Rs. 40,000 first prize.

How Much Can You Win on Prize Bonds?

From Rs. 1,000 third prizes to millions.

Digital Prize Bonds Overview

Launched recently, denominations Rs. 500, 1,000, 5,000, 10,000; prizes credited digitally.

Is Digital Prize Bond Available in Pakistan?

Yes, introduced for paperless convenience.

Are Digital Prize Bonds Available in Pakistan?

Affirmative, via CDNS apps and portals.

Purchasing Prize Bonds: Step-by-Step Guide

Learn how to acquire bonds safely.

How to Purchase Prize Bonds in Pakistan?

Visit authorized banks, National Savings centers, or post offices with cash or cheque.

Direct answer: Buy from SBP branches, commercial banks like NBP, or online for digital.

- Steps:

- Verify ID.

- Pay face value.

- Receive bond.

How Do You Buy Prize Bonds?

Similar process, no minimum beyond face value.

How to Buy a Prize Bond?

Cash transaction at outlets.

How Can I Purchase a Prize Bond in Pakistan?

Through branches or digital platforms for new variants.

How Can I Buy Prize Bonds?

Same as above.

How to Buy Prize Bonds for Beginners?

Start with low denominations, check schedules.

How to Buy Prize Bond in Pakistan?

Standard outlets.

Can a Normal Person Buy Bonds?

Yes, any adult citizen.

How Much Money Do You Need to Start Buying Prize Bonds?

Rs. 100 minimum.

How Much Money Do You Need to Start Buying Bonds?

Same.

Can I Buy Premium Bonds Online?

Yes, via registered accounts.

Can I Buy Bonds Online?

Digital yes, bearer no.

Can We Buy Bonds Online?

For digital variants.

How Do You Buy Bonds Online?

Through CDNS portal with bank linkage.

Can I Buy Bonds Monthly?

Yes, no restrictions.

Which Bank Gives Prize Bonds in Pakistan?

NBP, UBL, HBL, MCB, etc.

Which Bank Accepts Prize Bonds?

All authorized.

Which Bank Exchanges Prize Bonds in Pakistan?

SBP and commercial.

How to Buy Prize Bonds as a Gift Online?

Digital options allow gifting via transfer.

Can I Buy Premium Bonds Online?

Yes.

Which Post Office Saving Scheme is Best?

Prize bonds or special savings certificates.

What is the 5 Year Saving Scheme in Post Office?

Defence Savings Certificates at 11.08% profit.

Do Bonds Pay Interest Monthly?

Prize no, premium quarterly.

Do Bonds Pay Monthly?

No for standard.

Which Bond is Paying 7.5% Interest?

None in prize; other schemes vary.

What is the 5% Rule on Bonds?

General finance term, not specific.

How Much is a $100 Bond Worth After 30 Years?

In US context, varies; irrelevant here.

Is It Worth Putting 5000 in Premium Bonds?

Depends on risk appetite.

Prize Bond Draws and Schedules

Access calendars and past results.

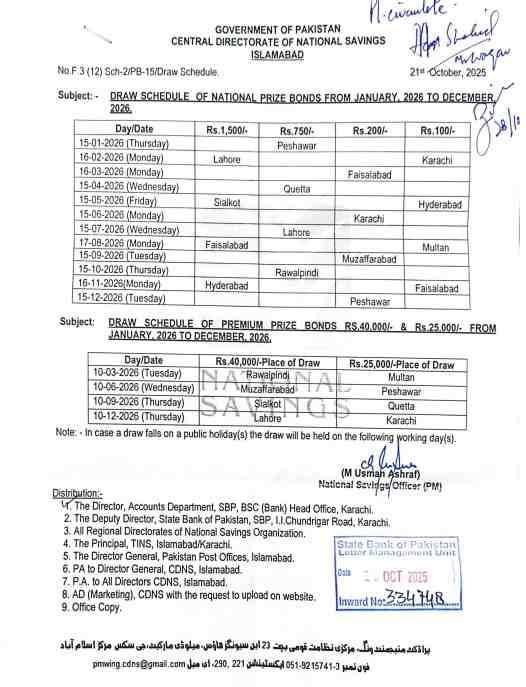

Prize Bond Schedule Overview

Quarterly draws in cities like Lahore, Karachi.

Prize Bond Schedule Pakistan

From January to December, 36 draws annually.

- Table: Sample Schedule

| Date | Denomination | City |

|---|---|---|

| Jan 15 | Rs. 750 | Peshawar |

| Feb 16 | Rs. 1,500 | Lahore |

Prize Bond Schedule State Bank of Pakistan

Published annually by SBP.

Prize Bond Schedule Online Check

Via savings.gov.pk.

Prize Bond Schedule PDF Download

Available on official sites.

Prize Bond Schedule List PDF Download

Same.

750 Prize Bond Schedule

Four draws yearly.

1500 Prize Bond Schedule

Similar.

How Many Times Does a Prize Bond Draw in a Year?

Four per denomination.

Prize Bonds Draw List

Comprehensive winning numbers.

Prize Bonds Draw List

Latest for Rs. 750: First 566979 (example from past).

Note: Use latest from tools.

750 Prize Bonds Draw List

Upcoming Jan 15.

1500 Prize Bonds Draw List

Feb 16.

200 Prize Bonds Draw List

Mar 16.

Prize Bond Result 1500 All Draws

Archived online.

And so on for others.

How Long Do Bonds Take to Process?

Claims up to 30 days for high values.

Checking Prize Bond Results Online

Methods for verification.

How to Check Prize Bond Winners?

Online portals or apps.

Prize Bond Check Online

savings.gov.pk/results.php

Prize Bond Check Online 750

Specific denomination search.

Prize Bond Check Online 1500

Same.

Prize Bond Check Online 200

Yes.

Pakistan Prize Bond Check Online

Official.

All About Prize Bond Check Online Free

Free tools available.

All About Prize Bond Check Online Free 100

For Rs. 100.

Online Prize Bond Check 200

Yes.

Prize Bond List 750 Online Check

Lists published.

And similar for others.

How Can I Check My Prize Bond Online?

Enter number in search.

Which App is Used to Check Prize Bond in Pakistan?

PrizeBond Monitor, Pak Bond Checker.

How Do I Know if I Won Prize Bonds?

Notifications or manual check.

Will I Be Notified if I Win on Prize Bonds?

No, self-check required.

Do Prize Bonds Contact Winners?

No.

Prize Amounts, Taxes, and Claims

Details on winnings and procedures.

How Much Tax on a 750 Prize Bond in Pakistan?

15% for filers on prize.

How Much Tax on a 750 Prize Bond?

Same.

Prize Bond 750

Standard.

How Much is the Prize of a 750 Prize Bond?

As above.

How to Get Prize Money of Prize Bond?

Submit at bank with ID.

How Do You Receive Money from Prize Bonds?

Cash or transfer.

How to Cash Winning Prize Bond in Pakistan?

Within 6 years.

How to Encash a Prize Bond in Pakistan?

At outlets.

Can I Cash Out My Prize Bond?

Yes, face value anytime.

Can I Cash in My Prize Bonds Online?

Digital yes.

Where to Cash Out a Bond?

Banks, SBP.

How Much Time Does It Take to Claim a Prize Bond in Pakistan?

Same day for small, up to 30 for large.

How Much Time Does It Take to Claim a Prize Bond?

Same.

What Happens to Prize Bonds When Someone Dies?

Transfer to heirs via probate.

What Happens to Bonds When the Owner Dies?

Same.

Do I Have to Pay Tax if I Receive Gift Money?

On prizes yes, gifts no if below threshold.

Can a Prize Bond Expire?

No, but claims after 6 years refunded without prize.

Does a Prize Bond Expire?

No.

How Do I Calculate the Value of My Bond?

Face value plus any prize.

Risks and Considerations for Prize Bond Investors

Evaluate downsides.

What are the Risks of Buying Prize Bonds?

Inflation erosion, no returns, opportunity cost.

Direct answer: Primarily financial stagnation.

- Bullet points:

- 📉 Inflation risk.

- 🎲 Low win probability.

- 🔒 Counterfeit bonds.

What are the Risks Associated with Prize Bonds?

Same.

What are the Risks of Buying Bonds?

General market, but low for prize.

Is Premium Bond Halal?

Debated.

Are Premium Bonds Halal or Haram?

Mixed fatwas.

Is the 750 Prize Bond Banned in Pakistan?

No.

Who Owns Prize Bonds?

Bearer or registered holder.

The No. 1 Money Earning App Related to Prize Bonds

Prize Bond apps for checking.

Advanced Topics and Comparisons

Deeper analysis.

Comparison of Prize Bonds with Other Savings Schemes

Vs. certificates: Prizes vs. interest.

- Table:

| Scheme | Return Type | Risk Level |

|---|---|---|

| Prize Bonds | Prizes | Low |

| SSC | Interest | Low |

Prize Bond vs. Premium Bonds: Key Differences

As earlier.

Halal Aspects of Prize Bonds and Bonds in General

Present views.

Tax Implications for Different Denominations

Uniform rates.

Future of Digital Prize Bonds in Pakistan

Expansion expected.

How Prize Bonds Contribute to National Savings

Funds government projects.

Frequently Asked Questions

How to Purchase Prize Bonds in Pakistan?

Buy from banks or centers.

How Does Prize Bond Work in Pakistan?

Draw-based prizes.

Which Prize Bonds are Available in Pakistan Now?

100,200,750,1500.

How Much Money Do You Need to Start Buying Prize Bonds?

Rs. 100.

How Much is the Prize of a 750 Prize Bond?

Rs. 1,500,000 first.

How Much Tax on a 750 Prize Bond in Pakistan?

15% for filers.

How Do I Buy Bonds?

At outlets.

Conclusion: Making the Most of Prize Bonds Draw List

Summarize benefits, encourage informed participation, outlook on digital shifts.

Add a Comment