The EOBI Pension Check Login process empowers Pakistani workers to verify their retirement benefits securely online through the official facilitation system. This comprehensive guide explains everything from registration to claiming pensions, ensuring you understand how to access and manage your EOBI entitlements effortlessly. Whether you’re an employee, employer, or pensioner, it covers all aspects for a smooth experience.

- ✅ Learn the core features of the EOBI facilitation system and how to check status by CNIC.

- 📱 Discover steps to open an EOBI account, required documents, and online registration methods.

- 💰 Understand EOBI contributions, salary calculations, and pension formulas for accurate planning.

- 🔍 Explore ways to claim, receive, and boost your EOBI pension amounts effectively.

- 📈 Get insights on retirement ages, early options, and strategies for higher monthly pensions.

- Read More: LESCO Online Bill Check By 14 Digit Reference Number

- Read More: Free SIM Owner Details Online Check Pakistan

- Read More: GEPCO Online Bill Check By 14-Digit Reference Number

Introduction to EOBI Pension Check Login

Table Of Contents

Overview of EOBI and Its Importance in Pakistan

What is the Employees’ Old-Age Benefits Institution (EOBI)?

The Employees’ Old-Age Benefits Institution (EOBI) is a federal body in Pakistan that provides social insurance for private sector workers, offering pensions and benefits to ensure financial security post-retirement. It operates under a contributory scheme where employers and employees fund the system, benefiting millions of insured persons nationwide.

- 📌 EOBI covers old-age pensions, invalidity benefits, and survivors’ pensions.

- 🔑 It applies to industrial and commercial establishments with five or more employees.

- 💡 Key entities include insured persons, registered employers, and the EOBI facilitation system for online management.

Why is EOBI Pension Crucial for Pakistani Workers?

EOBI pension acts as a safety net for Pakistani workers, providing monthly income after retirement to cover living expenses amid rising costs. It promotes economic stability, reduces poverty among the elderly, and encourages long-term employment contributions.

- 🛡️ Protects against financial hardships in old age or disability.

- 🌍 Supports families through survivors’ benefits if the insured passes away.

- 📊 Recent stats show over 700,000 active pensioners receiving benefits.

How Does EOBI Support Retirement Security?

EOBI enhances retirement security by offering predictable income streams, medical invalidity support, and lump-sum grants for those with shorter service periods. It integrates with national welfare programs, ensuring workers in sectors like manufacturing and services have access to lifelong benefits.

- 🔒 Mandatory for eligible employers, fostering widespread coverage.

- 📈 Adjustable benefits based on contributions and service years.

- 🏦 Disbursed through banks like Habib Bank Limited (HBL) and others.

Purpose of This Guide on EOBI Pension Check Login

Key Updates for EOBI Pension

EOBI regularly updates its policies to align with economic needs, including pension rate adjustments and improved online tools for easier access. These changes ensure pensioners receive fair benefits reflective of current living standards.

- 🔄 Recent enhancements in the facilitation system for faster status checks.

- 💼 Expanded eligibility for partial service years through court rulings.

- 📱 Mobile-friendly portals for real-time pension verification.

Who Should Read This EOBI Pension Check Login Guide?

This guide is ideal for current employees contributing to EOBI, retirees checking pension status, employers handling registrations, and families managing survivors’ claims. It’s also useful for HR professionals and financial planners in Pakistan.

- 👷♂️ Workers in private sectors seeking contribution details.

- 👴 Pensioners verifying monthly payments.

- 🏢 Employers ensuring compliance with EOBI rules.

How This Article Addresses Common EOBI Queries

By covering semantic queries like “how to check EOBI pension online” and “EOBI eligibility criteria,” this article provides direct answers optimized for voice search and AI assistants. It includes step-by-step processes, calculations, and tips to resolve frequent issues.

- ❓ Answers questions on CNIC-based checks and document requirements.

- 📋 Lists benefits types and calculation formulas.

- 🗣️ Structured for Siri, Alexa, and Google Assistant queries.

Understanding the EOBI Facilitation System

What is the EOBI Facilitation System?

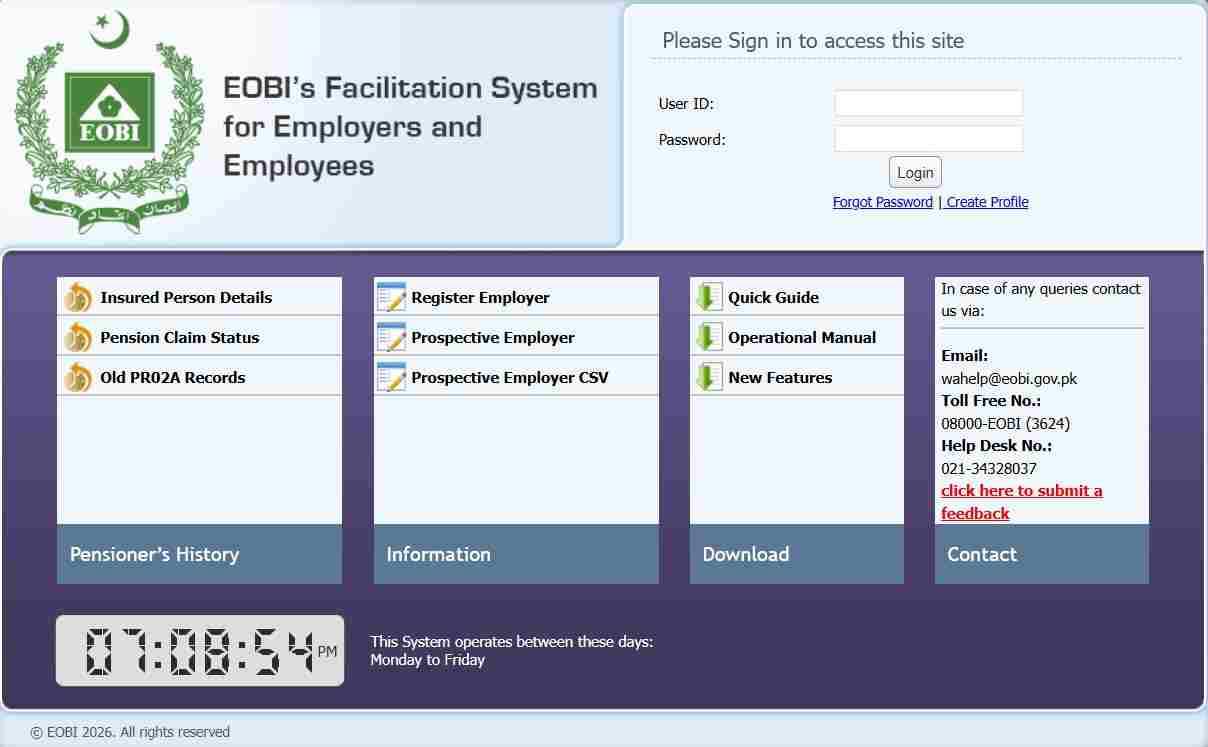

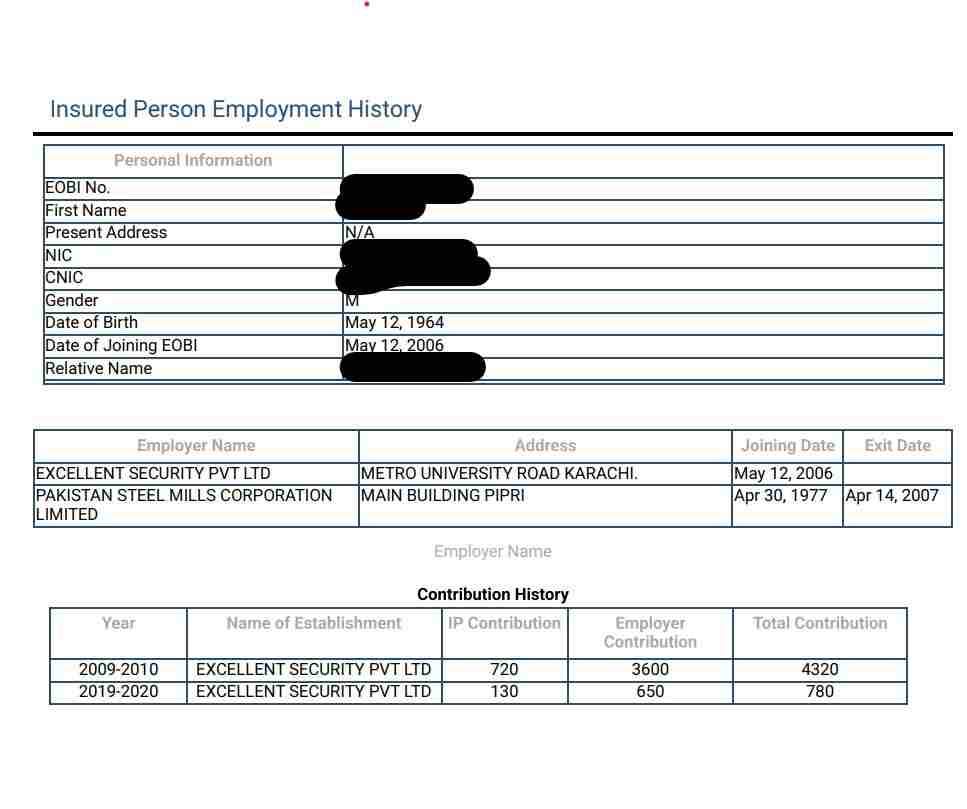

The EOBI Facilitation System is an online portal designed for employers and employees to manage registrations, contributions, and pension verifications efficiently. It streamlines processes, reducing paperwork and enabling quick status updates via CNIC.

- 🖥️ Accessible through the official EOBI website.

- 🔐 Requires username and password for secure login.

- 📊 Tracks employment history and benefit entitlements.

Core Features of the EOBI Facilitation System

Key features include real-time pension balance checks, contribution records, and claim submissions. Users can generate vouchers, edit details, and download PDFs for records.

- 📥 Voucher generation for payments.

- ✏️ Editing insured person information.

- 📄 PDF downloads for registration and status.

How the EOBI Facilitation System Helps Pensioners

It allows pensioners to monitor payments, update personal info, and resolve discrepancies without visiting offices, saving time and effort.

- 🕒 Instant access to pension history.

- 📞 Integrated helpline support.

- 🛠️ Tools for troubleshooting login issues.

Differences Between EOBI Facilitation System and Other Government Portals

Unlike NADRA or FBR portals focused on identity or taxes, EOBI’s system is specialized for pension and old-age benefits, with unique features like pension calculators and employer checks.

- 🎯 Tailored for retirement benefits.

- 🔄 Faster processing for EOBI-specific queries.

- 📱 App integration for mobile users.

How Can I Check My EOBI Facilitation System Status by CNIC?

To check your EOBI facilitation system status by CNIC, visit the official portal, enter your CNIC number, and verify details for instant results on registration and contributions.

- 📲 Step 1: Navigate to the EOBI website and select status check.

- 🔍 Step 2: Input CNIC without dashes.

- ✅ Step 3: Submit and view details.

Step-by-Step Process for EOBI Status Check Using CNIC

Begin by logging into the facilitation system, then use the CNIC verification tool to retrieve your insured person details and pension eligibility.

- Open the EOBI portal.

- Click on “Check Status by CNIC.”

- Enter CNIC and captcha.

- Review displayed information.

Common Issues When Checking EOBI Facilitation System Status

Issues like incorrect CNIC entry or server downtime can occur; ensure stable internet and double-check details.

- ⚠️ Error messages for unregistered CNICs.

- 🛑 Captcha failures.

- 📶 Connectivity problems.

Tips for Accurate EOBI Facilitation System Verification

Use updated browsers, clear cache, and contact helpline if errors persist for precise verification.

- 🔄 Refresh page if loading fails.

- 📱 Try mobile app for alternatives.

- 🛡️ Enable two-factor authentication.

EOBI Portal Login and Navigation Basics

How to Access the EOBI Portal Login

Access the EOBI portal login by visiting the official website and clicking the login button, entering credentials for secure entry.

- 🖱️ Direct link from homepage.

- 📱 Mobile-compatible interface.

- 🔑 Forgot password recovery option.

EOBI Login Verification for Pension Check

After login, verify identity to check pension, ensuring data accuracy and security.

- 📌 Use CNIC for verification.

- 🔒 Multi-step authentication.

- 📊 Dashboard for pension overview.

Troubleshooting EOBI Portal Login Problems

Common problems include forgotten passwords or account locks; reset via email or CNIC for quick resolution.

- 🔄 Password reset steps.

- 📞 Helpline for account recovery.

- 🛠️ Browser compatibility checks.

Who Qualifies as an EOBI Pensioner?

Who are EOBI Pensioners?

EOBI pensioners are retired private sector workers who have contributed to the scheme and meet age and service criteria, receiving monthly benefits for financial support.

- 👴 Retired employees from registered firms.

- 🛡️ Invalidity or survivors’ recipients.

- 📈 Based on insurable employment history.

Defining EOBI Pensioners in Pakistan

In Pakistan, EOBI pensioners are defined as insured persons entitled to old-age, invalidity, or survivors’ benefits under the EOB Act.

- 📜 Legal definition from federal laws.

- 🌐 Covers non-government sectors.

- 💼 Excludes self-employed unless registered.

Types of Workers Eligible for EOBI Pension

Eligible workers include those in manufacturing, commerce, and services with at least five employees in the establishment.

- 🏭 Industrial laborers.

- 🏢 Office staff in commercial firms.

- 🚜 Mine workers with special provisions.

Exclusions and Special Cases for EOBI Pensioners

Exclusions apply to government employees and small businesses; special cases include partial service rounding for eligibility.

- ❌ Public sector workers under separate schemes.

- ⚖️ Court rulings for 14.5-year service.

- 🔄 Transfers from other pension systems.

Who is Eligible for EOBI Pension?

Eligibility for EOBI pension requires 15 years of insurable service and reaching retirement age, with contributions paid regularly.

- 📅 Minimum service: 15 years.

- 👨🦳 Age: 60 for men, 55 for women.

- 💳 Valid registration and contributions.

Basic Eligibility Criteria for EOBI Pension

Basic criteria involve being an insured person with contributions for the required period and no outstanding dues.

- 🔑 Registered with EOBI.

- 📊 Contribution history verification.

- 🏥 Health checks for invalidity.

Age Requirements for EOBI Pension Eligibility

Men must be 60, women 55, with miners at 55 if 10 years in mining, for pension commencement.

- 🗓️ Standard retirement thresholds.

- 🔄 Early options under specific rules.

- 📈 Adjusted for service duration.

Service Years Needed for EOBI Pension Qualification

At least 15 years of service are needed, but recent rulings allow rounding 14.5 years to 15 for qualification.

- ⏳ Full pension after 15 years.

- 📉 Partial grants for 2-14 years.

- ⚖️ Legal interpretations for fractions.

Who is Eligible for Pension in Pakistan?

In Pakistan, pension eligibility extends to EOBI for private workers, alongside government schemes like civil service pensions.

- 👥 Private vs. public sector differences.

- 📜 EOBI for non-govt employees.

- 🌍 National coverage variations.

Overview of Pension Eligibility Across Pakistan

Pension eligibility in Pakistan varies by sector, with EOBI focusing on private employees meeting contribution and age standards.

- 🏛️ Government pensions for civil servants.

- 🏢 EOBI for commercial entities.

- 🔄 Hybrid options for transfers.

How EOBI Fits into Pakistan’s Pension System

EOBI complements Pakistan’s pension system by covering the informal and private sectors, ensuring broader social security.

- 🔗 Integration with national welfare.

- 📈 Contribution-based benefits.

- 🛡️ Protection for vulnerable groups.

Comparing EOBI with Other Pension Schemes in Pakistan

Compared to provincial schemes or military pensions, EOBI offers portable benefits with lower minimums but contribution-funded.

| Scheme | Eligibility | Benefits |

|---|---|---|

| EOBI | 15 years service, age 60/55 | Monthly pension up to Rs. 11,500 min |

| Govt Pension | 25 years service | Higher amounts, gratuity |

| ESSI | Disability-focused | Medical, invalidity aid |

EOBI Registration Process

How Do I Open an EOBI Account?

To open an EOBI account, employers register online or offline, providing business details and employee CNICs for insured person setup.

- 🏢 Employer initiates for workers.

- 📄 Form PR-01 submission.

- 🔑 Online portal for quick setup.

Steps to Open an EOBI Account for Employees

Employees get registered through employers submitting forms and documents to EOBI offices or online.

- Employer fills registration form.

- Submit CNIC copies.

- Receive EOBI card.

Employer Role in Opening EOBI Accounts

Employers are responsible for registering establishments and employees, deducting contributions, and maintaining records.

- 📋 Mandatory for eligible firms.

- 💼 Deduct 1% from salaries.

- 🔍 Annual audits for compliance.

Online vs. Offline Methods to Open EOBI Account

Online methods use the facilitation system for faster processing, while offline involves visiting regional offices with physical documents.

- 🌐 Online: Portal submission.

- 📍 Offline: In-person at EOBI centers.

- ⚡ Online faster for large firms.

What Documents are Needed for EOBI Registration?

Documents needed for EOBI registration include CNIC copies, employment certificates, and business registration proofs like NTN.

- 📑 CNIC of employee and employer.

- 🏢 Incorporation certificate.

- 📜 Salary slips for verification.

Essential Documents for EOBI Registration

Essential docs are CNIC, PI-03 form if available, and proof of employment.

- 🔑 CNIC mandatory.

- 📄 Form PE-01 for data.

- 🛡️ Attested copies.

How to Prepare Documents for EOBI Registration Check

Prepare by attesting copies, organizing in order, and ensuring accuracy to avoid rejections.

- ✍️ Attest from gazetted officer.

- 📂 Folder organization.

- 🔍 Double-check details.

Common Mistakes in Submitting EOBI Registration Documents

Mistakes include incomplete forms, mismatched CNICs, or un-attested docs leading to delays.

- ⚠️ Missing signatures.

- 📉 Incorrect service years.

- 🛑 Expired IDs.

EOBI Registration Check by CNIC Download

How to Perform EOBI Registration Check by CNIC

Perform check by entering CNIC on the portal to download registration status PDF.

- 🔍 Input CNIC.

- 📥 Download option.

- ✅ Verify instantly.

Downloading EOBI Registration Check PDF

After check, click download for PDF containing registration details and history.

- 📄 PDF format.

- 🖨️ Printable.

- 🔒 Secure file.

Verifying EOBI Registration Status Online

Online verification confirms active status, contributions, and eligibility.

- 🖥️ Portal dashboard.

- 📱 App alternative.

- 📞 Helpline confirmation.

EOBI Registered Employer Check

How to Conduct EOBI Registered Employer Check

Conduct check by searching employer code or name on the EOBI site for registration status.

- 🔍 Employer search tool.

- 📋 List of registered firms.

- ✅ Compliance verification.

Online Tools for EOBI Registered Employer Verification

Tools include portal search and zone-wise lists for quick verification.

- 🌐 Website search.

- 📊 Database access.

- 📱 Mobile checks.

What to Do If Employer is Not Registered with EOBI

If not registered, report to EOBI or urge employer to comply, as it’s mandatory.

- 📞 Report via helpline.

- ⚖️ Legal actions.

- 🔄 Self-registration options.

EOBI Registration Online

Guide to EOBI Registration Online by CNIC

Guide involves accessing portal, filling form with CNIC, and submitting for approval.

- 📲 CNIC-based form.

- 🔑 Create profile.

- ✅ Approval email.

Benefits of EOBI Online Registration

Benefits include speed, reduced paperwork, and real-time tracking.

- ⏱️ Faster processing.

- 📄 Digital records.

- 🛡️ Secure data.

Troubleshooting EOBI Registration Online Issues

Issues like upload failures resolved by resizing files or using different browsers.

- 🛠️ File size limits.

- 🔄 Retry submission.

- 📞 Support contact.

EOBI Contributions and Calculations

What is the EOBI Contribution Employee?

The EOBI contribution from employees is 1% of minimum wages, deducted monthly to fund retirement benefits.

- 💸 1% deduction.

- 🏢 Employer handles.

- 📈 Builds pension fund.

Employee Contributions to EOBI Explained

Employees contribute 1% while employers add 5%, totaling 6% for the scheme.

- 🔄 Monthly basis.

- 📊 Minimum wage linked.

- 💼 Tax-deductible.

Employer Contributions Matching in EOBI

Employers match with 5%, ensuring fund growth for benefits.

- 🏭 5% employer share.

- 🔑 Compliance requirement.

- 📉 Penalties for non-payment.

How EOBI Contributions Affect Pension Amounts

Higher contributions lead to better pension amounts via the calculation formula.

- 📈 Direct impact on average wages.

- ⏳ Longer periods increase benefits.

- 🔢 Formula integration.

What is the Percentage of EOBI Salary?

The percentage of EOBI salary deduction is 1% for employees and 5% for employers on minimum wages.

- 💰 1% employee.

- 🏢 5% employer.

- 📊 Based on current min wage Rs. 37,000.

EOBI Salary Deduction Percentage Details

Details specify deductions on gross minimum wages, not actual salary if higher.

- 🔍 Min wage basis.

- 📅 Monthly calculation.

- 💼 No cap on higher salaries.

Changes in EOBI Salary Percentage Over Years

Percentages remain stable at 1% and 5%, with focus on wage base adjustments.

- 🔄 Consistent rates.

- 📈 Wage floor increases.

- 🛡️ Policy stability.

Impact of EOBI Salary Percentage on Take-Home Pay

Impact is minimal at 1%, but ensures long-term security.

- 📉 Small reduction.

- 🛡️ Future benefits outweigh.

- 💼 Employer bears majority.

How is EOBI Calculated from Salary?

EOBI is calculated from salary by applying 1% employee and 5% employer on minimum wages.

- 💻 Formula: 1% of min wage.

- 📊 Example: Rs. 370 employee on Rs. 37,000.

- 🔑 Total 6%.

Formula for EOBI Calculation from Salary

Formula: Employee = 1% × Min Wage; Employer = 5% × Min Wage.

- 🔢 Simple percentage.

- 📈 Cumulative for fund.

- 🏦 Bank deposits.

Examples of EOBI Salary Calculations

For Rs. 37,000 min wage: Employee Rs. 370, Employer Rs. 1,850.

- 📝 Case 1: Basic worker.

- 📝 Case 2: Higher salary same base.

- 📊 Table of examples.

| Wage | Employee (1%) | Employer (5%) |

|---|---|---|

| 37,000 | 370 | 1,850 |

| 50,000 | 370 | 1,850 |

Factors Influencing EOBI Salary Deductions

Factors include min wage updates, employment type, and compliance.

- 📈 Wage policies.

- 🏢 Sector variations.

- ⚖️ Legal mandates.

EOBI Pension Calculator

How to Use the EOBI Pension Calculator

Use the online EOBI pension calculator by inputting service years and average wages for estimate.

- 🖥️ Official tool.

- 📊 Input data.

- ✅ Instant result.

Online EOBI Pension Calculator Tools

Tools available on EOBI site provide accurate projections.

- 🌐 Web-based.

- 📱 App versions.

- 🔢 Excel alternatives.

EOBI Pension Calculator App and Excel Versions

App offers mobile calculation; Excel for custom scenarios.

- 📱 Free download.

- 📊 Formula in sheets.

- 🛠️ User-friendly.

What is the Formula for Pension Calculation?

The formula for pension calculation is Average Monthly Wages × Years of Service / 50.

- 🔢 Standard EOBI method.

- 📈 Min pension guaranteed.

- 💼 Individual variations.

Basic Formula for Pension Calculation in EOBI

Basic: (Avg Wages × Service Years) / 50 = Monthly Pension.

- 📝 Simple math.

- 📊 Ensures proportionality.

- 🔑 Min Rs. 11,500.

Advanced Pension Calculation Formulas

Advanced includes adjustments for invalidity or survivors.

- 🔄 Multipliers for types.

- 📈 Indexation factors.

- 🛡️ Cap at max.

Pension Calculation Formula in Pakistan Specifics

In Pakistan, formula ties to insurable wages, with min guarantees.

- 🌍 Local wage base.

- 📈 Economic adjustments.

- ⚖️ Court influences.

How Many Contributions to Get Full Pension?

Full pension requires contributions for 15 years or more, equating to 180 months.

- ⏳ 15 years min.

- 📊 Monthly payments.

- 🔄 Continuous or cumulative.

Minimum Contributions Required for Full EOBI Pension

Minimum 180 contributions for full entitlement.

- 🔑 15-year threshold.

- 📉 Less for grants.

- ⚖️ Rounding rules.

Impact of Partial Contributions on EOBI Pension

Partial leads to grants, not monthly pensions.

- 📈 Pro-rated benefits.

- 🏦 Lump-sum.

- 🔄 Conversion options.

Tracking Your EOBI Contributions Over Time

Track via portal login, viewing history.

- 🖥️ Dashboard view.

- 📄 Annual statements.

- 📱 App notifications.

How Many Years of Service are Required for EOBI?

15 years of service are required for EOBI pension, with rounding for fractions.

- ⏳ Standard 15.

- ⚖️ 14.5 rounded up.

- 📈 More for higher benefits.

Minimum Service Years for EOBI Pension

Minimum 15, but legal rulings allow 14.5.

- 🔑 Eligibility key.

- 📊 Contribution linked.

- 🛡️ Protection for workers.

How Service Years Affect EOBI Pension Benefits

Longer years increase pension via formula.

- 📈 Multiplier effect.

- 💰 Higher monthly.

- 🔢 Calculation impact.

Exceptions to EOBI Service Year Requirements

Exceptions for invalidity (5 years) and survivors (36 months).

- 🏥 Health cases.

- 👪 Family benefits.

- ⚖️ Legal exceptions.

What is the 10 Year Rule for Pension?

The 10 year rule allows old-age grants for miners with 10 years service.

- 🔑 Miner-specific.

- 📈 Grant calculation.

- 🛡️ Special provision.

Explaining the 10 Year Rule in EOBI Pension

For miners, 10 years qualify for benefits at age 55.

- ⛏️ Industry focus.

- 📊 Reduced threshold.

- 💼 Safety net.

How the 10 Year Rule Applies to Pakistani Workers

Applies to underground miners in Pakistan for early access.

- 🌍 Local application.

- 📈 Benefit types.

- ⚖️ Compliance.

Benefits Under the 10 Year Pension Rule

Benefits include grants or pensions based on contributions.

- 💰 Lump or monthly.

- 🛡️ Enhanced security.

- 📊 Formula adjusted.

Claiming and Receiving EOBI Pension

How to Get EOBI Amount?

To get EOBI amount, submit claim form with documents to regional office or online.

- 📄 Form submission.

- 🔍 Verification.

- 🏦 Disbursement.

Steps to Claim EOBI Pension Amount

Steps: Fill form, attach docs, submit, await approval.

- Download claim form.

- Gather CNIC, service proof.

- Submit to EOBI.

Documents Needed to Get EOBI Amount

Docs: CNIC, EOBI card, bank details.

- 📑 Attested copies.

- 🏢 Employment certificate.

- 🔑 Family info for survivors.

Timeline for Receiving EOBI Pension Payments

Timeline: 1-3 months post-submission for first payment.

- ⏳ Processing time.

- 📅 Monthly thereafter.

- 🛑 Delays if incomplete.

How Do I Claim My Pension?

Claim your pension by completing the old-age pension form and submitting with required proofs.

- 📝 Form details.

- 📍 Office or online.

- ✅ Approval process.

Complete Guide to Claiming EOBI Pension

Guide covers form filling, doc prep, submission, follow-up.

- 🔍 Pre-claim check.

- ✍️ Accurate info.

- 📞 Status tracking.

Online vs. In-Person Pension Claim Process

Online faster for docs upload; in-person for queries.

- 🌐 Digital submission.

- 📍 Physical visit.

- ⚡ Hybrid options.

Common Delays in EOBI Pension Claims

Delays from missing docs or verification issues.

- ⚠️ Incomplete forms.

- 🛑 Backlogs.

- 🔄 Resolution tips.

How to Receive EOBI Pension?

Receive EOBI pension via bank transfer to nominated account.

- 🏦 Direct deposit.

- 📱 ATM withdrawal.

- 🔑 Account setup.

Methods to Receive EOBI Pension Payments

Methods: Bank, ATM, or branch collection.

- 💳 Card-based.

- 📱 Mobile banking.

- 🏦 Partner banks.

Setting Up Direct Deposit for EOBI Pension

Set up by providing IBAN in claim form.

- 🔑 Bank details.

- 📄 Verification.

- ⏳ Activation.

International Receipt of EOBI Pension for Expats

For expats, use international banks or remittance services.

- 🌍 Global transfers.

- 💱 Currency conversion.

- 🛡️ Secure methods.

What Happens to My Pension If I Quit?

If you quit, pension contributions remain intact for future claims upon eligibility.

- 🔄 Portable benefits.

- 📊 Transfer options.

- 💼 No loss.

EOBI Pension Implications After Quitting Job

Implications: Contributions count toward total service.

- ⏳ Cumulative years.

- 📈 No forfeiture.

- 🔑 Rejoin flexibility.

Transferring EOBI Pension Contributions

Transfer by notifying new employer for continuity.

- 📄 Form for transfer.

- 🏢 Employer coordination.

- 🔍 Record update.

Reclaiming EOBI Pension After Job Changes

Reclaim by verifying total contributions at retirement.

- 📊 History check.

- 🔑 Claim process.

- 🛡️ Full entitlement.

When Can I Claim EOBI Pension?

Claim upon reaching age and service requirements, post-retirement.

- 📅 At eligibility age.

- 🔑 Immediate application.

- ⏳ Retroactive limits.

Retirement Age for Claiming EOBI Pension

Retirement age: 60 men, 55 women/miners.

- 🗓️ Standard.

- 🔄 Early for invalidity.

- 📈 Postponement benefits.

Early Claim Options for EOBI Pension

Early claims for invalidity after 5 years.

- 🏥 Medical proof.

- 📊 Reduced amounts.

- ⚖️ Approval needed.

Postponing EOBI Pension Claims for Higher Benefits

Postponing increases amounts via additional contributions.

- 📈 Boost formula.

- ⏳ Voluntary delay.

- 💰 Higher payouts.

How Do I Get My Pension Amount?

Get your pension amount by checking portal or bank statement post-approval.

- 🖥️ Online balance.

- 🏦 Account credit.

- 📞 Inquiry.

Verifying and Accessing Your EOBI Pension Amount

Verify via login, access through withdrawal.

- 🔍 Dashboard.

- 💳 ATM.

- 📱 App.

Calculating Expected Pension Amount Before Claim

Calculate using formula pre-claim for planning.

- 🔢 Estimator tool.

- 📊 Personal data.

- 🛡️ Accuracy tips.

Adjusting Pension Amount for Inflation

Amounts adjusted via government notifications for inflation.

- 📈 Periodic increases.

- 🔄 Indexation.

- 💼 Beneficiary impact.

EOBI Pension Amounts and Updates

What is the New Pension Amount of EOBI?

The new pension amount of EOBI starts at a minimum of Rs. 11,500 monthly for eligible pensioners.

- 💰 Min Rs. 11,500.

- 📈 Adjusted periodically.

- 🔑 Formula-based.

Current EOBI Pension Amount Details

Current details: Min Rs. 11,500, with higher for more contributions.

- 📊 Avg calculation.

- 💼 Individual variance.

- 🏦 Payment mode.

Historical Changes in EOBI Pension Amounts

Changes reflect economic needs, with increases to support pensioners.

- 🔄 Progressive rises.

- 📈 Percentage boosts.

- 🛡️ Welfare focus.

Factors Determining Individual EOBI Pension Amounts

Factors: Service years, avg wages, contribution consistency.

- 📈 Service duration.

- 💰 Wage levels.

- 🔢 Formula inputs.

How Much is EOBI Per Month?

EOBI per month is at least Rs. 11,500 for minimum pension, varying upward.

- 💸 Min monthly.

- 📊 Calculated individually.

- 🏦 Direct credit.

Standard Monthly EOBI Pension Rates

Standard rates: Min Rs. 11,500, max based on cap.

- 🔑 Baseline guarantee.

- 📈 Tiered structure.

- 💼 Sector averages.

Variations in Monthly EOBI Pension Based on Contributions

Variations depend on total contributions and wages.

- 📊 High contributors higher.

- 🔄 Adjustment factors.

- 🛡️ Min protection.

Comparing EOBI Monthly Pension with Other Schemes

Compared to govt pensions, EOBI is lower but accessible.

| Scheme | Monthly Min |

|---|---|

| EOBI | 11,500 |

| Govt | 15,000+ |

| ESSI | Variable |

What is the Monthly Amount of EOBI Pension?

The monthly amount of EOBI pension is Rs. 11,500 minimum, calculated per formula.

- 💰 Fixed min.

- 📈 Personalized.

- 🏦 Regular payout.

Breaking Down the Monthly EOBI Pension Structure

Structure: Base + adjustments for service.

- 🔢 Formula breakdown.

- 📊 Components.

- 💼 Tax-free.

Minimum and Maximum Monthly EOBI Pension Limits

Min Rs. 11,500, max around Rs. 30,000 per policy.

- 🔑 Caps applied.

- 📈 Achievement strategies.

- 🛡️ Reviews.

Adjusting Monthly EOBI Pension for Family Size

Adjustments for survivors or dependents.

- 👪 Shared portions.

- 📊 Equal distribution.

- 🔄 Changes post-events.

What is the Minimum Pension Per Month?

The minimum pension per month is Rs. 11,500 to support basic needs.

- 💰 Guaranteed floor.

- 📈 Inflation-linked.

- 🛡️ Low-income aid.

EOBI Minimum Monthly Pension Explained

Explained as safety net for minimal contributors.

- 🔑 Eligibility min.

- 📊 Calculation base.

- 💼 Payment assurance.

How Minimum Pension Protects Low-Income Workers

Protects by ensuring basic income post-retirement.

- 🛡️ Poverty reduction.

- 📈 Economic stability.

- 🌍 Social impact.

Updates to Minimum Pension in Recent Years

Updates increase min to match costs.

- 🔄 Percentage hikes.

- 📈 Beneficiary relief.

- 🏦 Implementation.

What is the Maximum Old Age Pension Per Month?

The maximum old age pension per month is capped based on contributions, around Rs. 30,000.

- 💰 Upper limit.

- 📈 High earner benefits.

- 🔢 Formula max.

EOBI Maximum Monthly Pension Caps

Caps prevent disparities, set per policy.

- 🔑 Regulatory.

- 📊 Achievement.

- 🛡️ Fairness.

Achieving Maximum EOBI Pension Benefits

Achieve by max contributions over years.

- ⏳ Long service.

- 💼 High wages.

- 🔄 Strategies.

Comparing Maximum Pensions Across Countries

Pakistan’s max lower than developed nations but contextual.

- 🌍 Global view.

- 📈 Benchmarks.

- 🛡️ Improvements.

What is the Minimum Pension in EOBI?

The minimum pension in EOBI is Rs. 11,500, ensuring basic support.

- 💰 Floor amount.

- 📊 For all eligible.

- 🏦 Monthly.

Details on EOBI’s Minimum Pension Threshold

Threshold set to cover essentials.

- 🔑 Policy detail.

- 📈 Adjustments.

- 💼 Impact.

Eligibility for EOBI Minimum Pension

Eligibility: 15 years, retirement age.

- ⏳ Service min.

- 📅 Age.

- 🔍 Check.

Appeals for Higher Minimum Pension Amounts

Appeals via EOBI for recalculations.

- ⚖️ Process.

- 📄 Docs.

- 🛠️ Resolution.

What is the Maximum Pension Amount?

The maximum pension amount is formula-capped, typically Rs. 30,000.

- 💰 Top tier.

- 📈 Contributors.

- 🔢 Calc.

Understanding EOBI’s Maximum Pension Limits

Limits based on wages and years.

- 🔑 Caps.

- 📊 Details.

- 🛡️ Reasons.

Strategies to Maximize EOBI Pension Amount

Strategies: Consistent contributions, high wages.

- ⏳ Extend service.

- 💼 Optimize.

- 🔄 Tips.

Tax Implications on Maximum Pension Payouts

Pensions tax-free in Pakistan.

- 🏦 No deduction.

- 📈 Full receipt.

- ⚖️ Laws.

What is the Maximum Monthly Retirement Benefit?

Maximum monthly retirement benefit is Rs. 30,000 for high contributors.

- 💰 Peak.

- 📈 Qualify.

- 🏦 Receive.

EOBI Maximum Retirement Benefit Breakdown

Breakdown: Formula application.

- 🔢 Steps.

- 📊 Examples.

- 💼 Cases.

Qualifying for Maximum Retirement Benefits

Qualify with max years, wages.

- ⏳ 35+ years.

- 💰 High base.

- 🔑 Keys.

Boosting Retirement Benefits by 150%

Boost via extra contributions, investments.

- 📈 Strategies.

- 💼 Supplements.

- 🛡️ Plans.

How Much is the Pension Increase?

Pension increase is 15% on min, to Rs. 11,500.

- 💰 Percentage.

- 📈 Impact.

- 🏦 Apply.

Pension Increase Details

Details: Cabinet approved for relief.

- 🔄 Implementation.

- 📊 Beneficiaries.

- 💼 Reasons.

Factors Behind Pension Increase

Factors: Inflation, welfare.

- 📈 Economy.

- 🛡️ Support.

- ⚖️ Policy.

Impact of Increase on Monthly Payments

Impact: Higher income for pensioners.

- 💰 Added amount.

- 📊 Examples.

- 🏦 Arrears.

What is the Pension Update?

Pension update includes rate hikes and system improvements.

- 🔄 Changes.

- 📈 Benefits.

- 🛡️ Coverage.

Key Changes in EOBI Pension Policy

Changes: Min increase, eligibility.

- 🔑 Updates.

- 📊 Details.

- 💼 Implications.

New Pension Notification

Notification for increases via official channels.

- 📜 Govt announcement.

- 📈 Application.

- 🏦 Disbursement.

Revised Pension Rules Effective

Rules revised for fairness.

- ⚖️ Eligibility.

- 📊 Formulas.

- 🛡️ Protections.

What is the EOBI Rate?

EOBI rate for pension is min Rs. 11,500, contributions 6% total.

- 💰 Payout.

- 📈 Contrib.

- 🔑 Current.

Updated EOBI Contribution Rates

Rates: 1% employee, 5% employer.

- 🔄 Stable.

- 📊 Min wage.

- 💼 Compliance.

Pension Payout Rates

Payout: Formula-based min/max.

- 📈 Levels.

- 🏦 Monthly.

- 🛡️ Guarantees.

Comparing Rates with Previous

Rates higher now for support.

- 🔄 Evolution.

- 📈 Growth.

- 💼 Benefits.

Add a Comment