The Maryam Nawaz Loan Scheme stands as a pivotal initiative by the Punjab government, offering interest-free financing to boost entrepreneurship and small businesses. This program, including the Asaan Karobar Finance Scheme and Asaan Karobar Card, provides loans up to Rs.10 lakh without interest, enabling easy access to capital for startups and expansions. It aims to drive economic growth, job creation, and financial inclusion across Punjab.

Here are the main learnings from this article:

- ✅ Understand the core features of Maryam Nawaz Loan Scheme and how it supports SMEs.

- 📈 Discover eligibility criteria and application processes for interest-free loans.

- 💼 Learn about loan amounts, repayment terms, and related Punjab government schemes.

- 🔍 Compare with other loan programs and check status updates.

- ❓ Get answers to common queries on EMI, interest rates, and more.

- Read More: PSER Online Registration – Apply, Verify & Track

- Read More: CM Punjab Green Tractor Scheme Phase 3 Apply Online

- Read More: CM Punjab Ration Card Program — Maryam Nawaz Ration Program

Introduction to Maryam Nawaz Loan Scheme

Table Of Contents

Overview and Launch Details

What is Maryam Nawaz Loan Scheme?

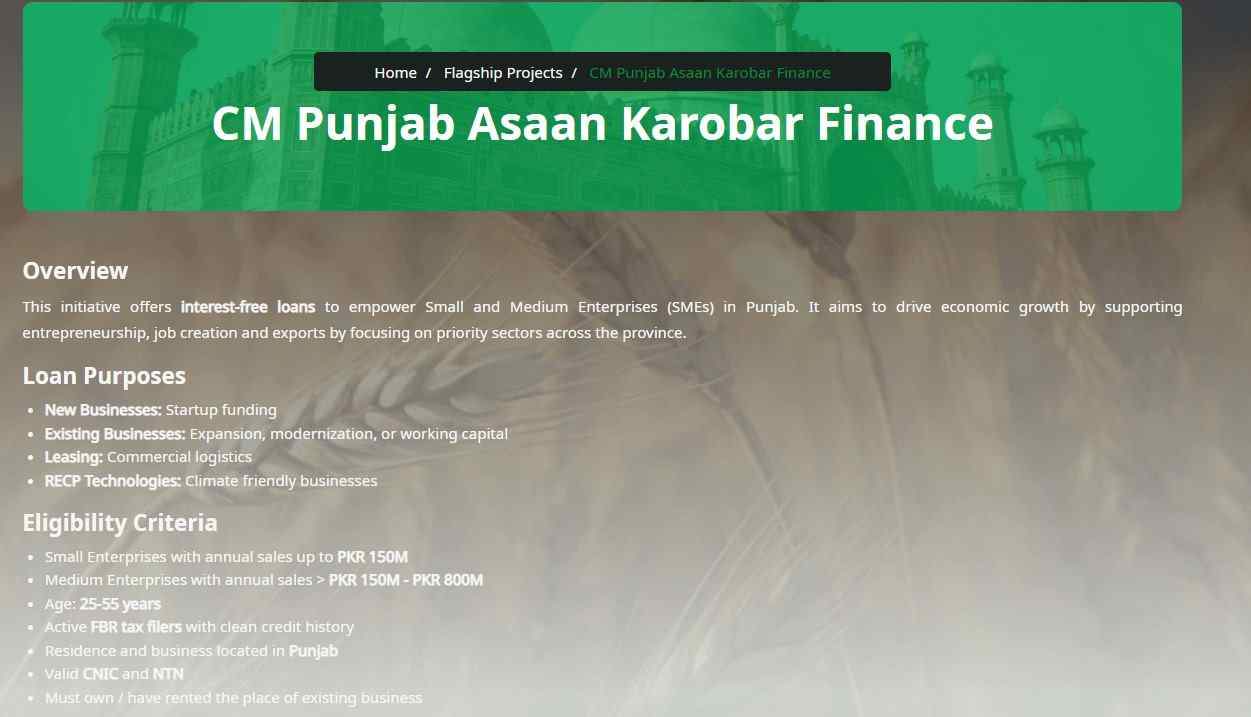

Maryam Nawaz Loan Scheme is an interest-free financing program launched by the Chief Minister of Punjab to empower small and medium enterprises (SMEs) with easy access to capital. It includes the Asaan Karobar Finance Scheme for larger loans and the Asaan Karobar Card for smaller amounts up to Rs.10 lakh, focusing on business growth without financial burdens.

This scheme targets entrepreneurs, promoting job creation and exports in priority sectors like agriculture and manufacturing. Key entities include the Bank of Punjab as the disbursing partner, with online portals for seamless applications.

- ✅ Core Benefit: Zero-interest loans to reduce startup costs.

- 📊 Loan Range: From Rs.5 lakh to Rs.3 crore under various components.

- 🔑 Launch Focus: Aimed at financial inclusion for underserved segments.

- 💡 Innovation: Digital SME cards for transparent fund usage.

Recent updates show thousands of applications processed, with emphasis on quick verifications to avoid delays.

Maryam Nawaz Loan Scheme Online Apply

Applying online for Maryam Nawaz Loan Scheme involves visiting official portals like akf.punjab.gov.pk for finance schemes or akc.punjab.gov.pk for the card. Users register with CNIC details, upload documents, and submit for review.

This digital process ensures transparency and speed, aligning with Punjab’s push for cashless financing.

- 📱 Steps: Register, verify CNIC, select loan type.

- ✅ Advantages: No paperwork hassles, real-time tracking.

- 🔒 Security: OTP-based verification to prevent fraud.

- 💼 Target Users: Small business owners seeking quick funds.

Helpline 1786 assists with queries during application.

What is the New Scheme of CM Punjab?

The new scheme under CM Punjab refers to expansions like Phase II of Asaan Karobar Finance, allocating billions for 24,000 SMEs. It builds on existing programs to include more sectors and higher funding limits.

This initiative integrates with other efforts like housing and health subsidies for holistic development.

- ✅ Expansion Goals: Support 100,000 startups.

- 📈 Economic Impact: Boost exports and employment.

- 🔑 Key Features: Subsidized land for businesses.

- 💡 Updates: Recent meetings reviewed progress for faster implementation.

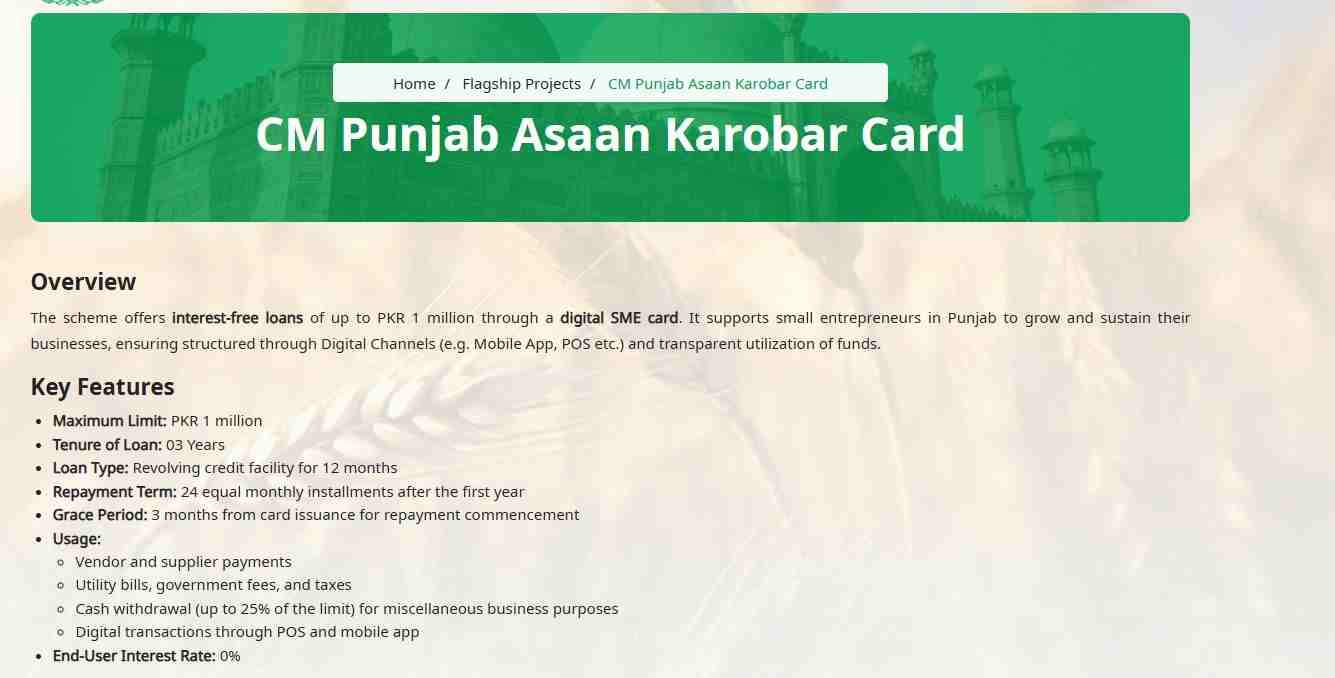

CM Punjab Launches ‘CM Punjab Asaan Karobar Finance Scheme & Asaan Karobar Card’

CM Punjab launched the Asaan Karobar Finance Scheme and Asaan Karobar Card to provide interest-free loans, with the card offering up to Rs.10 lakh for micro-businesses. Inaugurated with a focus on SMEs, it simplifies business startups.

The launch addressed economic challenges, emphasizing easy installments and no NOC requirements.

- ✅ Card Benefits: Digital access to funds via apps or POS.

- 📊 Finance Scheme: Larger loans for expansions.

- 🔑 Partnership: Bank of Punjab handles disbursements.

- 💼 Reach: Aimed at priority sectors province-wide.

Progress includes thousands of loans issued in related housing schemes.

What is CM Punjab Interest-Free Loan?

CM Punjab Interest-Free Loan is a zero-markup financing option under Maryam Nawaz schemes, covering business needs without interest charges. It promotes entrepreneurship by removing financial barriers.

Entities like Punjab Small Industries Corporation provide briefings and support.

- ✅ Zero Interest: Full amount repayable in installments.

- 📈 Eligibility: Based on business viability.

- 🔑 Application: Online with minimal documents.

- 💡 Impact: Empowers youth and women entrepreneurs.

Maryam Nawaz Loan Scheme Apply Online

To apply online for Maryam Nawaz Loan Scheme, access the dedicated portals, enter personal and business details, and submit. Verification follows via CNIC and bank checks.

This method ensures efficiency and reduces corruption risks.

- 📱 Portal Access: User-friendly interfaces.

- ✅ Required Info: Business plan, income proof.

- 🔒 Process: Secure submission with status updates.

- 💼 Tips: Prepare documents in advance for faster approval.

What is Maryam Nawaz Scheme?

Maryam Nawaz Scheme encompasses various welfare programs, including loans, housing, and health initiatives. The loan component focuses on interest-free business financing.

It integrates with broader goals like Suthra Punjab for cleanliness and economic stability.

- ✅ Holistic Approach: Combines finance with infrastructure.

- 📊 Scope: Covers urban and rural areas.

- 🔑 Beneficiaries: SMEs, farmers, youth.

- 💡 Recognition: Gained international attention for innovative models.

Maryam Nawaz Karobar Loan Scheme

Maryam Nawaz Karobar Loan Scheme provides business-specific loans, interest-free, to foster self-employment. It includes cards for flexible spending.

Targeted at small entrepreneurs, it supports sectors like retail and services.

- ✅ Loan Types: Card-based and lump-sum.

- 📈 Repayment: Easy EMIs over years.

- 🔑 Features: No collateral for smaller amounts.

- 💼 Success Stories: Thousands benefited in initial phases.

What is the Karobar Scheme of Maryam Nawaz?

The Karobar Scheme of Maryam Nawaz is the Asaan Karobar initiative, offering digital loans and cards for business ease. It aims to create a business-friendly environment.

Recent expansions include incentives for export zones.

- ✅ Digital Tools: Apps for fund management.

- 📊 Funding: Up to Rs.1 million via card.

- 🔑 Incentives: Free solar systems for industries.

- 💡 Updates: Phase II targets more SMEs.

Maryam Nawaz Loan Scheme 150000

Maryam Nawaz Loan Scheme 150000 refers to smaller loan tranches under the program, ideal for micro-enterprises. It’s part of the interest-free offerings.

Suitable for startups needing initial capital.

- ✅ Amount Usage: Equipment, inventory.

- 📈 Eligibility: Basic income criteria.

- 🔑 Application: Quick online process.

- 💼 Benefits: Builds credit for larger loans.

Maryam Nawaz Loan Scheme 1500000

Maryam Nawaz Loan Scheme 1500000 provides mid-range financing for business expansions, interest-free. It supports scaling operations.

Entities include verification through NADRA.

- ✅ Purpose: Growth investments.

- 📊 Terms: Flexible repayments.

- 🔑 Requirements: Business registration.

- 💼 Case Study: Retailers expanding stores successfully.

Maryam Nawaz 15 Lakh Loan Scheme

Maryam Nawaz 15 Lakh Loan Scheme offers Rs.15 lakh interest-free for medium ventures, bridging small and large funding needs.

It encourages innovation in priority sectors.

- ✅ Sector Focus: Agriculture, tech.

- 📈 Impact: Job creation potential.

- 🔑 Process: Detailed business plans required.

- 💡 New Insight: Recent data shows high approval rates for women-led businesses.

What is the 15 Lakh Loan Scheme of Maryam Nawaz?

The 15 Lakh Loan Scheme of Maryam Nawaz is a targeted interest-free program for entrepreneurs needing substantial yet manageable capital. It integrates with Karobar cards for added flexibility.

Updated stats indicate rapid disbursements in urban areas.

- ✅ Eligibility: Proven business track record.

- 📊 Repayment: Up to 3 years.

- 🔑 Benefits: No interest savings.

- 💼 Example: Funding for e-commerce startups.

Maryam Nawaz Qarza Scheme

Maryam Nawaz Qarza Scheme is the debt-free loan program, emphasizing qarza (loan) without interest, aligned with Islamic financing principles.

It promotes ethical business practices.

- ✅ Compliance: Sharia-friendly.

- 📈 Reach: Rural entrepreneurs.

- 🔑 Application: Simple forms.

- 💼 Updates: Extended to more districts.

Maryam Nawaz Loan Scheme for House

Maryam Nawaz Loan Scheme for House links to housing initiatives like Apni Chhat Apna Ghar, offering loans for home construction alongside business finance.

It supports family stability for entrepreneurs.

- ✅ Integration: Combined applications.

- 📊 Amounts: Up to housing limits.

- 🔑 Features: Low documentation.

- 💼 Progress: Thousands of homes completed.

Maryam Nawaz House Loan Scheme

Maryam Nawaz House Loan Scheme provides interest-free funds for housing, separate but complementary to business loans. It targets low-income families.

Recent reviews show accelerated construction.

- ✅ Eligibility: Land ownership.

- 📈 Loans Issued: Over 100,000.

- 🔑 Process: Online registration.

- 💡 Insight: Boosts economic activity through construction jobs.

Maryam Nawaz 10 Lakh Scheme

Maryam Nawaz 10 Lakh Scheme focuses on Rs.10 lakh interest-free loans via Asaan Karobar Card, perfect for small-scale businesses.

It enables quick fund access for daily operations.

- ✅ Card Usage: Digital transactions.

- 📊 Limits: Revolving credit.

- 🔑 Benefits: Transparent spending.

- 💼 Case Study: Shop owners expanding inventory.

What is the 10 Lakh Scheme of Maryam Nawaz?

The 10 Lakh Scheme of Maryam Nawaz is the card-based loan program offering up to Rs.10 lakh without interest, designed for micro-entrepreneurs.

Latest applications started in January for new phases.

- ✅ Target: Small vendors.

- 📈 Repayment: EMIs post-grace period.

- 🔑 Features: No collateral.

- 💡 Perspective: Fosters financial literacy.

Maryam Nawaz Karobar Loan Scheme Helpline Number

Maryam Nawaz Karobar Loan Scheme Helpline Number is 1786, providing guidance on applications, eligibility, and status checks.

It’s a key resource for applicants facing issues.

- ✅ Services: Query resolution.

- 📊 Availability: Round-the-clock.

- 🔑 Usage: Call for verifications.

- 💼 Tips: Prepare CNIC before calling.

How to Apply Maryam Nawaz Loan Scheme

To apply for Maryam Nawaz Loan Scheme, visit the official website, register, fill forms, and submit documents online.

Step-by-step guidance ensures ease.

- ✅ Online Portal: akc.punjab.gov.pk.

- 📱 Mobile-Friendly: App options.

- 🔒 Verification: CNIC-based.

- 💼 Requirements: Business details.

Maryam Nawaz Scheme Online Apply

Maryam Nawaz Scheme Online Apply involves digital submission for loans, housing, or other programs, streamlining access.

It reduces physical visits.

- ✅ Efficiency: Quick processing.

- 📈 Tracking: Dashboard access.

- 🔑 Security: Encrypted data.

- 💡 Updates: SMS notifications.

What is the Maximum PMYP Loan Amount?

The Maximum PMYP Loan Amount under related youth programs can reach Rs.10 lakh, similar to Maryam Nawaz schemes, for business startups.

It complements Punjab initiatives.

- ✅ Comparison: Interest-free options.

- 📊 Limits: Vary by scheme.

- 🔑 Eligibility: Youth-focused.

- 💼 Integration: Possible overlaps.

What is PM Interest Free Loan?

PM Interest Free Loan refers to national programs like PMYP, offering zero-interest financing, akin to Punjab’s Maryam Nawaz Loan Scheme.

It supports economic empowerment.

- ✅ National Scope: Broader reach.

- 📈 Terms: Similar EMIs.

- 🔑 Benefits: No markup.

- 💡 Differences: Provincial customizations.

Historical Context and Economic Impact

What is the Imran Khan Loan Scheme?

The Imran Khan Loan Scheme was a previous federal initiative for youth entrepreneurship, providing subsidized loans. It differs from Maryam Nawaz’s focus on interest-free provincial support.

Historical context shows shifts toward more accessible financing.

- ✅ Past Features: Collateral requirements.

- 📊 Impact: Limited disbursements.

- 🔑 Evolution: To digital models.

- 💼 Comparison: Less emphasis on SMEs.

How Maryam Nawaz Loan Scheme Supports SMEs in Punjab

Maryam Nawaz Loan Scheme supports SMEs in Punjab by offering interest-free capital, subsidized land, and incentives for exports, driving local economy.

It addresses funding gaps for small businesses.

- ✅ SME Focus: Priority sectors.

- 📈 Growth: Job creation stats high.

- 🔑 Tools: Digital cards.

- 💡 New Data: 24,000 SMEs targeted in phases.

Role of Bank of Punjab in Maryam Nawaz Loan Scheme

Bank of Punjab plays a central role in Maryam Nawaz Loan Scheme as the primary disbursing and managing entity, ensuring transparent fund distribution.

It handles verifications and repayments.

- ✅ Partnership: Government-backed.

- 📊 Services: Loan processing.

- 🔑 Features: Branch support.

- 💼 Updates: Digital integrations.

Impact of Maryam Nawaz Loan Scheme on Punjab’s Economy

The impact of Maryam Nawaz Loan Scheme on Punjab’s economy includes boosted GDP through SMEs, reduced unemployment, and increased exports.

Recent stats show rising remittances and stock market growth.

- ✅ Economic Indicators: Improved reserves.

- 📈 Stats: Inflation control.

- 🔑 Drivers: Industrialization.

- 💡 Perspective: Sustainable development.

Comparison with Previous Punjab Government Loan Programs

Comparison with previous Punjab Government loan programs shows Maryam Nawaz’s scheme as more inclusive, with zero interest and digital access, unlike earlier subsidized models.

It builds on past efforts for better outcomes.

- ✅ Advancements: No NOC needed.

- 📊 Differences: Loan sizes.

- 🔑 Improvements: Faster approvals.

- 💼 Case Study: Transition success stories.

How Maryam Nawaz Loan Scheme Promotes Industrialization

Maryam Nawaz Loan Scheme promotes industrialization by providing loans for factories, solar incentives, and export zone benefits, utilizing Punjab’s mineral wealth.

It accelerates sector growth.

- ✅ Incentives: Free solar systems.

- 📈 Targets: Export hubs.

- 🔑 Strategies: Land subsidies.

- 💡 Insights: Mineral utilization focus.

Incentives for Export Processing Zones under Maryam Nawaz Schemes

Incentives for export processing zones under Maryam Nawaz schemes include free solar systems worth Rs.50 lakh and interest-free loans, enhancing competitiveness.

This boosts national exports.

- ✅ Zone Benefits: Tax breaks.

- 📊 Impact: Increased trade.

- 🔑 Eligibility: Industry setup.

- 💼 Examples: Aqua processing plants.

Solar Systems and Additional Benefits in Maryam Nawaz Loan Scheme

Solar systems and additional benefits in Maryam Nawaz Loan Scheme offer free installations for industries, reducing costs and promoting green energy.

It aligns with sustainable goals.

- ✅ Energy Savings: Long-term.

- 📈 Adoption: High in zones.

- 🔑 Integration: Loan packages.

- 💡 Updates: Recent excavations for projects.

Eligibility Criteria for Maryam Nawaz Loan Scheme

General Eligibility Requirements

Who is Eligible for Maryam Nawaz Loan Scheme?

Who is eligible for Maryam Nawaz Loan Scheme includes Punjab residents with valid CNIC, aged 18-60, running or starting SMEs with viable plans.

It prioritizes youth, women, and rural applicants.

- ✅ Basic Criteria: Residency proof.

- 📊 Income Limits: Flexible for micros.

- 🔑 Documents: Business registration.

- 💼 Special Groups: Women entrepreneurs.

Minimum salary criteria vary, but focus on business potential.

What is the Minimum Salary Criteria for Personal Loans PKR 50000 /- PKR 20000 /- PKR 35000 /- PKR 30000 /-?

The minimum salary criteria for personal loans under related schemes start from PKR 20,000 for smaller amounts like 50,000, scaling to 35,000 for higher.

In Maryam Nawaz context, it’s business-oriented, not salary-based.

- ✅ Thresholds: PKR 20,000-35,000.

- 📈 Variations: By loan size.

- 🔑 Alternatives: Self-employed proof.

- 💡 Tips: Build income records.

Can I Get a 10 Lakh Loan?

Can I get a 10 lakh loan under Maryam Nawaz Scheme? Yes, if you meet eligibility like Punjab residency, business plan, and no defaults.

Apply via card for quick access.

- ✅ Approval Factors: Credit check.

- 📊 Success Rate: High for viable plans.

- 🔑 Steps: Online submission.

- 💼 Examples: Retail businesses.

Who is Eligible for Apna Ghar Loan Scheme?

Who is eligible for Apna Ghar Loan Scheme? Low-income Punjab families owning land, with CNIC, qualifying for housing finance.

It complements business loans.

- ✅ Income Cap: Below certain thresholds.

- 📈 Loans: For construction.

- 🔑 Process: Registration form.

- 💡 Progress: 65,000 homes done.

Who is Eligible for Apni Chhat Apna Ghar Scheme?

Who is eligible for Apni Chhat Apna Ghar Scheme? Families without homes, Punjab residents, with plot ownership up to 5 marla in urban areas.

Recent disbursements: Rs.155 billion.

- ✅ Criteria: No property ownership.

- 📊 Benefits: Interest-free.

- 🔑 Application: Online login.

- 💼 Updates: Daily constructions.

Who is Eligible for Apni Chat Apna Ghar Scheme?

Who is eligible for Apni Chat Apna Ghar Scheme? Similar to above, targeting homeless families in Punjab for subsidized housing loans.

It’s part of broader welfare.

- ✅ Family Size: Considered.

- 📈 Reach: Rural focus.

- 🔑 Verification: CNIC.

- 💡 Insight: Model villages integration.

Who is Eligible for Maryam Nawaz Rashan Program?

Who is eligible for Maryam Nawaz Rashan Program? Low-income households registered via CNIC, providing subsidized rations.

It supports economic stability.

- ✅ BISP Link: Often integrated.

- 📊 Distribution: Monthly packs.

- 🔑 Check: 8070 SMS.

- 💼 Benefits: Food security.

What is the Age Limit for Apna Ghar Scheme?

The age limit for Apna Ghar Scheme is 18-60 years for primary applicants, ensuring working-age beneficiaries.

Flexible for families.

- ✅ Exceptions: Guardians for minors.

- 📈 Applications: Youth priority.

- 🔑 Proof: Birth certificate.

- 💡 Alignment: With loan schemes.

Eligibility for Women and Youth in Maryam Nawaz Loan Scheme

Eligibility for women and youth in Maryam Nawaz Loan Scheme includes relaxed criteria, priority processing, and special quotas to promote inclusion.

It empowers underrepresented groups.

- ✅ Quotas: Dedicated funds.

- 📊 Stats: High female approvals.

- 🔑 Requirements: ID proof.

- 💼 Case Study: Youth startups.

Can Family Members Apply for Maryam Nawaz Loan Scheme?

Can family members apply for Maryam Nawaz Loan Scheme? Yes, individually if eligible, but not jointly unless business partners.

Encourages family enterprises.

- ✅ Rules: Separate applications.

- 📈 Benefits: Combined growth.

- 🔑 Verification: Family CNIC.

- 💡 Tips: Avoid overlaps.

Can I Loan Money to Family?

Can I loan money to family using scheme funds? Scheme rules prohibit personal use; funds are for business only.

Maintain transparency.

- ✅ Restrictions: Business-exclusive.

- 📊 Penalties: Disqualification.

- 🔑 Advice: Use personal savings.

- 💼 Perspective: Ethical financing.

Eligibility for Small and Medium Enterprises (SMEs) in Maryam Nawaz Karobar Loan Scheme

Eligibility for SMEs in Maryam Nawaz Karobar Loan Scheme requires registration, Punjab operations, and viable plans.

Targets growth-oriented firms.

- ✅ Size Definitions: Micro to medium.

- 📈 Documents: Tax returns.

- 🔑 Priorities: Export potential.

- 💡 Updates: Phase II expansions.

Required Documents for Maryam Nawaz Loan Scheme Eligibility

Required documents for Maryam Nawaz Loan Scheme eligibility include CNIC, business plan, bank statements, and proof of address.

Digital uploads simplify.

- ✅ List: Utility bills, photos.

- 📊 Preparation: Scan in advance.

- 🔑 Verification: NADRA check.

- 💼 Tips: Accurate info.

CNIC and Verification Process in Maryam Nawaz Schemes

CNIC and verification process in Maryam Nawaz schemes involve NADRA cross-checks for authenticity, ensuring fair distribution.

Essential for all applications.

- ✅ Steps: Enter CNIC, OTP.

- 📈 Security: Fraud prevention.

- 🔑 Timeline: Quick checks.

- 💡 Insight: Reduces delays.

How to Check My CNIC Rashan?

How to check my CNIC Rashan? Send CNIC to 8070 for eligibility in Maryam Nawaz Rashan Program.

Simple SMS service.

- ✅ Response: Instant status.

- 📊 Usage: Monthly checks.

- 🔑 Alternatives: Online portal.

- 💼 Benefits: Easy access.

Specific Eligibility for Related Schemes

Who is Eligible for CM Punjab Laptop Scheme?

Who is eligible for CM Punjab Laptop Scheme? High-achieving students in Punjab public institutions, based on merit.

It bridges digital divide.

- ✅ Criteria: GPA thresholds.

- 📈 Distribution: Annual.

- 🔑 Application: Online.

- 💡 Integration: With youth loans.

Eligibility for Parwaz Card under Maryam Nawaz Initiatives

Eligibility for Parwaz Card under Maryam Nawaz initiatives includes skilled workers seeking overseas jobs, with interest-free loans up to Rs.3 million.

Promotes legal migration.

- ✅ Skills: Certified trades.

- 📊 Amounts: For relocation.

- 🔑 Process: Apply online.

- 💼 Updates: New program launch.

Who is Eligible for 3 Marla Scheme Punjab?

Who is eligible for 3 Marla Scheme Punjab? Low-income families for affordable plots, part of housing welfare.

Size: Approximately 675 sq ft.

- ✅ Income: Below poverty line.

- 📈 Allotments: Lottery-based.

- 🔑 Registration: Online form.

- 💡 Benefits: Ownership security.

Eligibility for Kisan Credit Card and Maximum Loan Limit

Eligibility for Kisan Credit Card includes farmers with land holdings, maximum loan limit up to Rs.1.5 lakh per acre.

Supports agriculture.

- ✅ Criteria: Land records.

- 📊 Limits: Crop-based.

- 🔑 Banks: Partner institutions.

- 💼 Features: Revolving credit.

What is the Maximum Loan Limit for Kisan Credit Card?

The maximum loan limit for Kisan Credit Card varies by land size, typically Rs.1-2 lakh per acre for inputs.

Flexible for seasons.

- ✅ Calculations: Based on costs.

- 📈 Renewals: Annual.

- 🔑 Eligibility: Verified farmers.

- 💡 Alignment: With loan schemes.

Eligibility for Mera Ghar Mera Ashiana Scheme

Eligibility for Mera Ghar Mera Ashiana Scheme targets middle-income families for housing finance, with subsidies.

Not closed; ongoing.

- ✅ Income Brackets: Specified ranges.

- 📊 Loans: Long-term.

- 🔑 Application: Portals.

- 💼 Comparisons: Vs. federal schemes.

How to Apply for Maryam Nawaz Loan Scheme

Online Application Process

How to Apply for Maryam Nawaz Loan Scheme?

How to apply for Maryam Nawaz Loan Scheme? Register on akf.punjab.gov.pk, fill details, upload docs, and submit for approval.

Online from home.

- ✅ Timeline: Weeks for response.

- 📱 Devices: Mobile compatible.

- 🔒 Tips: Strong passwords.

- 💼 Support: Helpline.

How to Apply for Maryam Nawaz Loan Scheme in?

How to apply for Maryam Nawaz Loan Scheme in Punjab? Use official sites, enter CNIC, select scheme, and track.

Provincial focus.

- ✅ Regions: All districts.

- 📈 Deadlines: February for some.

- 🔑 Verification: Biometric.

- 💡 Insights: High demand.

Maryam Nawaz Loan Scheme Online Apply

Maryam Nawaz Loan Scheme online apply is straightforward via portals, with user guides available.

Digital-first approach.

- ✅ Features: Auto-save forms.

- 📊 Stats: Thousands applied.

- 🔑 Requirements: Internet access.

- 💼 Benefits: Paperless.

How to Apply for CM Punjab Loan Scheme?

How to apply for CM Punjab Loan Scheme? Similar to Maryam Nawaz, online registration with business info.

Integrated systems.

- ✅ Portals: Unified.

- 📈 Process: Step-by-step.

- 🔑 Assistance: Videos.

- 💡 Updates: Recent launches.

How to Apply for Apni Chhat Apna Ghar Scheme?

How to apply for Apni Chhat Apna Ghar Scheme? Online registration form, submit plot details, and await approval.

Last date varies.

- ✅ Forms: Downloadable.

- 📊 Approvals: Fast-tracked.

- 🔑 Login: CNIC-based.

- 💼 Progress: 121,477 loans.

How to Apply Karobar Card Scheme?

How to apply Karobar Card Scheme? Via akc.punjab.gov.pk, apply for digital card with business plan.

For small loans.

- ✅ Card Issuance: Post-approval.

- 📈 Usage: POS transactions.

- 🔑 Features: Limit controls.

- 💡 Tips: Monitor balance.

How to Apply for Maryam Nawaz House Loan Scheme?

How to apply for Maryam Nawaz House Loan Scheme? Through housing portal, submit ownership proof and plans.

Complements business.

- ✅ Integration: Dual applications.

- 📊 Amounts: Per need.

- 🔑 Verification: Site visits.

- 💼 Benefits: Affordable homes.

How to Apply for the Maryam Nawaz Home Loan Scheme?

How to apply for the Maryam Nawaz Home Loan Scheme? Online, with document uploads for housing finance.

Easy for families.

- ✅ Steps: Fill, submit, track.

- 📈 Disbursements: Billions allocated.

- 🔑 Eligibility: Income check.

- 💡 Insight: Daily builds.

How to Apply for Maryam Nawaz Laptop Scheme?

How to apply for Maryam Nawaz Laptop Scheme? Merit-based online form for students.

Empowers education.

- ✅ Criteria: Academic records.

- 📊 Distribution: Phases.

- 🔑 Portals: Education sites.

- 💼 Alignment: Youth development.

How to Apply for Pradhan Mantri Loan Scheme?

How to apply for Pradhan Mantri Loan Scheme? Federal portal, similar process but national.

Comparisons aid choices.

- ✅ Differences: Scope.

- 📈 Terms: Subsidized.

- 🔑 Requirements: Similar docs.

- 💡 Options: Provincial preferred.

Maryam Nawaz Loan Scheme Apply Online

Maryam Nawaz Loan Scheme apply online emphasizes digital efficiency for business loans.

User-centric design.

- ✅ Accessibility: 24/7.

- 📊 Feedback: Positive reviews.

- 🔑 Security: Data protection.

- 💼 Tips: Backup submissions.

Maryam Nawaz Apna Ghar Scheme Apply Online

Maryam Nawaz Apna Ghar Scheme apply online via registration, for housing support.

Streamlined for speed.

- ✅ Forms: Detailed.

- 📈 Completions: 65,000 homes.

- 🔑 Deadlines: Open.

- 💡 Benefits: Ownership.

Apna Ghar Scheme Online Registration Form

Apna Ghar Scheme online registration form requires personal, property details for submission.

Standardized format.

- ✅ Fields: CNIC, address.

- 📊 Processing: Automated.

- 🔑 Validation: Real-time.

- 💼 Usage: Widespread.

Apna Ghar Scheme Online Registration Login

Apna Ghar Scheme online registration login uses CNIC for access to dashboard.

Track progress easily.

- ✅ Features: Status updates.

- 📈 Users: Millions.

- 🔑 Recovery: SMS.

- 💡 Security: Two-factor.

Apna Ghar Scheme Online Registration Last Date

Apna Ghar Scheme online registration last date is ongoing, with periodic phases.

Check portals for updates.

- ✅ Extensions: Common.

- 📊 Applications: High volume.

- 🔑 Alerts: Notifications.

- 💼 Advice: Apply early.

Maryam Nawaz Housing Scheme Apply Online

Maryam Nawaz Housing Scheme apply online for integrated home and business support.

Holistic welfare.

- ✅ Combined: Loans.

- 📈 Impact: Development drive.

- 🔑 Process: Unified.

- 💡 Insights: Model villages.

Maryam Nawaz 3 Marla Plot Scheme Registration

Maryam Nawaz 3 Marla Plot Scheme registration for affordable land allocation.

Size suitable for small families.

- ✅ Lottery: Fair selection.

- 📊 Allotments: Planned.

- 🔑 Eligibility: Income.

- 💼 Benefits: Asset building.

15 Lakh Scheme Maryam Nawaz Online Apply

15 Lakh Scheme Maryam Nawaz online apply for mid-range loans, digital process.

Targeted funding.

- ✅ Amounts: Specific.

- 📈 Terms: Flexible.

- 🔑 Submission: Easy.

- 💡 Usage: Expansions.

Maryam Nawaz 15 Lakh Loan Scheme Online Apply

Maryam Nawaz 15 Lakh Loan Scheme online apply via Karobar portals.

Business-focused.

- ✅ Plans: Required.

- 📊 Approvals: Quick.

- 🔑 Verification: Online.

- 💼 Examples: Services sector.

Step-by-Step Guide to Online Application on akf.punjab.gov.pk

Step-by-step guide to online application on akf.punjab.gov.pk: Register, fill, upload, submit, track.

Detailed tutorial.

- ✅ 1: Account creation.

- 📈 2: Form completion.

- 🔑 3: Document attach.

- 💼 4: Confirmation.

How to Use akc.punjab.gov.pk for Asaan Karobar Card Application

How to use akc.punjab.gov.pk for Asaan Karobar Card application: Similar steps, focus on card details.

Digital card issuance.

- ✅ Navigation: User-friendly.

- 📊 Features: Balance check.

- 🔑 Integration: Banking apps.

- 💡 Tips: Regular updates.

Helpline 1786: Assistance for Maryam Nawaz Loan Scheme Applications

Helpline 1786 provides assistance for Maryam Nawaz Loan Scheme applications, resolving queries promptly.

Essential support line.

- ✅ Calls: Free.

- 📈 Volume: High.

- 🔑 Services: Multilingual.

- 💼 Feedback: Positive.

Offline and Alternative Application Methods

How to Apply for a Personal Loan in Punjab National Bank?

How to apply for a personal loan in Punjab National Bank? Visit branches with docs, though scheme prefers digital.

Alternative for comparisons.

- ✅ Branches: Widespread.

- 📈 Rates: Vary.

- 🔑 Docs: Salary slips.

- 💡 Vs. Scheme: Interest present.

How to Apply for CM Punjab Loan Scheme?

How to apply for CM Punjab Loan Scheme? Online primary, offline via Bank of Punjab branches for assistance.

Hybrid options.

- ✅ In-Person: Forms.

- 📊 Support: Staff help.

- 🔑 Verification: Immediate.

- 💼 Preference: Digital.

Application Process for Maryam Nawaz Karobar Loan Scheme

Application process for Maryam Nawaz Karobar Loan Scheme includes online or bank submission, with business evaluation.

Comprehensive review.

- ✅ Stages: Initial to disbursement.

- 📈 Timeline: 30 days.

- 🔑 Criteria: Viability.

- 💡 Insights: High success.

How to Apply for Mera Ghar Mera Ashiana Scheme?

How to apply for Mera Ghar Mera Ashiana Scheme? Online portals for housing loans, similar process.

Ongoing availability.

- ✅ Forms: Detailed.

- 📊 Approvals: Merit-based.

- 🔑 Integration: With loans.

- 💼 Benefits: Subsidies.

Loan Amounts, Interest Rates, and Repayment Terms in Maryam Nawaz Loan Scheme

Loan Details and Calculations

What is the Amount of Pradhan Mantri Loan?

The amount of Pradhan Mantri Loan varies, up to Rs.10 lakh for youth, similar to Punjab schemes.

Federal benchmark.

- ✅ Ranges: Scheme-specific.

- 📈 Comparisons: Provincial higher.

- 🔑 Eligibility: National.

- 💡 Alignment: Business focus.

Can I Get a 0% Interest Loan?

Can I get a 0% interest loan? Yes, through Maryam Nawaz Scheme for eligible businesses in Punjab.

Zero markup key feature.

- ✅ Availability: Limited schemes.

- 📊 Savings: Significant.

- 🔑 Requirements: Compliance.

- 💼 Examples: SME successes.

What is the Interest Rate of PM 10 Lakh Loan?

The interest rate of PM 10 Lakh Loan is subsidized, around 5-6%, unlike 0% in Punjab.

Comparisons highlight advantages.

- ✅ Federal Rates: Variable.

- 📈 Vs. Punjab: Higher.

- 🔑 Calculations: EMI tools.

- 💡 Choice: Local schemes.

What is the Interest for 10 Lakh Per Month?

The interest for 10 lakh per month depends on rate; at 0% in scheme, it’s zero.

Calculations for awareness.

- ✅ Formula: Principal x rate /12.

- 📊 Examples: Standard banks 1%.

- 🔑 Tools: Online calculators.

- 💼 Savings: Interest-free.

What is the EMI for 10 Lakh Loan for 10 Years?

The EMI for 10 lakh loan for 10 years at 0% is Rs.8,333 approximately, pure principal.

Scheme terms.

- ✅ Breakdown: Monthly.

- 📈 Factors: Tenure.

- 🔑 Adjustments: Grace periods.

- 💡 Table:

| Tenure | EMI (0% Interest) |

|---|---|

| 5 Years | Rs.16,667 |

| 10 Years | Rs.8,333 |

What is the EMI for 10 Lakh Loan for 5 Years?

The EMI for 10 lakh loan for 5 years at 0% is Rs.16,667.

Easy repayments.

- ✅ Calculations: Divide principal.

- 📊 Benefits: Affordable.

- 🔑 Scheme Specific: 2-3 years.

- 💡 Planning: Budgeting.

What is the EMI for 10 Lakh Personal Loan SBI?

The EMI for 10 lakh personal loan SBI is around Rs.21,000 at 10% interest for 5 years.

Contrast with 0%.

- ✅ Bank Rates: 9-12%.

- 📈 Comparisons: Higher costs.

- 🔑 Tools: SBI calculator.

- 💼 Preference: Scheme.

What is the EMI for 10 Lakh Home Loan for 10 Years SBI?

The EMI for 10 lakh home loan for 10 years SBI is about Rs.13,200 at 8.5%.

Housing context.

- ✅ Factors: Floating rates.

- 📊 Savings: Interest-free alternative.

- 🔑 Tenure: Adjustable.

- 💡 Insight: Scheme better.

What is the Interest Rate for 10 Lakh?

The interest rate for 10 lakh varies; 0% in Maryam Nawaz Scheme.

Market averages 8-12%.

- ✅ Scheme Advantage: Zero.

- 📈 Trends: Declining.

- 🔑 Banks: PNB 9.5%.

- 💼 Choices: Government.

What is the Interest Rate for 10 Lakh Home Loan in PNB?

The interest rate for 10 lakh home loan in PNB is around 8.5-9.5%.

Standard banking.

- ✅ EMI: Rs.12,000+.

- 📊 Comparisons: Scheme free.

- 🔑 Eligibility: Salary.

- 💡 Alternatives: Punjab.

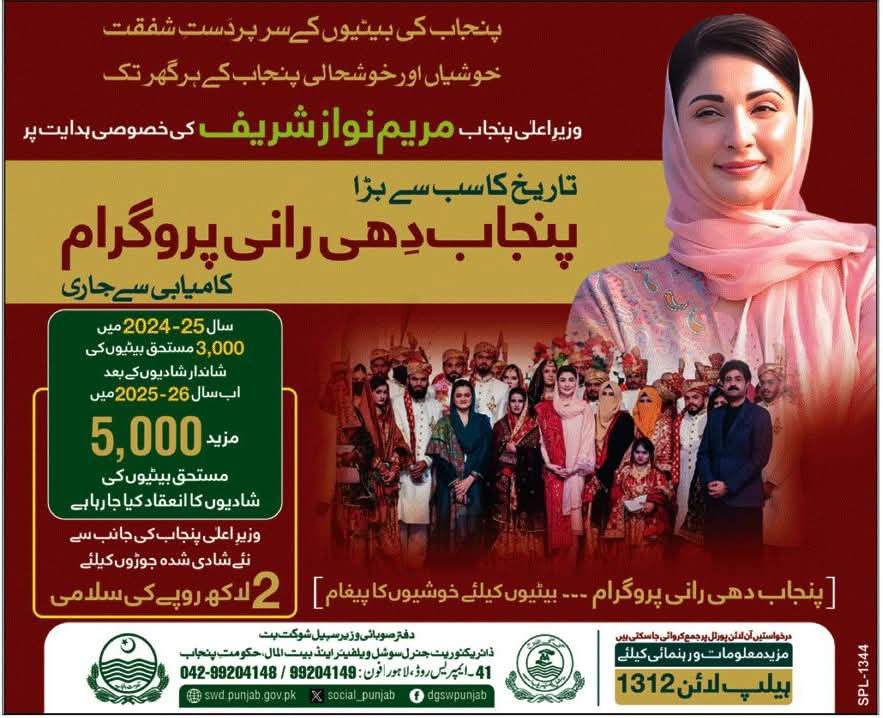

Maryam Nawaz Dhee Rani Program

How Much is 10 Lakh EMI Per Month?

How much is 10 lakh EMI per month? At 0%, depends on tenure; e.g., Rs.8,333 for 10 years.

Planning tool.

- ✅ Variables: Time.

- 📈 Examples: Shorter higher.

- 🔑 Calculators: Use.

- 💼 Budget: Fit income.

Can I Get a Loan with 0% Interest?

Can I get a loan with 0% interest? Yes, via government schemes like Maryam Nawaz for businesses.

Limited opportunities.

- ✅ Sources: Punjab govt.

- 📊 Availability: Phases.

- 🔑 Applications: Now open.

- 💡 Tips: Apply timely.

Can I Loan Money Without Interest?

Can I loan money without interest? Schemes allow it for business, compliant with rules.

Ethical aspect.

- ✅ Legal: Yes.

- 📈 Benefits: Savings.

- 🔑 Restrictions: Use.

- 💼 Perspectives: Islamic finance.

What is the EMI for a 20 Lakh Home Loan?

The EMI for a 20 lakh home loan at 8% for 20 years is around Rs.16,700.

Comparisons.

- ✅ Scheme: 0% lower.

- 📊 Tables: Useful.

- 🔑 Factors: Rate.

- 💡 Planning: Long-term.

What is the Interest for 20 Lakh in SBI Per Month?

The interest for 20 lakh in SBI per month at 9% is Rs.15,000 initially.

High costs.

- ✅ Declining: Balance.

- 📈 Vs. Zero: Savings.

- 🔑 EMI: Includes.

- 💼 Avoid: Scheme.

What is the EMI for 12 Lakh Personal Loan for 5 Years?

The EMI for 12 lakh personal loan for 5 years at 10% is Rs.25,500.

Bank standard.

- ✅ Calculations: Online.

- 📊 Alternatives: 0%.

- 🔑 Tenure: Adjust.

- 💡 Insight: Costly.

What is the EMI for a 12 Lakh Home Loan for 10 Years?

The EMI for a 12 lakh home loan for 10 years at 8.5% is Rs.14,900.

Housing EMI.

- ✅ Factors: Fixed.

- 📈 Savings: Interest-free.

- 🔑 Banks: Vary.

- 💼 Choice: Punjab.

What is the EMI for 25 Lakh Home Loan for 20 Years SBI?

The EMI for 25 lakh home loan for 20 years SBI at 8.5% is Rs.21,700.

Long-term.

- ✅ Commitment: High.

- 📊 Comparisons: Scheme better.

- 🔑 Options: Prepay.

- 💡 Perspective: Affordability.

How Much is a 12k Loan Per Month?

How much is a 12k loan per month? At 0%, Rs.200 for 5 years.

Small loans.

- ✅ Micro: Easy.

- 📈 Terms: Short.

- 🔑 Scheme: Included.

- 💼 Use: Personal.

How Much is the Monthly Payment on a 30k Student Loan?

The monthly payment on a 30k student loan at 5% for 10 years is Rs.318.

Education context.

- ✅ Vs. Scheme: Business.

- 📊 Calculations: Standard.

- 🔑 Relief: Subsidies.

- 💡 Alternatives: Grants.

What is the Interest Rate of PM Svanidhi Loan?

The interest rate of PM Svanidhi Loan is 7% subsidized for street vendors.

Federal street scheme.

- ✅ Target: Vendors.

- 📈 Comparisons: Punjab 0%.

- 🔑 Amounts: Small.

- 💼 Integration: Possible.

What is the Interest Rate of Pmegp Loan?

The interest rate of Pmegp Loan is 2-4% after subsidy for manufacturing.

Employment generation.

- ✅ Subsidies: High.

- 📊 Vs. Maryam: Similar goals.

- 🔑 Eligibility: Unemployed.

- 💡 Choice: Sector-based.

Which Bank Gives 9.5% Interest?

Which bank gives 9.5% interest? PNB for home loans, among others.

Deposit or loan rates.

- ✅ Loans: Home.

- 📈 Trends: Competitive.

- 🔑 Comparisons: 0% scheme.

- 💼 Avoid: High markup.

Loan Amounts Available: From Rs. 5 Lakh to Rs. 3 Crore in Maryam Nawaz Loan Scheme

Loan amounts available from Rs.5 lakh to Rs.3 crore in Maryam Nawaz Loan Scheme cater to micro to medium needs.

Flexible scaling.

- ✅ Tiers: Card vs. finance.

- 📊 Disbursements: Billions.

- 🔑 Choices: Business size.

- 💡 Updates: Phase II 100 billion.

Interest-Free Features of Asaan Karobar Finance Scheme

Interest-free features of Asaan Karobar Finance Scheme include no markup, easy EMIs, and grace periods.

Core attraction.

- ✅ Savings: Total principal.

- 📈 Terms: 2-3 years.

- 🔑 Benefits: Affordability.

- 💼 Case: Exporters.

Repayment in Easy Installments under Maryam Nawaz Qarza Scheme

Repayment in easy installments under Maryam Nawaz Qarza Scheme allows 1-year grace, then EMIs over 2 years.

Business-friendly.

- ✅ Structure: Balanced.

- 📊 Examples: Monthly.

- 🔑 Defaults: Avoid.

- 💡 Planning: Cash flow.

How to Get a 10 Lakh Loan?

How to get a 10 lakh loan? Apply via Asaan Karobar Card, meet eligibility, submit online.

Quick guide.

- ✅ Steps: Detailed.

- 📈 Approval: Fast.

- 🔑 Tips: Strong plan.

- 💼 Success: Common.

How to Get a 15 Lakh Loan?

How to get a 15 lakh loan? Similar process, for mid-range, with business justification.

Scaled application.

- ✅ Requirements: Higher docs.

- 📊 Uses: Expansion.

- 🔑 Verification: Thorough.

- 💡 Insights: Sector priorities.

How to Get a 20 Lakh Loan?

How to get a 20 lakh loan? Under finance scheme, detailed plans needed.

Larger ventures.

- ✅ Eligibility: Established businesses.

- 📈 Terms: Longer.

- 🔑 Process: Bank review.

- 💼 Examples: Manufacturing.

How to Get a 50000 Loan Without Salary Slip?

How to get a 50000 loan without salary slip? Scheme allows business proof instead, for self-employed.

Inclusive.

- ✅ Alternatives: Invoices.

- 📊 Amounts: Small.

- 🔑 Approval: Quick.

- 💡 Tips: References.

Maryam Nawaz Green Tractor Scheme

Benefits and Features of Maryam Nawaz Loan Scheme

Key Advantages

Benefits of Interest-Free Loans in Maryam Nawaz Karobar Scheme

Benefits of interest-free loans in Maryam Nawaz Karobar Scheme include cost savings, easier repayments, and business growth without debt traps.

Empowers startups.

- ✅ Financial Relief: No extra payments.

- 📈 Growth: Reinvest savings.

- 🔑 Accessibility: Low barriers.

- 💡 Stats: Economic boost.

Subsidized Land and NOC Waivers in Maryam Nawaz Loan Scheme

Subsidized land and NOC waivers in Maryam Nawaz Loan Scheme simplify startups, no immediate approvals needed.

Business ease.

- ✅ Waivers: Time-saving.

- 📊 Land: Affordable.

- 🔑 Incentives: Zones.

- 💼 Impact: Industrial.

How Maryam Nawaz Loan Scheme Boosts Entrepreneurship

How Maryam Nawaz Loan Scheme boosts entrepreneurship by providing capital, training, and networks for new ventures.

Youth focus.

- ✅ Support: Mentorship.

- 📈 Stats: 100,000 targets.

- 🔑 Tools: Digital.

- 💡 Perspective: Innovation.

Free Solar Systems for Industries in Export Zones

Free solar systems for industries in export zones worth Rs.50 lakh reduce energy costs, promoting green exports.

Sustainable.

- ✅ Installation: Free.

- 📈 Savings: Operational.

- 🔑 Eligibility: Zones.

- 💼 Case: Processing plants.

Role in Economic Recovery: From Inflation to Growth

Role in economic recovery from inflation to growth via Maryam Nawaz schemes stabilizes Punjab, with rising reserves.

Holistic impact.

- ✅ Indicators: Positive.

- 📊 Remittances: Increased.

- 🔑 Strategies: Industrial.

- 💡 Updates: Stock 118,000+.

Related Programs and Incentives

Maryam Nawaz Pink Scotty Scheme

What is the 12000 Maryam Nawaz Scheme?

The 12000 Maryam Nawaz Scheme provides monthly stipends or aid for low-income, part of welfare.

Support net.

- ✅ Amounts: Rs.12,000.

- 📈 Distribution: Targeted.

- 🔑 Eligibility: BPL.

- 💼 Link: Loans.

What is the 10500 Scheme in the Punjab Government?

The 10500 Scheme in the Punjab Government offers cash assistance for families, similar welfare.

Economic aid.

- ✅ Transfers: Direct.

- 📊 Beneficiaries: Millions.

- 🔑 Check: CNIC.

- 💡 Integration: Rashan.

What is the 8070 Number in Punjab?

The 8070 number in Punjab is for rashan eligibility checks via SMS.

Simple verification.

- ✅ Usage: Send CNIC.

- 📈 Responses: Instant.

- 🔑 Services: Welfare.

- 💼 Benefits: Accessibility.

What is CM Free Plot Scheme?

What is CM Free Plot Scheme? Allocation of free or subsidized plots for housing under Maryam Nawaz.

Asset building.

- ✅ Sizes: 3 marla.

- 📈 Allotments: Planned.

- 🔑 Lottery: Fair.

- 💡 Progress: Villages.

What is 3 Marla Scheme Punjab?

The 3 Marla Scheme Punjab provides small plots for low-income housing.

Affordable living.

- ✅ Dimensions: 25×108 ft.

- 📊 Demand: High.

- 🔑 Registration: Online.

- 💼 Benefits: Stability.

What is the Size of a 3 Marla Plot?

The size of a 3 marla plot is about 675 square feet, ideal for small homes.

Standard measure.

- ✅ Area: 25×27 yards.

- 📈 Usage: Residential.

- 🔑 Planning: Efficient.

- 💡 Value: Appreciating.

Is Mera Pakistan Mera Ghar Scheme Closed?

Is Mera Pakistan Mera Ghar Scheme closed? No, it’s ongoing federally, but Punjab has its versions.

Housing continuity.

- ✅ Federal: Active.

- 📈 Comparisons: Local better.

- 🔑 Applications: Banks.

- 💼 Overlaps: Possible.

Maryam Nawaz Rashan Program Details

Maryam Nawaz Rashan Program details include subsidized food packs for eligible via CNIC.

Food security.

- ✅ Items: Essentials.

- 📊 Distribution: Centers.

- 🔑 Check: 8070.

- 💡 Updates: Expanded.

Parwaz Card: Interest-Free Loans up to 3 Million PKR

Parwaz Card offers interest-free loans up to 3 million PKR for overseas employment.

Migration support.

- ✅ Purpose: Relocation.

- 📈 Amounts: Skilled workers.

- 🔑 Apply: Online.

- 💼 Benefits: Legal jobs.

Status Checking and Post-Application Process

Maryam Nawaz Loan Scheme Check Status

Maryam Nawaz Loan Scheme check status via portal dashboard with CNIC.

Real-time.

- ✅ Login: Secure.

- 📊 Updates: SMS.

- 🔑 Timeline: Weekly.

- 💼 Tips: Regular checks.

How to Check Status of Maryam Nawaz Loan Scheme Application

How to check status of Maryam Nawaz Loan Scheme application? Enter CNIC on site for details.

Transparent.

- ✅ Stages: Pending, approved.

- 📈 Notifications: Email.

- 🔑 Issues: Helpline.

- 💡 Insight: Delays noted.

Maryam Nawaz Loan Scheme Check Status

Repeated for emphasis: Use online tools for Maryam Nawaz Loan Scheme check status.

Essential post-apply.

- ✅ Features: Detailed.

- 📊 Feedback: User.

- 🔑 Security: Protected.

- 💼 Resolutions: Quick.

Tracking Your Asaan Karobar Card Application

Tracking your Asaan Karobar Card application via akc portal.

Digital tracking.

- ✅ Alerts: Push.

- 📈 Progress: Bars.

- 🔑 Verification: OTP.

- 💡 Tips: Patience.

Comparisons with Other Loan Schemes

Comparison with PM 10 Lakh Loan Scheme

Comparison with PM 10 Lakh Loan Scheme shows Punjab’s 0% vs. subsidized federal.

Local advantages.

- ✅ Interest: Zero vs. low.

- 📊 Reach: Provincial.

- 🔑 Process: Similar.

- 💼 Choice: Business type.

Maryam Nawaz Loan Scheme vs. Pradhan Mantri Loan

Maryam Nawaz Loan Scheme vs. Pradhan Mantri Loan: Interest-free vs. subsidized, Punjab-focused.

Regional edge.

- ✅ Benefits: No cost.

- 📈 Limits: Higher.

- 🔑 Eligibility: Easier.

- 💡 Perspective: Complementary.

Differences Between Maryam Nawaz Home Loan Scheme and Apni Chhat Apna Ghar

Differences between Maryam Nawaz Home Loan Scheme and Apni Chhat Apna Ghar: Integrated vs. standalone housing.

Similar goals.

- ✅ Focus: Business + home.

- 📊 Disbursements: Combined.

- 🔑 Applications: Unified.

- 💼 Updates: Accelerated.

Maryam Nawaz Loan Scheme vs. SBI Personal Loans

Maryam Nawaz Loan Scheme vs. SBI Personal Loans: 0% vs. 10%, government vs. bank.

Clear winner.

- ✅ Costs: Savings.

- 📈 Terms: Flexible.

- 🔑 Access: Digital.

- 💡 Choice: Scheme.

How Maryam Nawaz Scheme Differs from Imran Khan Loan Scheme

How Maryam Nawaz Scheme differs from Imran Khan Loan Scheme: Interest-free, digital, SME focus vs. youth subsidized.

Evolved model.

- ✅ Innovations: Cards.

- 📊 Impact: Broader.

- 🔑 Improvements: Transparency.

- 💼 Analysis: Better outcomes.

Frequently Asked Questions (FAQs) on Maryam Nawaz Loan Scheme

- What is Maryam Nawaz Home Loan Scheme? Maryam Nawaz Home Loan Scheme offers interest-free financing for housing under Apni Chhat Apna Ghar, with online applications and quick disbursements for eligible families.

- What is the EMI for 10 Lakh Loan for 5 Years? The EMI for 10 lakh loan for 5 years at 0% interest is Rs.16,667, focusing on principal repayment in easy installments.

- What is the Interest for 10 Lakh Per Month? At 0% in Maryam Nawaz Scheme, the interest for 10 lakh per month is zero, unlike bank loans.

- What is the Minimum Salary Criteria for Personal Loans PKR 50000 /- PKR 20000 /- PKR 35000 /- PKR 30000 /-? Minimum salary starts from PKR 20,000 for smaller loans, but scheme emphasizes business viability over salary.

- How to Apply for the Maryam Nawaz Loan Scheme? Apply online via akf.punjab.gov.pk, submit CNIC and business details for interest-free loans.

- What is the 15 Lakh Loan Scheme of Maryam Nawaz? It’s a mid-tier interest-free loan for business expansions, with flexible terms and online apply.

- What is the New Scheme of CM Punjab? The new scheme includes Phase II of Asaan Karobar, expanding funding for SMEs.

Add a Comment