Benazir Income Support Programme (BISP) has launched the “BISP Saving Scheme” for already registered users of the Benazir Income Support Cash Program.

BISP Saving Scheme registrations are open free of cost for the following cities applicants only:

- Islamabad

- Muzaffarabad

- Neelam

- Peshawar

- Lucky Marwat

- Quetta

- Qila Saifullah

- Lahore

- Multan

- Karachi

- Sukkur

- Gilgit

- Astor.

In this article, we will explore eligibility requirements and provide a step-by-step guide on how to apply for the “BISP Saving Scheme” online for free. Let’s get started!

BISP New Registration “BISP Saving Scheme” | بی آئی ایس پی بچت اسکیم

Table Of Contents

Recommended Reading: BISP 8171 Result Check (کفالت پروگرام) | BISP Kafalat Program Check CNIC

What Is The BISP Saving Scheme?

- Financial Inclusion: The BISP Saving Scheme is designed to provide a unique blend of savings opportunities and financial assistance, catering specifically to existing beneficiaries, as well as individuals engaged in informal employment and daily wage labor.

- Eligibility Information: Prospective participants can check their eligibility for the BISP Saving Scheme by visiting the official website at https://savings.bisp.gov.pk.

- Geographical Launch: The Benazir Income Support Program has initiated the Savings Scheme in key locations, including Islamabad, Muzaffarabad, Neelam, Peshawar, Lucky Marwat, Quetta, Qila Saifullah, Lahore, Multan, Karachi, Sukkur, Gilgit, and Astor.

- Fee-Free Application Process: It is essential to note that the Benazir Income Support Program does not impose any fees for applying.

Recommended Reading: BISP 8171 (کفالت پروگرام)

BISP Saving Scheme Instructions

- Savings Account Requirement: Participation in the BISP Saving Scheme necessitates the opening of a savings account in a designated bank.

- Monthly Deposit Range: Scheme participants are required to deposit a monthly sum ranging from 500 to 1000 rupees into their designated bank accounts.

- Additional Support from BISP: Consumers enrolled in the scheme stand to receive an extra 40% of their accumulated savings courtesy of the Benazir Income Support Program.

- Two-Year Duration: The BISP Saving Scheme operates over a two-year period, during which participants have the opportunity to accumulate funds. After this duration, individuals gain the flexibility to withdraw the entirety of their savings.

- Restrictions on Principal Withdrawal: While participants are free to withdraw from the scheme at any point, the withdrawal of the principal amount is restricted during the two-year duration. Cash grants by BISP and profit gained under this scheme could be withdrawn through the designated bank.

- Withdrawal and Re-Joining: Withdrawal from the scheme is permitted at any time; however, re-joining becomes possible only upon the completion of the two-year scheme duration.

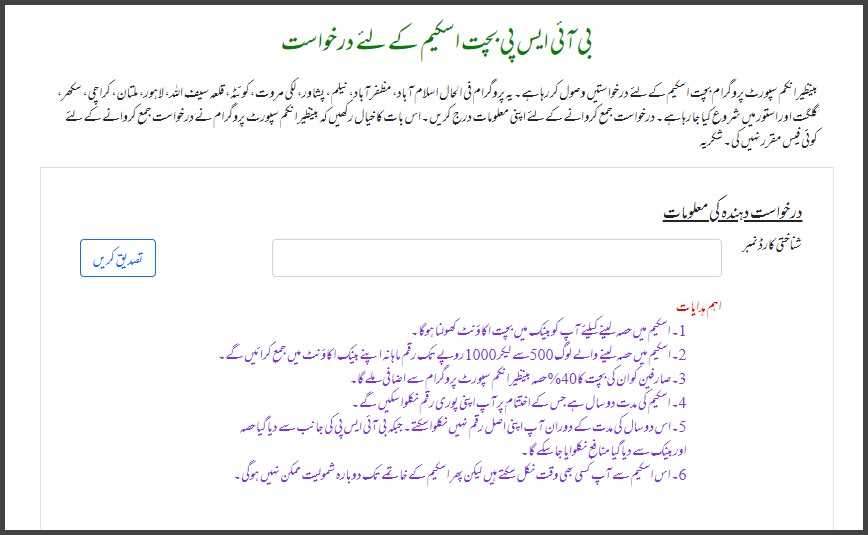

How To Register For BISP Saving Scheme Online?

Following is a step-by-step guide on how you can apply for the BISP Saving Scheme Online free of cost any time and anywhere by using your phone. Provided, you are eligible for this scheme.

Official Website Visit

Initiate the registration process by visiting the dedicated official website for the BISP Saving Scheme at https://savings.bisp.gov.pk/.

ID Card Confirmation

Enter your ID card number to undergo a confirmation process, ensuring that you are a registered beneficiary with BISP and reside in a district covered by the BISP saving scheme.

Bank Account Opening

Upon confirming your eligibility, the next step involves the guidance to open a “savings bank account” in one of the affiliated banks associated with the BISP Savings Scheme. This account serves as the designated channel for your monthly deposits and subsequent benefits.

Monthly Deposit Requirement

After successfully opening the bank account, commit to depositing a monthly sum ranging from Rs. 500 to Rs. 1,000. This regular contribution forms the basis for maximizing the benefits offered by the scheme, including a 40% profit on the accumulated deposited amounts.

Flexibility in Withdrawal From Scheme

Lastly, Participants in the scheme retain the flexibility to leave or withdraw from the program at any point in the future.

Benazir Income Support Programme Helpline Number

For any enrollment-related queries or grievances, the Benazir Income Support Programme provides a dedicated helpline and contacts to ensure effective communication and issue resolution.

- Vijay Kumar – Director (E&GR)

- Extension: 140

- Contact: 051-9246422

- Email: dir.bs@bisp.gov.pk

- Ibrar Ul Hassan – Deputy Director

- Extension: 324

- Contact: 051-9246414

- Email: dd.gr@bisp.gov.pk

- Malik Waqar Imtiaz – Deputy Director

- Extension: 328

- Contact: 051-9246414

- Email: dd.enr@bisp.gov.pk

- Ajmal Khan – Assistant Director (Public Grievance)

- Extension: 328

- Email: ad.pg@bisp.gov.pk.

FAQs | BISP Saving Scheme

How can I participate in the BISP Saving Scheme?

To participate in the scheme, visit the official website at https://savings.bisp.gov.pk/ and confirm your eligibility by entering your ID card number.

What is the monthly deposit range for scheme participants?

Participants are required to deposit a monthly sum ranging from Rs. 500 to Rs. 1,000 into their designated bank accounts to maximize benefits, including a 40% profit.

What additional support do consumers receive from the Benazir Income Support Program?

Consumers enrolled in the scheme receive an extra 40% of their accumulated savings as additional financial assistance from the Benazir Income Support Program.

How long does the BISP Saving Scheme last, and when can I withdraw my entire amount?

The scheme has a duration of two years, and participants can withdraw their entire savings at the end of this period.

Are there restrictions on withdrawing the principal amount during the two-year duration?

Yes, participants cannot withdraw the principal amount during the two years. Contributions by BISP and accrued interest can be withdrawn through the designated bank.

How can I leave or withdraw from the BISP Savings Scheme?

Participants can withdraw from the scheme at any time. However, re-joining is only possible at the end of the two-year scheme duration.

Who should I contact for enrollment-related queries or grievances?

For enrollment and grievances, you can contact Vijay Kumar, Director (E&GR), at extension 140 or via email at dir.bs@bisp.gov.pk.

How can I get assistance or address queries related to BISP Saving Scheme enrollment?

For any enrollment-related queries or grievances, the Benazir Income Support Programme provides a dedicated helpline and contacts to ensure effective communication and issue resolution. Accessible contact details are available for prompt assistance.

Recommended Reading: BISP Kafalat Program Check CNIC

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

Have any questions or need further details? Please don’t hesitate to reach out to us at Info@governmentschemes.pk!

Add a Comment