The Maryam Nawaz Loan Scheme, officially known as the CM Punjab Asan Karobar Loan Scheme, is a flagship initiative by Chief Minister Punjab Maryam Nawaz Sharif to empower small and medium enterprises (SMEs) through interest-free financing. This program provides accessible business loans to promote entrepreneurship, job creation, and economic growth across Punjab.

Here’s what you’ll learn from this comprehensive guide:

- Key features of the Asan Karobar Finance Scheme and Asaan Karobar Card

- Detailed eligibility criteria and application process

- Loan amounts, repayment terms, and interest-free benefits

- How to check application status and access support

- Related welfare schemes under Maryam Nawaz initiatives

Introduction to Maryam Nawaz Loan Scheme

Table Of Contents

What is Maryam Nawaz Loan Scheme?

The Maryam Nawaz Loan Scheme refers to the CM Punjab Asan Karobar Loan Scheme, a groundbreaking program launched by Chief Minister Maryam Nawaz Sharif to support small businesses and entrepreneurs in Punjab. This initiative offers interest-free loans to make starting or expanding a business easier without financial burdens.

This scheme stands out as the first of its kind in Punjab’s history, focusing on SMEs with simplified processes and no immediate need for NOCs or licenses.

Key highlights include:

- Interest-free financing for broader accessibility

- Digital application and transparent fund utilization

- Support for diverse sectors, including agriculture and startups

- Allocation of billions in budget to benefit thousands

Overview of CM Punjab Asan Karobar Loan Scheme

The CM Punjab Asan Karobar Loan Scheme encompasses two main components: the Asaan Karobar Finance Scheme for larger loans and the Asaan Karobar Card for smaller digital financing. Launched to boost economic development, it targets youth, women, and small entrepreneurs.

Established facts show over 1.5 million applications processed, with disbursements starting swiftly through the Bank of Punjab.

Benefits at a glance:

- Promotes self-employment and reduces unemployment

- No collateral required for many tiers

- Flexible repayment with grace periods

- Priority for women and marginalized groups

How Does CM Punjab Asan Karobar Loan Scheme Support Entrepreneurship in Punjab?

The CM Punjab Asan Karobar Loan Scheme supports entrepreneurship by providing hassle-free, interest-free capital, enabling quick business launches. It eliminates traditional banking hurdles, allowing applicants to “get a loan today and start business tomorrow.”

This scheme has created opportunities for over 100,000 potential startups, with additional perks like subsidized land in industrial zones.

Impact points:

- Drives job creation in priority sectors

- Empowers women entrepreneurs with quotas

- Fosters innovation in SMEs

- Contributes to provincial GDP growth

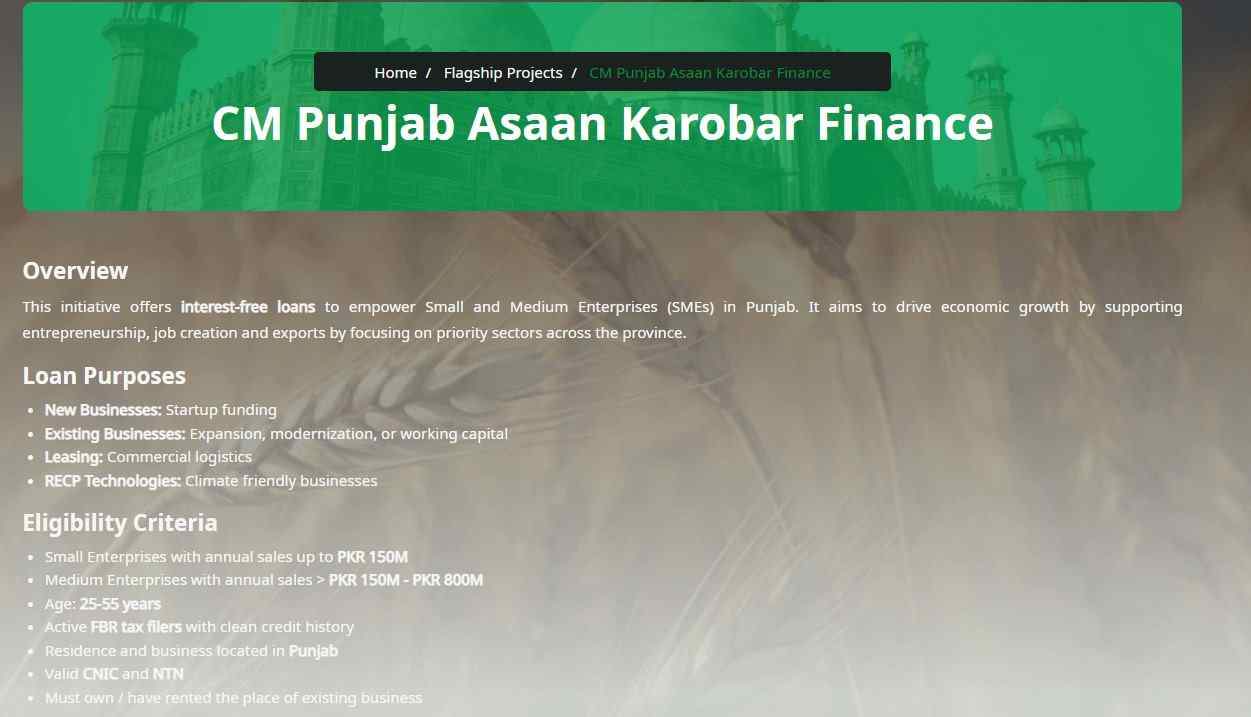

Eligibility Criteria for Maryam Nawaz Loan Scheme

General Eligibility Requirements

General eligibility for the Maryam Nawaz Loan Scheme requires applicants to be Punjab residents aged 25-55, with a valid CNIC and clean credit history. This ensures funds reach genuine entrepreneurs committed to business growth.

Core requirements include:

- Punjab domicile

- Active tax filer status (or registration within months)

- No default on previous loans

- Business plan for higher tiers

Who is Eligible for CM Punjab Asan Karobar Loan Scheme?

Anyone meeting age, residency, and credit criteria can apply for the CM Punjab Asan Karobar Loan Scheme, including men, women, transgender individuals, and persons with disabilities. Special focus on youth and first-time entrepreneurs.

Eligible categories:

- Small business owners

- Startups in any sector

- Existing SMEs seeking expansion

- Freelancers transitioning to formal businesses

Age and Residency Requirements for Maryam Nawaz Loan Scheme Applicants

Applicants for the Maryam Nawaz Loan Scheme must be between 25 and 55 years old and hold Punjab residency. This targeted range ensures support for working-age individuals building sustainable ventures.

Residency proof options:

- Valid CNIC with Punjab address

- Domicile certificate

- Utility bills as supporting evidence

What Documents Are Needed for Eligibility in Asan Karobar Loan Scheme?

Required documents for Asan Karobar Loan Scheme eligibility include CNIC, proof of residency, business details, and income evidence. Digital uploads simplify the process.

Essential documents list:

- Scanned CNIC

- Business plan (for larger loans)

- Proof of premises (owned or leased)

- Bank statements or income proof

Who is Eligible for an Asaan Karobar Card?

The Asaan Karobar Card targets small entrepreneurs needing up to Rs 1 million interest-free. Eligibility mirrors the main scheme but focuses on micro-businesses with digital fund usage.

Qualifiers include:

- Small vendors and shop owners

- Daily wage earners starting ventures

- Women-led home businesses

Minimum Salary Criteria for Personal Loans in Related Schemes

While the Maryam Nawaz Loan Scheme is business-focused, related personal or small loans may consider minimum salary for repayment assurance. No strict salary threshold for core Asan Karobar, but stable income proof helps.

Common benchmarks:

- Rs 30,000-50,000 monthly for smaller tiers

- Business viability over salary

Can Freelancers and Startups Apply for CM Punjab Asan Karobar Loan Scheme?

Yes, freelancers and startups can apply for the CM Punjab Asan Karobar Loan Scheme, with priority for innovative ideas in IT and other sectors.

Advantages for them:

- No prior business history required

- Support for Nawaz Sharif IT City startups

- Preferential terms available

Eligibility for Agriculture-Related Loans in Maryam Nawaz Loan Scheme

Agriculture is a priority sector in the Maryam Nawaz Loan Scheme, with dedicated allocations for farmers and agri-businesses.

Eligible activities:

- Farm modernization

- Equipment purchase

- Agri-startups

How to Apply for Maryam Nawaz Loan Scheme

Step-by-Step Application Process

The application process for Maryam Nawaz Loan Scheme is fully digital and user-friendly, starting with online registration.

Steps overview:

- Visit official portal

- Register with CNIC

- Fill details and upload documents

- Submit and track

How to Apply for Punjab Loan Scheme?

To apply for Punjab Loan Scheme under Asan Karobar, access the dedicated PITB portal and follow prompts for Asaan Karobar Finance or Card.

Quick tips:

- Prepare documents in advance

- Pay nominal processing fee

- Use helpline for guidance

CM Punjab Loan Scheme Online Apply: Complete Guide

CM Punjab Loan Scheme online apply involves logging into akc.punjab.gov.pk or related sites, selecting tier, and submitting.

Detailed guide:

- Acknowledge terms

- Enter personal/business info

- Verify via OTP

Asaan Karobar Apply Online: Detailed Steps

Asaan Karobar apply online starts at the official site, with separate sections for Finance Scheme and Card.

Numbered steps:

- Choose scheme

- Enter CNIC and phone

- Complete form

- Upload scans

- Pay fee and submit

Maryam Nawaz Loan Scheme Apply Online: Official Portal Access

Access Maryam Nawaz Loan Scheme apply online via punjab.gov.pk or akc.punjab.gov.pk for seamless registration.

Portal features:

- User dashboard

- Status tracking

- Helpline integration

CM Punjab Asaan Karobar Loan Scheme Online Apply Process

The process emphasizes transparency, with Bank of Punjab handling verification.

Timeline:

- Application: Instant submission

- Verification: Few weeks

- Disbursement: Upon approval

Asaan Karobar Card Apply Online: Registration Tutorial

For Asaan Karobar Card, registration is quick with focus on digital usage.

Tutorial highlights:

- Restricted cash withdrawal (25%)

- Vendor payments priority

Required Documentation and Verification

Documentation includes CNIC, business proof, and address verification. Verification ensures fair distribution.

Common verifications:

- CNIC check

- Credit history

- Site visit if needed

Loan Details and Financial Aspects of CM Punjab Asan Karobar Loan Scheme

Loan Amounts and Tiers

Loan amounts in CM Punjab Asan Karobar Loan Scheme range from Rs 1 million to Rs 30 million, divided into tiers.

Tiers breakdown:

- Tier 1: Up to Rs 10 lakh (Card)

- Tier 2: Rs 10-30 million (Finance)

What is the Maximum Loan Amount Under Maryam Nawaz Loan Scheme?

The maximum loan amount under Maryam Nawaz Loan Scheme is Rs 30 million interest-free for qualifying SMEs.

Higher amounts for:

- Export-oriented businesses

- Priority sectors

CM 15 Lakh Loan Scheme: Details and Features

While primarily business-focused, related housing under Maryam Nawaz includes 15 lakh interest-free for home construction (Apni Chhat Apna Ghar).

Features:

- 9-year repayment

- No interest

Interest Rates and Repayment Terms

All loans under the scheme are interest-free, with repayment up to 5 years and grace periods.

Terms table:

| Loan Type | Repayment Period | Grace Period |

|---|---|---|

| Asaan Karobar Card | 3 years | Varies |

| Finance Scheme | 5 years | 3 months |

Can I Get a Loan Without Interest Through Maryam Nawaz Loan Scheme?

Yes, the Maryam Nawaz Loan Scheme provides 100% interest-free loans, a unique feature in Punjab.

Benefits:

- No markup burden

- Easy installments

Interest-Free Options in CM Punjab Asan Karobar Loan Scheme

Interest-free options cover the full amount, making it accessible for low-income entrepreneurs.

Examples:

- Full waiver on principal repayment only

Loan Types and Categories

Types include working capital, equipment finance, and expansion loans.

Categories:

- SME loans

- Agri loans

- Startup funding

Status Check and Support for Asan Karobar Loan Scheme

Tracking Application Status

Tracking is easy via online portal with CNIC login.

Methods:

- Dashboard view

- SMS updates

How to Check Asan Karobar Card Status?

Check Asan Karobar Card status by logging into akc.punjab.gov.pk with credentials.

Steps:

- Login

- View dashboard

- See updates

Asaan Karobar Card Status Check Online by CNIC: Step-by-Step

Use CNIC for quick status check without full login in some portals.

Process:

- Enter CNIC

- Verify OTP

- View status

Helpline and Customer Support

Helpline 1786 offers free assistance for queries.

Support options:

- Toll-free calls

- Online chat

- Branch visits

Asaan Karobar Card Helpline: Contact Numbers and Assistance

Primary helpline: 1786, with Bank of Punjab support at 111-267-200.

Common assists:

- Application issues

- Document guidance

Login and Account Management

Login secures your application data.

Features:

- Update info

- Track progress

Asaan Karobar Login: Managing Your Application Portal

Asaan Karobar login provides full control over your profile.

Tips:

- Secure password

- Regular checks

Related Schemes Under Maryam Nawaz Initiatives

Housing and Home Loan Schemes

Maryam Nawaz has launched Apni Chhat Apna Ghar for affordable housing.

Key program:

- Interest-free 15 lakh loans

- For land owners

What is the Punjab Apna Ghar Scheme?

Punjab Apna Ghar Scheme, or Apni Chhat Apna Ghar, provides housing loans to build homes.

Details:

- Up to 15 lakh

- 9-year repayment

How to Apply for Mera Ghar Mera Ashiana Scheme?

Application via acag.punjab.gov.pk with property proof.

Process similar to Asan Karobar.

What is Apni Chhat Apna Ghar Scheme in Punjab?

Apni Chhat Apna Ghar offers interest-free loans for house construction on owned land.

Progress:

- Thousands completed

- Billions disbursed

Who is Eligible for Apni Chhat Apna Ghar Scheme?

Eligible if no existing house, own small plot, low-income.

Criteria:

- 1-10 marla land

- Punjab resident

Maryam Nawaz House Loan Scheme: Key Details

Interest-free, staged disbursement.

Benefits:

- Low installments (Rs 14,000 max)

What is the Maximum Loan Amount Under Apna Ghar?

Maximum Rs 15 lakh under Apna Ghar.

For construction only.

Employment and Rozgar Schemes

Rozgar schemes complement loans with skill development.

Includes youth employment programs.

What is CM Punjab Rozgar Scheme?

Legacy scheme revived with new features for job creation.

Focus on trained youth.

Vehicle and Mobility Schemes

Bike schemes for students and women.

E-bikes promoted for green transport.

What is Meri Gari Scheme?

Related car or vehicle financing under discussion.

Focus on affordable mobility.

Subsidy and Financial Aid Programs

Various subsidies like wheat support and relief packages.

Includes Rashan programs.

What is CM Punjab 10000 Scheme?

Financial aid packages for vulnerable families.

Part of welfare initiatives.

Rashan and Welfare Schemes

Rashan cards for subsidized essentials.

Eligibility via survey.

Who is Eligible for Maryam Nawaz Rashan Card?

Low-income families registered in surveys.

Benefits monthly rations.

Comparisons and Additional Insights

Comparing Maryam Nawaz Loan Scheme with Other Loans

Compared to bank loans, zero interest and no collateral stand out.

Advantages:

- Faster approval

- Government backing

CM Karobar Loan Scheme vs. Other Provincial Schemes

Superior in amount and ease compared to federal programs.

Unique digital card feature.

Frequently Asked Questions About Maryam Nawaz Loan Scheme

How to Apply for CM Punjab Asan Karobar Card?

Visit akc.punjab.gov.pk, register, and submit details.

What is the 15 Lakh Loan Scheme in Punjab?

Refers to Apni Chhat Apna Ghar housing loan.

Can I Get a Loan Without Interest?

Yes, all under Asan Karobar are interest-free.

How to Check Asan Karobar Card Status?

Login to portal with CNIC.

Who is Eligible for an Asaan Karobar Card?

Small entrepreneurs aged 25-55 in Punjab.

What is CM Punjab Rozgar Scheme?

Employment-focused initiative linked to loans.

What is the Maximum Loan Amount for Agriculture?

Up to Rs 30 million in priority sectors.

Add a Comment